Japan Smart Welding Equipment Market Size, Share, Trends and Forecast by Component, Material Type, Welding Technology, Automation Level, End Use Industry, and Region, 2026-2034

Japan Smart Welding Equipment Market Overview:

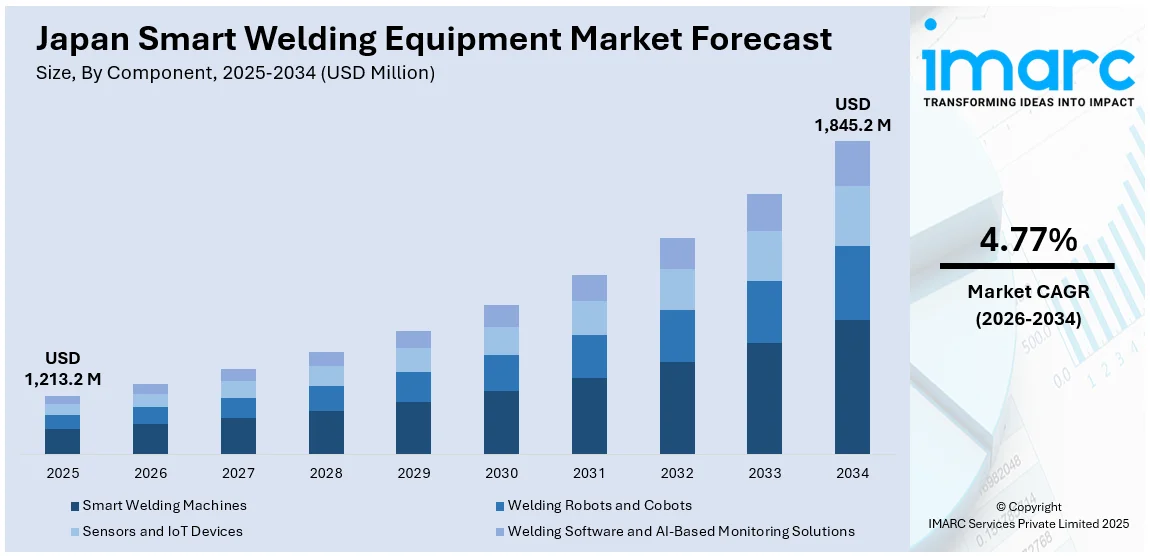

The Japan smart welding equipment market size reached USD 1,213.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,845.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.77% during 2026-2034. The market is growing steadily due to increased automation in manufacturing, advancements in robotics, and rising demand for precision engineering across the automotive and electronics sectors. Continued investment in Industry 4.0 technologies and the need for skilled labor alternatives are further fueling the Japan smart welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,213.2 Million |

| Market Forecast in 2034 | USD 1,845.2 Million |

| Market Growth Rate 2026-2034 | 4.77% |

Japan Smart Welding Equipment Market Trends:

Advanced Manufacturing and Industry 4.0 Integration

Japan is globally recognized for its cutting-edge manufacturing practices, which have increasingly embraced Industry 4.0 principles. Smart welding equipment aligns seamlessly with this shift, incorporating automation, AI, real-time monitoring, and IoT connectivity. These features help manufacturers improve efficiency, precision, and traceability in welding processes. Leading sectors like automotive, electronics, and machinery benefit from the data-driven insights and consistent quality that smart systems offer. The Japanese government and industry associations actively promote digital transformation by providing incentives and research and development (R&D) support. This fosters faster adoption of advanced technologies. As factories modernize and optimize production lines, smart welding solutions become indispensable tools for staying competitive, reducing downtime, and increasing output while meeting strict quality and safety standards. For instance, in April 2025, Techman Robot and Panasonic Connect's Welding Systems Division launched a strategic partnership to accelerate the development of welding automation systems. Through the integration of Techman Robot's cutting-edge collaborative robot technology and Panasonic's vast welding expertise, the two businesses are creating new avenues for welding process automation.

To get more information on this market Request Sample

Automotive Industry’s Demand for Precision Welding

Japan’s automotive sector remains one of the most advanced and quality-conscious in the world, with high demands for precision welding in vehicle manufacturing. The shift toward electric and hybrid vehicles introduces lighter materials and more complex component assemblies, requiring specialized welding techniques. Smart welding equipment provides the flexibility, precision, and quality control essential to meet these evolving needs. Robotic and laser-based systems ensure consistent welds and minimize defects, which are critical for safety and performance. Automotive giants and suppliers in Japan are actively adopting such technologies to meet global standards and increase production efficiency. This sector's continual innovation and manufacturing scale are major forces behind the growing demand for smart welding solutions, thereby boosting the Japan smart welding equipment market growth.

Government Support and Skilled Workforce Development

The Japanese government plays a central role in advancing smart manufacturing, including welding technologies. Through initiatives such as the Connected Industries policy, it promotes the integration of IoT and robotics in industrial sectors. Additionally, government-backed organizations and technical institutes offer funding, R&D programs, and training to upskill workers in using smart systems. This focus on education ensures the workforce can adapt to automation trends. Such support not only accelerates adoption of smart welding tools but also fosters innovation within domestic manufacturers. By aligning policy with industry needs, Japan ensures both large corporations and SMEs can access advanced equipment and remain competitive in global markets, driving the overall expansion of smart welding technology.

Japan Smart Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, material type, welding technology, automation level, and end use industry.

Component Insights:

- Smart Welding Machines

- Welding Robots and Cobots

- Sensors and IoT Devices

- Welding Software and AI-Based Monitoring Solutions

The report has provided a detailed breakup and analysis of the market based on the component. This includes smart welding machines, welding robots and cobots, sensors and IoT devices, and welding software and AI-based monitoring solutions.

Material Type Insights:

- Steel and Stainless Steel Welding

- Aluminum and Non-Ferrous Metal Welding

- Composite and Advanced Material Welding

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel and stainless steel welding, aluminum and non-ferrous metal welding, and composite and advanced material welding.

Welding Technology Insights:

- Arc Welding

- Resistance Welding

- Laser Welding

- Electron Beam Welding

- Ultrasonic Welding

- Friction Stir Welding

- Plasma Welding

A detailed breakup and analysis of the market based on the welding technology have also been provided in the report. This includes arc welding, resistance welding, laser welding, electron beam welding, ultrasonic welding, friction stir welding, and plasma welding.

Automation Level Insights:

- Manual Welding Equipment

- Semi-Automated Welding Systems

- Fully Automated and AI-Integrated Welding Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding equipment, semi-automated welding systems, and fully automated and AI-integrated welding systems.

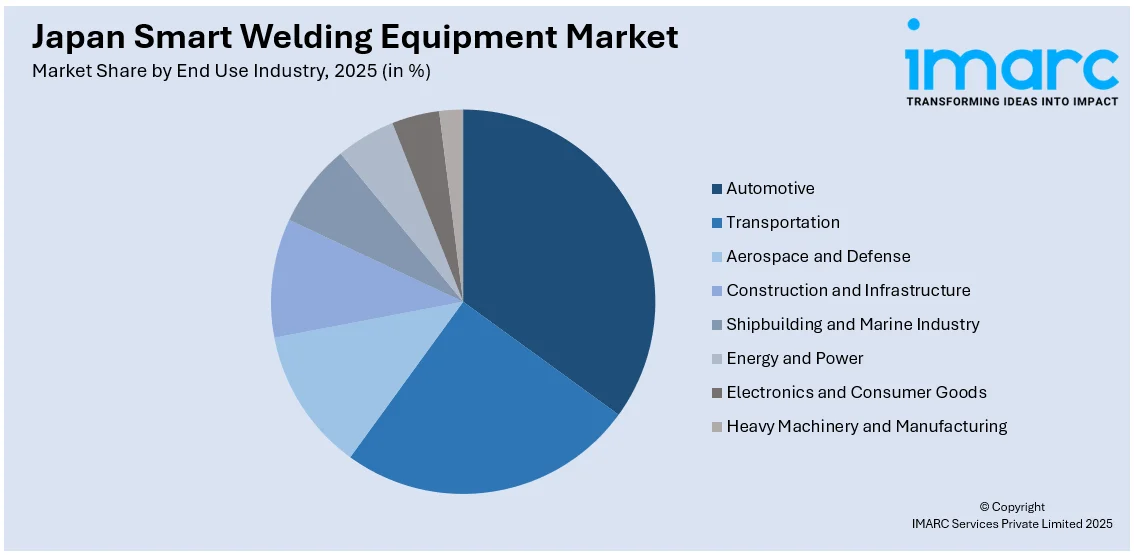

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Shipbuilding and Marine Industry

- Energy and Power

- Electronics and Consumer Goods

- Heavy Machinery and Manufacturing

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, transportation, aerospace and defense, construction and infrastructure, shipbuilding and marine industry, energy and power, electronics and consumer goods, and heavy machinery and manufacturing.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Smart Welding Equipment Market News:

- In April 2025, Sequence Freezing Arc-Welding (SFA), a novel arc welding technique employing industrial robots, was unveiled by Yaskawa Electric during a press conference in Toyota City, Aichi Prefecture. SFA, which was created in collaboration with Toyota Motor Corporation, has been used to shorten the production time of racing vehicle protective roll cages from two to three weeks to just two to three days.

Japan Smart Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Smart Welding Machines, Welding Robots and Cobots, Sensors and IoT Devices, Welding Software and AI-Based Monitoring Solutions |

| Material Types Covered | Steel and Stainless Steel Welding, Aluminum and Non-Ferrous Metal Welding, Composite and Advanced Material Welding |

| Welding Technologies Covered | Arc Welding, Resistance Welding, Laser Welding, Electron Beam Welding, Ultrasonic Welding, Friction Stir Welding, Plasma Welding |

| Automation Levels Covered | Manual Welding Equipment, Semi-Automated Welding Systems, Fully Automated and AI-Integrated Welding Systems |

| End Use Industries Covered | Automotive, Transportation, Aerospace and Defense, Construction and Infrastructure, Shipbuilding and Marine Industry, Energy and Power, Electronics and Consumer Goods, Heavy Machinery and Manufacturing |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan smart welding equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan smart welding equipment market on the basis of component?

- What is the breakup of the Japan smart welding equipment market on the basis of material type?

- What is the breakup of the Japan smart welding equipment market on the basis of welding technology?

- What is the breakup of the Japan smart welding equipment market on the basis of automation level?

- What is the breakup of the Japan smart welding equipment market on the basis of end use industry?

- What is the breakup of the Japan smart welding equipment market on the basis of region?

- What are the various stages in the value chain of the Japan smart welding equipment market?

- What are the key driving factors and challenges in the Japan smart welding equipment?

- What is the structure of the Japan smart welding equipment market and who are the key players?

- What is the degree of competition in the Japan smart welding equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan smart welding equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan smart welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan smart welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)