Japan Power Cables Market Size, Share, Trends and Forecast by Installation, Voltage, Material, End-Use Sector, and Region, 2026-2034

Japan Power Cables Market Overview:

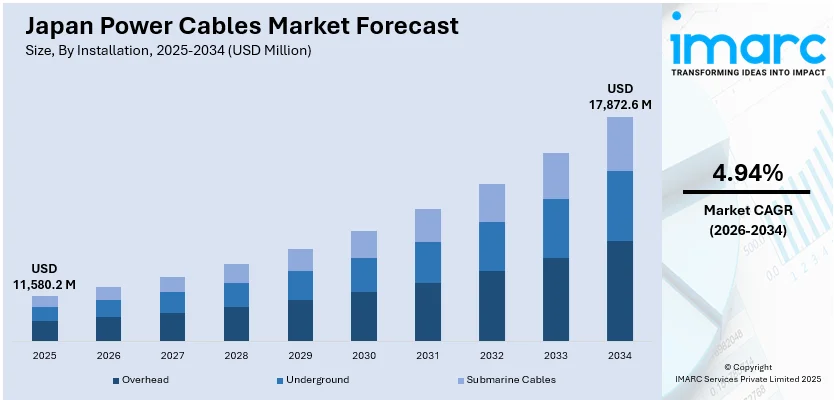

The Japan power cables market size reached USD 11,580.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 17,872.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is being driven by the increasing demand for renewable energy infrastructure, urbanization, advancements in smart grid technology, supportive government policies aimed at reducing carbon emissions, rising electric vehicle (EV) sales, and the escalating need for reliable and efficient power distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11,580.2 Million |

| Market Forecast in 2034 | USD 17,872.6 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Japan Power Cables Market Trends:

Rise in Renewable Energy and the Elevating Need for High-Voltage Power Cables

Japan’s goal of reaching net-zero emissions by 2050 is fueling strong growth in the power cable industry, especially as the country increasingly relies on renewable energy sources like wind, solar, and hydro power. As Japan accelerates its transition to renewables, the demand for high-voltage and specialized power cables, essential for transmitting energy from renewable generation sites to urban and industrial areas, is rising. The government's ambitious renewable energy goals are central to this transition, with Japan aiming to achieve a 36-38% renewable share in its power generation mix by 2030. This shift requires substantial investments in power transmission infrastructure, which directly fuels the need for advanced power cables. Additionally, the growing use of offshore wind energy calls for subsea cables that can handle higher voltages and ensure efficient transmission over long distances. The country is also targeting 10 GW of installed offshore wind capacity by 2030, further stimulating demand for high-voltage cables and driving growth in the power cables market.

To get more information on this market Request Sample

Expansion of EV Infrastructure and the Demand for Charging Station Cables

The rapid adoption of EVs in Japan is significantly driving the demand for power cables, especially for EV charging stations. With Japan aiming to make all new vehicles sold by 2035 electric or hybrid, the infrastructure supporting EVs is expanding rapidly. This includes the installation of a widespread network of EV charging stations, which requires high-quality power cables capable of efficiently delivering power. According to the Japan Automobile Manufacturers Association (JAMA), the number of EVs in Japan is expected to exceed 10 million by 2035, creating a substantial demand for charging infrastructure. As of 2024, Japan had around 54,000 EV charging stations, with plans to increase this number substantially over the near-term. This expansion necessitates the use of high-performance cables capable of handling the high power loads needed for fast-charging stations, while ensuring safety and durability. The shift to EVs is also driving the development of cables for ultra-fast charging, further boosting demand for advanced power cables in Japan’s growing EV infrastructure.

Japan Power Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on installation, voltage, material, and end-use sector.

Installation Insights:

- Overhead

- Underground

- Submarine Cables

The report has provided a detailed breakup and analysis of the market based on the installation. This includes overhead, underground, and submarine cables.

Voltage Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes high, medium, and low.

Material Insights:

- Copper

- Aluminum

The report has provided a detailed breakup and analysis of the market based on the material. This includes copper and aluminum.

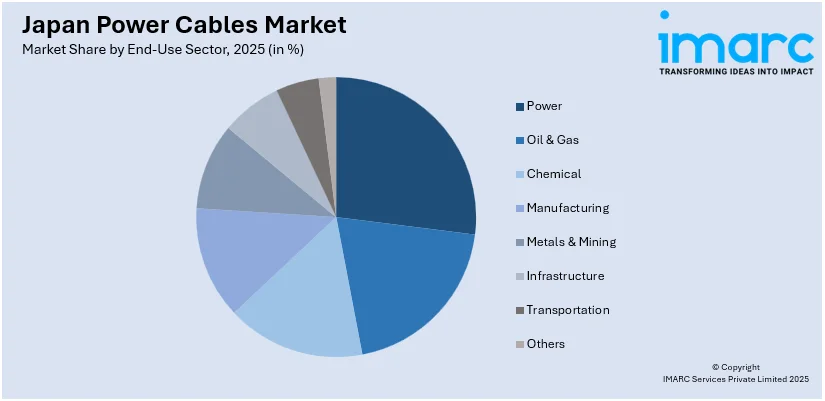

End-Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Power

- Oil & Gas

- Chemical

- Manufacturing

- Metals & Mining

- Infrastructure

- Transportation

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes power, oil & gas, chemical, manufacturing, metals & mining, infrastructure, transportation, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Power Cables Market News:

- February 2025: Japan announced plans to boost submarine cable investments amid rising security concerns and global tensions, strengthening power cable networks. Supported by strategic production and cable-laying vessel subsidies, the government aims to secure critical infrastructure, counteract potential sabotage, and address escalating geopolitical risks effectively.

- December 2024: Yokogawa introduced the OpreX Subsea Power Cable Monitoring system, designed to detect damage and enable condition-based maintenance for offshore wind farms. This solution enhances the reliability of subsea power cables by providing real-time monitoring, allowing operators to identify issues promptly and reduce downtime.

- March 2024: SeaTwirl, a Swedish developer of vertical-axis floating wind turbines, partnered with Sumitomo Corporation Power & Mobility to promote its technology in Japan. This collaboration targets Japan's vast offshore wind potential. The deployment of offshore wind farms will also necessitate substantial power cable infrastructure to transmit electricity to the grid.

Japan Power Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| Materials Covered | Copper, Aluminum |

| End-Use Sectors Covered | Power, Oil & Gas, Chemical, Manufacturing, Metals & Mining, Infrastructure, Transportation, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan power cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan power cables market on the basis of installation?

- What is the breakup of the Japan power cables market on the basis of voltage?

- What is the breakup of the Japan power cables market on the basis of material?

- What is the breakup of the Japan power cables market on the basis of end-use sector?

- What are the various stages in the value chain of the Japan power cables market?

- What are the key driving factors and challenges in the Japan power cables market?

- What is the structure of the Japan power cables market and who are the key players?

- What is the degree of competition in the Japan power cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan power cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan power cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan power cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)