Japan Smart Manufacturing Software Market Size, Share, Trends and Forecast by Software Type, Enterprise Size, Deployment Mode, Industry Vertical, and Region, 2026-2034

Japan Smart Manufacturing Software Market Overview:

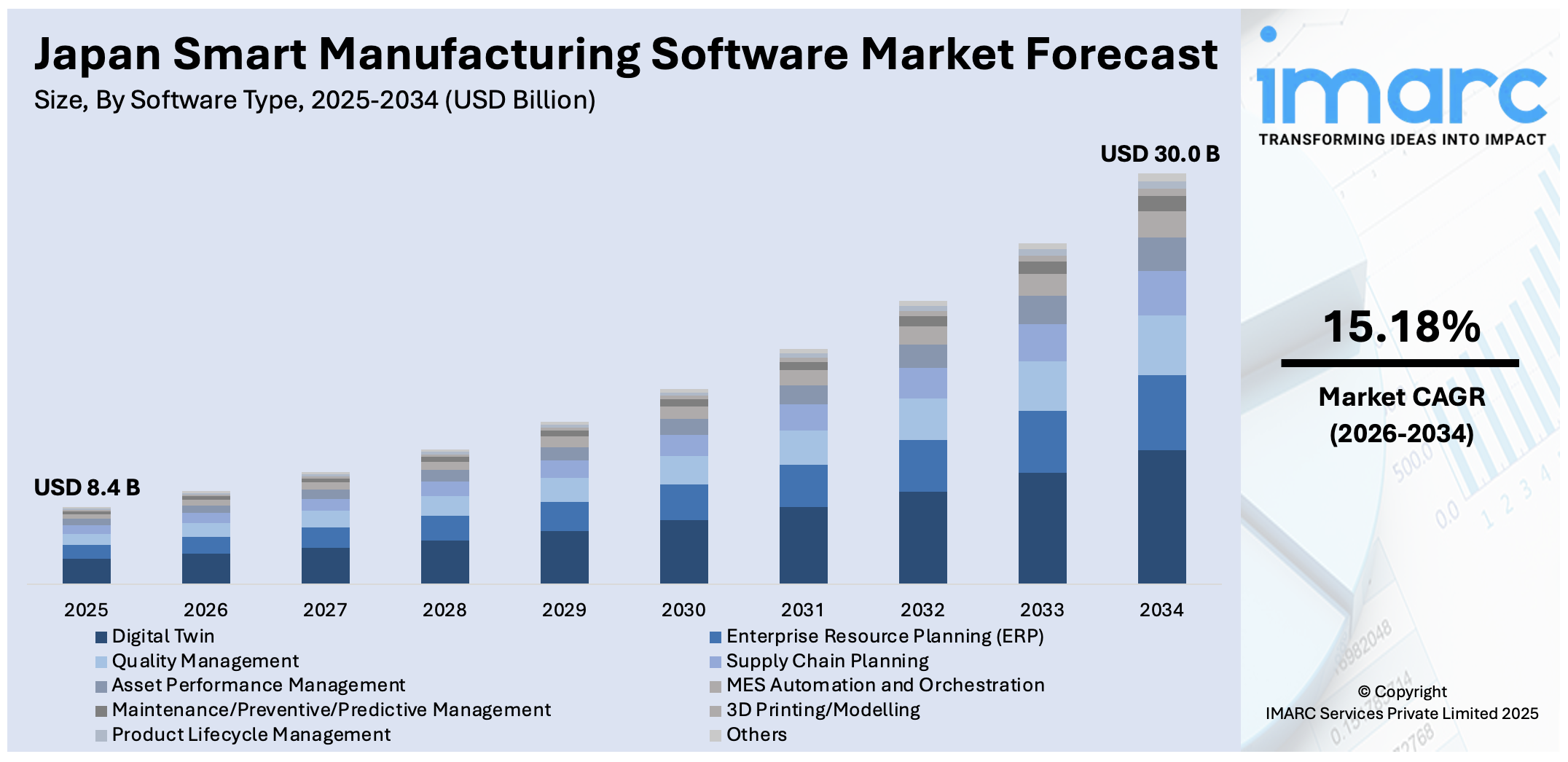

The Japan smart manufacturing software market size reached USD 8.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 30.0 Billion by 2034, exhibiting a growth rate (CAGR) of 15.18% during 2026-2034. The market is experiencing robust growth due to rising industrial automation, strong government support for Industry 4.0, and increasing integration of AI and IoT in production systems. The need for real-time data insights, predictive maintenance, and operational efficiency is driving adoption across key sectors like automotive, electronics, and machinery. Additionally, the focus on energy optimization and digital transformation is encouraging software upgrades. Leading companies are enhancing capabilities through R&D to strengthen their position in the Japan smart manufacturing software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.4 Billion |

| Market Forecast in 2034 | USD 30.0 Billion |

| Market Growth Rate 2026-2034 | 15.18% |

Japan Smart Manufacturing Software Market Trends:

Integration of AI and IoT in Manufacturing Processes

Japanese makers are increasingly using AI and the IoT to transform factory production. The two technologies enable machines and systems to talk, track, and tweak processes in real time. Through AI, firms can sift through huge amounts of data to make informed decisions, while IoT sensors enable them to monitor equipment condition and improve energy consumption. This leads to intelligent, more responsive production lines with less waste and downtime. A notable development in 2024 is Delta Electronics' showcase at CEATEC 2024 of its Digital Twin Solution for smart manufacturing. This innovation combines AI and advanced digital simulation technology, enabling manufacturers to reduce equipment development time by up to 20% while achieving over 95% simulation accuracy. As digital connectivity becomes an integral part of factory infrastructure, manufacturers are gaining more flexibility, productivity, and quality control. This change also helps Japan's overall goal of staying competitive in the global manufacturing world through digital innovation.

To get more information on this market Request Sample

Government Initiatives Driving Digital Transformation

Japan's government also has a vital role in stimulating the adoption of smart manufacturing technology by adopting policies and frameworks. Policies such as "Society 5.0" have been put in place to combine physical and digital systems, leading industries to more intelligent, data-based operations. All these efforts are facilitated by policy guidance, collaboration platforms, and financing mechanisms that facilitate companies particularly small and medium enterprises to embrace digital tools. By advancing standards and supporting collaboration among academia, government, and industry, Japan is building a strong foundation for digital transformation. The outcome is a more agile, resilient, and competitive manufacturing ecosystem, with the government playing a key role thus bolstering the Japan smart manufacturing software market growth.

Advancements in Robotics and Automation

Japan has long been a global leader in robotics, and its integration into smart manufacturing is accelerating rapidly. In 2023 , Japan installed 46,106 industrial robots, securing its position as the second-largest market globally, just behind China. This ongoing investment reflects the country's strategic push toward automation amid global economic uncertainties. Japanese manufacturers are increasingly leveraging robotics to handle complex and repetitive tasks, enhancing consistency and minimizing human error. Today’s robotics systems, integrated with intelligent software, enable machines to adapt to changing tasks and work collaboratively with humans. This advancement supports more agile production lines capable of responding swiftly to shifts in demand or design. With a shrinking workforce due to demographic challenges, automation has become essential. By combining robotics with digital platforms, Japan is transforming its factories into smart, high-efficiency production hubs that uphold its manufacturing excellence.

Japan Smart Manufacturing Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on software type, enterprise size, deployment mode, and industry vertical.

Software Type Insights:

- Digital Twin

- Enterprise Resource Planning (ERP)

- Quality Management

- Supply Chain Planning

- Asset Performance Management

- MES Automation and Orchestration

- Maintenance/Preventive/Predictive Management

- 3D Printing/Modelling

- Product Lifecycle Management

- Others

The report has provided a detailed breakup and analysis of the market based on the software. This includes digital twin, enterprise resource planning (ERP), quality management, supply chain planning, asset performance management, MES automation and orchestration, maintenance/preventive/predictive management, 3D printing/modelling, product lifecycle management, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Mid-sized Enterprises (SMEs)

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises, and small and mid-sized enterprises (SMEs).

Deployment Mode Insights:

- Cloud based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud based and on-premises.

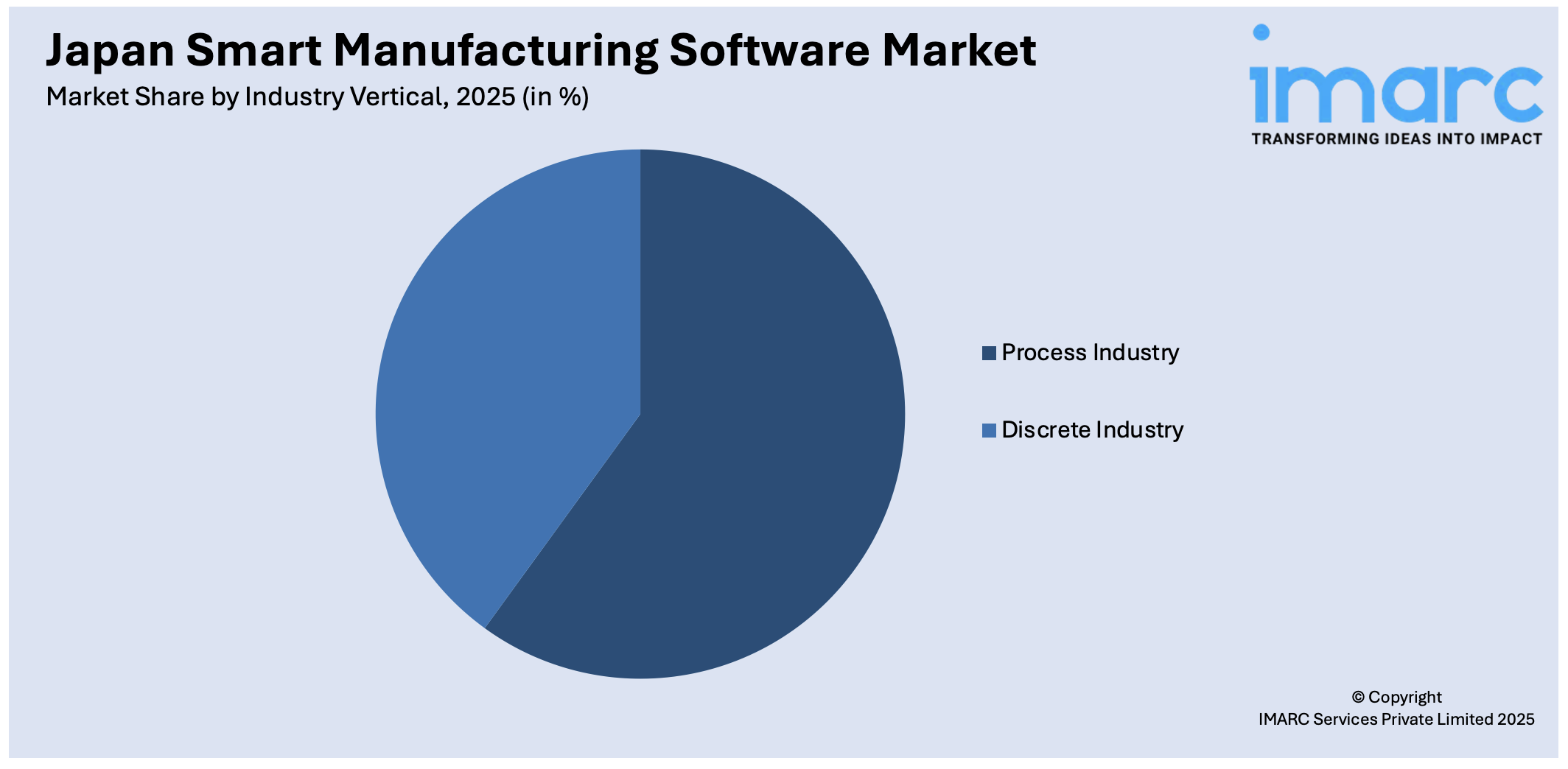

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Process Industry

-

- Oil and Gas

- Power and Energy

- Chemicals

- Pharmaceuticals

- Food and Beverages

- Metal and Mining

- Others

- Discrete Industry

-

- Automotive

- Electronics and Manufacturing

- Industrial Manufacturing

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes process industry (oil and gas, power and energy, chemicals, pharmaceuticals, food and beverages, metal and mining, and others) discrete industry (automotive, electronics and manufacturing, industrial manufacturing, aerospace and defense, and others).

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Smart Manufacturing Software Market News:

- In October 2024, Lantek partnered with Japan’s FA Service to expand its presence in the Japanese sheet metal manufacturing market. This strategic alliance combines Lantek’s advanced software—including MES, AI, and quoting tools—with FAS’s local expertise. The partnership aims to deliver multivendor, data-driven solutions tailored to Japan’s manufacturing needs, helping companies boost efficiency, drive digital transformation, and stay competitive in the evolving smart manufacturing landscape.

- In September 2024, Yokogawa Electric launched the OpreX™ Intelligent Manufacturing Hub globally (excluding Japan), offering a low-code/no-code RPA-based solution that unifies OT and IT data in a single database. It delivers organization-wide KPI dashboards, drastically cuts reporting time, and enhances decision-making from the C-suite to plant floor. Designed for industries like oil, gas, and pharma, it also includes Yokogawa's consulting, support, and training services for successful digital transformation.

Japan Smart Manufacturing Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Digital Twin, Enterprise Resource Planning (ERP), Quality Management, Supply Chain Planning, Asset Performance Management, MES Automation and Orchestration, Maintenance/Preventive/Predictive Management, 3D Printing/Modelling, Product Lifecycle Management, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Mid-sized Enterprises (SMEs) |

| Deployment Modes Covered | Cloud based, On-premises |

| Industry Verticals Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan smart manufacturing software market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan smart manufacturing software market on the basis of software type?

- What is the breakup of the Japan smart manufacturing software market on the basis of enterprise size?

- What is the breakup of the Japan smart manufacturing software market on the basis of deployment mode?

- What is the breakup of the Japan smart manufacturing software market on the basis of industry vertical?

- What is the breakup of the Japan smart manufacturing software market on the basis of region?

- What are the various stages in the value chain of the Japan smart manufacturing software market?

- What are the key driving factors and challenges in the Japan smart manufacturing software market?

- What is the structure of the Japan smart manufacturing software market and who are the key players?

- What is the degree of competition in the Japan smart manufacturing software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan smart manufacturing software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan smart manufacturing software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan smart manufacturing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)