Japan Poultry Feed Market Size, Share, Trends and Forecast by Nature, Form, Additives, Animal Type, Distribution Channel, and Region, 2026-2034

Japan Poultry Feed Market Summary:

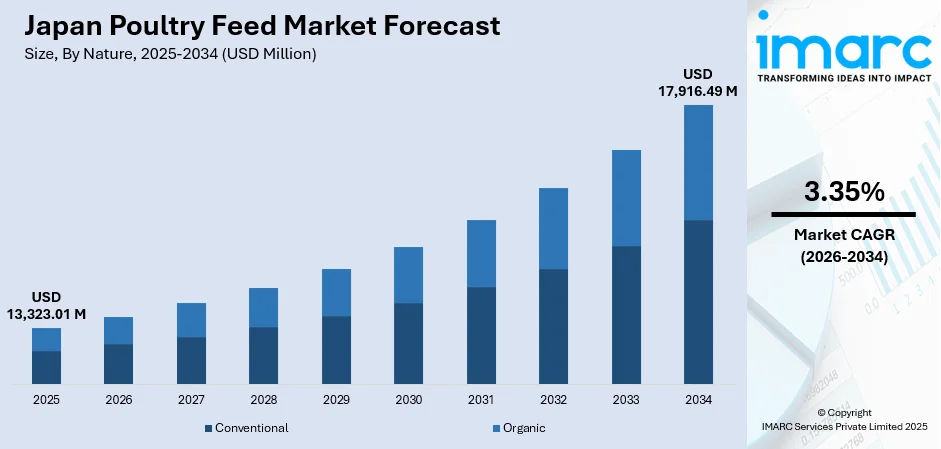

The Japan poultry feed market size was valued at USD 13,323.01 Million in 2025 and is anticipated to reach USD 17,916.49 Million by 2034, expanding at a compound annual growth rate of 3.35% from 2026-2034.

In Japan, the market expansion is propelled by rising domestic chicken consumption, driven by tourism growth and price-sensitive consumers seeking affordable protein alternatives. Technological advancements in feed production, increasing demand for specialized nutritional formulations, government initiatives to enhance feed efficiency, and the emphasis on biosecurity measures following avian influenza outbreaks are supporting the market share.

Key Takeaways and Insights:

- By Nature: Conventional dominates the market with a share of 63.0% in 2025, owing to its established manufacturing processes, cost-effectiveness, and widespread availability through traditional agricultural supply networks.

- By Form: Pellets lead the market with a share of 44.2% in 2025, driven by superior feed conversion efficiency, reduced wastage, and consistent nutritional delivery that supports optimal poultry growth.

- By Additives: Amino acid represents the largest segment with a market share of 44.9% in 2025, attributed to their essential role in protein synthesis, muscle development, and overall poultry health optimization.

- By Animal Type: Broilers prevail the market with a share of 72.0% in 2025, reflecting strong domestic demand for chicken meat and the need for nutrient-dense formulations supporting rapid growth cycles.

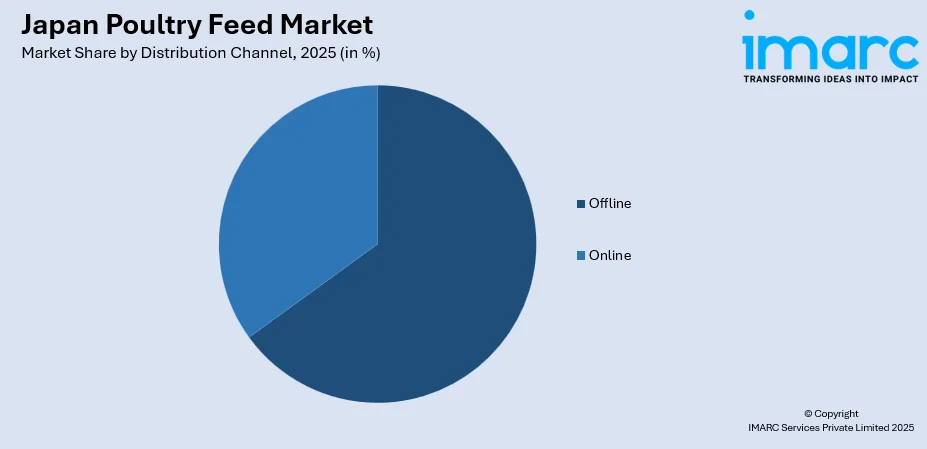

- By Distribution Channel: Offline comprises the largest segment with a market share of 63.4% in 2025, supported by established relationships between feed manufacturers, agricultural cooperatives, and poultry farmers across Japan.

- By Region: Kanto Region exhibits a clear dominance with a market share of 35.0% in 2025, driven by its concentration of poultry farming operations, proximity to major consumption centers, and advanced agricultural infrastructure.

- Key Players: The Japan poultry feed market exhibits moderate competitive intensity, with established domestic manufacturers and multinational corporations competing through product innovations, research capabilities, and comprehensive farmer support services.

To get more information on this market Request Sample

The market continues to strengthen as Japan's poultry industry is expanding production capacity to meet rising domestic chicken demand. According to the Ministry of Agriculture, Forestry and Fisheries, Japan's total broiler population reached approximately 145 Million birds, as of February 2024, reflecting a 2% increase from 2023. The depreciated yen and general inflation are driving consumers and food service businesses towards domestically produced chicken as a cost-effective protein source, supporting sustained feed demand growth. Industry participants are focusing on developing digestible feed formulations that enhance broiler performance while optimizing production costs. Demand for antibiotic-free and enriched feed formulations is also increasing due to consumer concerns about food safety. Sustainability is emerging as a key focus, with growing interest in alternative protein sources and waste-based feed ingredients.

Japan Poultry Feed Market Trends:

Rising Demand for Eggs and Affordable Poultry Protein

The growing consumer preferences for chicken and eggs as affordable, high animal protein food are propelling the market expansion in Japan. As per IMARC Group, the Japan animal protein market size reached USD 1,839.7 Million in 2025. Compared to beef and pork, poultry offers lower prices, faster production cycles, and better feed efficiency, encouraging higher consumption across households and foodservice outlets. Convenience-oriented diets, including ready-to-eat (RTE) meals, bento boxes, and processed foods, further increase demand for poultry products, especially eggs. As consumption grows, poultry producers scale flock sizes to maintain supply consistency, which directly raises feed demand.

Growing Biosecurity Concerns and Disease Prevention Strategies

The increasing risk of poultry diseases is strongly boosting the demand for scientifically formulated feed. In November 2025, Japan verified the third outbreak of highly pathogenic avian influenza. Officials in Niigata Prefecture reported that the virus was identified at a poultry farm in Tainai City, leading to the culling of approximately 630,000 egg-laying hens. Poultry farmers are focusing on disease prevention instead of treatment, which raises the demand for fortified diets that strengthen bird immunity. Vitamins, minerals, and gut-health ingredients are essential components of feed formulations. Improved nutrition reduces mortality rates and improves recovery during outbreaks, making quality feed a protective investment for producers.

Surging Emphasis on Feed Formulation Optimization

Japanese feed manufacturers are increasingly investing in advanced formulation technologies that enhance nutrient bioavailability and feed conversion efficiency. The industry is witnessing significant developments in precision nutrition approaches that tailor feed compositions to specific growth stages and production objectives. The focus on improving digestibility enables broilers to achieve optimal weight targets while reducing overall feed consumption, addressing cost concerns amid elevated raw material prices. This trend is particularly prominent among large-scale integrated producers seeking competitive advantages through enhanced operational efficiency.

Market Outlook 2026-2034:

The Japan poultry feed market is projected to achieve steady growth, driven by sustained demand for domestically produced chicken meat and continuous improvements in feed technology. The market generated a revenue of USD 13,323.01 Million in 2025 and is projected to reach a revenue of USD 17,916.49 Million by 2034, growing at a compound annual growth rate of 3.35% from 2026-2034, The market broadening is supported by increasing poultry consumption, tourism-driven food service demand, and producer investments in automation and biosecurity infrastructure. The ongoing focus on feed efficiency optimization and nutritional precision will remain central to market development, as producers balance cost pressures with performance requirements.

Japan Poultry Feed Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Nature | Conventional | 63.0% |

| Form | Pellets | 44.2% |

| Additives | Amino Acid | 44.9% |

| Animal Type | Broilers | 72.0% |

| Distribution Channel | Offline | 63.4% |

| Region | Kanto Region | 35.0% |

Nature Insights:

- Conventional

- Organic

Conventional dominates with a market share of 63.0% of the total Japan poultry feed market in 2025.

Conventional poultry feed maintains market leadership through established production infrastructure, proven nutritional efficacy, and competitive pricing that enables broad accessibility across farm scales. The segment benefits from decades of formulation refinement, extensive distribution networks, and strong relationships between manufacturers and agricultural cooperatives that facilitate efficient product delivery. Japanese poultry producers predominantly rely on conventional feed solutions that incorporate imported corn and soybean meal alongside domestic ingredients, providing balanced nutrition supporting commercial production requirements.

The segment's continued dominance reflects practical considerations, including consistent quality standards, regulatory compliance simplicity, and favorable economics compared to premium alternatives. Conventional feed manufacturers have responded to market pressures by improving formulations that enhance digestibility and reduce waste, addressing cost concerns while maintaining nutritional performance. The established supply chains and manufacturing capabilities supporting conventional production ensure reliable product availability across Japan's geographically dispersed poultry farming regions.

Form Insights:

- Mashed

- Pellets

- Crumbles

- Others

Pellets lead with a share of 44.2% of the total Japan poultry feed market in 2025.

Pelleted feed commands significant market presence through demonstrated advantages in feed utilization efficiency, storage stability, and handling convenience that appeal to modern commercial poultry operations. The pelleting process improves nutrient digestibility through heat treatment while creating uniform product density that ensures consistent nutritional intake across flocks.

Japanese poultry producers increasingly favor pelleted formulations that minimize wastage and support precise feeding management essential for optimizing production economics. The compact structure reduces dust generation and simplifies automated feeding system integration, particularly valuable as labor shortages drive adoption of mechanized equipment in poultry operations. Pellet durability during transportation and storage additionally reduces spoilage losses, contributing to overall operational efficiency improvements.

Additives Insights:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

Amino acid exhibits a clear dominance with a 44.9% share of the total Japan poultry feed market in 2025.

Amino acid maintains market leadership as essential components for protein synthesis, muscle development, and metabolic regulation in poultry nutrition. These fundamental building blocks enable optimal growth performance and feed conversion efficiency that directly impact production profitability.

Japanese poultry producers increasingly recognize amino acid supplementation as essential for maximizing genetic potential while minimizing excess protein in formulations that can increase nitrogen excretion and environmental impact. Key amino acids, including lysine, methionine, and threonine, are systematically incorporated into feed programs supporting specific growth stages and production objectives. The segment benefits from established domestic manufacturing capabilities and ongoing research advancing understanding of amino acid interactions and optimal inclusion levels.

Animal Type Insights:

- Layers

- Broilers

- Turkey

- Others

Broilers represent the leading segment with a 72.0% share of the total Japan poultry feed market in 2025.

Broilers represent the predominant market segment reflecting Japan's substantial chicken meat consumption and production infrastructure supporting domestic supply. As per the statistics released by the Ministry of Agriculture, Forestry and Fisheries (MAFF), on February 1, 2023, there was a 2% increase in the broiler population. The segment's commanding position derives from intensive feeding requirements during rapid growth cycles that demand nutrient-dense formulations optimized for weight gain and feed conversion efficiency.

The broiler segment's growth trajectory is supported by rising preference shift towards chicken as an economical protein source amid elevated beef and pork prices. Japanese food service businesses and convenience stores have increasingly substituted chicken for alternative proteins in menu offerings, sustaining demand for domestically produced broiler meat. Feed manufacturers are responding with specialized formulations addressing heat stress management, gut health optimization, and growth performance enhancement to support producer profitability.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Offline

- Online

Offline comprises the largest segment with a 63.4% share of the total Japan poultry feed market in 2025.

Traditional offline distribution channels maintain market leadership through established relationships between feed manufacturers, agricultural cooperatives, and poultry farmers that facilitate personalized service and technical support. The Japan Agricultural Cooperatives system plays a significant role in feed distribution by collectively purchasing production inputs and providing advisory services to member farmers. This infrastructure enables efficient product delivery alongside technical guidance that supports optimal feed utilization.

The offline channel's prominence reflects Japanese agricultural industry characteristics, including emphasis on relationship-based commerce, preference for expert consultation in purchasing decisions, and the technical complexity of feed selection requiring specialized knowledge. Feed manufacturers maintain dedicated sales and technical service teams that work directly with producers to customize formulations and address production challenges. The physical presence of distribution points throughout agricultural regions ensures reliable supply access even for operations in remote locations.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a share of 35.0% of the total Japan poultry feed market in 2025.

The Kanto region dominates the market through its concentration of layer farming operations, proximity to major urban consumption centers, and advanced agricultural infrastructure supporting efficient production. Ibaraki and Chiba prefectures within Kanto rank among Japan's leading egg-producing areas, driving substantial feed demand for layer nutrition. Layers are reared most extensively in the Kanto region in central Japan, reflecting the area's strategic positioning serving Tokyo metropolitan area consumers.

The region benefits from sophisticated logistics networks, established relationships with major feed manufacturers, and access to technical expertise supporting production optimization. Kanto's poultry operations increasingly adopt automation technologies addressing labor constraints while enhancing biosecurity protocols following avian influenza concerns. The concentration of food processing and retail industries creates strong demand pull for consistent poultry product supply, supporting sustained feed consumption growth.

Market Dynamics:

Growth Drivers:

Why is the Japan Poultry Feed Market Growing?

Rising Domestic Chicken Consumption and Tourism Recovery

Japan's poultry feed market is experiencing sustained growth, driven by increasing domestic chicken consumption fueled by price-conscious consumer behavior and tourism recovery. The depreciated yen has elevated import costs for various foods, prompting consumers to shift toward domestically produced chicken as an affordable protein alternative. The food service sector is witnessing particular strength, as international visitor numbers are surging, with tourists dining extensively in restaurants that feature chicken dishes prominently. As per the Japan National Tourism Organization, 36.9 Million foreign tourists visited Japan in 2024, increasing by 47.1% compared to 2023. This is substantially boosting hotel, restaurant, and institutional demand for chicken products and consequently supporting feed consumption growth.

Government Support Programs for Livestock Producers

The Japanese government has implemented comprehensive support mechanisms addressing elevated feed costs that threaten producer profitability. In April 2023, the Ministry of Agriculture, Forestry and Fisheries (MAFF) enacted a specific measure within the Compound Feed Price Stabilization System to increase feed compensation payments for livestock, poultry, and swine producers. These programs enable producers to maintain operations and continue to invest in production capacity despite challenging cost environments. Additionally, government initiatives promoting feed self-sufficiency are encouraging expanded utilization of domestically produced ingredients, supporting rural agricultural economies while enhancing supply chain resilience against international market volatility.

Technological Advancements in Feed Manufacturing and Production

Feed manufacturers are driving the market growth through continuous technological innovations that enhance production efficiency and product performance. Advancements in feed formulation science enable more precise nutrition delivery that improves feed conversion ratios and reduces waste. The industry is adopting sophisticated manufacturing technologies, including improved pelleting processes, advanced quality control systems, and automated production equipment that enhance consistency and efficiency. These innovations enable feed producers to develop specialized products addressing specific production challenges, including heat stress management, gut health optimization, and disease resistance enhancement. From October 2024 to February 2025, around 8.4 Million birds were euthanized due to outbreaks in Japan. Innovations in manufacturing support producer profitability, encouraging continued investments in quality feed solutions.

Market Restraints:

What Challenges the Japan Poultry Feed Market is Facing?

High Import Dependence for Feed Ingredients

Japan's poultry feed industry is facing structural vulnerability from heavy reliance on imported raw materials, particularly corn and soybean meal that comprise significant portions of standard formulations. The feed self-sufficiency rate for concentrated feed remains below, exposing producers to international commodity price volatility and currency fluctuation risks. This import dependence creates cost pressures that are difficult to mitigate through operational adjustments alone.

Labor Shortages in Agricultural Sector

The declining and aging agricultural workforce presents ongoing challenges for Japan's poultry industry and associated feed demand growth. Farms struggle to attract younger workers willing to engage in labor-intensive livestock production, constraining expansion potential despite favorable market conditions. While automation addresses some labor requirements, initial investment costs and technical complexity create barriers, particularly for smaller operations.

Disease Outbreak Risks and Biosecurity Costs

Disease outbreak risks and rising biosecurity costs are limiting the growth of the market by increasing operational expenses for farmers. Investments in vaccination, sanitation systems, and controlled environments reduce farm profitability and restrict expansion. During outbreaks, temporary farm closures and lower bird populations reduce feed demand, creating short-term market instability and cautious purchasing behavior among producers.

Competitive Landscape:

The Japan poultry feed market features moderate competitive intensity, characterized by the presence of established domestic manufacturers alongside multinational corporations serving specialized segments. Major market participants leverage comprehensive product portfolios, extensive distribution networks, and integrated technical support services to maintain customer relationships. Competition centers on feed performance characteristics, pricing strategies, and value-added services, including production management systems and veterinary consultation. Market leaders are pursuing strategic initiatives, including manufacturing capacity enhancements, research and development (R&D) investments, and partnership arrangements that strengthen competitive positioning. Companies are differentiating through specialty formulations addressing specific production challenges, sustainability initiatives, and digital solutions supporting farm management optimization. The fragmented nature of Japan's poultry farming sector creates opportunities for manufacturers serving diverse customer segments ranging from large integrated operations to smaller independent producers.

Japan Poultry Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Conventional, Organic |

| Forms Covered | Mashed, Pellets, Crumbles, Others |

| Additives Covered | Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, Others |

| Animal Types Covered | Layers, Broilers, Turkey, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan poultry feed market size was valued at USD 13,323.01 Million in 2025.

The Japan poultry feed market is expected to grow at a compound annual growth rate of 3.35% from 2026-2034 to reach USD 17,916.49 Million by 2034.

Conventional holds the largest market share at 63.0%, as it is more affordable, widely available, and supported by an established supply chain. Conventional farming meets mass consumer demand better than higher-priced organic or specialty alternatives.

Key factors driving the Japan poultry feed market include rising domestic chicken consumption, driven by tourism recovery and price-sensitive consumers, government support programs stabilizing producer economics, technological advancements in feed formulation and manufacturing, and increasing focus on feed efficiency optimization.

Major challenges include high dependence on imported feed ingredients creating vulnerability to commodity price and currency fluctuations, labor shortages constraining production expansion, disease outbreak risks requiring significant biosecurity investments, and elevated raw material costs pressuring producer margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)