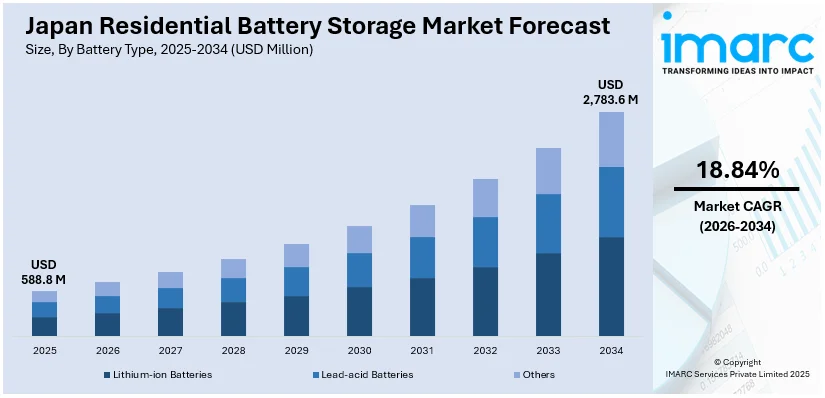

Japan Residential Battery Storage Market Size, Share, Trends and Forecast by Battery Type, Capacity, Ownership Model, Sales Channel, Application, and Region, 2026-2034

Japan Residential Battery Storage Market Overview:

The Japan residential battery storage market size reached USD 588.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,783.6 Million by 2034, exhibiting a growth rate (CAGR) of 18.84% during 2026-2034. The market is driven by high residential electricity prices and growing demand for energy independence. Also, national subsidy programs and local financial support are fueling the product adoption. Additionally, frequent natural disasters have increased interest in backup power solutions. Furthermore, energy security concerns, household preparedness, and government-backed financial incentives are some of the other factors positively impacting the Japan residential battery storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 588.8 Million |

|

Market Forecast in 2034

|

USD 2,783.6 Million |

| Market Growth Rate 2026-2034 | 18.84% |

Japan Residential Battery Storage Market Trends:

High Electricity Prices and Consumer Demand for Energy Autonomy

Japan has some of the highest residential electricity prices in Asia, driven by import dependence for fossil fuels and the gradual phase-out of nuclear energy following the Fukushima disaster. As utilities pass increased generation costs onto consumers, households are exploring technologies that reduce grid reliance and improve consumption control. Residential battery systems have emerged as a logical solution, particularly when paired with rooftop solar installations. These systems allow homeowners to store solar power generated during the day and use it during peak evening hours, reducing the need to draw from the grid when prices are highest. On April 26, 2024, Canadian Solar secured 193 MW of battery energy storage system (BESS) projects in Japan’s first Long-Term Decarbonization Power Source Auction, accounting for 13.3% of the total awarded capacity. The projects, located in Aomori, Fukushima, and Yamaguchi, will operate under 20-year Capacity Reserve Agreements with OCCTO and are scheduled to come online between 2027 and 2028. This solidifies Canadian Solar’s position in Japan’s energy storage sector, supporting the growth of residential and utility-scale BESS markets as the country advances toward its 2050 carbon neutrality goal. Japanese consumers are particularly sensitive to energy efficiency, and the integration of battery systems into smart home platforms reflects this priority. In dense urban centers such as Tokyo, Osaka, and Nagoya, where energy bills are particularly burdensome, battery installations are growing among middle- and high-income households. Many of these consumers are seeking long-term stability in their energy expenses, while also aligning with environmental goals. This is a significant factor driving Japan residential battery storage market growth, especially as product availability increases and battery unit costs decline. The combination of economic pressure and a preference for technological self-sufficiency continues to shape residential energy investment decisions.

To get more information on this market Request Sample

National Incentives and Supportive Energy Policy

Japan’s Ministry of Economy, Trade and Industry (METI) has actively supported residential energy storage through a range of incentives and policy initiatives. Subsidy programs such as the Sustainable Open Innovation Initiative (SII) provide partial reimbursement for homeowners installing battery storage alongside solar systems. These financial incentives are complemented by low-interest loans and municipal-level grants in prefectures with high population density or power instability. On May 9, 2024, Japan’s Ministry of Economy, Trade and Industry (METI) selected 13 battery aggregators under a JPY 9 billion (USD 58 million) subsidy program to support the integration of distributed storage into the national grid. The initiative targets over 1.1 GWh of aggregated battery capacity from residential, EV, and commercial sources, including major participants like ENERES, Next Kraftwerke Toshiba, and Mitsubishi Electric. This program reinforces Japan's strategy to scale virtual power plants and enhance grid resilience through residential battery deployment. The government's target of achieving carbon neutrality by 2050 has further accelerated focus on distributed energy resources, with residential systems playing a supporting role in reducing grid strain and enabling load balancing. New standards around energy management, interoperability, and safety are also helping create a reliable market environment for both consumers and suppliers. Japan’s history of disaster preparedness plays into this dynamic as well. After major earthquakes and typhoons disrupted electricity supply in several regions, backup energy solutions gained traction as part of national resilience planning. As a result, battery storage has become integrated into public messaging around household preparedness and energy independence, increasing public awareness and normalizing its adoption.

Japan Residential Battery Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on battery type, capacity, ownership model, sales channel, and application.

Battery Type Insights:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead-acid batteries, and others.

Capacity Insights:

- Below 5 kWh

- 5–10 kWh

- 10–20 kWh

- Above 20 kWh

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 5 kWh, 5–10 kWh, 10–20 kWh, and above 20 kWh.

Ownership Model Insights:

- Customer-owned Systems

- Third-party Owned/Leasing Models

The report has provided a detailed breakup and analysis of the market based on the ownership model. This includes customer-owned systems and third-party owned/leasing models.

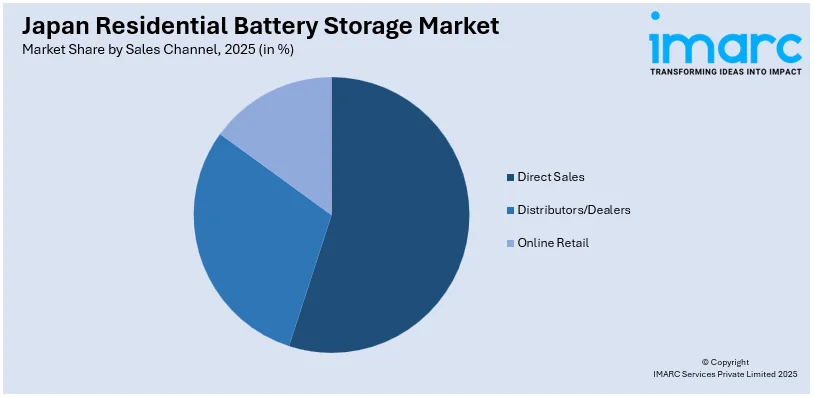

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors/Dealers

- Online Retail

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales, distributors/dealers, and online retail.

Application Insights:

- Backup Power Supply

- Solar Energy Storage

- Off-grid Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes backup power supply, solar energy storage, off-grid systems, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Residential Battery Storage Market News:

- On September 3, 2024, Tokyo Electric Power Company (TEPCO), Tokyo Gas, and ENERES launched a pilot project integrating Kyocera's Enerezza home battery systems into Japan’s power supply-demand adjustment framework. The initiative aggregates residential battery storage units for remote operation and dispatch, contributing to grid stability and advancing virtual power plant (VPP) capabilities. This marks a significant move in Japan’s residential storage market, with major utilities formally recognizing home batteries as assets for grid management.

Japan Residential Battery Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Capacities Covered | Below 5 kWh, 5–10 kWh, 10–20 kWh, Above 20 kWh |

| Ownership Models Covered | Customer-owned Systems, Third-party Owned/Leasing Models |

| Sales Channels Covered | Direct Sales, Distributors/Dealers, Online Retail |

| Applications Covered | Backup Power Supply, Solar Energy Storage, Off-grid Systems, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan residential battery storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan residential battery storage market on the basis of battery type?

- What is the breakup of the Japan residential battery storage market on the basis of capacity?

- What is the breakup of the Japan residential battery storage market on the basis of ownership model?

- What is the breakup of the Japan residential battery storage market on the basis of sales channel?

- What is the breakup of the Japan residential battery storage market on the basis of application?

- What is the breakup of the Japan residential battery storage market on the basis of region?

- What are the various stages in the value chain of the Japan residential battery storage market?

- What are the key driving factors and challenges in the Japan residential battery storage market?

- What is the structure of the Japan residential battery storage market and who are the key players?

- What is the degree of competition in the Japan residential battery storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan residential battery storage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan residential battery storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan residential battery storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)