Japan Prebiotic and Probiotic Foods Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, End User, and Region, 2026-2034

Japan Prebiotic and Probiotic Foods Market Overview:

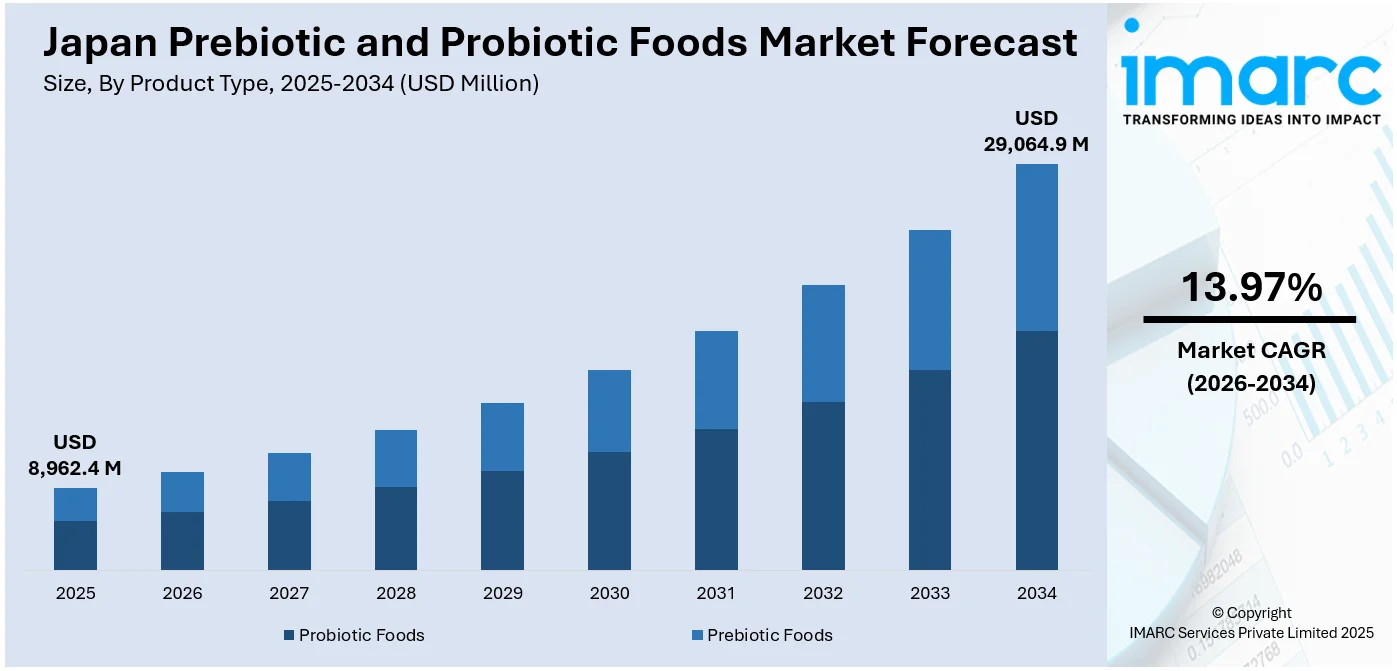

The Japan prebiotic and probiotic foods market size reached USD 8,962.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 29,064.9 Million by 2034, exhibiting a growth rate (CAGR) of 13.97% during 2026-2034. Japan's aging population is driving a growing focus on preventive health, leading seniors to prioritize digestive health and immunity. This demographic shift, along with rising health consciousness, is catalyzing the demand for prebiotic and probiotic foods, which are seen as essential for maintaining well-being. Functional, natural foods that support gut health are becoming mainstream as part of a broader wellness trend and contributing to the expansion of the Japan prebiotic and probiotic foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8,962.4 Million |

|

Market Forecast in 2034

|

USD 29,064.9 Million |

| Market Growth Rate 2026-2034 | 13.97% |

Japan Prebiotic and Probiotic Foods Market Trends:

Growing Health Consciousness and Demand for Gut Health Products

As more individuals seek to improve their overall wellness and tackle digestive issues, products for gut health are gaining popularity. Japan’s geriatric population are notably focused on maintaining healthy digestion, leading to a rise in the need for probiotic foods that promote a balanced gut microbiome. Additionally, the growing awareness about the links between gut health and immunity, mental well-being, and disease prevention is increasing interest in these functional foods. Health-conscious people are opting for natural, nutrient-rich foods, such as fermented products that contain beneficial bacteria. This movement is supported by educational initiatives and marketing tactics that emphasize the health benefits of prebiotic and probiotic foods, as well as their role in promoting digestive and immune health. For example, in 2025, the Japan Natto Cooperative Society Federation enhanced its “Natto Power” website to promote natto, a traditional Japanese fermented dish rich in probiotics. Improvements include new animations, support for multiple languages, and health science content based on expert knowledge. The site highlights the probiotic benefits of natto for digestive wellness and overall health. Producers are responding by developing and broadening their offerings to meet this demand, providing a range of probiotics and prebiotics in formats like drinks, snacks, and supplements, simplifying the process for consumers to include them in their daily habits.

To get more information on this market Request Sample

Aging Population and Preventive Health Focus

Japan's aging population is rapidly increasing, and this demographic shift is fueling a growing interest in preventive care. By 2024, Japan's senior population reached a record 36.25 million, with individuals aged 65 and older representing nearly one-third of the country's total population. As this group continues to grow, people are becoming more focused on maintaining their health rather than simply managing illnesses. Digestive health, nutrient absorption, and immune system support are becoming key areas of concern. Many older individuals are actively choosing foods that help with these issues, and once they find a product that works, they tend to remain loyal. Unlike younger consumers who may be driven by trends, seniors are looking for reliable, long-term solutions to support their well-being. Prebiotic and probiotic foods are particularly appealing in this context because they offer a non-pharmaceutical, natural approach to improving daily health. These foods are not only seen as supplements but are becoming integral to everyday routines. With Japan’s national focus on healthy aging, functional foods are increasingly viewed as a proactive strategy to avoid medical complications, rather than just a trend. As a result, prebiotics and probiotics are shifting from niche products to mainstream staples in the diets of many older adults, reflecting a broader cultural shift towards preventive health and wellness. This rising preference for health-boosting foods is a key factor impelling the Japan prebiotic and probiotic foods market growth.

Japan Prebiotic and Probiotic Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, form, distribution channel, and end user.

Product Type Insights:

- Probiotic Foods

- Dairy Products

- Non-Dairy Products

- Beverages

- Supplements

- Prebiotic Foods

- Whole Grains

- Vegetables

- Fruits

- Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes probiotic foods (dairy products, non-dairy products, beverages, and supplements) and prebiotic foods (whole grains, vegetables, fruits, and supplements).

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

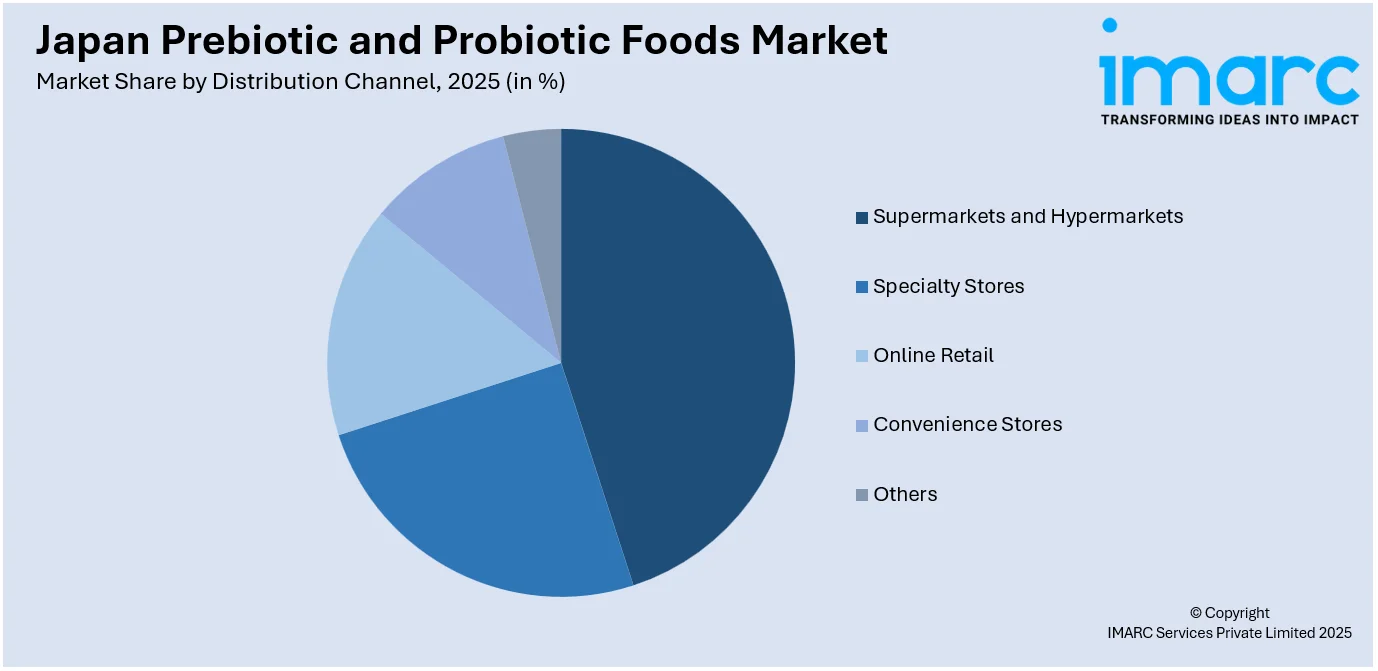

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and others.

End User Insights:

- Adults

- Children

- Geriatric Population

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes adults, children, and geriatric population.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Prebiotic and Probiotic Foods Market News:

- In May 2025, Probi partnered with Nomura Dairy to launch Japan’s first probiotic-enhanced carrot juice under the “My Flora” brand. The drink is fortified with Probi’s LP299V® strain, known for its gut health benefits. This marks a major step in bringing clinically supported probiotics to Japan’s functional beverage market.

- In August 2024, Morinaga Milk Industry introduced new functional foods in Japan, including the Puresu fermented drink with Bifidobacterium probiotic strain Bifidobacteria longum BB 536 to support healthy ageing. The drink claimed to reduce fatigue, belly fat, and improve gut health.

Japan Prebiotic and Probiotic Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Forms Covered | Liquid, Solid |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, Others |

| End Users Covered | Adults, Children, Geriatric Population |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan prebiotic and probiotic foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan prebiotic and probiotic foods market on the basis of product type?

- What is the breakup of the Japan prebiotic and probiotic foods market on the basis of form?

- What is the breakup of the Japan prebiotic and probiotic foods market on the basis of distribution channel?

- What is the breakup of the Japan prebiotic and probiotic foods market on the basis of end user?

- What is the breakup of the Japan prebiotic and probiotic foods market on the basis of region?

- What are the various stages in the value chain of the Japan prebiotic and probiotic foods market?

- What are the key driving factors and challenges in the Japan prebiotic and probiotic foods market?

- What is the structure of the Japan prebiotic and probiotic foods market and who are the key players?

- What is the degree of competition in the Japan prebiotic and probiotic foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan prebiotic and probiotic foods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan prebiotic and probiotic foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan prebiotic and probiotic foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)