Japan Portable Power Tools Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Japan Portable Power Tools Market Summary:

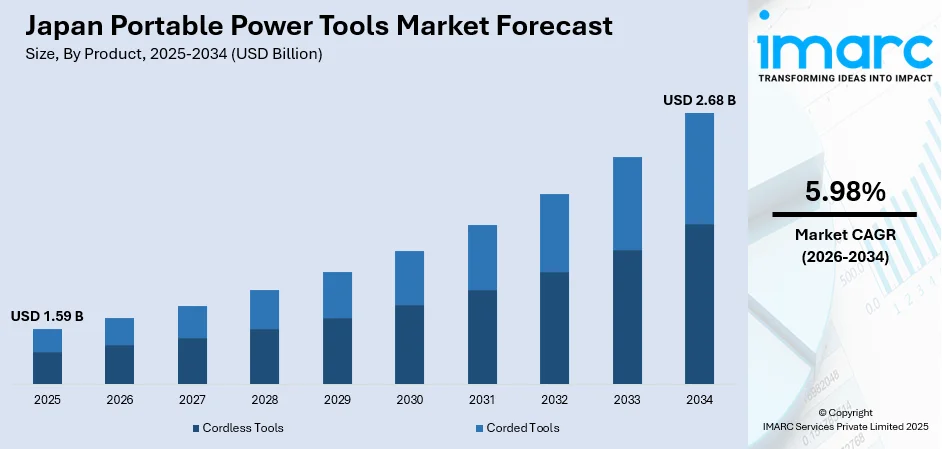

The Japan portable power tools market size was valued at USD 1.59 Billion in 2025 and is projected to reach USD 2.68 Billion by 2034, growing at a compound annual growth rate of 5.98% from 2026-2034.

The Japan portable power tools market is experiencing growth driven by robust construction activities, expanding automotive manufacturing, and increasing adoption of advanced cordless technologies. Rising infrastructure investments, government initiatives for urban development, and the growing popularity of do-it-yourself (DIY) home improvement projects are strengthening demand across professional and user segments. Technological advancements in lithium-ion battery systems, brushless motors, and Internet of Things (IoT)-enabled smart features are enhancing product efficiency and user convenience, contributing to the overall Japan portable power tools market share.

Key Takeaways and Insights:

- By Product: Cordless tools dominate the market with a share of 32.5% in 2025, driven by superior portability, enhanced lithium-ion battery technology, and brushless motor efficiency that appeals to both professional contractors and DIY enthusiasts seeking flexible power solutions.

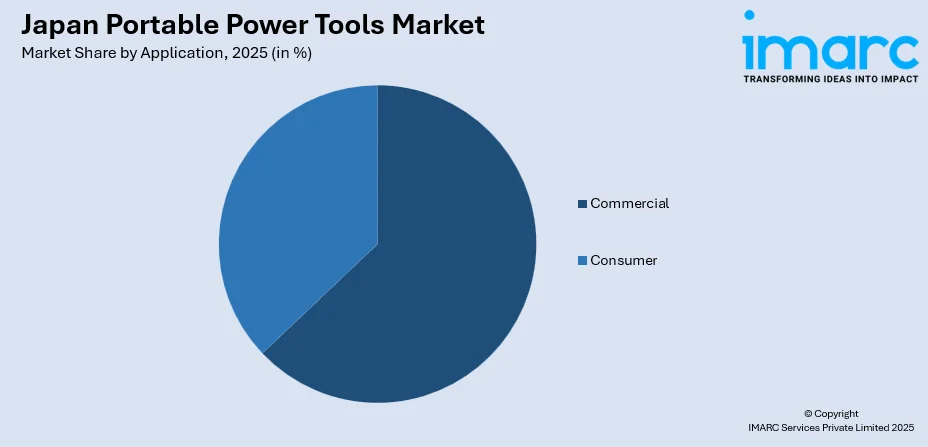

- By Application: Commercial leads the market with a share of 62.8% in 2025. This dominance is driven by strong demand from the construction, automotive manufacturing, and aerospace industries requiring high-performance drilling, fastening, and cutting tools for precision operations.

- By Region: Kanto Region represents the largest segment with a market share of 38.7% in 2025, supported by Tokyo's major infrastructure projects, high concentration of construction and manufacturing industries, and advanced retail infrastructure serving professional contractors.

- Key Players: The Japan portable power tools market exhibits strong competitive intensity, with leading domestic manufacturers maintaining market leadership through continuous innovation in battery technology, ergonomic designs, and smart tool integration, while international players compete through value-oriented offerings and technological partnerships.

To get more information on this market Request Sample

The Japan portable power tools market is experiencing growth, driven by continuous technological advancements and increasing demand across various industrial sectors. Innovations in battery and motor technologies are leading to the development of tools that are not only more efficient and durable but also lightweight and ergonomically designed, appealing to both professional tradespeople and individuals interested in DIY and home improvement projects. This professional demand is closely tied to national development initiatives. For example, in 2025, Toyota completed the first phase of its futuristic Woven City in Susono, Japan. This large-scale, smart infrastructure project, designed as a living laboratory for innovation, will initially house approximately 100 residents, with plans for expansion to 2,000. The city, which integrates residential, corporate, and community spaces, requires the high-performance and precision capabilities of modern portable power tools for both construction and ongoing maintenance. As a result, the combination of advanced, user-friendly tool designs and large-scale infrastructure projects like Woven City ensures the continued growth and maturity of the portable power tools market.

Japan Portable Power Tools Market Trends:

Growth in Construction and Infrastructure Activity

The Japan portable power tools market is growing in response to ongoing construction and infrastructure projects in both urban and regional areas. These tools enhance on-site efficiency, precision, and reduce manual labor, making them essential for contractors and skilled workers. In 2025, Tokyo's major redevelopment projects, including Takanawa Gateway City and Azabudai Hills, are reshaping the city with new mixed-use skyscrapers and smart urban spaces. These developments, which aim to bolster business, residential, and international functions, further drive the demand for portable power tools, especially for renovation work and residential improvements where compact, efficient equipment is crucial.

Rising Applications in Automotive Industry

In the automotive sector, portable power tools are essential for vehicle assembly, repair, and maintenance. Tools such as impact drivers, drills, and grinders are used for tasks like part assembly, fastener removal, and surface smoothing, ensuring precision and efficiency. Japan reported sales of 4,421,494 new passenger cars in 2024, according to the data published by the International Trade Administration (ITA), highlighting the growing vehicle production. This increase in production further emphasizes the need for portable power tools, as the automotive industry prioritizes efficiency and high-quality standards to meet rising demand while maintaining fast and precise operations in manufacturing and maintenance processes.

Increasing Employment in Mining Industry

The growing use of portable power tools in mining operations for crucial for tasks, such as drilling, cutting, and grinding rocks and minerals, is offering a favorable market outlook. Tools like pneumatic drills, jackhammers, and grinders are essential for mineral extraction and processing, and they must endure harsh underground conditions, including dust, moisture, and heavy vibrations. In 2025, Japan announced plans to begin test mining rare-earth-rich mud from the deep seabed near Minamitori Island in early 2026, aiming to secure a stable domestic supply of critical minerals. This initiative highlights the increasing demand for durable, high-performance portable power tools to enhance productivity and safety in challenging mining environments.

Market Outlook 2026-2034:

The Japan portable power tools market is poised for strong growth throughout the forecast period, driven by continued infrastructure development, expansion in the automotive sector, and ongoing technological innovations. As construction projects and industrial activities accelerate, the demand for portable power tools is expected to rise. The market generated a revenue of USD 1.59 Billion in 2025 and is projected to reach a revenue of USD 2.68 Billion by 2034, growing at a compound annual growth rate of 5.98% from 2026-2034.

Japan Portable Power Tools Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Cordless Tools | 32.5% |

| Application | Commercial | 62.8% |

| Regional | Kanto Region | 38.7% |

Product Insights:

- Cordless Tools

- Corded Tools

Cordless tools dominate with a market share of 32.5% of the total Japan portable power tools market in 2025.

Cordless tools represent the largest segment owing to their convenience and flexibility. These tools provide enhanced mobility, allowing users to work in various locations without being limited by power outlets or cords. Their battery-powered design offers greater operational ease.

Additionally, technological advancements in battery efficiency and power output have further boosted the popularity of cordless tools. Improved battery life, faster charging times, and lightweight designs make them increasingly attractive for both professional and DIY users, contributing to the market dominance.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Consumer

Commercial leads with a market share of 62.8% of the total Japan portable power tools market in 2025.

Commercial holds the biggest market share due to the high demand for durable, high-performance tools in industries like construction, manufacturing, and automotive. This segment requires tools that can withstand continuous heavy use, driving commercial adoption.

Furthermore, commercial requires specialized power tools to handle demanding tasks efficiently. As infrastructure development and industrial expansion continue to grow, the need for reliable and robust tools for commercial use increases, solidifying their dominant share in the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region exhibits a clear dominance with a 38.7% share of the total Japan portable power tools market in 2025.

Kanto Region dominates the market, driven by its economic significance and increasing construction activity. With Tokyo as a major commercial hub, the region sees high demand for construction, automotive, and industrial applications, driving the need for portable power tools.

Additionally, the Kanto Region's advanced infrastructure and concentration of manufacturing facilities further contribute to its market dominance. The rising demand for efficient, high-performance power tools across key industries like construction is validated by the sheer volume of new development in the Kanto region, highlighted by the 2025 announcement of the Kawasaki New! Arena City Project, a 15,000-seat arena and 17-story commercial complex targeting completion by October 2030.

Market Dynamics:

Growth Drivers:

Why is the Japan Portable Power Tools Market Growing?

Growing Demand in Furniture Manufacturing

The furniture industry relies heavily on portable power tools for tasks, such as cutting, drilling, sanding, and finishing materials like wood, metal, and plastic. Tools, including power saws, sanders, and drills help furniture makers create high-quality, precise pieces while allowing for greater flexibility in design and customization. As individual demand for custom-made and functional furniture grows, the use of these tools is becoming essential in modern manufacturing. In 2025, the Japan furniture market reached USD 23.2 billion, according to the IMARC Group, reflecting the increasing demand for tailored furniture solutions and the need for efficient manufacturing tools.

Rising Need in Telecommunications Industry

The increasing complexity and continuous expansion of telecommunications infrastructure necessitate the use of portable power tools for precise and efficient on-site work, including cable installation, network maintenance, and equipment assembly. The portability and efficiency of tools like drills and crimping devices are indispensable for technicians operating in dynamic or remote environments. This crucial role is further amplified by advanced network development projects, as exemplified by SoftBank Corp. announcement in 2025, which mentioned Japan’s first outdoor trial of the 7GHz band for 6G in partnership with Nokia, deploying three pre-commercial base stations in Tokyo’s Ginza district to evaluate high-speed, wide-area coverage in dense urban environments. This ongoing R&D for 6G commercialization drives continuous demand for specialized, highly mobile tools that can support the rapid and accurate installation of new communication lines.

Increasing Applications in Shipbuilding and Maritime Industry

Portable power tools are essential in the shipbuilding and maritime industries for precision tasks, such as cutting, grinding, and welding metal components of vessels. Tools like drills and impact wrenches are vital for both assembly and maintenance, enabling workers to operate efficiently and safely, even in confined spaces. The demanding standards for durability and accuracy in shipbuilding are continually pushed forward by industry innovations. For example, in 2025, the NYK Group announced an R&D project under Japan’s K Program, led by MTI Co., Ltd., aimed at developing high-performance next-generation vessels. This project leverages advanced digital simulations to shorten development times and enhance competitiveness, requiring specialized portable tools to support the construction and outfitting of these innovative vessels.

Market Restraints:

What Challenges the Japan Portable Power Tools Market is Facing?

High Initial Costs of Advanced Power Tools

The high initial costs associated with advanced power tools pose a barrier to widespread market adoption, particularly for price-sensitive consumers. Premium cordless tools, which incorporate advanced features such as lithium-ion batteries, brushless motors, and smart technologies, often come with significantly higher price tags compared to traditional alternatives. While these features offer long-term operational benefits, such as increased efficiency and longer tool life, many people may find the upfront cost prohibitive.

Labor Shortage in Construction and Manufacturing Sectors

Japan’s labor shortage, driven by a declining and aging workforce, presents a significant challenge for the construction and manufacturing sectors, which are major drivers of demand for power tools. As companies face difficulties in maintaining productivity levels, they may need to rely more heavily on technological solutions to offset the impact of labor shortages. To sustain growth and competitiveness in these sectors, improved employment conditions, as well as greater automation and technology adoption, will be crucial.

Supply Chain Constraints and Import Dependencies

Japan’s heavy reliance on imported power tools exposes the market to significant supply chain risks. This concentration of imports creates vulnerabilities, especially in the face of geopolitical tensions, trade policy changes, and disruptions in global logistics. Any fluctuation in raw material costs or exchange rates can lead to price instability and affect the availability of power tools. Such dependencies make the Japanese market highly susceptible to external shocks, underscoring the need for greater supply chain diversification and more resilient import strategies to ensure steady product availability.

Competitive Landscape:

The Japan portable power tools market exhibits strong competitive intensity characterized by the dominant presence of leading domestic manufacturers alongside international players competing across professional and consumer segments. Market dynamics reflect strategic positioning emphasizing continuous innovation in battery technology, brushless motor development, and IoT integration. Domestic manufacturers maintain leadership through extensive product portfolios, established distribution networks, and strong brand recognition built on precision engineering heritage. Competition is increasingly shaped by sustainability initiatives, smart tool capabilities, and platform ecosystem development that locks in professional users. International brands compete through competitive pricing, technological partnerships, and localized product offerings tailored to Japanese market preferences.

Recent Developments:

- In July 2025, Renesas Electronics unveiled the RA2T1 microcontroller group, optimized for motor control in single-motor applications like portable power tools, vacuum cleaners, and home appliances. The RA2T1 MCUs feature advanced control functions, including 3-phase current detection, ideal for power tools like cordless drills and saws.

Japan Portable Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cordless Tools, Corded Tools |

| Applications Covered | Commercial, Consumer |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan portable power tools market size was valued at USD 1.59 Billion in 2025.

The Japan portable power tools market is expected to grow at a compound annual growth rate of 5.98% from 2026-2034 to reach USD 2.68 Billion by 2034.

Cordless tools held the largest revenue share of 32.5% in 2025, driven by advanced lithium-ion battery technology, superior portability, and brushless motor efficiency that appeals to both professional contractors and DIY enthusiasts.

Key factors driving the Japan portable power tools market include the increasing automotive production, with Japan selling 4,421,494 new passenger vehicles in 2024, according to the ITA. This rise in vehicle manufacturing heightens the demand for precision tools like impact drivers, drills, and grinders used in assembly, repair, and maintenance.

Major challenges include high initial costs for advanced tools, a labor shortage in key sectors, and dependence on imports, particularly from China. These issues impact affordability, productivity, and supply chain stability, requiring solutions for sustained growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)