Japan Retail Analytics Market Expected to Reach USD 780 Million by 2033 - IMARC Group

Japan Retail Analytics Market Statistics, Outlook and Regional Analysis 2025-2033

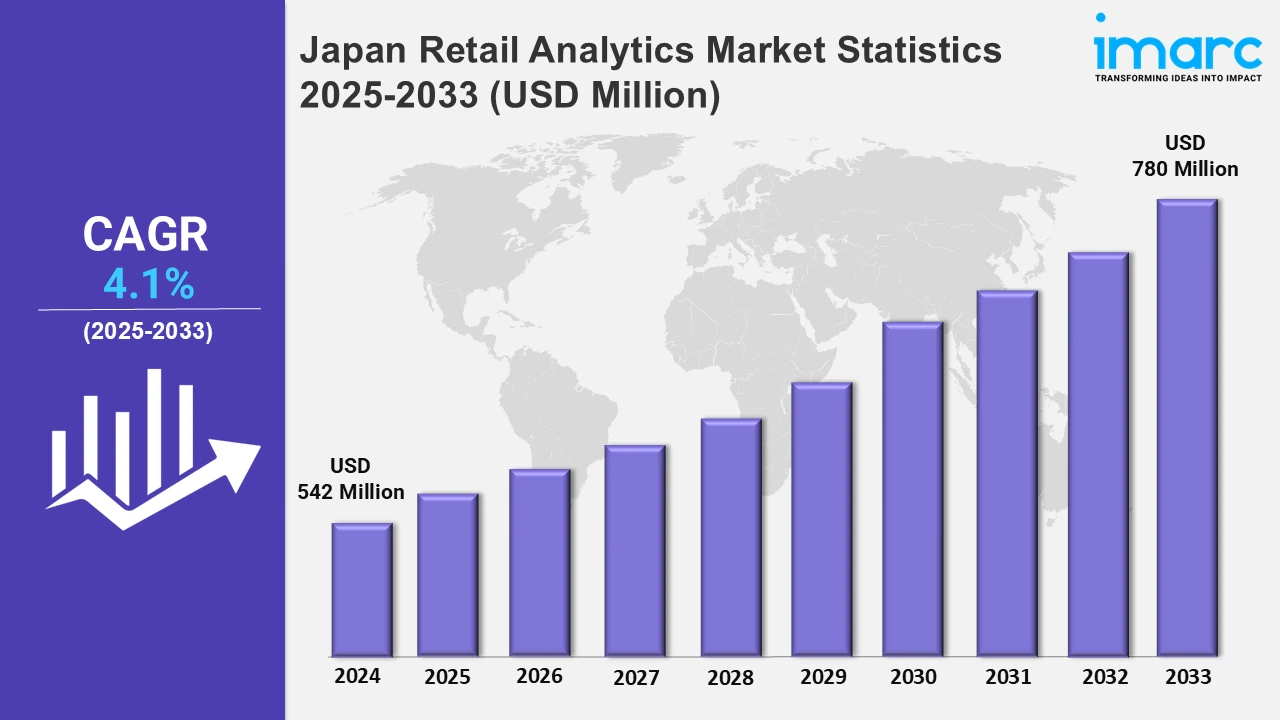

The Japan retail analytics market size was valued at USD 542 Million in 2024, and it is expected to reach USD 780 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% from 2025 to 2033.

To get more information on this market Request Sample

In Japan, the retail analytics market is experiencing significant growth, driven by advancements in technology and changing consumer behaviors. As the retail industry becomes more data-driven, businesses are increasingly relying on AI and automation to optimize their operations. In February 2025, OpenAI and SoftBank launched SB OpenAI Japan, a partnership focused on providing AI agent solutions to Japanese enterprises. This collaboration aims to revolutionize retail analytics by automating workflows, enhancing operational efficiency, and delivering more accurate, data-driven insights. The integration of AI is poised to reshape the Japanese retail sector, enabling businesses to streamline their processes, improve customer engagement, and ultimately increase profitability. Moreover, Fujitsu introduced a generative AI-based software analysis and visualization service in February 2025, which is tailored to improve software modernization for businesses across various sectors, including retail. This service will help retailers in Japan navigate the complexities of transitioning to newer technologies by offering more efficient migration planning and design documentation.

Businesses can improve operational productivity and decrease downtime by streamlining these transitions, which increase the retail analytics ecosystem's agility and responsiveness to changes in the market. Furthermore, this action demonstrates the increasing significance of AI-powered solutions in enhancing retail productivity, and it is anticipated to stimulate the industry's embrace of cutting-edge analytics technologies. According to an article published by KOMOJU in November 2024, Japan's e-commerce sector is projected to grow by 55% by 2029, reaching USD 263.37 billion. Key trends like cashless payments, smartphone commerce, and AI-driven personalization are driving this increase. These developments are changing retail analytics by giving companies a greater understanding of the tastes, behaviors, and purchasing patterns of their customers. In addition, retailers now customize offerings, improve sales tactics, and provide a more individualized shopping experience thanks to the ongoing advancements in AI technologies. As a result, data is becoming a crucial resource for company expansion and client retention, and the retail analytics landscape is changing into a more inventive and dynamic area.

Japan Retail Analytics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising demand for retail analytics is fueling market growth by enhancing supply chain efficiency, tracking supplier performance and shipments, and pinpointing logistics and distribution improvement areas.

Kanto Region Retail Analytics Market Trends:

Tokyo is leading the retail analytics sector in the Kanto region with innovations such as Rakuten’s launch of Rakuten Analytics in September 2024. The platform facilitates improved product planning, targeted marketing campaigns, and deeper customer insights through the use of extensive data from Rakuten's ecosystem. Tokyo retailers like Uniqlo are using this information to enhance inventory control and customize the shopping experience. Furthermore, the retail industry is changing due to this move toward data-driven decision-making, which is also establishing new benchmarks for retail analytics in the area.

Kansai/Kinki Region Retail Analytics Market Trends:

Retail analytics are utilized in the Kansai/Kinki region, especially in Osaka, to accommodate a wide range of customer preferences. Moreover, retailers are implementing advanced analytics to improve demand forecasts and personalize marketing. For example, Osaka departmental stores generate personalized discounts based on information from loyalty programs. Moreover, there’s an emphasis on location-based analytics to optimize store layouts, helping retailers target local consumer behaviors more effectively in densely populated areas like Osaka’s Umeda district.

Central/Chubu Region Retail Analytics Market Trends:

In the Central/Chubu region, Nagoya is becoming a hub for retail analytics innovation with the launch of STATION Ai in November 2024. The creation of data-driven retail analytics solutions is advanced by this open innovation hub, which supports more than 500 businesses. These resources are used by Nagoya retailers, including Toyota's retail partners, to enhance consumer engagement, optimize supply chain tactics, and spur growth. Besides this, advanced analytics is incorporated into retail operations more quickly as a result of the region's adoption of these technologies.

Kyushu-Okinawa Region Retail Analytics Market Trends:

Kyushu, including Fukuoka, is using retail analytics to adapt to its strong tourism-driven retail market. In Fukuoka, analytics help retailers monitor tourist demographics and adjust their product offerings accordingly. For example, duty-free stores use advanced analytics to forecast demand for specific products, adjusting stock in real-time based on tourist shopping habits. This region is also seeing the rise of AI-powered chatbots to assist customers, driving a seamless retail experience across both physical and online stores.

Tohoku Region Retail Analytics Market Trends:

Retail analytics are used to improve consumer loyalty in remote areas of the Tohoku region. In addition, retailers optimize stock and promotions by using analytics to understand seasonal trends and local consumer habits. Besides this, stores in Sendai, Tohoku's main city, for example, use purchasing data to launch customized discounts that coincide with regional holidays. This helps retailers in Tohoku build stronger connections with their communities, emphasizing more personalized and region-specific shopping experiences.

Chugoku Region Retail Analytics Market Trends:

Chugoku, including cities like Hiroshima, focuses on integrating retail analytics to improve operational efficiency and customer engagement. Mobile and cloud-based analytics solutions are becoming more popular among retailers in the area. In addition, convenience stores in Hiroshima, for instance, use information from mobile apps to monitor consumer preferences and modify their in-store promotions and product selection. Furthermore, another emerging trend in the region is the use of data for predictive maintenance in retail establishments, which lessens downtime and raises customer happiness.

Hokkaido Region Retail Analytics Market Trends:

Hokkaido's retail sector, particularly in Sapporo, is seeing an increase in the use of climate-based analytics. Retailers analyze seasonal data to adjust inventory based on Hokkaido’s cold winters and hot summers. For instance, clothing retailers in Sapporo use predictive analytics to adjust their stock levels for seasonal shifts in demand, offering products like winter wear or summer apparel at the right time. Additionally, retailers use weather data to influence promotional campaigns, enhancing sales during peak seasons.

Shikoku Region Retail Analytics Market Trends:

Retail analytics in Shikoku, especially in Takamatsu, focuses on understanding consumer patterns in smaller, more traditional retail environments. Analytics are being used to optimize in-store layouts and improve the customer journey. For example, Shikoku retailers use foot traffic data to design store layouts that enhance product visibility, helping customers easily navigate smaller shops. The region’s trend also includes leveraging local data to tailor marketing campaigns and increase customer retention in both physical stores and online platforms.

Top Companies Leading in the Japan Retail Analytics Industry

Japan's retail analytics sector is evolving, with key players like JPX Market Innovation & Research and Snowflake leading innovations. The partnership, announced in February 2025, enhances data access via the J-LAKE platform, allowing for better customer insights, trend analysis, and predictive modeling for Japanese retailers. The report also provides an in-depth competitive landscape analysis, focusing on market structure, positioning of key players, company evaluation quadrants, and winning strategies. Detailed profiles of major companies further highlight the competitive dynamics shaping the market.

Japan Retail Analytics Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into software and services. Software and services enhance decision-making by analyzing customer preferences, optimizing store layouts, and streamlining inventory management, leading to improved sales performance and operational efficiency.

- Based on the function, the market is categorized into customer management, in-store operation, strategy and planning, supply chain management, marketing and merchandizing, and others. These functions contribute to maximizing profitability and operational efficiency in the retail sector. By improving processes like inventory, customer engagement, or marketing strategies, these functions help drive higher profitability within the retail sector.

- On the basis of the deployment mode, the market has been divided into on-premises and cloud-based. On-premises and cloud-based solutions offer flexibility in data storage and processing, allowing retailers to access real-time insights, ensure scalability, and drive efficiency while managing operational costs and securing sensitive information.

- Based on the enterprise size, the market is categorized into small and medium-sized enterprises and large enterprises. These enterprise sizes utilize advanced software solutions to optimize operations, improve customer engagement, and enhance profitability, with different scale and resource demands influencing their approach to data analysis and technology adoption.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 542 Million |

| Market Forecast in 2033 | USD 780 Million |

| Market Growth Rate 2025-2033 | 4.1% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Functions Covered | Customer Management, In-Store Operation, Strategy and Planning, Supply Chain Management, Marketing and Merchandizing, Other |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Retail Analytics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)