Japan Quick Service Restaurants Market Size, Share, Trends and Forecast by Cuisine, Outlet, Location, and Region, 2026-2034

Japan Quick Service Restaurants Market Overview:

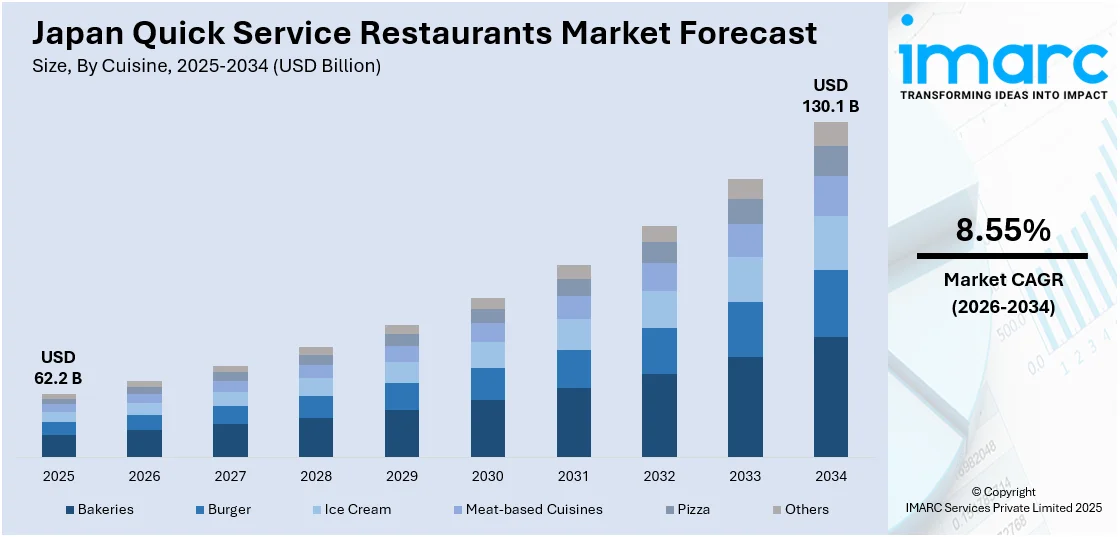

The Japan quick service restaurants market size reached USD 62.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 130.1 Billion by 2034, exhibiting a growth rate (CAGR) of 8.55% during 2026-2034. Changing eating habits, digital ordering, and healthier menu innovations are helping major brands attract and retain customers. In addition, the Japan quick service restaurants market share is expected to expand further as leading brands strengthen their menus, delivery services, and customer loyalty programs to meet evolving consumer expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 62.2 Billion |

| Market Forecast in 2034 | USD 130.1 Billion |

| Market Growth Rate 2026-2034 | 8.55% |

Japan Quick Service Restaurants Market Trends:

Increasing Demand for Healthier Options

Consumer interest in healthy eating has been shaping Japan’s quick-service restaurant market. Brands are introducing menus with organic ingredients, low-calorie meals, and plant-based alternatives to meet new customer preferences. Many outlets are offering smaller portion sizes and balanced meals to appeal to health-conscious individuals. Younger consumers, especially those living in urban areas, are showing strong interest in nutritious fast-food choices. Popular chains are collaborating with nutritionists to design better menu options that align with wellness goals. Seasonal menus now include salads, grilled items, and rice-based meals instead of traditional fried foods. In recent developments, companies like MOS Burger and Freshness Burger have expanded their plant-based menu offerings to meet this rising demand. Quick-service restaurants are also promoting transparency by listing calorie counts and ingredient details on menus, further building customer trust. Loyalty programs and promotional campaigns for healthy products have helped attract new customers. Expansion of healthier food lines is expected to stay a key trend, with players constantly refining their offerings to maintain competitiveness. As awareness of health and wellness continues to rise, more brands are likely to invest in creating attractive, nutritious menu options without compromising on taste or affordability.

To get more information on this market Request Sample

Digital Ordering and Delivery Growth

Technology adoption is reshaping the quick-service restaurant sector across Japan. More customers prefer ordering online or through mobile apps rather than visiting in person, leading to the expansion of digital platforms. Restaurants are upgrading their digital infrastructure to offer smoother online experiences with faster checkout systems and personalized promotions. Integration with third-party delivery services, such as Uber Eats and Demae-can, has widened access to restaurant menus beyond physical locations. Companies are also launching loyalty programs tied directly to mobile apps, encouraging repeat business through rewards and exclusive deals. Digital kiosks at outlets have reduced wait times and improved order accuracy. In a recent move, McDonald’s Japan announced investments in AI-driven ordering systems to enhance customer experience. Some brands are testing delivery-only kitchens in urban areas to manage costs and meet growing online demand. Contactless payments and real-time order tracking have become common, making the process more convenient for customers. As digital tools continue to evolve, restaurants are focusing on building efficient omnichannel strategies to balance dine-in, takeaway, and delivery orders. The shift toward online ordering and app-based loyalty systems is likely to stay strong, especially among younger and tech-savvy customer groups.

Japan Quick Service Restaurants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on cuisine, outlet, and location.

Cuisine Insights:

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

The report has provided a detailed breakup and analysis of the market based on the cuisine. This includes bakeries, burger, ice cream, meat-based cuisines, pizza, and others.

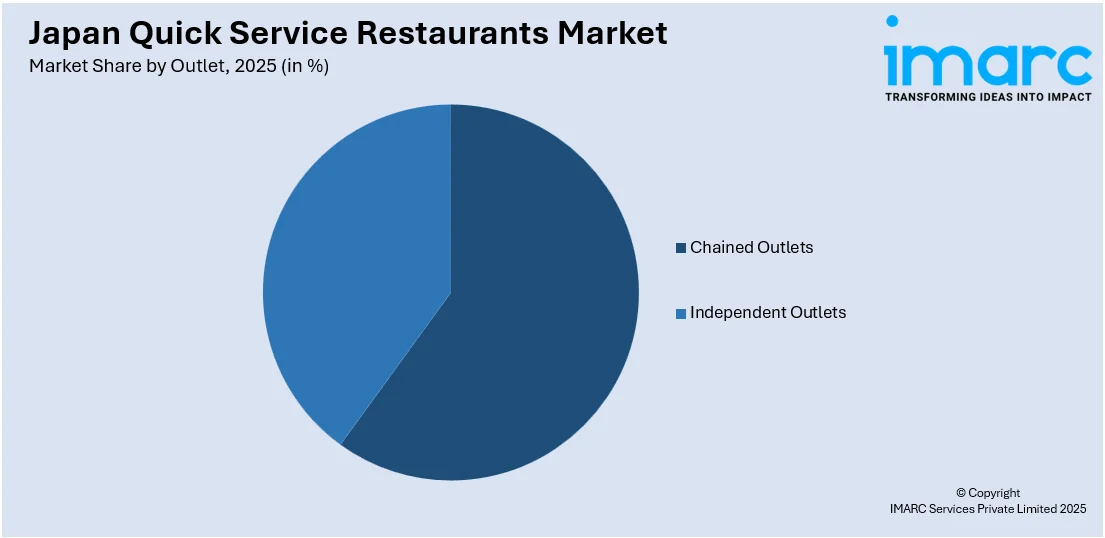

Outlet Insights:

Access the comprehensive market breakdown Request Sample

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes leisure, lodging, retail, standalone, and travel.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Quick Service Restaurants Market News:

- October 2024: Burger King Japan announced the launch of the Kyoto Whopper, a Japan-exclusive burger co-developed with Hachidaime Gihey. This product innovation strengthened the quick service restaurants market in Japan by promoting local collaboration, menu diversification, and enhancing consumer interest in premium regional offerings.

Japan Quick Service Restaurants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisines Covered | Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Others |

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan quick service restaurants market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan quick service restaurants market on the basis of cuisine?

- What is the breakup of the Japan quick service restaurants market on the basis outlet?

- What is the breakup of the Japan quick service restaurants market on the basis location?

- What is the breakup of the Japan quick service restaurants market on the basis of region?

- What are the various stages in the value chain of the Japan quick service restaurants market?

- What are the key driving factors and challenges in the Japan quick service restaurants market?

- What is the structure of the Japan quick service restaurants market and who are the key players?

- What is the degree of competition in the Japan quick service restaurants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan quick service restaurants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan quick service restaurants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan quick service restaurants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)