Japan Testing and Commissioning Market Size, Share, Trends and Forecast by Service Type, Commissioning Type, Sourcing Type, End Use Sector, and Region, 2026-2034

Japan Testing and Commissioning Market Summary:

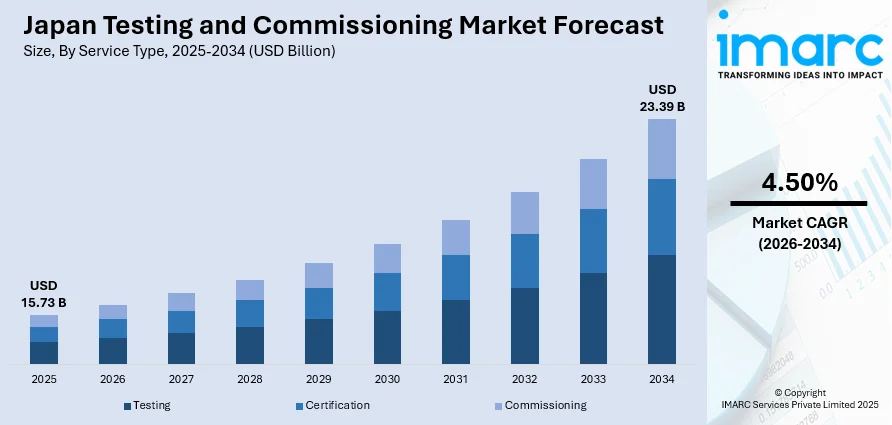

The Japan testing and commissioning market size was valued at USD 15.73 Billion in 2025 and is projected to reach USD 23.39 Billion by 2034, growing at a compound annual growth rate of 4.50% from 2026-2034.

The Japan testing and commissioning market is experiencing sustained expansion, driven by rigorous quality standards across manufacturing, construction, and infrastructure sectors. The nation's emphasis on technological precision, seismic resilience requirements, and adherence to international compliance standards continues to fuel demand for comprehensive testing and commissioning services. Opportunities for market expansion are further supported by growing investments in renewable energy and smart infrastructure initiatives.

Key Takeaways and Insights:

-

By Service Type: Testing dominates the market with a share of 48% in 2025, driven by stringent regulatory requirements and quality assurance mandates across industrial and construction sectors.

-

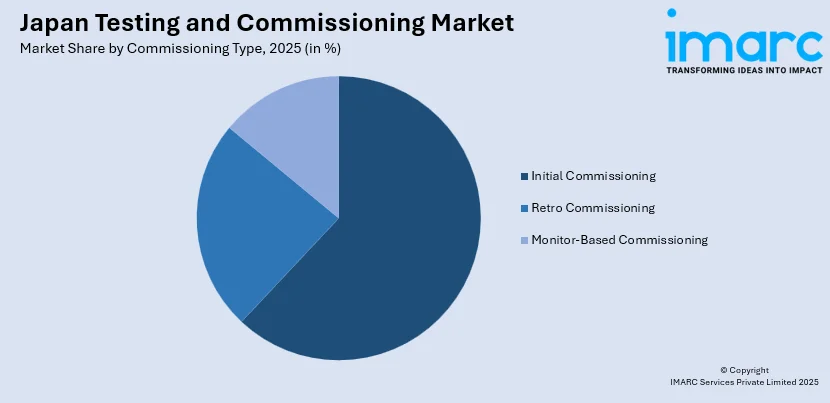

By Commissioning Type: Initial commissioning leads the market with a share of 62% in 2025, attributed to substantial new infrastructure projects and facility installations requiring thorough system verification.

-

By Sourcing Type: Outsourced represents the largest segment with a market share of 60% in 2025, reflecting industry preference for specialized expertise and cost-effective service delivery models.

-

By End Use Sector: Construction exhibits a clear dominance with a 25% share in 2025, propelled by ongoing urban development initiatives and infrastructure modernization programs.

-

By Region: Kanto Region leads the market with a share of 36% in 2025, supported by Tokyo's concentration of industrial facilities, commercial complexes, and mega infrastructure projects.

-

Key Players: The testing and commissioning market in Japan is moderately competitive, with both specialized domestic service providers and well-known international TIC providers present. Market participants are increasingly leveraging advanced technologies, including AI-powered inspection systems and IoT-enabled monitoring solutions, to enhance service delivery and maintain competitive positioning.

To get more information on this market Request Sample

Japan's testing and commissioning landscape benefits from the nation's well-established reputation for manufacturing excellence and stringent quality control protocols. The market serves diverse End Use sectors, with construction, industrial manufacturing, and energy applications representing primary demand drivers. Regulatory frameworks administered by METI and the Ministry of Land, Infrastructure, Transport and Tourism mandate comprehensive testing protocols for construction projects, electrical installations, and industrial equipment. Japan has supported initiatives to guarantee IoT product security. For instance, the Ministry of Internal Affairs and Communications (MIC), the Ministry of Economy, Trade, and Industry (METI), and its incorporated administrative body Information-technology Promotion body (IPA) have released a number of instructions to assist companies that produce IoT products with their security measures.

Japan Testing and Commissioning Market Trends:

Digital Transformation in Testing Services

The integration of digital technologies is revolutionizing testing and commissioning methodologies across Japan. Service providers are deploying cloud-based platforms, augmented reality headsets, and AI-powered analytical tools to enhance inspection accuracy and operational efficiency. Leading providers now utilize smart glasses compatible with 5G Standalone networks, enabling remote supervision of testing procedures across geographically dispersed facilities. This technological evolution facilitates real-time data streaming and predictive maintenance capabilities, transforming traditional paper-based reporting into integrated digital workflows.

Expansion of Renewable Energy Testing Requirements

Japan's accelerating transition toward renewable energy sources is generating substantial demand for specialized testing and commissioning services. Solar installations, wind farms, and battery storage systems require rigorous performance validation, safety certification, and grid integration testing. The government's commitment to achieving carbon neutrality by 2050 is driving investments in green energy infrastructure, necessitating comprehensive commissioning protocols for these technologically complex systems. Testing service providers are expanding their capabilities to address the unique requirements of renewable energy installations.

Enhanced Focus on Seismic Resilience Verification

Given Japan's geographic susceptibility to seismic activity, testing and commissioning services increasingly emphasize earthquake resilience verification for buildings, infrastructure, and industrial equipment. Advanced structural health monitoring systems are being deployed to assess building conditions, while new construction projects undergo comprehensive seismic performance testing. The National Resilience Plan channels multi-year investments into infrastructure upgrades, creating sustained demand for testing services that verify compliance with stringent earthquake resistance standards.

Market Outlook 2026-2034:

The Japan testing and commissioning market demonstrates robust growth prospects, supported by sustained infrastructure investments, evolving regulatory requirements, and technological advancements across industrial sectors. Government initiatives such as the 2025 World Exposition in Osaka, the National Resilience Plan focusing on disaster-resistant infrastructure, and ongoing urban development projects in major metropolitan areas continue to generate substantial testing and commissioning service requirements. The increasing complexity of construction projects, coupled with stringent quality standards and digital transformation initiatives, further reinforces positive market trajectory throughout the forecast period. The market generated a revenue of USD 15.73 Billion in 2025 and is projected to reach a revenue of USD 23.39 Billion by 2034, growing at a compound annual growth rate of 4.50% from 2026-2034.

Japan Testing and Commissioning Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service Type | Testing | 48% |

| Commissioning Type | Initial Commissioning | 62% |

| Sourcing Type | Outsourced | 60% |

| End Use Sector | Construction | 25% |

| Region | Kanto Region | 36% |

Service Type Insights:

- Testing

- Certification

- Commissioning

The testing dominates with a market share of 48% of the total Japan testing and commissioning market in 2025.

The testing segment maintains market leadership due to mandatory regulatory requirements across construction, manufacturing, and infrastructure sectors. Japanese industries prioritize rigorous quality verification to maintain their global reputation for product excellence, driving consistent demand for comprehensive testing services. Advanced non-destructive testing methodologies, material verification protocols, and performance assessment procedures constitute core service offerings within this segment. According to the Japanese Ministry of Land, Infrastructure, Transport and Tourism, new regulations for construction projects mandate third-party inspections and certifications to ensure safety and quality standards.

Testing service providers continue investing in advanced equipment and methodologies to address evolving client requirements and increasingly complex regulatory frameworks. The integration of AI-powered inspection systems and IoT-enabled monitoring devices enhances testing accuracy while significantly reducing turnaround times and operational costs. Industries including automotive, electronics, semiconductors, and consumer products rely heavily on comprehensive testing services to validate product quality, ensure safety compliance, and meet stringent regulatory standards before domestic and international market release.

Commissioning Type Insights:

Access the comprehensive market breakdown Request Sample

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

The initial commissioning leads with a share of 62% of the total Japan testing and commissioning market in 2025.

Initial commissioning dominates the market due to substantial new construction activity, industrial facility installations, and extensive infrastructure development projects across Japan. This segment encompasses comprehensive verification procedures for newly installed mechanical, electrical, and control systems, ensuring operational readiness and full compliance with design specifications and performance requirements. The upcoming World Exposition in Osaka and ongoing urban development initiatives in major metropolitan areas generate sustained demand for professional initial commissioning services throughout the forecast period.

The segment benefits from Japan's continuous infrastructure renewal programs and substantial private sector investments in commercial, industrial, and residential facilities. Initial commissioning procedures systematically verify that mechanical, electrical, plumbing, and control systems operate according to design intent, establishing critical performance baselines for ongoing facility management and maintenance optimization. Service providers increasingly utilize digital commissioning tools, automated documentation systems, and building information modeling integration to enhance process efficiency and reduce timelines.

Sourcing Type Insights:

- Inhouse

- Outsourced

The outsourced exhibits a clear dominance with a 60% share of the total Japan testing and commissioning market in 2025.

Outsourced testing and commissioning services maintain market dominance as organizations increasingly recognize the substantial benefits of engaging specialized third-party providers. This strategic approach enables companies to access advanced testing capabilities, specialized technical expertise, and comprehensive service portfolios without maintaining extensive in-house infrastructure and dedicated personnel. Small and medium-sized enterprises particularly favor outsourcing arrangements that provide cost-effective access to high-quality testing services, allowing them to allocate resources toward core business operations while ensuring regulatory compliance and quality assurance requirements are professionally addressed.

Global TIC providers have significantly strengthened their presence in Japan through strategic laboratory acquisitions and substantial capability investments aligned with domestic standards and regulatory requirements. Organizations have transitioned from representative offices to majority-owned laboratories, investing in sophisticated equipment compatible with Japanese Industrial Standards requirements. This strategic expansion enables outsourcing clients to benefit from international best practices, cutting-edge testing methodologies, and global expertise while ensuring full compliance with Japan's complex local regulatory frameworks and certification protocols.

End Use Sector Insights:

- Construction

- Industrial

- Consumer Products

- Life Sciences

- Oil and Gas

- Food and Agriculture

- Marine and Offshore

- Transport and Aerospace

- Energy and Power

- Chemicals

- Others

The construction dominates with a market share of 25% of the total Japan testing and commissioning market in 2025.

Construction sector leadership reflects Japan's extensive building activity and infrastructure development programs. Stringent building codes, seismic resistance requirements, and energy efficiency standards necessitate comprehensive testing and commissioning procedures for all construction projects. The National Resilience Plan directs multi-year investments into flood-control infrastructure, bridge renewals, and earthquake-resistant water pipelines. The Japan construction industry is expected to reach USD 941.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.15% during 2026-2034, generating sustained demand for construction-related testing services.

Construction testing encompasses structural integrity verification, material quality assessment, electrical system testing, fire safety compliance, and mechanical equipment commissioning across diverse project types. High-rise building projects, transportation infrastructure developments, seismic retrofit initiatives, and commercial facility construction generate substantial testing service requirements throughout project lifecycles. The widespread adoption of Building Information Modeling, prefabricated construction methods, and advanced digital construction technologies further enhances the complexity and scope of testing and commissioning procedures, necessitating specialized expertise and sophisticated verification protocols to ensure regulatory compliance and operational performance standards.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 36% of the total Japan testing and commissioning market in 2025.

Kanto Region maintains market leadership due to Tokyo's concentration of industrial facilities, commercial complexes, and infrastructure projects. The region functions as Japan's primary economic engine, hosting headquarters of major corporations and serving as the nation's launch-pad for new businesses and industries. Mega projects including rail extensions, high-rise condominiums, and data center corridors generate substantial testing and commissioning service demand. Kanto maintained a commanding share of Japan's construction market, directly correlating with testing and commissioning service requirements.

The Kanto region's early adoption of Building Information Modeling, net-zero building codes, and advanced construction technologies positions it as a national trendsetter for testing and commissioning practices. Government investments in seismic retrofits of expressways and municipal infrastructure further extend testing service requirements within this economically dominant region. The Kanto Region, encompassing Tokyo and surrounding prefectures, represents Japan's largest testing and commissioning market. The concentration of manufacturing headquarters, financial institutions, and technology companies generates sustained demand for comprehensive quality assurance services across multiple industry verticals.

Market Dynamics:

Growth Drivers:

Why is the Japan Testing and Commissioning Market Growing?

Stringent Regulatory Compliance Requirements

Japan's comprehensive regulatory framework mandates rigorous testing and commissioning procedures across multiple industry sectors. Government agencies including METI and the Ministry of Land, Infrastructure, Transport and Tourism enforce stringent quality and safety standards that necessitate third-party verification services. The Industrial Standardization Act expanded JIS conformance labeling requirements, while the revised Chemical Substances Control Law tightened pre-marketing tests for additional formulations. Product Safety mark programs have transitioned from sampling to comprehensive lot testing for specific product categories, particularly lithium battery packs. These evolving regulatory requirements create sustained demand for professional testing and commissioning services capable of ensuring compliance with both domestic and international standards.

Infrastructure Development and Urban Renewal Initiatives

Japan's substantial investments in infrastructure development and urban renewal projects generate consistent demand for testing and commissioning services. The National Resilience Plan channels multi-year expenditures into flood-control tunnels, bridge renewals, and earthquake-resistant infrastructure upgrades. Major development projects including the Torch Tower in Tokyo, scheduled for completion in 2028, and the Grand Green Osaka civic development exemplify the scale of construction activity requiring comprehensive testing services. Transportation infrastructure improvements, smart city initiatives, and disaster resilience upgrades further expand the scope of testing and commissioning requirements across all prefectures.

Technological Advancement and Quality Excellence Standards

Japan's global reputation for manufacturing excellence and technological innovation drives demand for sophisticated testing and commissioning services. Industries including automotive, electronics, semiconductor manufacturing, and precision machinery require advanced testing protocols to maintain quality leadership positions. The integration of emerging technologies such as artificial intelligence, Internet of Things devices, and autonomous systems necessitates specialized testing capabilities for data security, operational reliability, and safety certification. The automotive sector particularly demonstrates this trend, with electric vehicle production requiring high-voltage safety tests, thermal runaway simulations, and cybersecurity penetration testing. Companies invest in testing infrastructure to validate product performance and ensure competitiveness in global markets with stringent quality expectations.

Market Restraints:

What Challenges is the Japan Testing and Commissioning Market Facing?

Skilled Labor Shortage and Workforce Aging

Japan's aging workforce presents significant challenges for the testing and commissioning sector, with experienced professionals approaching retirement across technical disciplines. The construction and industrial sectors specifically face labor shortages that impact testing service availability and project timelines, necessitating substantial investments in automation technologies, remote inspection capabilities, and workforce training programs to address growing service demands.

High Service Costs for Small and Medium Enterprises

The substantial costs associated with comprehensive testing and certification services present barriers for small and medium-sized enterprises seeking compliance verification. Advanced requirements of testing equipment, specialized technical expertise, laboratory accreditation fees, and complex regulatory frameworks contribute to service pricing that may exceed budget constraints for smaller organizations with limited financial resources.

Complex Regulatory Environment Navigation

Japan's intricate regulatory landscape, encompassing domestic standards, alongside the international compliance requirements, creates complexity for organizations seeking testing and certification services. The need to understand and comply with multiple overlapping regulatory frameworks administered by various government agencies increases administrative burden, extends project timelines, and elevates compliance costs for market participants.

Competitive Landscape:

The Japan testing and commissioning market exhibits a moderately competitive structure characterized by the presence of established global TIC providers alongside specialized domestic service organizations. Market leaders maintain significant market positions through comprehensive service portfolios, advanced technological capabilities, and extensive laboratory networks. These global providers have transitioned from representative offices to majority-owned laboratories, investing in equipment aligned with Japanese Industrial Standards requirements. Japanese firms leverage deep understanding of local regulatory requirements and strong industry relationships to maintain competitive positioning. The market demonstrates ongoing consolidation activity as major players pursue acquisition strategies to expand capabilities and geographic coverage.

Japan Testing and Commissioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Testing, Certification, Commissioning |

| Commissioning Types Covered | Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning |

| Sourcing Types Covered | Inhouse, Outsourced |

| End Use Sectors Covered | Construction, Industrial, Consumer Products, Life Sciences, Oil and Gas, Food and Agriculture, Marine and Offshore, Transport and Aerospace, Energy and Power, Chemicals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan testing and commissioning market size was valued at USD 15.73 Billion in 2025.

The Japan testing and commissioning market is expected to grow at a compound annual growth rate of 4.50% from 2026-2034 to reach USD 23.39 Billion by 2034.

Key factors driving the Japan testing and commissioning market include stringent regulatory compliance requirements, substantial infrastructure development investments, technological advancement across manufacturing sectors, and increasing adoption of digital testing technologies.

Key factors driving the Japan testing and commissioning market include stringent regulatory compliance requirements, substantial infrastructure development investments, technological advancement across manufacturing sectors, and increasing adoption of digital testing technologies.

Major challenges include skilled labor shortages due to workforce aging, high service costs for small and medium enterprises, complex regulatory environment navigation, diverse international standards compliance requirements, and technological adaptation demands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)