Japan Power Plant Equipment Market Size, Share, Trends and Forecast by Technology, Power Plant Type, and Region, 2026-2034

Japan Power Plant Equipment Market Overview:

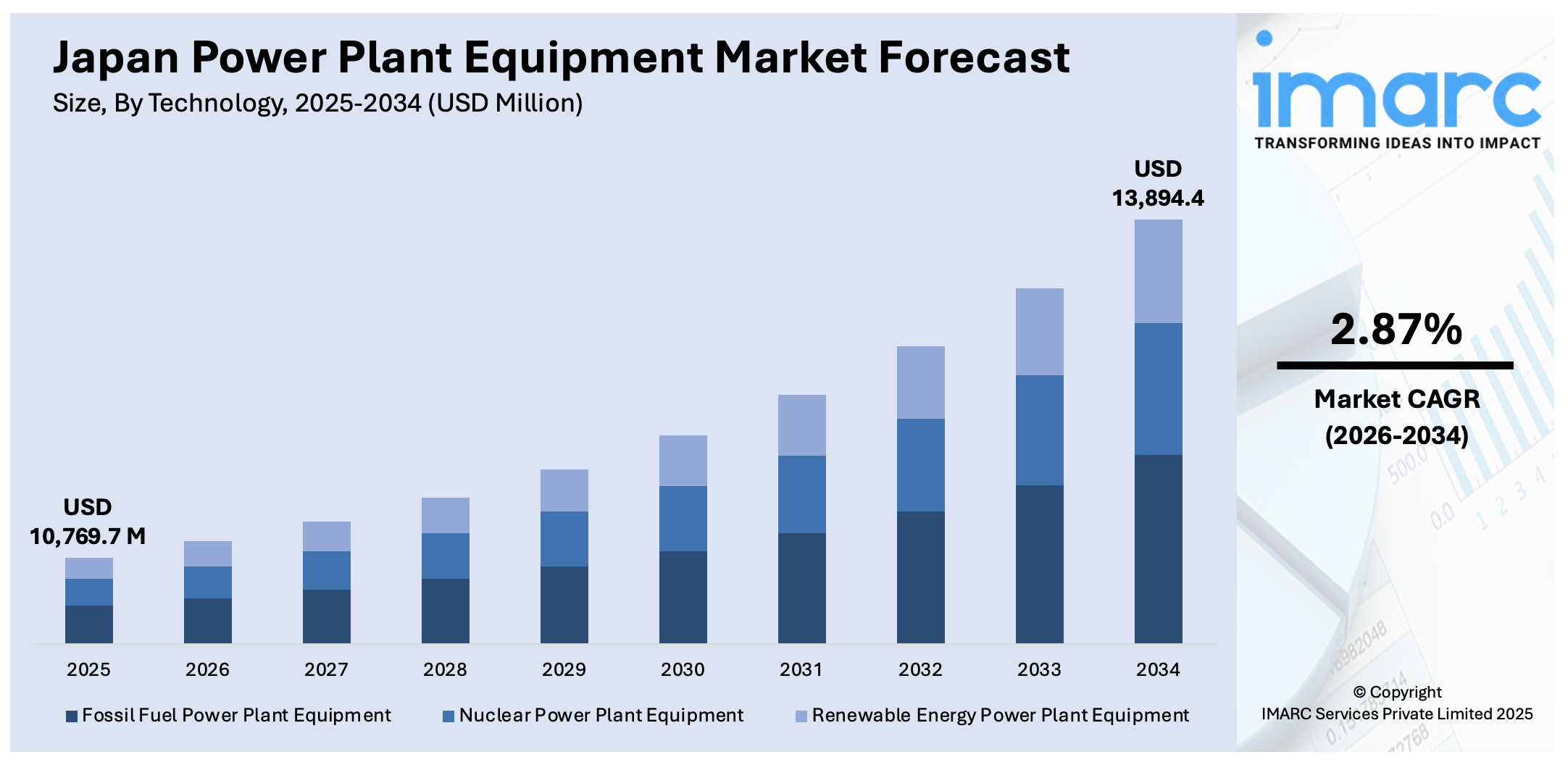

The Japan power plant equipment market size reached USD 10,769.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 13,894.4 Million by 2034, exhibiting a growth rate (CAGR) of 2.87% during 2026-2034. The market is evolving with strong momentum, supported by government-driven energy transition and technology upgrades. Demand also spans thermal, nuclear, renewables, and grid infrastructure, driven by goals of efficiency, decarbonization, and resilience. Major domestic manufacturers are further investing in smart grid, energy storage, and advanced plant systems while navigating supply-chain constraints. These developments are reshaping industry participation and reinforcing the Japan power plant equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10,769.7 Million |

|

Market Forecast in 2034

|

USD 13,894.4 Million |

| Market Growth Rate 2026-2034 | 2.87% |

Japan Power Plant Equipment Market Trends:

Policy Momentum Toward Energy Transition and Decarbonization

Japan's government has made clean energy and decarbonization a strategic national priority, which directly impacts the demand for advanced power plant equipment. Policies supporting renewable energy, energy efficiency, and zero-emission targets are pushing power utilities and private players to invest in next-generation systems. This includes high-efficiency turbines, low-emission boilers, carbon capture technologies, and smart grid equipment. Regulatory frameworks such as Japan’s Sixth Strategic Energy Plan and net-zero targets by 2050 emphasize upgrading outdated infrastructure to meet future energy needs. Government subsidies, research and development (R&D) grants, and carbon offset incentives are creating favorable conditions for market expansion. As a result, manufacturers are focusing on innovative solutions and local production capabilities, while energy providers are modernizing existing plants, leading to increased procurement of power generation and grid enhancement technologies.

To get more information on this market Request Sample

Renewable Energy Integration and Storage Expansion

Japan’s increasing reliance on renewables like solar, wind, and geothermal requires robust supporting infrastructure, which drives demand for power plants and grid equipment. Integrating variable energy sources into the national grid has led to investments in advanced energy storage systems, such as lithium-ion and vanadium flow batteries, and grid stabilization technologies. These developments necessitate new inverters, smart control panels, substation equipment, and remote monitoring systems. Government-backed projects in regions like Hokkaido are leading the deployment of utility-scale batteries that improve reliability. To optimize energy flow and reduce transmission losses, upgrades to grid interconnections and distribution transformers are also underway. As renewable penetration deepens, the demand for flexible, resilient, and scalable equipment becomes central to Japan’s future-proof energy infrastructure strategy, which is expected to fuel the Japan power plant equipment market growth.

Nuclear Revival and Life-Extension Programs

Following a period of inactivity post-Fukushima, Japan is reviving its nuclear energy strategy to enhance energy security and meet climate goals. The government has approved restarting several reactors and extending the operational lifespan of nuclear plants beyond 60 years. This revival necessitates major retrofitting, safety upgrades, and modernization of equipment such as pressure vessels, reactor cores, heat exchangers, and control systems. Equipment suppliers are seeing renewed demand for specialized nuclear-grade components. As nuclear becomes a long-term fixture in Japan’s power mix, the need for durable and high-performance equipment increases. With safety as a top priority, utilities are also investing in monitoring, diagnostics, and automation technologies, creating additional opportunities across the nuclear power plant equipment value chain.

Japan Power Plant Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology and power plant type.

Technology Insights:

- Fossil Fuel Power Plant Equipment

- Nuclear Power Plant Equipment

- Renewable Energy Power Plant Equipment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes fossil fuel power plant equipment, nuclear power plant equipment, and renewable energy power plant equipment.

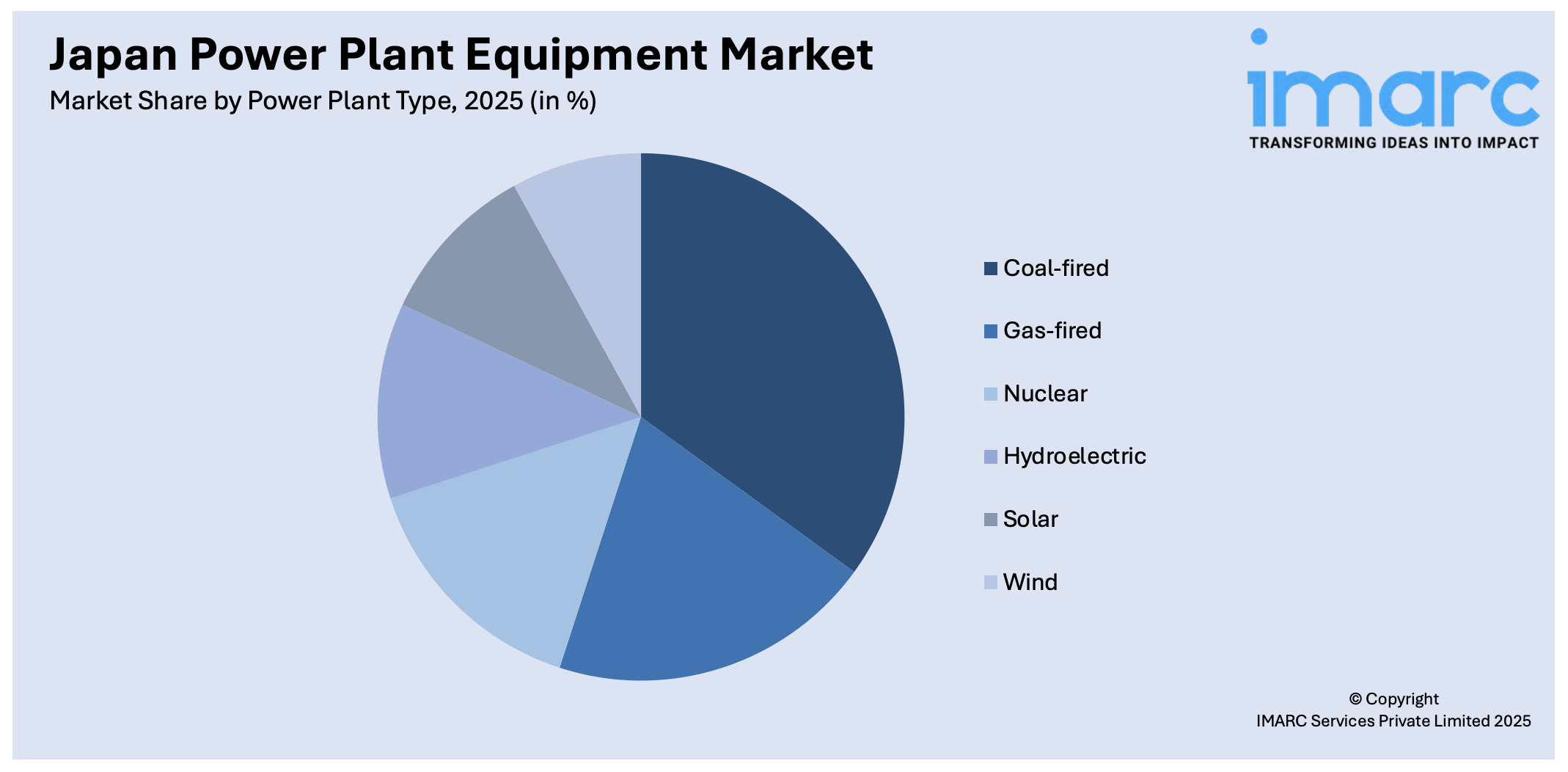

Power Plant Type Insights:

Access the comprehensive market breakdown Request Sample

- Coal-fired

- Gas-fired

- Nuclear

- Hydroelectric

- Solar

- Wind

A detailed breakup and analysis of the market based on the power plant type have also been provided in the report. This includes coal-fired, gas-fired, nuclear, hydroelectric, solar, and wind.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Power Plant Equipment Market News:

- In April 2025, GE Vernova Inc. announced that the Goi Thermal Power Station, a joint venture between Goi United Generation (GIUG) and Chiba Prefecture, which is a part of the Greater Tokyo Area, had begun commercial operations. The joint venture includes regional utility Kyushu Electric Power, ENEOS Power, and JERA, the largest power producer in Japan by capacity. The plant is anticipated to contribute to the stable supply of energy in Japan by supplying over 2.3 gigawatts (GW) to the grid. It is powered by three GE Vernova 9HA.02 gas turbines, the first of its kind to be installed in Japan.

- In July 2024, JERA, the largest power generator in Japan, announced that it will begin construction of a new 2.34 gigawatt (GW) gas-fired power plant at Goi in Chiba, close to Tokyo, on August 1 to assist in preventing power shortages during the summer demand season.

Japan Power Plant Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Fossil Fuel Power Plant Equipment, Nuclear Power Plant Equipment, Renewable Energy Power Plant Equipment |

| Power Plant Types Covered | Coal-fired, Gas-fired, Nuclear, Hydroelectric, Solar, Wind |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan power plant equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan power plant equipment market on the basis of technology?

- What is the breakup of the Japan power plant equipment market on the basis of power plant type?

- What is the breakup of the Japan power plant equipment market on the basis of region?

- What are the various stages in the value chain of the Japan power plant equipment market?

- What are the key driving factors and challenges in the Japan power plant equipment market?

- What is the structure of the Japan power plant equipment market and who are the key players?

- What is the degree of competition in the Japan power plant equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan power plant equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan power plant equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan power plant equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)