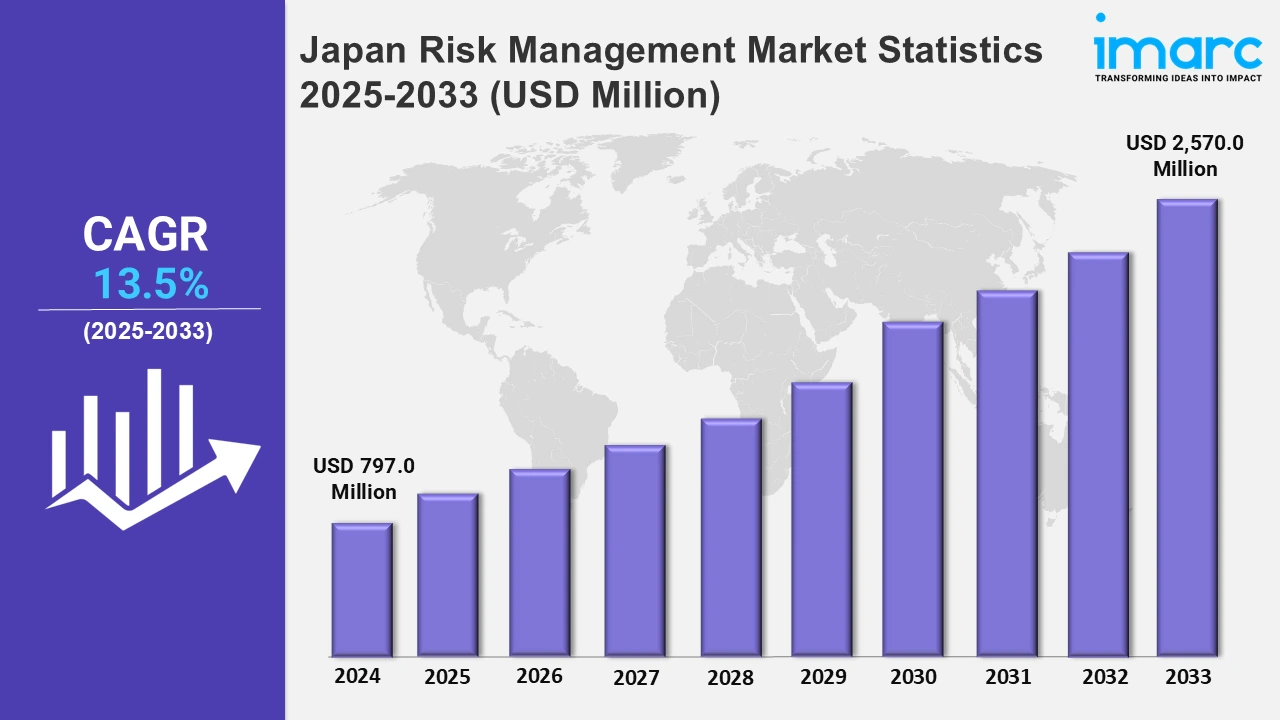

Japan Risk Management Market Expected to Reach USD 2,570.0 Million by 2033 - IMARC Group

Japan Risk Management Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan risk management market size was valued at USD 797.0 Million in 2024, and it is expected to reach USD 2,570.0 Million by 2033, exhibiting a growth rate (CAGR) of 13.5% from 2025 to 2033.

To get more information on this market, Request Sample

Increased focus on regulatory compliance and ESG reporting in Japan is driving demand for advanced risk management solutions as organizations seek efficient and technology-enabled tools to align with evolving standards and strengthen internal audit and governance frameworks. In September 2024, AuditBoard and Protiviti expanded their partnership to provide enhanced local support in Japan, helping organizations to modernize internal audit, risk, compliance, and ESG management processes.

Additionally, Japan's emphasis on disaster risk mitigation and public awareness is positively impacting the market. Efforts to address frequent disasters, enhance community cooperation, and refine disaster management systems drive the demand for innovative solutions. For instance, in October 2024, Japan showcased its disaster risk reduction strategies at the Asia-Pacific Ministerial Conference on Disaster Risk Reduction (APMCDRR). Besides this, with the increasing digitization of business operations, cybersecurity threats have become a critical concern for Japanese organizations. The rise in data breaches has driven the demand for advanced cybersecurity risk management solutions. Companies are adopting proactive measures to identify vulnerabilities, comply with data protection regulations, and safeguard sensitive information. This focus on mitigating digital risks is contributing to the market.

Japan Risk Management Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing frequency of cyber threats is creating substantial challenges for businesses in Japan, thereby driving the market expansion.

Kanto Region Risk Management Market Trends:

The Kanto region is improving disaster response with AI systems. High-altitude cameras detect fires during earthquakes in real-time. This aids in managing risks better and speeds up emergency actions in crowded cities. For instance, in August 2024, the Tokyo metropolitan government launched an AI system equipped with elevated-height cameras used to detect fire, aiming to speed up initial disaster response during major earthquakes.

Kinki Region Risk Management Market Trends:

The Kinki region, including Osaka, is focusing on reducing disaster risks. This is because typhoons and earthquakes often affect the area. Osaka's government partners with private companies to build earthquake-resistant structures and improve emergency systems. For instance, Osaka has developed a disaster prevention map to address the risks of potential tsunamis following earthquakes.

Central/Chubu Region Risk Management Market Trends:

The Central/Chubu region, including Nagoya, works to prevent supply chain problems. This is important for its manufacturing economy. Toyota, based in Aichi Prefecture, uses digital twins and real-time data to avoid production risks. The Nagoya Chamber of Commerce supports using different suppliers to handle material shortages from political issues or natural disasters.

Kyushu-Okinawa Region Risk Management Market Trends:

In Kyushu-Okinawa, managing risks is important because of active volcanoes like Sakurajima. Authorities across the region have improved evacuation plans, set up hazard zones, and created ways to clean up volcanic ash. Various companies in Kagoshima and Kumamoto are working on insurance plans to cover farm damage from ash, thereby contributing to the market expansion.

Tohoku Region Risk Management Market Trends:

The Tohoku region focuses on managing tsunami risks after the major disaster. Coastal cities like Sendai have built tsunami barriers, created evacuation routes, and used green solutions to reduce damage. Besides this, the Sendai Framework for disaster risk reduction started here and has influenced both local policies.

Chugoku Region Risk Management Market Trends:

The Chugoku region faces a growing number of data breaches, which is expanding the demand for stronger cybersecurity solutions. In September 2023, a data breach affected a civil engineering company based in Hiroshima, Japan. This has led to market growth as businesses invest in advanced technologies and services to protect sensitive information and prevent potential threats.

Hokkaido Region Risk Management Market Trends:

Hokkaido focuses on managing risks from cold weather, like blizzards and snow disruptions. Cities such as Sapporo use advanced snow removal systems and smart tools to keep transport running in winter. Insurance now covers snow-related damage, helping businesses in the region to reduce losses.

Shikoku Region Risk Management Market Trends:

The risk management market in the Shikoku region is growing because more businesses are using digital technology. In cities like Takamatsu and Matsuyama, industries, including manufacturing and agriculture, are adopting advanced tech. This makes the need for risk management solutions, like cybersecurity and data protection, stronger.

Top Companies Leading in the Japan Risk Management Industry

The report encompasses novel players across the country. In October 2024, WTW, an advisory and broking solutions provider, expanded its Corporate Risk & Broking (CRB) division in Japan with the introduction of an insurance brokerage service. Furthermore, in September 2024, AuditBoard and Protiviti expanded their partnership to provide enhanced local support in the country.

Japan Risk Management Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into software and services. The software segment includes tools for cybersecurity, data protection, and risk assessment. In contrast, the services segment offers consulting, advisory, and compliance support to help businesses manage risks and adhere to regulations.

- Based on the deployment mode, the market has been bifurcated into on-premises and cloud-based. On-premises solutions provide organizations with control over their data and security, while cloud-based options offer flexibility, scalability, and cost-efficiency, enabling businesses to manage risks remotely.

- On the basis of the enterprise size, the market has been bifurcated into large enterprises and small and medium-sized enterprises. Large enterprises require comprehensive and customized risk management solutions. At the same time, SMEs focus on affordable and scalable options that address their specific risks and regulatory needs efficiently.

- Based on the industry vertical, the market has been bifurcated into BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others. In BFSI, the focus is on cybersecurity and compliance. Moreover, IT and telecom require robust data protection, further driving the demand for risk management. Besides this, the retail sector requires fraud prevention and supply chain risk management. Furthermore, the healthcare industry emphasizes on patient data security.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 797.0 Million |

| Market Forecast in 2033 | USD 2,570.0 Million |

| Market Growth Rate 2025-2033 | 13.5% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Risk Management Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)