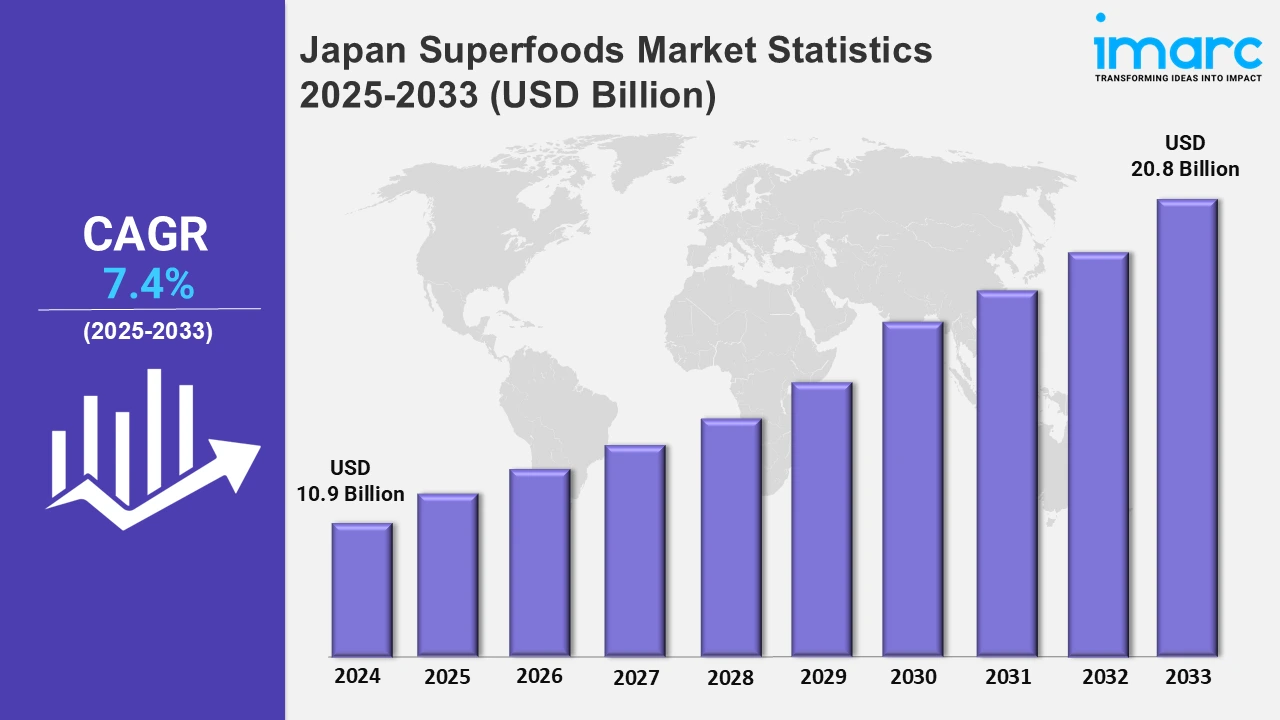

Japan Superfoods Market Expected to Reach USD 20.8 Billion by 2033 - IMARC Group

Japan Superfoods Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan superfoods market size was valued at USD 10.9 Billion in 2024, and it is expected to reach USD 20.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.4% from 2025 to 2033.

To get more information on this market, Request Sample

Japan's superfoods market is evolving through advancements in convenient food products. Collaborative efforts emphasize on integrating health, biotechnology, and culinary innovation, driving forward solutions that cater to enhancing wellness applications. For instance, in May 2024, Mars City Design formed a strategic partnership with Innovation Labo Tokyo to create a superfood supplement. This collaboration aims to develop culinary innovations to support the needs of future space travel.

Moreover, the market is expanding with innovative plant-based products using locally harvested ingredients like sorghum, recognized as a superfood. Vegan-certified offerings demonstrate a growing focus on sustainability and the use of nutrient-dense traditional crops in modern culinary creations. In August 2024, Fujiya, a restaurant operator in Tokushima and Kagawa, introduced Nikugoe, a vegan-certified plant-based meat line made from Tokushima-grown sorghum. Besides this, products combining traditional Japanese ingredients like yuzu and wakame with international superfoods such as quinoa are gaining popularity. These creative fusions enhance accessibility and convenience, thereby attracting health-conscious consumers. Additionally, the incorporation of superfoods into everyday items like ready-to-eat meals and cosmetics widens their appeal. Innovations tailored to specific health needs, including skin health and weight management, further bolster the market.

Japan Superfoods Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing awareness regarding the health benefits associated with superfoods drives market growth in Japan.

Kanto Region Superfoods Market Trends:

Superfoods like spirulina, chia seeds, and quinoa are becoming popular in the Kanto region. Many people in Tokyo and Yokohama are health-conscious. Organic cafes and wellness restaurants in these cities use superfoods in preparing meals and smoothies, which is elevating the market expansion.

Kinki Region Superfoods Market Trends:

In the Kinki region, notably in Osaka, traditional Japanese superfoods such as matcha and natto are being modified to appeal to modern tastes. Matcha, for example, is utilized in a variety of goods other than tea, including smoothies, snacks, and desserts. Companies in Kyoto are incorporating matcha into health drinks and protein bars, capitalizing on the booming market for functional foods.

Central/Chubu Region Superfoods Market Trends:

Local superfoods, such as yacon and wasabi, are gaining popularity as useful ingredients in the Central/Chubu region. Farmers in Nagano have developed yacon syrup, a sugar substitute with prebiotic properties. Besides this, wasabi, which is high in antioxidants and antibacterial qualities, is gaining popularity beyond its traditional application in Japanese cuisine, thereby inflating the market expansion.

Kyushu-Okinawa Region Superfoods Market Trends:

The Kyushu-Okinawa region is known for its long life expectancy and many centenarians. People in Okinawa eat healthy foods like goya, turmeric, sweet potatoes, etc. They help with minimizing blood sugar and weight management. More individuals in Kyushu-Okinawa are learning about Okinawa's healthy lifestyle, further propelling the demand for superfoods.

Tohoku Region Superfoods Market Trends:

In the Tohoku region, superfoods like seaweed and mushrooms are becoming popular for their health benefits. Aomori Prefecture is famous for its blueberries, which are full of antioxidants and anthocyanins. Local farmers and health food companies sell these berries in jams, juices, and dried forms. Tohoku also has many wild mushrooms, like maitake and shiitake. They are being sold for their ability to boost the immune system.

Chugoku Region Superfoods Market Trends:

In the Chugoku region, superfoods like brown rice, umeboshi (pickled plums), and citrus fruits are becoming more popular. Hiroshima is known for its umeboshi, which helps with digestion. Now, it is also being promoted for its possible anti-inflammatory benefits. Citrus fruits like yuzu and mikan are used in health drinks and beauty products. This change shows how the superfoods industry in the region is focusing on using local and natural ingredients for better health and wellness.

Hokkaido Region Superfoods Market Trends:

Superfoods like barley, pumpkin, and sea buckthorn are becoming increasingly popular in Hokkaido. The region's cold climate is ideal for cultivating barley, which is utilized in health beverages and supplements. Hokkaido also employs sea buckthorn, which contains vitamin C, in beverages and beauty items. Consumers in the region prioritize sustainable and high-quality ingredients, which is driving the market expansion.

Shikoku Region Superfoods Market Trends:

Shikoku's superfoods industry is expanding as more individuals seek locally obtained and natural products that are beneficial to their health. Yuzu, a citrus fruit high in vitamin C and antioxidants, is becoming increasingly popular in health drinks, cosmetics, and gourmet cuisine. Takamatsu and Tokushima are also leading the way in marketing native crops such as green tea, further boosting the region's superfoods market.

Top Companies Leading in the Japan Superfoods Industry

Some of the superfood businesses across Japan have been mentioned in the report. In March 2023, konnyaku, a low-calorie yam food, was launched in Japan as a trendy and diet-friendly superfood. Apart from this, in August 2023, Daily Need Exim Pvt Ltd announced that the company started importing a traditional Japanese superfood called natto and selling it via its online shop.

Japan Superfoods Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into fruits, vegetables, grains and seeds, herbs and roots, meat, and others. Fruits like yuzu and blueberries are popular for their antioxidants, while vegetables like goya and seaweed offer health benefits. Moreover, grains such as barley and rice are used in supplements and drinks. Besides this, herbs and roots, including turmeric and konnyaku, are valued for their medicinal properties.

- Based on the application, the market has been bifurcated into bakery and confectionery, beverages, supplements, convenience or ready-to-eat foods, and others. In bakery and confectionery, ingredients like matcha and yuzu are used for flavor and health benefits. Moreover, beverages feature superfoods like turmeric and barley in teas and health drinks. Besides this, supplements focus on ingredients like sea buckthorn and green tea. Furthermore, convenience foods, including ready-to-eat meals, are incorporating nutrient-rich superfoods for added health value.

- On the basis of the distribution channel, the market has been bifurcated into supermarkets and hypermarkets, convenience stores, specialty stores, independent small grocery stores, online sales, and others. Supermarkets and hypermarkets offer a wide range of superfoods for everyday shoppers. Moreover, convenience stores provide quick access to ready-to-eat options. Specialty stores focus on premium and health-oriented products. Besides this, independent small grocery stores cater to local preferences. Furthermore, online sales are growing rapidly, offering convenience and a broad selection of superfood products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.9 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Market Growth Rate 2025-2033 | 7.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Meat, Others |

| Applications Covered | Bakery and Confectionery, Beverages, Supplements, Convenience/Ready-to-Eat Foods, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Independent Small Grocery Stores, Online Sales, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Superfoods Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)