Retail Analytics Market Report by Function (Customer Management, In-store Operation, Strategy and Planning, Supply Chain Management, Marketing and Merchandizing, and Others), Component (Software, Services), Deployment Mode (On-premises, Cloud-based), End User (Small and Medium Enterprises, Large Enterprises), and Region 2025-2033

Retail Analytics Market Size:

The global retail analytics market size reached USD 10.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 45.2 Billion by 2033, exhibiting a growth rate (CAGR) of 16.92% during 2025-2033. North America leads the market, driven by advanced technology infrastructure and the strong presence of major retail players. The retail analytics market is experiencing significant growth driven by the expanding digitization in organizations, rising use of cloud-based retail analytics solutions, and growing online shopping habits of consumers looking to save time and money.

Market Size & Forecasts:

- Retail analytics market was valued at USD 10.4 Billion in 2024.

- The market is projected to reach USD 45.2 Billion by 2033, at a CAGR of 16.92% from 2025-2033.

Dominant Segments:

- Function: Customer management accounts for the majority of the market share driven by the growing demand for individualized customer experience and the strategic significance of customer loyalty and retention in a cutthroat retail environment.

- Component: Software dominates the retail analytics industry as it is crucial to turning massive volumes of data into insights that can be put into practice, which helps retailers make better decisions.

- Deployment Mode: Cloud-based represents the leading market segment due to its scalability, flexibility, and affordability, all of which are critical for managing the enormous volumes of data created by contemporary retail operations.

- End User: Large enterprises exhibit a clear dominance in the market owing to their vast operational scope and the intricate data environments.

- Region: North America dominates the retail analytics market due to its sophisticated technological infrastructure, there has been a widespread use of big data solutions, and large investments in artificial intelligence (AI) and machine learning (ML).

Key Players:

- The leading companies in retail analytics market include 1010data Inc. (Advance Publications Inc.), Adobe Inc., Altair Engineering Inc., Flir Systems Inc., Fujitsu Limited, International Business Machines Corporation, Information Builders Inc., Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Qlik Technologies Inc. (Thoma Bravo LLC), SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), Tibco Software Inc., etc.

Key Drivers of Market Growth:

- Increased Use of Data: Retailers are making greater use of data analytics to obtain actionable knowledge about customers' behavior, maximize inventory, and enhance marketing strategies, thus driving the demand for retail analytics solutions.

- Growth in E-commerce: Constant growth in online shopping is creating enormous amounts of customer and transactional data, forcing retailers to embrace sophisticated analytics tools for improved decision-making and customer interaction.

- Technological Developments: Continuous innovation in AI, ML, and cloud computing is improving the functionality and ubiquity of retail analytics solutions.

- Personalization Patterns: Retailers are concentrating on making personalized shopping possible, and retail analytics is helping to facilitate targeted promotions, product recommendations, and customer segmentation.

- Competitive Pressures: Companies are increasingly turning to analytics to remain competitive, track market trends, and react quickly to shifting consumer trends and industry forces.

Future Outlook:

- Strong Growth Outlook: The retail analytics market continues to grow at a strong rate, driven by technology innovation, changing consumer expectations, and data-driven strategies becoming more critical to the future.

- Market Evolution: The use of retail analytics is shifting from operational improvement to strategy formulation, with usage expanding through different formats of retail and geographies.

The retail analytics industry is experiencing strong change, fueled by growing dependence on data for strategic choice and business process improvement. Sustainability is fast becoming mainstream retail strategy, and analytics is helping to monitor and report on the environment. Retailers are quantifying carbon footprints, reporting on energy consumption, and assessing the sustainability of supply chain partners. Analytics is also backing efforts like waste reduction, green product recommendations, and ethical sourcing. By integrating analytics with sustainable objectives, retailers are building a stronger brand reputation as well as addressing customer expectations for responsible business.

To get more information on this market, Request Sample

Retail Analytics Market Trends:

Growing Need for Personalized Customer Experience

Retailers are constantly emphasizing providing customers with very personalized experiences, and this is greatly pushing the usage of retail analytics solutions. As a result, a lot of companies are launching personalized retail solutions. For example, in 2025, Apple introduced Shop with a Specialist over Video in India, where people can shop online for apple products on the Apple Store. By gathering information from multiple sources like online surfing history, buying habits, loyalty schemes, and social media usage, companies are creating highly tailored marketing programs. Retail analytics solutions are assisting retailers to segment shoppers more efficiently, forecast tastes, and personalize product suggestions and offers based on that. With rising expectations for personalized shopping among customers, retailers are using sophisticated analytics solutions to drive engagement and satisfaction. Real-time personalization is emerging as a competitive advantage, with companies leveraging dynamic pricing and personalized offers to boost sales. Retailers are also embedding AI and ML into analytics platforms to improve accuracy and automate decision-making. The trend is speeding up as omnichannel retail gains momentum, with analytics platforms constantly gathering data both in physical and digital channels to optimize the customer journey.

Sudden Boom in E-Commerce and Digital Channels

The continuing growth of online retailing and digital channels is creating vast amounts of data, leading retailers to embrace advanced analytics to decipher it. With customers increasingly turning to online shopping, retailers are gathering rich information about customer behavior, such as click-through rates, cart abandonment, session length, and repeat visits. Retail analytics software is now being employed to monitor these online interactions in real-time so that companies can enhance website designs, enhance product exposure, and make user experience even better. With mobile shopping and app-based retailing also increasing, the analytics potential is expanding on various digital platforms. Retailers are utilizing data insights to enhance customer acquisition, increase retention rates, and refine their digital marketing campaigns. In this changing scenario, real-time analytics is starting to become a necessity to track key performance indicators (KPIs), identify market trends, and react in advance to customer behavior. IMARC Group predicts that the global e-commerce market is projected to attain USD 214.5 Trillion by 2033.

Artificial Intelligence (AI) and Machine Learning (ML) advancements

Artificial intelligence (AI) and machine learning (ML) technologies are revolutionizing the retail analytics industry, helping businesses gain deeper insights and automate intricate processes. Retailers are using AI-based analytics solutions actively to predict demand, identify fraud, and recognize emerging trends with great accuracy. ML algorithms are constantly working on big data sets to identify underlying patterns, refine pricing strategies, and suggest products in real-time. These technologies are also changing customer service with smart chatbots and virtual assistants, which are answering customer questions and facilitating purchases based on data-driven insights. Retailers are using AI to enhance inventory management by forecasting stock needs and reducing waste. Also, prescriptive analytics enabled by AI is facilitating more strategic decision-making by recommending the optimal course of action based on predictive outcomes. As these technologies proceed to advance, retailers are investing in AI-powered analytics to remain competitive and agile in an ever-changing market landscape. In 2025, Standard AI launched Vision Analytics empowers retailers and brands with insights into consumer behavior, product effectiveness, and store operations obtained through unmatched clarity of individuals, products, and interactions.

Retail Analytics Market Growth Drivers:

Omnichannel Retail Strategies Integration

Omnichannel retail strategies are being picked up by retailers in earnest, and analytics is at the center of their ability to provide seamless customer experiences across various touch points. Customers are interacting with brands in a multichannel environment combining physical interaction, website interaction, smartphone app interaction, and social media interaction, and retailers are gathering data from all these sources to build an integrated view of the customer experience. Retail analytics solutions are allowing companies to monitor behavior across channels, determine drop-off points, and maximize channel performance. For instance, a customer who is browsing online will subsequently come into a store to make a purchase, and analytics platforms are monitoring such behaviors to influence marketing and sales efforts. Stores are also leveraging omnichannel analytics for coordinating promotions, for cross-channel inventory management, and optimizing the efficiency of fulfillment. Such an approach is allowing companies to align their marketing, operations, and customer service initiatives to ultimately maximize brand consistency and consumer satisfaction. As the two worlds of digital and physical retail continue to merge, adoption of omnichannel analytics continues to gain speed steadily.

Supply Chain Optimization and Effective Inventory Management

Retailers are continuously applying analytics for better optimization of supply chain operations and inventory management, which is another key driver of the market. In an era of rising customer expectations to speedily and accurately deliver products, real-time data insights are being used to forecast demand, review stock quantities, and manage logistics more efficiently. Retail analytics software is monitoring product flow between warehouses and stores, allowing companies to cut overstocking, minimize stockouts, and improve replenishment accuracy. Predictive models are being used to determine the best order sizes and distribution schedules based on past performance and seasonal patterns. Geospatial analytics are also being employed by retailers to minimize transportation expenses and maximize service levels by optimizing warehouse positions and delivery routes. Analytics is also being utilised to track performance of suppliers, monitor lead times, and assess risks in supply chains. Through data-driven decision-making in procurement and inventory planning, retailers are enhancing operational effectiveness as well as profitability. These capabilities are becoming more of a necessity in an environment of changing consumer demand and supply chain disruptions across the world.

Increasing Use of Cloud-Based Analytics Solutions

Retailers are increasingly using cloud-based analytics platforms because they are scalable, flexible, and cost-effective. These platforms are allowing companies to capture, process, and analyze huge amounts of data without the need for heavy on-premise infrastructure. Cloud-based retail analytics solutions are giving real-time insights, quicker deployment, and simpler integration with current enterprise systems. Companies are using these solutions to work inter-departmentally, get remote access to data, and ensure consistency of reports. The move to cloud is also tightening data security and compliance because top vendors provide high-strength encryption and follow global data privacy regulations. Cloud platforms are also making it easy to use AI and ML by providing high-end computing capabilities on a pay-as-you-use basis. Retailers are gaining from subscription-based options that minimize initial investment and enable more agility in scaling up. As digital transformation gathers pace, cloud-based analytics is emerging as a key driver of innovation and competitive differentiation in retail.

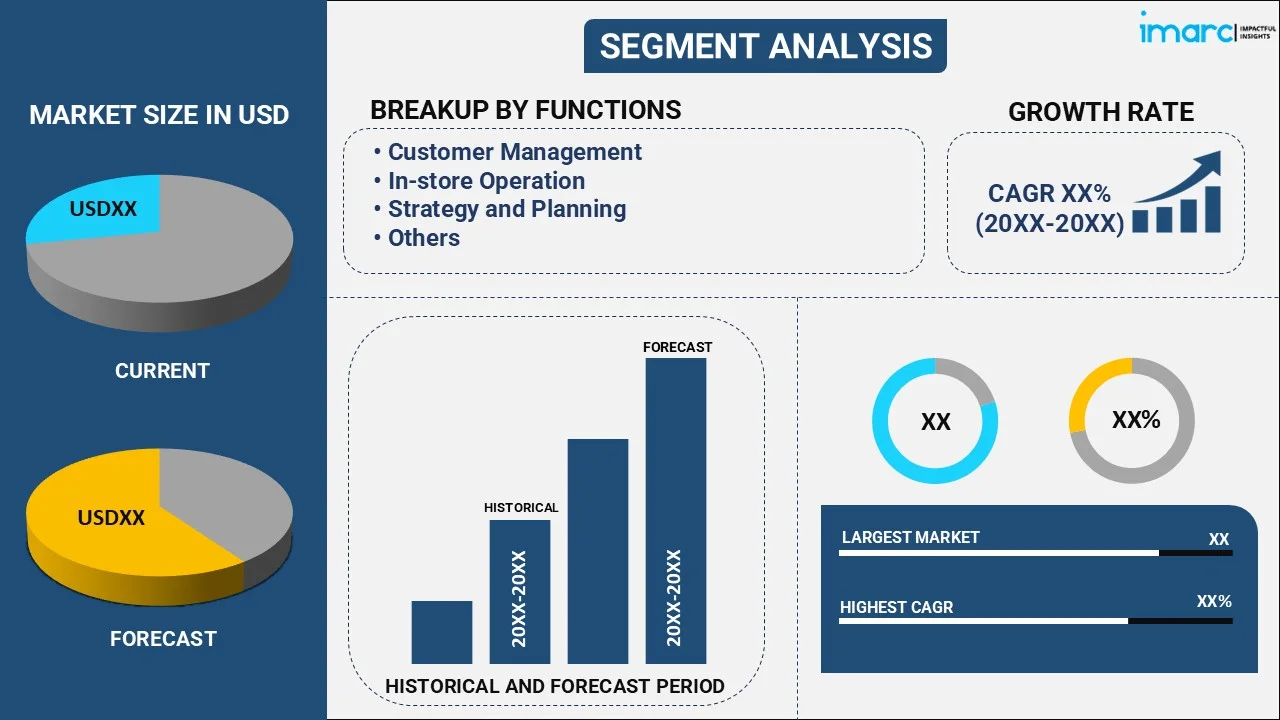

Retail Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on function, component, deployment mode, end user.

Breakup by Function:

- Customer Management

- In-store Operation

- Strategy and Planning

- Supply Chain Management

- Marketing and Merchandizing

- Others

Customer management accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the function. This includes customer management, in-store operation, strategy and planning, supply chain management, marketing and merchandizing, and others. According to the report, customer management represented the largest segment.

Due to the growing demand for individualized customer experiences and the strategic significance of customer loyalty and retention in a cutthroat retail environment, customer management leads the retail analytics market by function. Retailers may deliver customized marketing, improve customer interactions, and expand their service offerings by using analytics to obtain deep insights into customer behaviors, preferences, and purchasing habits. For instance, the Census Bureau data shows significant insights into retail sales and e-commerce trends which are crucial for customer management in retail analytics. In addition, the Annual Retail Trade Survey provides detailed annual sales, e-commerce sales, and inventories across various retail sectors. This can help businesses understand consumer buying patterns and adapt their customer management strategies accordingly. This data-driven strategy aids in the identification of valuable clients, forecasting their future purchasing patterns and putting in place efficient loyalty schemes. Furthermore, by facilitating real-time decision-making and predictive analytics, the incorporation of technologies like artificial intelligence (AI) and machine learning further augments the efficacy of these techniques.

Breakup by Component:

- Software

- Services

Software holds the largest share of the industry

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software and services. According to the report, software accounted for the largest market share.

Software dominates the retail analytics industry as it is crucial to turning massive volumes of data into insights that can be put into practice, which helps retailers make better decisions. The U.S. Census Bureau reports that in Q12021, e-commerce sales made up almost 13% of overall sales, highlighting the significance of analytics in maximizing online sales tactics. In today's data-driven market climate, retail analytics software offers extensive solutions for customer behavior monitoring, inventory management, and sales forecasting. The growing use of digital operations in retail, as noted by the Bureau of Labor Statistics, calls for advanced analytics solutions to manage the scope and intricacy of contemporary retail operations.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based. According to the report, cloud-based represented the largest segment.

Due to their scalability, flexibility, and affordability—all of which are critical for managing the enormous volumes of data created by contemporary retail operations—cloud-based solutions provide a positive impact on the retail analytics industry outlook. Retailers are able to efficiently handle peak shopping periods because they have the flexibility to scale resources up or down as needed. A U.S. Small Business Administration survey states that as cloud computing can lower IT overhead expenses and increase operational efficiency, small and medium-sized firms are adopting it at an increasing rate. This change is particularly important for the retail industry, where real-time data processing and analytics are required due to changing market conditions. Cloud systems make this possible by offering data storage and sophisticated analysis capabilities without requiring a substantial initial outlay of funds.

Breakup by End User:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small and medium enterprises and large enterprises. According to the report, large enterprises accounted for the largest market share.

Due to their vast operational scope and the intricate data environments, they oversee, large organizations hold a dominant position in the end-user retail analytics market. These companies possess the infrastructure and financial means to invest in cutting-edge retail analytics solutions, which are essential for managing the enormous volumes of data produced across numerous channels and regions. Large businesses may learn a great deal about market trends, supply chain efficiency, and consumer behavior by integrating and analyzing this data. Strategic planning, competitiveness in international markets, and operational optimization all depend on this degree of analytics. Large businesses can also frequently use more advanced analytics, such as AI-driven tools and predictive modeling, to spur innovation and enhance consumer experiences.

Breakup By Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest retail analytics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represented the largest market for retail analytics.

North America dominates the retail analytics market due to its sophisticated technological infrastructure, there has been a widespread use of big data solutions, and large investments in artificial intelligence (AI) and machine learning. The U.S. Department of Commerce reports that North American retail e-commerce sales increased 32.4% in 2019 compared to 2020, indicating the sector's rapid expansion and the growing demand for advanced analytics. Large digital organizations and startups that specialize in retail analytics solutions to improve customer experiences and operational efficiency call this region home. According to the U.S. Bureau of Economic Analysis, the demand for analytics to comprehend consumer behavior, manage inventory, and improve supply chains is driven by the digital transformation in retail. This is further catalyzing the retail analytics market growth.

Competitive Landscape:

- The retail analytics market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the retail analytics industry include 1010data Inc. (Advance Publications Inc.), Adobe Inc., Altair Engineering Inc., Flir Systems Inc., Fujitsu Limited, International Business Machines Corporation, Information Builders Inc., Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Qlik Technologies Inc. (Thoma Bravo LLC), SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), Tibco Software Inc, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Some of the leading companies in the retail analytics space, such as Microsoft Corporation, Fujitsu Limited, Flir Systems Inc., Altair Engineering Inc., Adobe Inc., and 1010data Inc., are constantly improving their products to increase the retail analytics market value. 1010data Inc. is a cloud-based analytics provider with a strong emphasis on retail operations optimization. Adobe Inc. provides customized digital marketing solutions through its advanced Adobe Analytics platform. Retailers can enhance supply chain and inventory management with the assistance of Altair Engineering Inc., which incorporates analytics into product design. Flir Systems Inc. uses cutting-edge thermal imaging technology to gain insights into customer behavior and security. Complete retail solutions, such as data-driven point-of-sale systems, are provided by Fujitsu Limited. Microsoft Corporation, is advancing the personalization of shopping experiences by leveraging cutting-edge AI and cloud-based technologies to improve customer engagement. Collectively, these businesses are paving the way for sophisticated, data-driven retail strategy. For instance, Adobe Experience Platform delivered new tools such as customer journey analytics with which retailers can now leverage AI to detect broken experiences (or to uncover new opportunities). This update takes anomaly detection beyond the website — where it has been predominantly used — and allows brands to see where issues arise as shoppers move between channels.

Retail Analytics Market News:

- July 2025: Retail Insight, an AI-driven analytics platform for grocery stores, today revealed important upgrades to its WasteInsight platform with additional robust features—Stock Exit Management, Intelligent Donation Facilitation, and Food Safety Alerts. These new functionalities enhance the company’s current expiration date management tools, Prompted Markdowns and Dynamic Markdowns, further increasing WasteInsight’s effectiveness in reducing food waste and optimizing inventory.

- June 2025: Revenue Analytics, a pioneer in intelligent, AI-driven revenue enhancement, today revealed its purchase of Climber, a Portugal-based Revenue Management Software (RMS) firm catering to boutique, independent, and regional chains throughout Europe, the Americas, and Brazil, where it holds the top market position. The acquisition signifies a strategic move in Revenue Analytics' worldwide growth plan, enhancing its product offerings and boosting its presence in critical international markets.

- May 2025: Qlik®, a worldwide leader in data integration, data quality, analytics, and artificial intelligence, today revealed the acquisition of the Qloud Cover Migration technology from Stretch Qonnect, a well-established Qlik Elite Solution Provider. This automated tool, named the Qlik Analytics Migration Tool, simplifies the process of transitioning from QlikView®, Qlik Sense®, and NPrinting® to Qlik Cloud®—a constant hurdle to cloud migration. It will be provided via Qlik at no charge to customers or through our Qlik-certified partners.

- May 2025: Zepto launched a new data analytics tool, Atom, for consumer brands listed on the platform. This tool will gather deeper insights like pincode-by-pincode market share data and brand performance and will also answer queries of merchants through a chatbot.

- February 2025: Achilles, a worldwide frontrunner in supply chain risk and performance management, has introduced Achilles Analytics, an advanced yet user-friendly online supply chain intelligence tool aimed at addressing the increasing need for sustainability and regulatory compliance reporting globally. By implementing Achilles Analytics, businesses can monitor supply chain performance using various carbon, ESG, and other metrics. They can swiftly obtain the necessary information to meet all regulatory obligations, report assuredly to stakeholders, and readily recognize and react to risks like political unrest, climate emergencies, social upheaval, and various other concerns.

- Feb 2024: Kroger partnered with Intelligence Node to enhance marketplace listings and provide clearer product guides for third-party vendors.

- Jan 2024: Microsoft announced the launch of new GenAI tools specifically designed for the retail industry, aiming to personalize shopping experiences and assist frontline workers in real time.

Retail Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Customer Management, In-store Operation, Strategy and Planning, Supply Chain Management, Marketing and Merchandizing, Others |

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Users Covered | Small and Medium Enterprises, Large Enterprises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 1010data Inc. (Advance Publications Inc.), Adobe Inc., Altair Engineering Inc., Flir Systems Inc., Fujitsu Limited, International Business Machines Corporation, Information Builders Inc., Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Qlik Technologies Inc. (Thoma Bravo LLC), SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), Tibco Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the retail analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global retail analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the retail analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global retail analytics market was valued at USD 10.4 Billion in 2024.

We expect the global retail analytics market to exhibit a CAGR of 16.92% during 2025-2033.

The rising deployment of retail analytics solutions, as they aid in empowering businesses and retailers by building mechanisms for learning and feedback, streamlining internal processes, identifying new revenue-generating opportunities, etc., is primarily driving the global retail analytics market.

The sudden outbreak of the COVID-19 pandemic has led to the rising adoption of retail analytics across numerous stores to assess risks and create suitable re-opening strategies, based on the consumer behavior, product demand, and the availability of logistics services.

Based on the function, the global retail analytics market has been segmented into customer management, in-store operation, strategy and planning, supply chain management, marketing and merchandizing, and others. Among these, customer management currently holds the majority of the total market share.

Based on the component, the global retail analytics market can be divided into software and services. Currently, software exhibits a clear dominance in the market.

Based on the deployment mode, the global retail analytics market has been categorized into on-premises and cloud-based, where cloud-based currently accounts for the majority of the global market share.

Based on the end user, the global retail analytics market can be segregated into small and medium enterprises and large enterprises. Currently large enterprises hold the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global retail analytics market include 1010data Inc. (Advance Publications Inc.), Adobe Inc., Altair Engineering Inc., Flir Systems Inc., Fujitsu Limited, International Business Machines Corporation, Information Builders Inc., Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Qlik Technologies Inc. (Thoma Bravo LLC), SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), and Tibco Software Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)