Japan Powder Coating Equipment Market Size, Share, Trends and Forecast by Resin Type, Component, End-Use Industry, and Region, 2026-2034

Japan Powder Coating Equipment Market Summary:

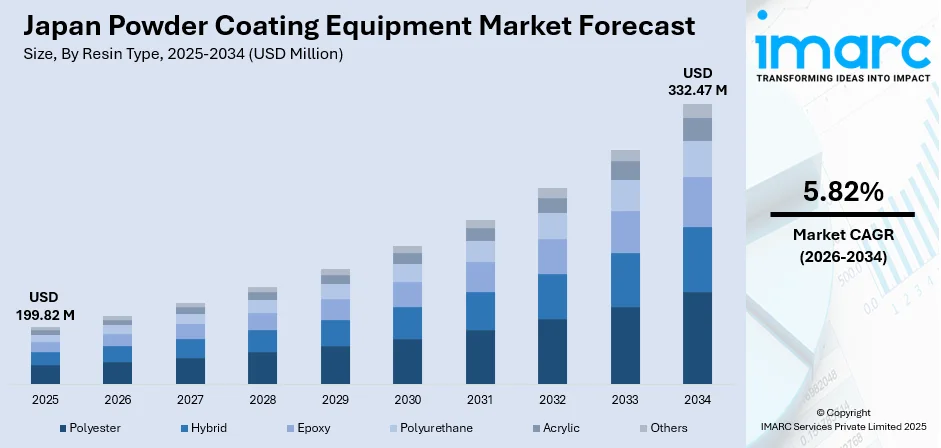

The Japan powder coating equipment market size was valued at USD 199.82 Million in 2025 and is projected to reach USD 332.47 Million by 2034, growing at a compound annual growth rate of 5.82% from 2026-2034.

The Japan powder coating equipment market is experiencing growth driven by the nation's advanced manufacturing ecosystem and commitment to sustainable industrial practices. The convergence of automotive production excellence, electronics manufacturing precision, and stringent environmental regulations is fundamentally reshaping surface finishing technologies across industries. Technological advancements in automation, customization capabilities, and defect-free coating processes are enhancing industrial productivity while supporting Japan's broader sustainability objectives, positioning the market for continued growth throughout the forecast period.

Key Takeaways and Insights:

- By Resin Type: Polyester dominates the market with a share of 37.5% in 2025, driven by its exceptional UV resistance, superior weatherability characteristics, and cost-effective performance across outdoor architectural and automotive applications requiring durable finishes.

- By Component: Grinder leads the market with a share of 35.2% in 2025, owing to its essential role in achieving precise particle size consistency and its adaptability across diverse powder formulations required for specialized coating applications.

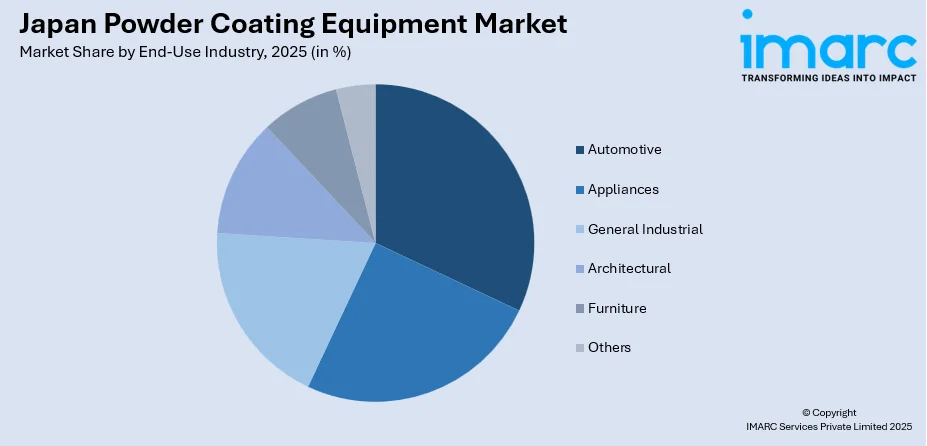

- By End-Use Industry: Automotive represents the largest segment with a market share of 29.8% in 2025. This dominance is driven by Japan's world-class automotive manufacturing base requiring superior corrosion resistance and premium surface finishes for chassis, alloy wheels, and EV battery components.

- By Region: Kanto Region leads the market with a share of 38.9% in 2025, driven by the concentration of Japan's automotive and electronics manufacturing in prefectures including Tokyo, Kanagawa, and surrounding industrial zones with superior infrastructure.

- Key Players: The Japan powder coating equipment market exhibits moderate to highly competitive intensity, with established domestic manufacturers and specialized global equipment suppliers competing across technology segments and application-specific solutions.

To get more information on this market Request Sample

The Japan powder coating equipment market is progressing as industries seek durable, high-performance finishes and align with environmental regulations that limit solvent-based coatings. Adoption is growing across automotive, electronics, construction, and general manufacturing due to the need for efficient material use, improved coating quality, and reduced operational costs. In 2024, Japan identified the Tokyo Outer Ring Road (Gaikan Expressway) expansion as its largest infrastructure project, covering 85 kilometers to ease congestion and enhance regional connectivity, which reflects ongoing investment in sectors that rely on metal components requiring protective finishes. Advancements in automation, precision application systems, and energy-efficient curing methods further support the shift toward powder coating. As companies emphasize long service life, minimal maintenance, and consistent production performance, demand for modern powder coating equipment continues to strengthen, reinforced by both regulatory expectations and industry-wide sustainability goals.

Japan Powder Coating Equipment Market Trends:

Rising Demand in Automotive Industry Coatings

The Japan powder coating equipment market is significantly driven by the growing demand from the automotive industry. Powder coating is favored for its superior quality finishes and durability, making it an ideal choice for automotive manufacturers. In 2024, Japan saw the sale of 4,421,494 new passenger vehicles, according to the ITA, reflecting the increasing production of vehicles. This growth, combined with a rising preference for eco-friendly solutions, further promotes the adoption of powder coating technologies. As manufacturers focus on providing high-quality, cost-effective solutions for both interior and exterior vehicle components, the demand for powder coating equipment is growing.

Increasing Focus on Automation and Industry 4.0 Integration

The shift towards automation and the adoption of Industry 4.0 technologies are propelling the market by enhancing production efficiency, precision, and scalability through the integration of smart systems and robotics. By integrating automated systems, robotics, and Internet of Things (IoT) technologies, powder coating equipment enhances productivity, precision, and scalability. For example, the Japanese automotive industry installed approximately 13,000 industrial robots in 2024, marking an 11% increase compared to the previous year and the highest level since 2020, according to the International Federation of Robotics (IFR). This growing trend highlights the emphasis on automation. As manufacturers increasingly focus on automation to stay competitive and optimize operations, there is a rise in the demand for advanced automated powder coating equipment.

Expansion of E-Commerce and Packaging Industry

The growth of the e-commerce sector in Japan is significantly driving the demand for powder coating equipment, particularly within the packaging industry. As online retail expands, the need for packaging that is durable and visually appealing intensifies. Powder coatings, known for their superior durability, scratch resistance, and vibrant finishes, provide an ideal solution for packaging materials. In 2024, Japan’s BtoC e-commerce market reached JPY26.1 trillion, maintaining annual growth of over 5%, while the BtoB e-commerce market grew to JPY514.4 trillion, reflecting a robust 10.6% increase the prior year, as reported by the Ministry of Economy, Trade and Industry (METI). This growth aligns with the demand for high-quality, customized coatings in packaging, further contributing to the powder coating equipment market growth.

Market Outlook 2026-2034:

The Japan powder coating equipment market is set to witness strong growth throughout the forecast period, driven by continuous technological advancements and the increasing demand for sustainable coating solutions. As industries shift towards more eco-friendly practices, powder coating’s advantages, such as low environmental impact and durability, are becoming more appealing. The market generated a revenue of USD 199.82 Million in 2025 and is projected to reach a revenue of USD 332.47 Million by 2034, growing at a compound annual growth rate of 5.82% from 2026-2034.

Japan Powder Coating Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin Type | Polyester | 37.5% |

| Component | Grinder | 35.2% |

| End-Use Industry | Automotive | 29.8% |

| Region | Kanto Region | 38.9% |

Resin Type Insights:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Acrylic

- Others

Polyester dominates with a share of 37.5% of the total Japan powder coating equipment market in 2025.

Polyester leads the market in terms of resin type due to its excellent durability, weather resistance, and versatility. It is widely used for applications exposed to outdoor environments, such as automotive parts and architectural finishes, ensuring long-lasting performance.

Additionally, polyester-based powder coating offers superior aesthetic qualities, including a smooth finish and a wide range of color options. Its ability to resist fading, corrosion, and abrasion makes it a popular choice across various industries.

Component Insights:

- Kneader

- Extruder

- Cooling Equipment

- Grinder

- Others

Grinder leads with a share of 35.2% of the total Japan powder coating equipment market in 2025.

Grinder holds the biggest market share due to its essential role in surface preparation. Efficient grinding ensures proper adhesion of the powder coating, making grinder crucial for achieving high-quality, durable finishes in various applications.

Furthermore, grinder offers precision and versatility, which is highly valued in the powder coating process. Its ability to remove imperfections and smooth surfaces before coating enhances the overall quality of the final product, solidifying its dominance in the market in Japan.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Appliances

- Automotive

- General Industrial

- Architectural

- Furniture

- Others

Automotive exhibits a clear dominance with a 29.8% share of the total Japan powder coating equipment market in 2025.

Automotive represents the largest segment, driven by its high demand for durable, aesthetically appealing, and environment-friendly coatings. Powder coatings offer superior performance, such as resistance to scratches and corrosion, making them ideal for automotive components.

Additionally, the automotive industry's focus on sustainability and cost-effectiveness drives the adoption of powder coating technologies. With growing environmental concerns, automakers increasingly favor powder coatings for their lower volatile organic compound (VOC) emissions, aligning with both performance requirements and regulatory standards in the automotive sector.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a share of 38.9% of the total Japan powder coating equipment market in 2025.

The Kanto Region dominates the market due to its concentration of industries, such as automotive, electronics, and manufacturing. As the economic center of Japan, the region drives significant demand for advanced coating solutions in various sectors.

The dominance of the Kanto Region, reinforced by its robust infrastructure and key manufacturing presence, is supported by massive commercial development projects like the Kawasaki New! Arena City Project, announced in 2025 by DeNA and Keikyu, which features a 15,000-seat arena and a 17-story commercial building aiming for a 2030 opening.

Market Dynamics:

Growth Drivers:

Why is the Japan Powder Coating Equipment Market Growing?

Growing Employment in Architectural Industry

Powder coatings are utilized in the architectural sector for enhancing the durability and aesthetics of metal surfaces, including windows, doors, and building facades, offering superior resistance against weathering, corrosion, and fading. This technical versatility, combined with their broad range of colors and textures, supports complex design demands for both residential and commercial structures. Reflecting a growing industry shift toward sustainable construction practices, their low environmental impact, as exemplified by the January 2025 reveal of the first completed phase of Toyota's Woven City near Mount Fuji, designed by BIG and Nikken Sekkei, which utilizes advanced, environmentally-conscious building materials. Such projects are making for powder coatings a compelling choice over traditional liquid systems.

Furniture Manufacturing

Powder coatings serve as a critical finishing solution for metal furniture components, including tables, chairs, and shelving units, within the furniture manufacturing sector. These coatings deliver a consistently smooth and exceptionally durable finish, offering strong resistance to scratching, chipping, and fading, thereby guaranteeing the long-term aesthetic integrity of the product under regular use. This quality is particularly relevant given the significant scale of the industry, where the Japan furniture market size reached USD 23.2 Billion in 2025, as per the IMARC Group. Furthermore, the ability to apply powder coatings in a wide spectrum of customizable colors and textures allows manufacturers to meet diverse and specific design requirements, directly enhancing the furniture's longevity and market appeal for both residential and commercial applications.

Rising Application in Railway and Transportation Sector

Railway operators in Japan rely on powder coating for interior and exterior metal components, as it offers strong resistance to corrosion, fading, vibration, and temperature variations. This supports the long service life expected across passenger and freight fleets. In 2025, Hokkaido Railway Co. announced two new luxury tourist trains, the Red Star and Blue Star, scheduled to begin service in 2027, reflecting ongoing investment in modern rolling stock. Powder coating also ensures consistent finishes across large fleets, aiding branding and simplifying maintenance. Its suitability for high-volume production and refurbishment programs further strengthens its role in railway applications.

Market Restraints:

What Challenges the Japan Powder Coating Equipment Market is Facing?

High Initial Equipment Investment and Capital Requirements

The high initial investment required for advanced powder coating systems poses a significant barrier, especially for small and medium-sized enterprises (SMEs) with limited financial resources. Setting up a complete powder coating production line requires substantial upfront costs. While these systems offer long-term operational savings due to their efficiency and lower environmental impact, the high capital expenditure needed to establish such setups may deter potential adopters, particularly those lacking access to large capital reserves or financing options.

Technical Complexity and Skilled Labor Shortage

Operating sophisticated powder coating equipment requires specialized technical expertise, which is often in short supply within Japan's manufacturing sector. These systems are complex and demand highly skilled operators who can maintain optimal coating parameters, troubleshoot potential issues, and ensure consistent product quality. The technical intricacy of these operations, ranging from adjusting curing times and temperatures to controlling powder application techniques, requires a well-trained workforce. However, Japan faces a shortage of such skilled labor, which presents a significant challenge for manufacturers seeking to expand their powder coating capabilities.

Raw Material Price Volatility and Supply Chain Constraints

Raw material price volatility, particularly for key components like resins and additives used in powder coatings, creates uncertainty in pricing, directly affecting market demand. These price fluctuations can disrupt production schedules and complicate cost planning for manufacturers, as the cost of materials can vary significantly over short periods. Additionally, Japan’s dependence on imported chemical feedstocks for powder coatings exposes manufacturers to global supply chain constraints. Disruptions in international trade or logistics can lead to material shortages, forcing manufacturers to delay production or seek alternative suppliers, which can further strain financial planning and investment decisions.

Competitive Landscape:

The Japan powder coating equipment market exhibits moderate to highly competitive intensity characterized by the presence of established domestic manufacturers alongside specialized global equipment suppliers. Market dynamics reflect strategic positioning across technology segments, with Japanese companies leveraging precision engineering expertise while international players offer comprehensive system solutions. Competition is increasingly shaped by innovation in automation technologies, sustainability features, and application-specific customization capabilities. Equipment suppliers differentiate through modular configurations enabling scalable production, fast color-change technologies reducing downtime, and integrated quality control systems meeting Japan's demanding manufacturing standards. Strategic partnerships between equipment manufacturers and coating material innovators continue driving product development and market growth.

Japan Powder Coating Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Hybrid, Epoxy, Polyurethane, Acrylic, Others |

| Components Covered | Kneader, Extruder, Cooling Equipment, Grinder, Others |

| End-Use Industries Covered | Appliances, Automotive, General Industrial, Architectural, Furniture, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan powder coating equipment market size was valued at USD 199.82 Million in 2025.

The Japan powder coating equipment market is expected to grow at a compound annual growth rate of 5.82% from 2026-2034 to reach USD 332.47 Million by 2034.

Polyester dominates the market with a share of 37.5% in 2025, driven by its exceptional UV resistance, superior weatherability characteristics, and cost-effective performance across outdoor architectural and automotive applications.

Key factors driving the Japan powder coating equipment market include the growing demand from the automotive industry. In 2024, Japan saw the sale of 4,421,494 new passenger vehicles, according to ITA, catalyzing the demand for durable, eco-friendly powder coatings in vehicle manufacturing.

Major challenges include high initial equipment investment and capital requirements, technical complexity requiring specialized skilled labor, raw material price volatility affecting production costs, and supply chain constraints impacting equipment availability and component sourcing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)