Japan Q-Commerce Market Size, Share, Trends and Forecast by Product Type, Platform, and Region, 2026-2034

Japan Q-Commerce Market Overview:

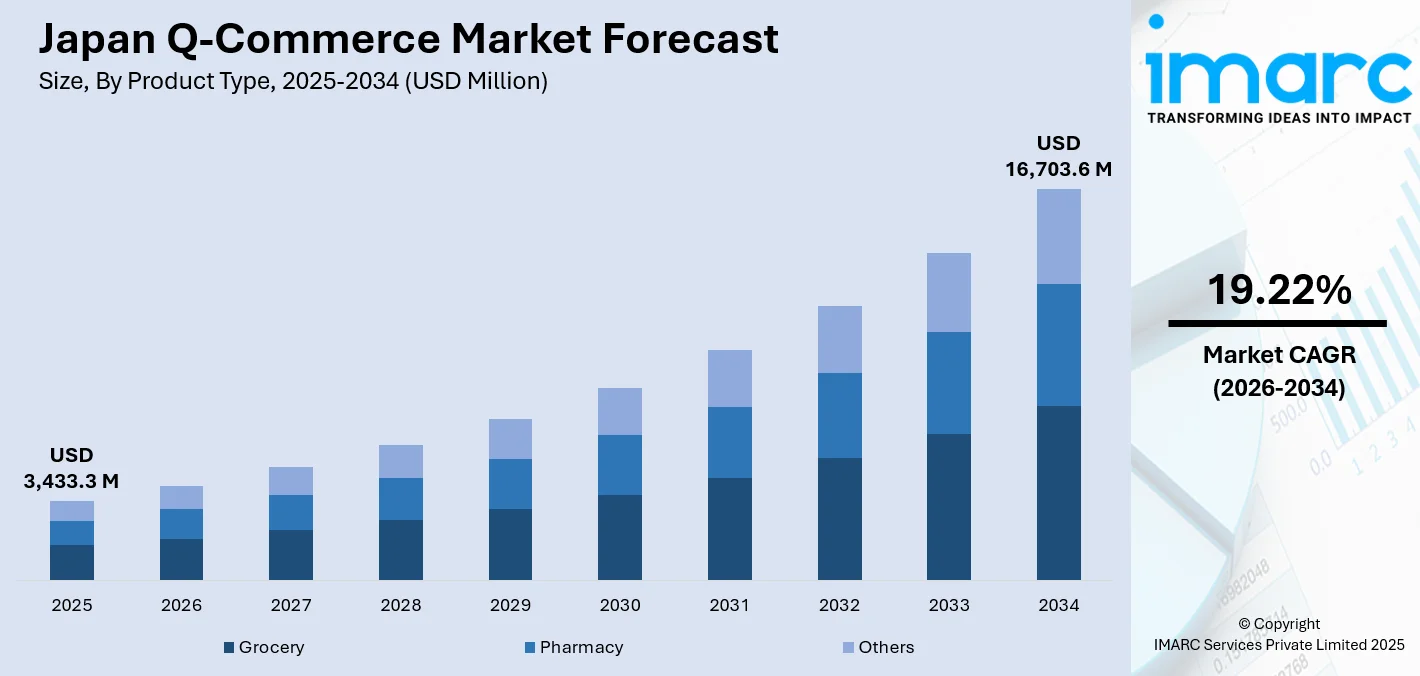

The Japan q-commerce market size reached USD 3,433.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 16,703.6 Million by 2034, exhibiting a growth rate (CAGR) of 19.22% during 2026-2034. Increasing smartphone adoption, demand for fast and convenient deliveries, urbanization, a tech-savvy population, integration of AI and logistics innovations, and partnerships between local retailers and delivery platforms to enhance service speed and customer satisfaction are some of the factors contributing to Japan q-commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,433.3 Million |

| Market Forecast in 2034 | USD 16,703.6 Million |

| Market Growth Rate 2026-2034 | 19.22% |

Japan Q-Commerce Market Trends:

Rise of Autonomous Delivery in Q-Commerce

Japan is embracing autonomous delivery solutions, with the introduction of food delivery robots set to enhance the efficiency of quick commerce services. These robots will cater to the growing consumer demand for fast and reliable delivery options, particularly in urban areas. By incorporating cutting-edge technology, the delivery process is being streamlined, reducing wait times and improving convenience for customers. The adoption of autonomous vehicles in the food delivery sector is reshaping consumer expectations, with quicker and more innovative solutions becoming the norm. This shift underscores the increasing importance of technology in Japan’s quick commerce market, where speed and convenience remain key drivers of growth. As this innovation evolves, it promises to redefine urban logistics and expand the possibilities for rapid delivery services. These factors are intensifying the Japan q-commerce market growth. For example, in February 2024, Uber Eats announced the introduction of futuristic food delivery robots in Japan. These autonomous robots will begin delivering food orders in select areas, revolutionizing the delivery process and enhancing the efficiency of Q-commerce services. This innovation aligns with Japan's growing demand for quick, tech-driven delivery solutions, making food delivery faster and more convenient in urban locations.

To get more information on this market Request Sample

Growth in E-Pharmacy and Quick Delivery

In Japan, the e-pharmacy market is experiencing significant growth, driven by the increasing preference for online purchasing of healthcare products. This shift toward digital platforms is fueling the demand for fast and efficient delivery services, aligning with the expanding quick commerce sector. As more consumers turn to online pharmacies for convenience, the need for rapid, reliable delivery systems is becoming more pronounced. This aligns with the broader rise of on-demand services in Japan, where consumers expect quicker access to both everyday items and essential healthcare products. With more pharmacies adopting technology and partnering with delivery services, consumers can expect faster fulfillment of health-related orders. This growing adoption of quick delivery solutions in the healthcare sector is helping to reshape the e-pharmacy landscape, making it an integral part of the broader quick commerce market in Japan. The market’s ongoing expansion is expected to continue as the demand for speed and convenience increases. For instance, the Japan e-pharmacy market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.5 Billion by 2033, exhibiting a growth rate (CAGR) of 12.4% during 2025-2033.

Japan Q-Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and platform.

Product Type Insights:

- Grocery

- Pharmacy

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes grocery, pharmacy, and others.

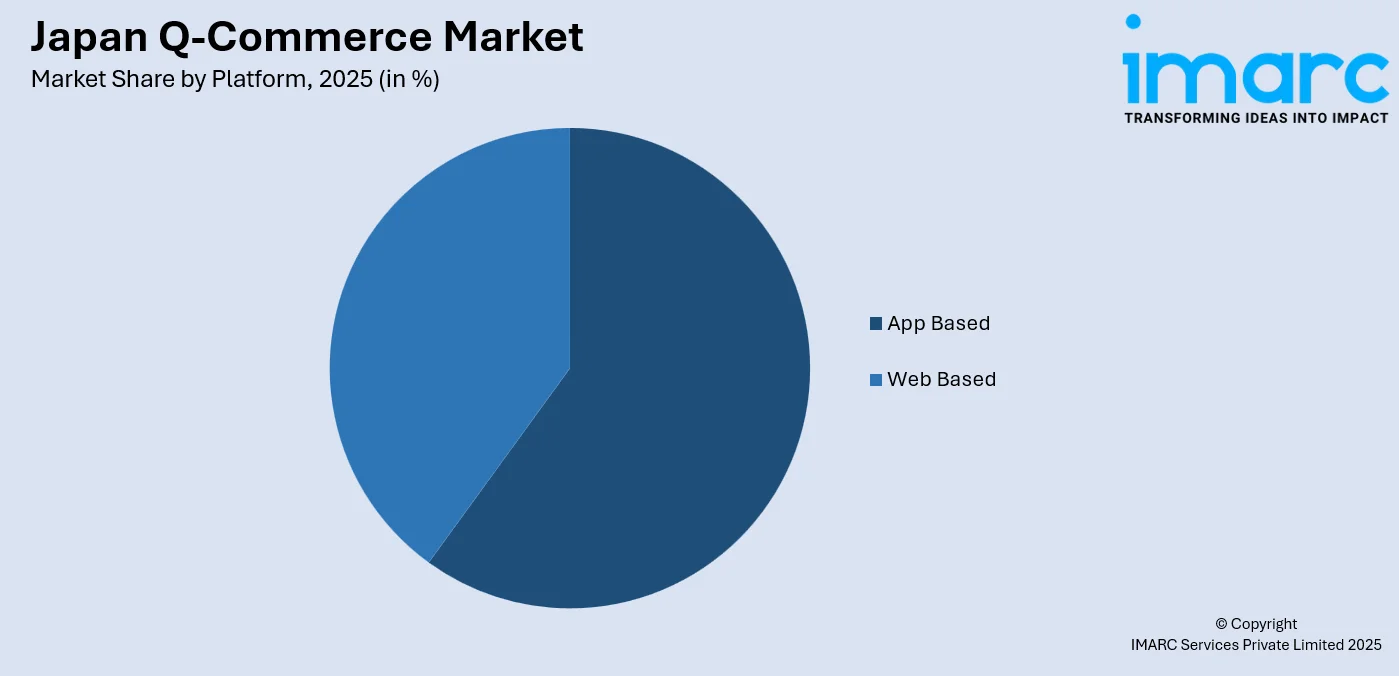

Platform Insights:

Access the comprehensive market breakdown Request Sample

- App Based

- Web Based

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes app based and web based.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Q-Commerce Market News:

- In January 2025, Coupang Eats, South Korea's leading e-commerce platform, launched its first overseas service in Japan. The company introduced its food delivery app, Rocket Now, in Minato, Tokyo, beginning with a pilot program. This move marks Coupang’s entry into the Japanese Q-commerce market, offering ultra-fast food delivery services, aligning with the growing demand for quick commerce solutions in Japan.

Japan Q-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Grocery, Pharmacy, Others |

| Platforms Covered | App Based, Web Based |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan q-commerce market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan q-commerce market on the basis of product type?

- What is the breakup of the Japan q-commerce market on the basis of platform?

- What is the breakup of the Japan q-commerce market on the basis of region?

- What are the various stages in the value chain of the Japan q-commerce market?

- What are the key driving factors and challenges in the Japan q-commerce market?

- What is the structure of the Japan q-commerce market and who are the key players?

- What is the degree of competition in the Japan q-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan q-commerce market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan q-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan q-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)