Japan Powder Coatings Market Size, Share, Trends and Forecast by Resin Type, Coating Method, Application, and Region, 2026-2034

Japan Powder Coatings Market Overview:

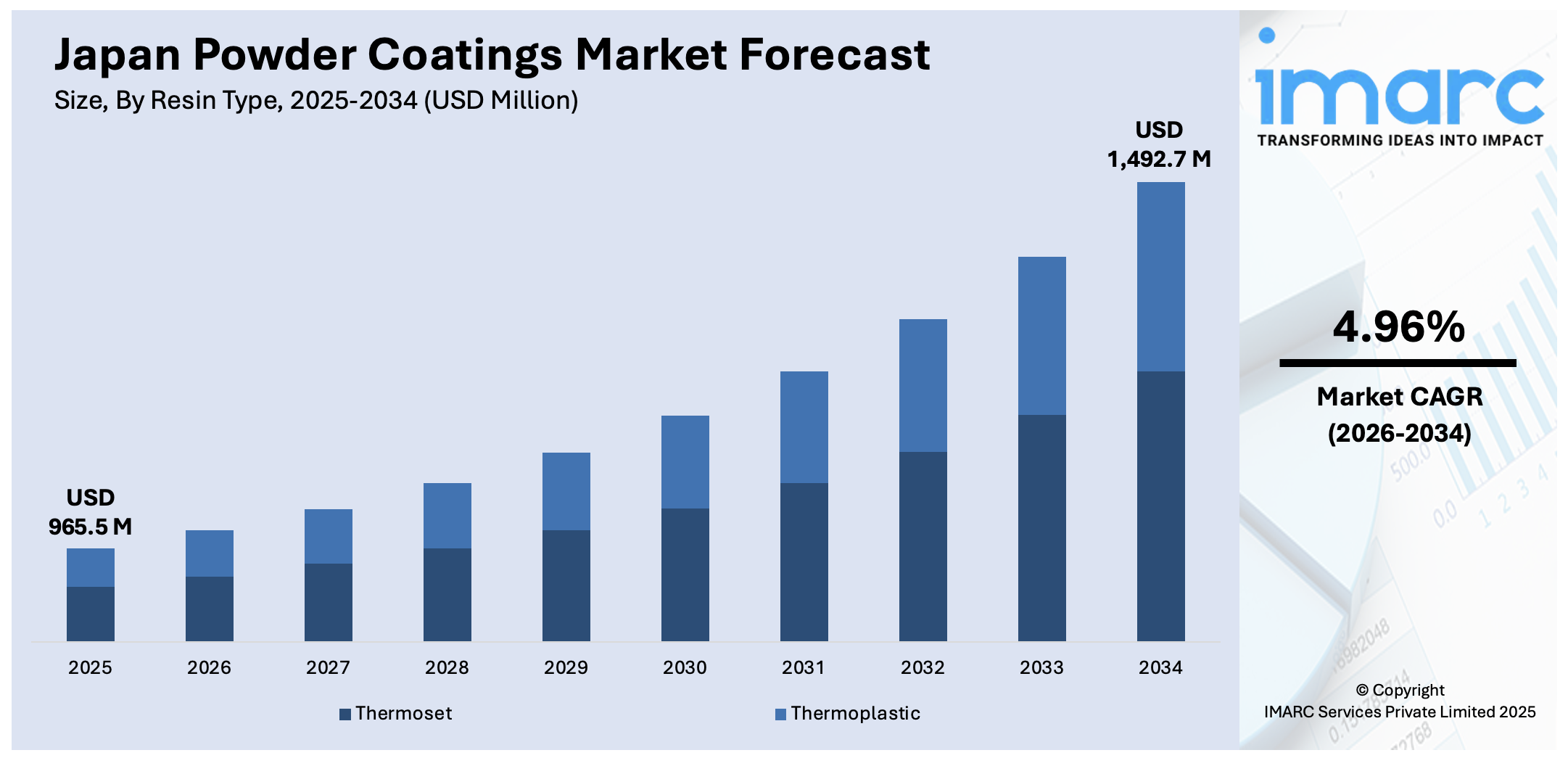

The Japan powder coatings market size reached USD 965.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,492.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.96% during 2026-2034. The market is driven by increasing demand from the automotive and construction sectors due to the superior durability and environmental benefits of powder coatings. Along with this, strict environmental regulations in Japan have encouraged a shift away from solvent-based coatings, favoring powder coatings that emit negligible VOCs. Additionally, advancements in resin technology and the growing preference for aesthetically consistent and long-lasting finishes in appliances and consumer goods further augments Japan powder coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 965.5 Million |

| Market Forecast in 2034 | USD 1,492.7 Million |

| Market Growth Rate 2026-2034 | 4.96% |

Japan Powder Coatings Market Trends:

Rising Use in Automotive Lightweighting and Component Protection

Japan’s automotive sector is under pressure to meet stricter fuel efficiency and emissions targets without sacrificing safety or performance. As a result, automakers are aggressively adopting lightweight materials such as aluminum, magnesium alloys, and carbon composites. Powder coatings are playing a growing role in protecting these materials due to their superior adhesion, corrosion resistance, and ability to form strong, uniform films on complex surfaces. Apart from this, powder coatings are now used not only on chassis and underbody parts but also on battery casings, suspension arms, and even interior trim components. The process’s compatibility with automation, combined with the elimination of solvents, supports automotive factories' push for cleaner, more energy-efficient production lines. Heat-sensitive parts can now be coated with the advancements in low-bake powders that cure at temperatures below 150°C, which was previously a major limitation. This trend is further reinforced by the electric vehicle (EV) segment’s growth, where weight savings are critical to maximizing battery efficiency. For instance, in September 2024, the Japanese government announced JPY 55.7 Billion (about USD 391.36 Million) to fund Nissan Motor Co. Ltd.'s electric vehicle (EV) battery research strategy. Government financial grants further support the growth of EV. his investment, part of Japan’s broader push to lead in electrified mobility, signals long-term demand for advanced materials and finishes, including high-performance powder coatings. Japanese automakers are working closely with powder coating manufacturers to ensure compatibility with high-voltage components, particularly in environments with exposure to thermal stress and road chemicals.

To get more information on this market Request Sample

Surging Demand in Construction and Infrastructure Refurbishment

Japan’s aging infrastructure, bridges, tunnels, public housing, and transit systems, requires durable, weather-resistant coatings for refurbishment and protection. This, in turn, is positively impacting Japan powder coatings market growth. Notably, on 7 June 2025, Japan’s Cabinet approved a comprehensive JYP 20 Trillion (about USD 139 Billion) disaster‑resilience plan covering fiscal 2026–2030. The initiative allocates JYP 10.6 Trillion to upgrade aging infrastructure, including water, sewer, transport, communication, and energy systems, and aims to repair all corroded sewer pipes by FY 2030 and upgrade 80% of urgent bridges by then. Additionally, JYP 5.8 Trilion is dedicated to flood and landslide countermeasures, while JYP 1.8 Trillion will enhance disaster preparedness at evacuation centers, such as improving school facilities. Powder coatings offer corrosion resistance, UV stability, and mechanical strength, making them suitable for aluminum facades, steel railings, and exterior cladding. With the country entering a phase of infrastructure renewal, demand has increased sharply for architectural-grade coatings. Fluoropolymer-based powders, which offer long-term gloss and color retention, are being used in urban projects where appearance and endurance are both critical. Moreover, government support for smart cities and eco-friendly public infrastructure has led to mandates or incentives for materials that meet environmental and durability benchmarks. This trend is further strengthened by Tokyo’s hosting of global events and urban redevelopment plans, which demand high-specification coatings with extended maintenance intervals.

Japan Powder Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on resin type, coating method, and application.

Resin Type Insights:

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Thermoplastic

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes thermoset (epoxy, polyester, epoxy polyester hybrid, and acrylic) and thermoplastic [polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidene fluoride (PVDF)].

Coating Method Insights:

- Electrostatic Spray

- Fluidized Bed

A detailed breakup and analysis of the market based on the coating method have also been provided in the report. This includes electrostatic spray and fluidized bed.

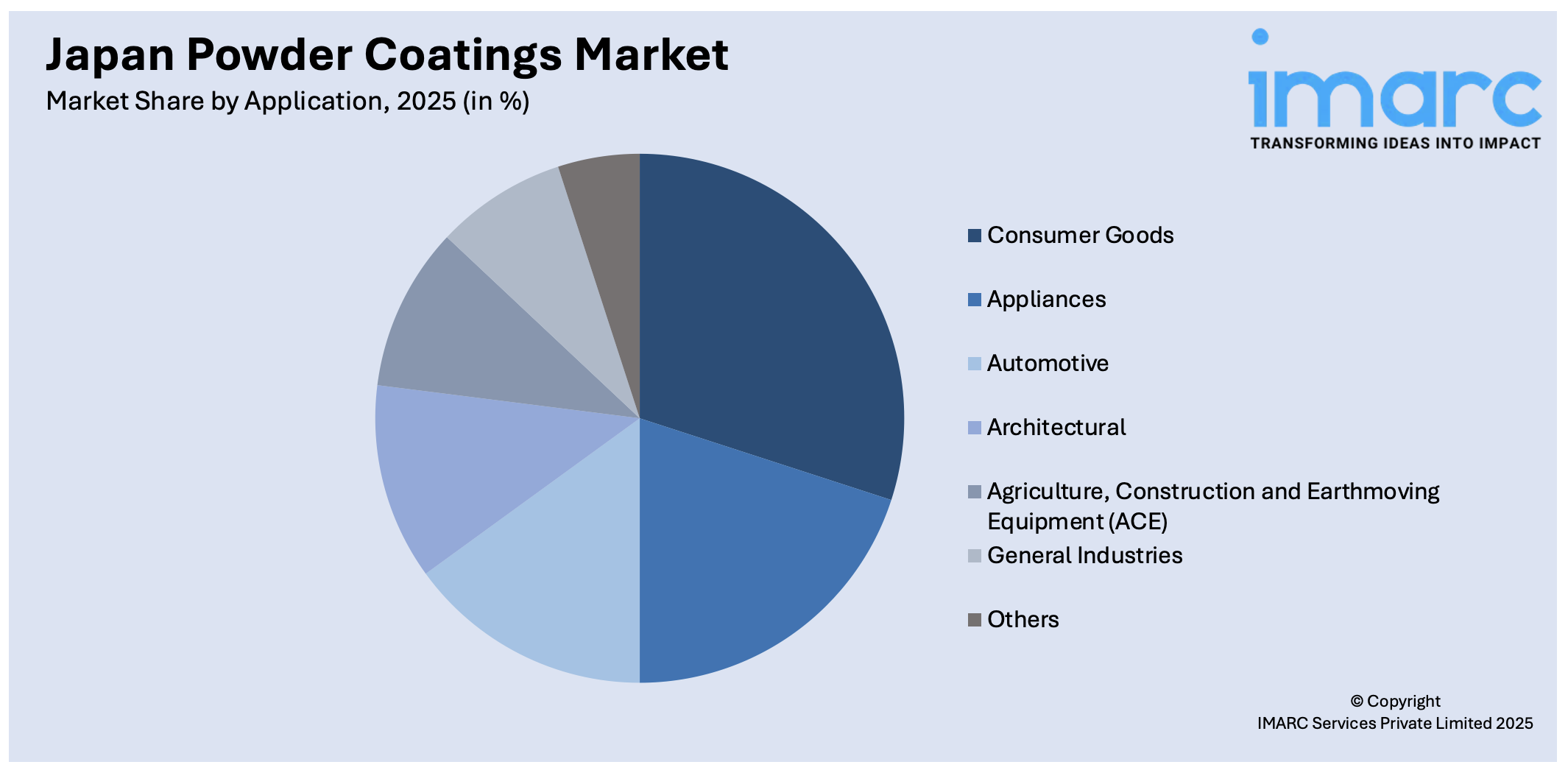

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Goods

- Appliances

- Automotive

- Architectural

- Agriculture, Construction and Earthmoving Equipment (ACE)

- General Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer goods, appliances, automotive, architectural, agriculture, construction and earthmoving equipment (ACE), general industries, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Powder Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered |

|

| Coating Methods Covered | Electrostatic Spray, Fluidized Bed |

| Applications Covered | Consumer Goods, Appliances, Automotive, Architectural, Agriculture, Construction and Earthmoving Equipment (ACE), General Industries, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan powder coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan powder coatings market on the basis of resin type?

- What is the breakup of the Japan powder coatings market on the basis of coating method?

- What is the breakup of the Japan powder coatings market on the basis of application?

- What is the breakup of the Japan powder coatings market on the basis of region?

- What are the various stages in the value chain of the Japan powder coatings market?

- What are the key driving factors and challenges in the Japan powder coatings market?

- What is the structure of the Japan powder coatings market and who are the key players?

- What is the degree of competition in the Japan powder coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan powder coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan powder coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan powder coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)