Japan Textile Market Expected to Reach USD 82.3 Billion by 2033 - IMARC Group

Japan Textile Market Statistics, Outlook and Regional Analysis 2025-2033

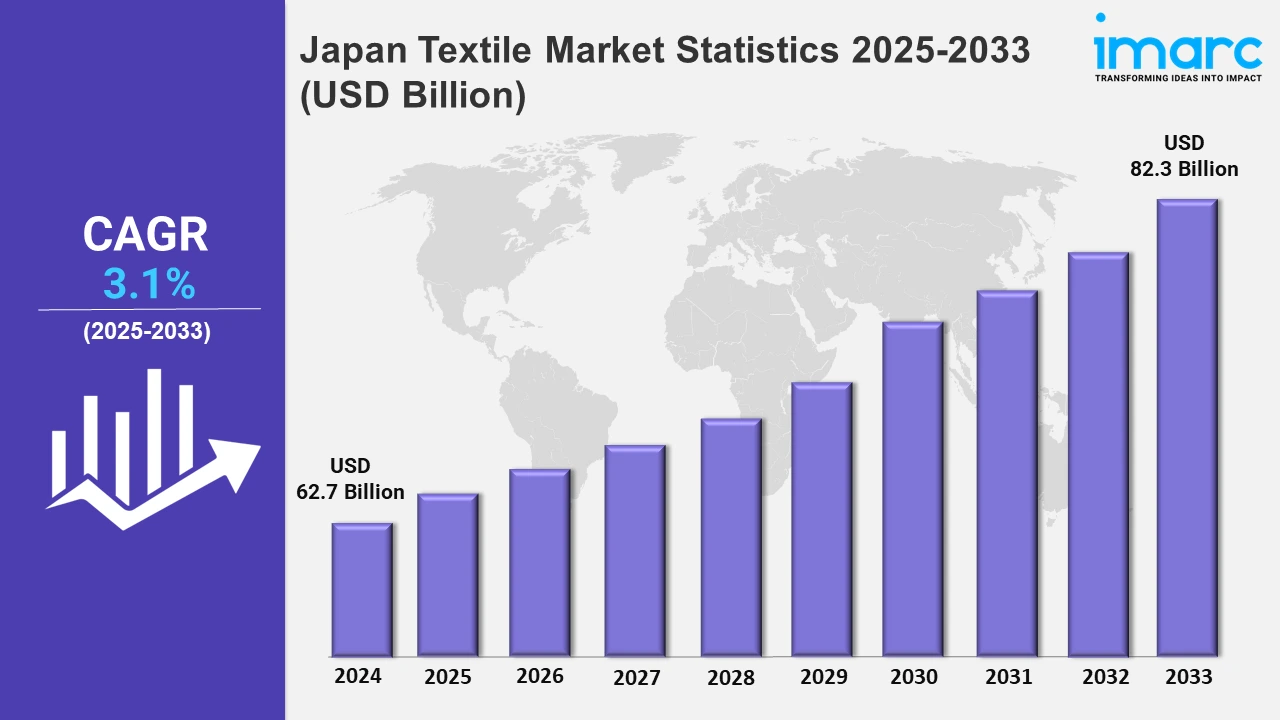

The Japan textile market size was valued at USD 62.7 Billion in 2024, and it is expected to reach USD 82.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.1% from 2025 to 2033.

To get more information on this market, Request Sample

Innovative bio-based fibers are gaining significance in the Japan textile market. These sustainable fibers are being blended into premium yarns, which will help to produce luxury knits and woven clothes while also addressing industry environmental issues. For example, in September 2024, Spiber Inc., a prominent bio-venture in Japan, continued its successful partnership with Consinee Group, one of the leaders in the manufacturing of premium yarns.

Moreover, sustainable fashion designs inspired by Japan's natural landscapes are reshaping the textile industry. Collaborations with creative designers prioritize eco-friendly fabric manufacturing, combining beauty and environmental conscience, as evident in patterns that represent the purity of iconic rivers such as Niyodo. For instance, in March 2024, Kyocera introduced the TRUE-BLUE TEXTILE Project, which proposed a new fashion concept by collaborating with innovative sustainable designers and designing fabrics based on the Niyodo River in Japan. Furthermore, Japanese textile producers are increasingly concentrating on producing high-performance textiles for technical applications, particularly in the automotive industry. They are also utilizing modern technology to produce lightweight, long-lasting, and environmentally friendly materials that fulfill demanding safety and efficiency criteria. Additionally, technological fabrics are gaining popularity over conventional materials due to their resilience to wear, tear, and high temperatures. For example, Toray Industries is at the forefront of automotive textile research and manufacturing advanced carbon fiber-reinforced polymers for vehicle components. These materials dramatically minimize vehicle weight, thereby helping to enhance fuel efficiency and meet criteria, including corporate average fuel economy (CAFE). Toray's collaborations with major manufacturers, including Toyota and Honda, highlight the growing need for high-performance textiles in this sector.

Japan Textile Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing cross-cultural exchanges in fashion are augmenting the market.

Kanto Region Textile Market Trends:

Sustainable textile production is becoming increasingly popular in the Kanto region, which includes Tokyo. To fulfill the increased demand for sustainable materials, companies like Tokyo-based Toray Industries are developing eco-friendly fibers such as Ecovon. Kanto's fashion firms are increasingly using these materials to appeal to environmentally concerned consumers, establishing the region as a hub for green textile solutions and propelling the industry forward.

Kinki Region Textile Market Trends:

The Kinki region, which includes Osaka and Kyoto, focuses on maintaining traditional textiles like Nishijin-ori silk. Companies like HOSOO, located in Kyoto, modernize this traditional technique by producing high-end textiles for luxury apparel and interior design. Kinki's combination of history and innovation keeps it at the top of Japan's luxury textile sector, appealing to both home and international markets.

Central/Chubu Region Textile Market Trends:

In the Central/Chubu region, including Nagoya, modern textile engineering drives the growth of the industry. Shima Seiki, located in Wakayama, develops cutting-edge knitting machines that are utilized all over the world. This technology improves technical textile production and helps the region maintain its position as a pioneer in creative and functional textile manufacture.

Kyushu-Okinawa Region Textile Market Trends:

The Kyushu-Okinawa area excels at textile dyeing by utilizing natural resources. Shimoda Shoji, headquartered in Fukuoka, specializes in indigo dyeing for cotton and denim goods. This method encourages sustainable and environmentally friendly fabrics and emphasizes Kyushu's role in conserving traditional dyeing techniques while meeting modern consumer needs.

Tohoku Region Textile Market Trends:

Wool manufacturing is critical to the textile industry in Tohoku. Iwate Textile Cooperative Association in Morioka is well-known for making enhanced wool textiles. These items, based on the region's cold environment and plentiful sheep husbandry, contribute to Tohoku's reputation for long-lasting and high-quality wool textiles.

Chugoku Region Textile Market Trends:

The Chugoku region, which includes Hiroshima, is well-known for denim manufacture. Japan Blue Group in Okayama produces some of the world's best selvage denim. Chugoku's denim sector, which combines traditional craftsmanship with cutting-edge processes, stimulates demand for premium Japanese jeans, therefore consolidating its position in the textile market.

Hokkaido Region Textile Market Trends:

Textiles created from natural fibers like wool and flax are in high demand in Hokkaido. Nitto Textile Co., situated in Sapporo, uses the region's resources to create eco-friendly materials for outdoor wear. These resilient fabrics are designed to withstand Hokkaido's severe environment and contribute to the island's rising role in sustainable fabric production.

Shikoku Region Textile Market Trends:

The Shikoku region, notably Ehime Prefecture, is known for its utilitarian textiles. Murakami Woolen Mills manufactures technological textiles such as moisture-wicking and antibacterial compounds. These fabrics are widely employed in the sportswear and medical industries, demonstrating Shikoku's creative contributions to Japan's modern textile industry.

Top Companies Leading in the Japan Textile Industry

Some of the leading Japan textile market companies have been included in the report. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report.

Japan Textile Market Segmentation Coverage

- Based on the raw material, the market has been classified into cotton, chemical, wool, silk, and others. Cotton is commonly used for breathable materials. Functional textiles are characterized by chemical fibers such as polyester. Wool is vital for winter apparel, especially in colder climates. Silk is essential in luxury clothes such as kimonos.

- Based on the product, the market has been categorized into natural fibers, polyesters, nylon, and others. Natural fibers are commonly used for traditional and environmentally friendly applications. Polyesters provide durability and adaptability in practical wear. Nylon shines in technical textiles and outdoor gear, meeting a wide range of consumer and industrial demands in the fashion and utility sectors.

- Based on the application, the market has been divided into household, technical, fashion and clothing, and others. Household textiles are preferred for comfort and durability. Technical textiles are used for industrial and functional purposes. Fashion and clothing textiles combine tradition and modernity, catering to both casual wear and high-end and luxury outfits.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 62.7 Billion |

| Market Forecast in 2033 | USD 82.3 Billion |

| Market Growth Rate 2025-2033 | 3.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Textile Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)