Japan Smart Industrial Motors Market Size, Share, Trends and Forecast by Motor Type, Connectivity & Intelligence, Power Rating, End-Use Industry, and Region, 2026-2034

Japan Smart Industrial Motors Market Overview:

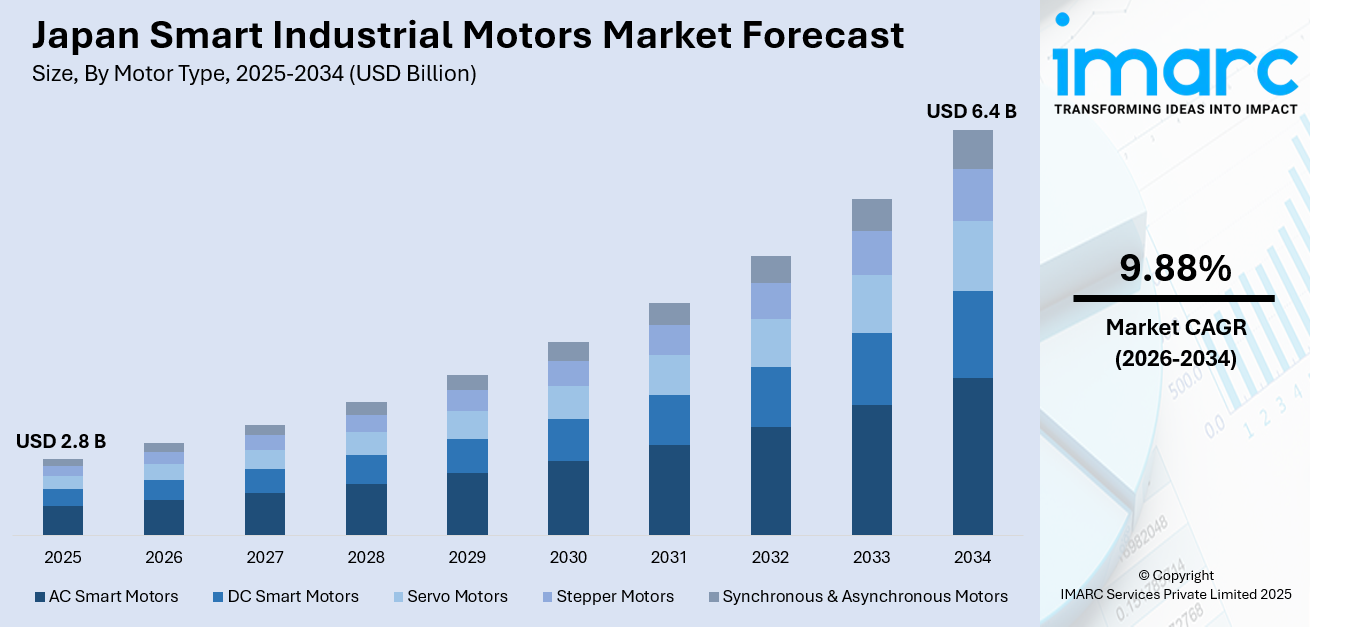

The Japan smart industrial motors market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.4 Billion by 2034, exhibiting a growth rate (CAGR) of 9.88% during 2026-2034. The market is expanding with rising energy efficiency demand, pervasive industrial automation, and advancing Internet of Things (IoT) and artificial intelligence (AI) capabilities at a fast pace. Government policies that encourage sustainability and smart manufacturing further boost market growth. Moreover, increasing usage in data centers, robotics, and high-precision systems also amplifies market opportunities. Japan smart industrial motors market share reflects its leadership position and sustained role in embracing new and efficient industrial motor technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 6.4 Billion |

| Market Growth Rate 2026-2034 | 9.88% |

Japan Smart Industrial Motors Market Trends:

Integration of IoT and AI for Predictive Maintenance

Japan's intelligent industrial motor market is witnessing robust momentum as IoT and AI technologies get integrated. Such innovation enables motors to share real-time information regarding performance, wear, and ambient conditions. AI-powered analytics make possible early warning for impending failures so that predictive maintenance can be achieved and unplanned downtime reduced. This reduces disturbances and increases the lifespan of the equipment. IoT connectivity also enables remote monitoring and control and optimizes overall operating efficiency. Firms are increasingly embracing these technologies to increase productivity, lower maintenance expenses, and facilitate sustainability objectives. The transition towards more intelligent, self-optimizing systems is revolutionizing industrial processes and making Japan a global leader in high-tech manufacturing environments.

Surge in Demand from AI Data Centers and Automation

The quick pace of automation and AI infrastructure is playing a substantial role in shaping demand for smart industrial motors in Japan. The motors play a crucial role in facilitating robotics, conveyor systems, and data center cooling and power requirements. For instance, in June 2024, OKI divested its precision small motor operations to Mabuchi Motor, expanding Japan's intelligent industrial motors market by fusing OKI's stepping motor technology with Mabuchi's high-efficiency DC motors. Moreover, within highly automated centers, they allow for accurate control and adaptive measures in response to workload variations. In data centers, they allow for optimal operational conditions through intelligent load management and energy efficiency. To this, manufacturers are countering with motor designs that blend with the automated and digitalized spaces. The move demonstrates a push towards intelligent, connected systems capable of addressing the level and intricacy of industrial and digital activity of today, especially in areas needing uptime and dependability at all times.

Government Initiatives Promoting Energy Efficiency

Government-led initiatives are playing a major role in encouraging the Japan smart industrial motors market growth. Policies are designed to promote energy conservation and reduce environmental impact across industrial sectors. These initiatives encourage companies to invest in energy-efficient and smart motor systems that align with national goals for carbon reduction and sustainable development. The push includes regulatory guidelines, energy standards, and incentive programs to support modernization of equipment. As a result, industries are increasingly replacing older, less efficient motors with smart alternatives that consume less energy and offer greater control. This regulatory encouragement accelerates innovation and the widespread use of advanced motor technologies in Japan’s industrial ecosystem.

Japan Smart Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on motor type, connectivity & intelligence, power rating, and end-use industry.

Motor Type Insights:

To get detailed segment analysis of this market Request Sample

- AC Smart Motors

- DC Smart Motors

- Servo Motors

- Stepper Motors

- Synchronous & Asynchronous Motors

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC smart motors, DC smart motors, servo motors, stepper motors, and synchronous & asynchronous motors.

Connectivity & Intelligence Insights:

- IoT-Enabled Smart Motors

- AI & ML-Integrated Motors

- Wireless & Cloud-Connected Motors

- Edge Computing & Embedded Systems in Motors

A detailed breakup and analysis of the market based on the connectivity & intelligence have also been provided in the report. This includes IoT-enabled smart motors, AI & ML-integrated motors, wireless & cloud-connected motors, and edge computing & embedded systems in motors.

Power Rating Insights:

- Low Power (0.1 kW – 10 kW)

- Medium Power (10 kW – 100 kW)

- High Power (Above 100 kW)

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes low power (0.1 kW – 10 kW), medium power (10 kW – 100 kW), and high power (Above 100 kW).

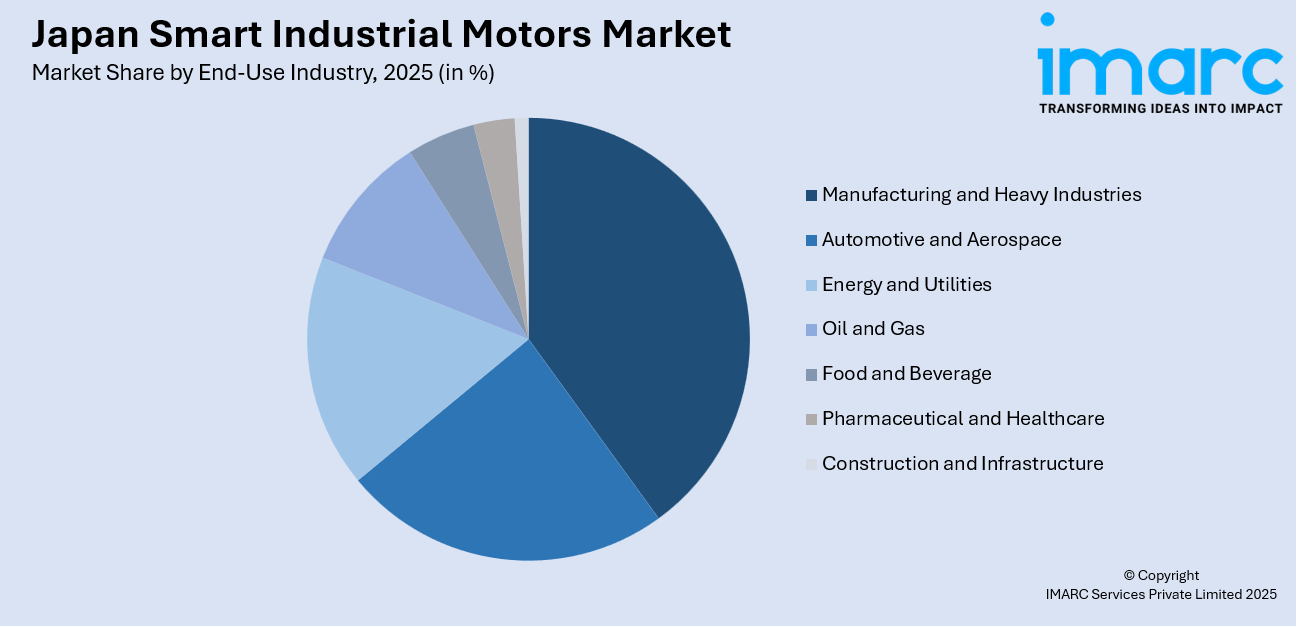

End-Use Industry Insights:

To get detailed regional analysis of this market Request Sample

- Manufacturing and Heavy Industries

- Automotive and Aerospace

- Energy and Utilities

- Oil and Gas

- Food and Beverage

- Pharmaceutical and Healthcare

- Construction and Infrastructure

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing and heavy industries, automotive and aerospace, energy and utilities, oil and gas, food and beverage, pharmaceutical and healthcare, and construction and infrastructure.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Smart Industrial Motors Market News:

- In March 2025, ITT Inc. launched VIDAR, a revolutionary industrial smart motor that reduces energy usage, CO2 emissions, operating costs, and boosts equipment lifespan. This compact motor, featuring embedded variable speed intelligence, is 60% smaller than current alternatives, making it ideal for harsh environments. VIDAR offers precise speed control, replacing outdated fixed-speed motors without the need for costly VFDs or additional equipment, providing a cost-effective, efficient solution for industrial pumps and fans.

- In October 2024, Mitsubishi Motors, MC Retail Energy, Kaluza Japan, and Mitsubishi Corporation launched Japan’s first EV smart-charging service using connected technologies. Available for Outlander PHEV owners, the system allows users to schedule vehicle charging via a smartphone app, optimizing it based on electricity prices. This service enhances energy efficiency, promotes renewable energy use, reduces peak-hour loads, and offers electricity bill discounts, supporting both customer convenience and a more sustainable power grid.

Japan Smart Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motor Types Covered | AC Smart Motors, DC Smart Motors, Servo Motors, Stepper Motors, Synchronous & Asynchronous Motors |

| Connectivity & Intelligences Covered | IoT-Enabled Smart Motors, AI & ML-Integrated Motors, Wireless & Cloud-Connected Motors, Edge Computing & Embedded Systems in Motors |

| Power Ratings Covered | Low Power (0.1 kW - 10 kW), Medium Power (10 kW - 100 kW), High Power (Above 100 kW) |

| End-Use Industries Covered | Manufacturing and Heavy Industries, Automotive and Aerospace, Energy and Utilities, Oil and Gas, Food and Beverage, Pharmaceutical and Healthcare, Construction and Infrastructure |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan smart industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan smart industrial motors market on the basis of motor type?

- What is the breakup of the Japan smart industrial motors market on the basis of connectivity & intelligence?

- What is the breakup of the Japan smart industrial motors market on the basis of power rating?

- What is the breakup of the Japan smart industrial motors market on the basis of end-use industry?

- What is the breakup of the Japan smart industrial motors market on the basis of region?

- What are the various stages in the value chain of the Japan smart industrial motors market?

- What are the key driving factors and challenges in the Japan smart industrial motors market?

- What is the structure of the Japan smart industrial motors market and who are the key players?

- What is the degree of competition in the Japan smart industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan smart industrial motors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan smart industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan smart industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)