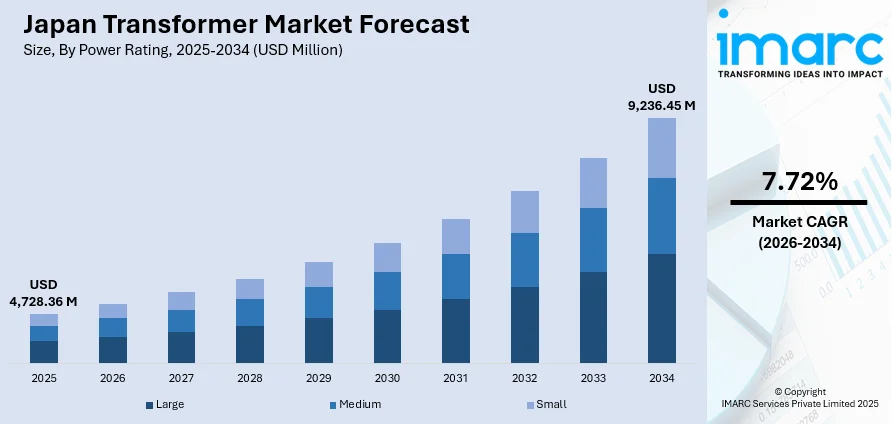

Japan Transformer Market Size, Share, Trends and Forecast by Power Rating, Cooling Type, Transformer Type, and Region, 2026-2034

Japan Transformer Market Summary:

The Japan transformer market size was valued at USD 4,728.36 Million in 2025 and is projected to reach USD 9,236.45 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034.

The market is driven by stringent energy efficiency regulations compelling manufacturers to develop high-performance transformers, alongside robust industrial demand for sustainable and cost-effective power solutions. The expansion of electric vehicle charging infrastructure and disaster-resilient power systems is accelerating demand for advanced transformer technologies. Additionally, government initiatives supporting smart grid development and renewable energy integration are catalyzing infrastructure modernization efforts. The growing emphasis on reducing operational expenses and carbon emissions continues to strengthen the Japan transformer market share.

Key Takeaways and Insights:

- By Power Rating: Medium dominates the market with a share of 50% in 2025, driven by widespread deployment across commercial buildings, industrial facilities, and urban distribution networks requiring balanced capacity and efficiency for diverse power management applications.

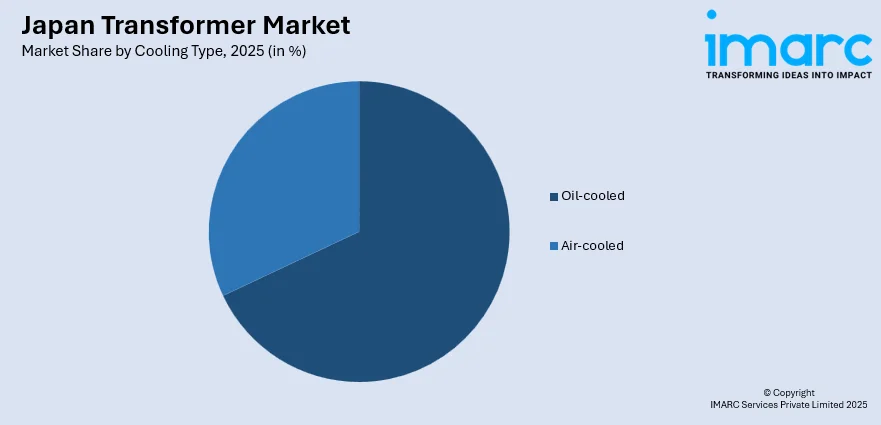

- By Cooling Type: Oil-cooled leads the market with a share of 68% in 2025, owing to superior thermal management capabilities, cost-effectiveness for high-capacity applications, and established maintenance infrastructure supporting utility-scale transmission and industrial power distribution requirements.

- By Transformer Type: Distribution transformer represents the largest segment with a market share of 63% in 2025, driven by expanding urban infrastructure, renewable energy integration requirements, electric vehicle charging network deployment, and ongoing grid modernization replacing aging equipment across residential and commercial sectors.

- Key Players: The market features strong competition between large domestic cement manufacturers and global chemical admixture companies, with firms increasingly focusing on high-performance, low-carbon, and prefab-compatible formulations to meet evolving construction, regulatory, and seismic-resilience demands.

To get more information on this market Request Sample

The Japan transformer market demonstrates sustained momentum as the nation prioritizes power infrastructure modernization and renewable energy adoption. Manufacturers are focusing on developing transformers with enhanced efficiency ratings to comply with governmental programs mandating energy conservation. In September 2025, GBP K.K. launched distribution transformers meeting Japan’s 2026 Top Runner energy-efficiency standards, featuring short lead times, full customization, and cost-effective solutions for improved power stability and decarbonization. The integration of digital monitoring systems and IoT-enabled technologies is transforming conventional transformer operations, enabling predictive maintenance and real-time performance optimization. Industrial expansion across manufacturing sectors continues generating substantial demand for reliable power distribution equipment. Furthermore, the nation's commitment to disaster preparedness is driving investments in resilient power systems capable of withstanding earthquakes and typhoons, with utilities increasingly adopting safer transformer variants designed for harsh environmental conditions.

Japan Transformer Market Trends:

Integration of Smart Grid Technologies and Digital Monitoring Systems

The Japanese transformer market witnesses accelerating adoption of smart grid technologies featuring advanced digital monitoring and automation capabilities. Utility companies are increasingly deploying transformers equipped with IoT sensors enabling real-time performance tracking, predictive maintenance, and enhanced fault detection. For example, in April 2024, Mitsubishi Electric agreed to transfer its distribution transformer business to Hitachi Industrial Equipment Systems a move the companies say will help accelerate the deployment of more energy-efficient, eco-friendly transformers and strengthen “grid edge” solutions in Japan’s distribution infrastructure. This reflects a growing industry-wide shift toward intelligent grid infrastructure. These intelligent systems optimize energy distribution, reduce operational downtime, and improve overall grid reliability. The integration of artificial-intelligence-driven analytics allows utilities to anticipate equipment failures before they occur, minimizing service disruptions and extending transformer operational lifespan while supporting efficient renewable energy integration.

Advancement of Environmentally Sustainable Transformer Materials

Japanese manufacturers pioneer the development of eco-friendly transformer solutions utilizing biodegradable insulating fluids and low-emission insulating gases replacing traditional materials. Natural ester–based insulation oils demonstrate superior environmental compatibility while maintaining excellent thermal properties and fire-safety characteristics. For instance, Fuji Electric launched a transformer using natural-ester oil (derived from soybean oil) called FR3®Fluid, emphasizing biodegradability and lower environmental impact compared with conventional mineral-oil transformers. These innovations align with national sustainability commitments and increasingly stringent environmental regulations. The transition toward greener transformer technologies reflects broader industry efforts to minimize ecological footprint throughout equipment lifecycle while meeting performance requirements for modern power distribution applications.

Development of Disaster-Resilient Power Infrastructure

Japan’s susceptibility to natural disasters including earthquakes and typhoons drives significant investment in disaster-resilient transformer technologies. Utilities and equipment makers prioritize deployment of dry-type and gas-insulated transformers offering enhanced safety and durability under harsh conditions. For instance, in August 2024, the Kandenko engineering firm provides seismic-resistance retrofit solutions that have undergone 3-D shaking tests simulating real earthquakes, demonstrating their ability to limit transformer displacement under strong seismic loads and effectively protect against terminal damage and short-circuits. Mobile transformer units enable rapid emergency response and power restoration following catastrophic events. The development of seismically reinforced installations and flood-resistant designs ensures continued power supply during extreme weather events, addressing critical infrastructure resilience requirements while supporting community safety and economic continuity throughout disaster-prone regions.

Market Outlook 2026-2034:

The Japan transformer market is set for strong revenue growth as nationwide grid modernization and expanding renewable energy integration accelerate transformer demand. Government-backed upgrades to transmission corridors linking wind, solar, and geothermal sites with major urban loads reinforce this trajectory. Rising electrification in transport and industry, supported by rapid data center expansion, further widens application needs. Replacement of aging assets, smart-grid adoption, and early deployment of solid-state technologies strengthen long-term prospects, with carbon-neutrality commitments ensuring sustained investment across generation, transmission, and distribution segments. The market generated a revenue of USD 4,728.36 Million in 2025 and is projected to reach a revenue of USD 9,236.45 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034.

Japan Transformer Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Power Rating | Medium | 50% |

| Cooling Type | Oil-Cooled | 68% |

| Transformer Type | Distribution Transformer | 63% |

Power Rating Insights:

- Large

- Medium

- Small

The medium dominates with a market share of 50% of the total Japan transformer market in 2025.

Medium power rating transformers dominate Japan’s market because they offer an optimal balance of capacity, efficiency, and adaptability across commercial, industrial, and utility environments. Their ability to manage moderate load demands makes them well suited for dense urban distribution networks, manufacturing complexes, and large commercial facilities. Standardized engineering designs also support cost-efficient production, streamlined installation, and predictable maintenance cycles, strengthening their long-term appeal to utilities and private operators seeking reliable mid-capacity solutions.

The expanding deployment of medium-rated transformers aligns with Japan’s shifting distribution needs as urban infrastructure evolves and industrial operations adopt more advanced electrical systems. In October 2025, Toshiba announced a 55‑billion-yen investment to expand production of transmission and distribution equipment, including medium-capacity transformers, addressing Japan’s growing electricity demand and infrastructure modernization. Their role is becoming increasingly important in supporting applications such as electric vehicle charging hubs, distributed renewable energy interconnection, and localized power management nodes. These transformers deliver reliable mid-range capacity backed by mature supply chains, making them essential for modernizing distribution architectures and improving network stability across diverse operational settings.

Cooling Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Air-cooled

- Oil-cooled

The oil-cooled leads with a share of 68% of the total Japan transformer market in 2025.

Oil-cooled transformers retain dominant market positioning in Japan due to their exceptional thermal dissipation capabilities, which are critical for managing heavy electrical loads in transmission and distribution networks. Decades of field-proven reliability, extensive maintenance expertise, and readily available service infrastructure further reinforce their continued preference among utilities. Mineral oil systems also remain cost-efficient, making them a practical choice for large-scale deployments where dependable cooling performance and long operational lifespans are essential.

The segment is advancing through increasing adoption of natural ester insulating fluids that provide strong environmental and safety advantages over conventional mineral oils. In December 2025, Toshiba Energy Systems & Solutions launched a SF₆‑free 420/550 kV gas-insulated busbar using natural-origin gases, significantly reducing greenhouse gas emissions in transmission and distribution equipment. Moreover, these biodegradable fluids deliver enhanced fire resistance, improved moisture tolerance, and reduced ecological impact, aligning with Japan’s emphasis on safety and sustainability. Utilities are progressively specifying ester-based oil-cooled transformers for new installations, especially in urban substations and environmentally sensitive zones requiring superior thermal management and higher safety margins.

Transformer Type Insights:

- Power Transformer

- Distribution Transformer

The distribution transformer exhibits a clear dominance with a 63% share of the total Japan transformer market in 2025.

Distribution transformers dominate Japan’s market as they form the critical interface between high-voltage transmission systems and end-use consumption across residential, commercial, and industrial sectors. Their widespread deployment is reinforced by dense urban development, expanding commercial facilities, and continuous upgrades within Japan’s distribution network. Growing power quality requirements and rising electricity demand further strengthen the need for reliable distribution-level equipment capable of supporting stable voltage delivery and enhanced operational efficiency across diverse load conditions nationwide.

The segment is undergoing notable technological advancement as utilities increasingly adopt smart distribution transformers equipped with real-time monitoring, fault detection, and load-management features. These modern high-efficiency units support Japan’s transition toward a more resilient and flexible grid by reducing energy losses and enhancing system visibility. Accelerated replacement of aging infrastructure, coupled with the expansion of renewable energy connections and electric vehicle charging networks, continues to elevate demand for advanced distribution-class solutions across the country.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region maintains Japan’s highest transformer demand, driven by Tokyo’s dense population, commercial concentration, and extensive urban redevelopment. High electricity consumption and continuous upgrades to distribution and transmission infrastructure ensure sustained deployment of new units to support reliability, efficiency, and modernization across residential, commercial, and industrial networks.

Kansai/Kinki Region records strong transformer requirements due to Osaka and Kobe’s industrial intensity and diversified manufacturing base. Urban expansion, commercial infrastructure upgrades, and grid reliability programs continue to stimulate investments in modern transformer systems essential for stable regional power distribution.

Central/Chubu Region depends on significant transformer capacity to support its automotive and heavy manufacturing hubs. Large production facilities, industrial load stability needs, and ongoing economic activity reinforce continuous demand for dependable transmission and distribution transformers.

Kyushu-Okinawa Region experiences growing transformer needs with expanding solar and geothermal capacity. Clean energy integration, reinforcement of regional grids, and distributed generation projects collectively drive deployment of transformers designed to handle variable renewable power flows efficiently.

Tohoku Region’s transformer demand is supported by infrastructure renewal and redevelopment initiatives. Renewable energy expansion, including large-scale wind and solar projects, continues to strengthen investments in modernized power networks and efficient distribution systems.

Chugoku Region demonstrates steady transformer adoption due to its active industrial base and regional power enhancement efforts. Cross-regional grid improvement projects bolster connectivity and stability, driving consistent demand for high-performance transformer solutions.

Hokkaido Region’s strong wind energy prospects generate rising demand for transformers capable of transmitting renewable electricity to major consumption centers. Increasing clean energy projects and grid capacity upgrades support ongoing investment in high-capacity transmission units.

Shikoku Region shows consistent transformer demand fueled by industrial development and grid interconnection projects. Infrastructure upgrades designed to enhance regional power flow and reliability continue encouraging deployment of advanced distribution and transmission transformers.

Market Dynamics:

Growth Drivers:

Why is the Japan Transformer Market Growing?

Accelerating Renewable Energy Integration and Grid Modernization

Japan's ambitious renewable energy targets drive substantial transformer demand as utilities expand transmission capacity connecting solar and wind generation facilities to consumption centers. The integration of variable renewable sources requires advanced transformer technologies capable of managing fluctuating power inputs while maintaining grid stability. Government investment in wide-area interconnection systems enhances power transfer capacity between regions, necessitating high-voltage transformer infrastructure deployment. The development of offshore wind energy installations along coastal areas creates demand for specialized transformers designed for marine environments and long-distance power transmission applications. In September 2025, Japan’s offshore wind capacity is projected to grow from 59 MW in 2020 to nearly 16.7 GW by 2035, reflecting rapid expansion in support of national decarbonization targets.

Expanding Electric Vehicle Charging Infrastructure Network

The rapid expansion of electric vehicle adoption across Japan generates significant transformer requirements supporting charging infrastructure development. In September 2023, the government announced plans to expand public EV charging infrastructure to 300,000 connectors by 2030, enhancing high-power fast-charging availability across expressways, rest areas, and commercial facilities. High-power fast-charging stations require dedicated distribution transformers capable of managing substantial power demands while minimizing grid impact. Government initiatives targeting electrified vehicle sales acceleration drive infrastructure investment including transformer installations at commercial facilities, expressway service areas, and residential developments. The growing adoption of vehicle-to-grid technology creates additional demand for bidirectional transformer solutions enabling energy exchange between vehicles and power networks supporting grid stabilization.

Aging Infrastructure Replacement and Capacity Enhancement

Japan's power infrastructure includes substantial transformer populations exceeding design life, creating extensive replacement demand as utilities prioritize grid reliability and safety improvements. The modernization of aging equipment with high-efficiency units reduces energy losses while enhancing operational performance and environmental compliance. Data center proliferation supporting digital economy growth drives capacity expansion requirements, particularly in metropolitan areas experiencing concentrated power demand increases. According to sources, in June 2025, Japan’s electricity demand is projected to rise up to 40 percent by 2050 due to increased data center construction and AI deployment, highlighting urgent power infrastructure upgrades. Semiconductor manufacturing facility expansion and industrial modernization efforts further accelerate transformer deployment across commercial and industrial applications requiring reliable power supply.

Market Restraints:

What Challenges the Japan Transformer Market is Facing?

Supply Chain Constraints and Material Availability

The transformer industry faces ongoing challenges related to specialized material availability, particularly grain-oriented electrical steel essential for core manufacturing. Extended procurement lead times and price volatility impact production planning and project timelines. Geographic concentration of critical component manufacturing creates supply vulnerability, while environmental regulations affecting steel production increase costs and complicate sourcing strategies for manufacturers.

High Capital Investment Requirements

Transformer infrastructure projects require substantial capital investment creating barriers for smaller utilities and private sector participants. The high costs associated with advanced technologies including smart transformers and eco-friendly insulation solutions challenge widespread adoption. Extended project development timelines and regulatory approval processes further complicate investment planning and market entry decisions.

Skilled Workforce Shortages

The transformer industry experiences challenges recruiting and retaining technical personnel capable of handling advanced manufacturing and maintenance requirements. The aging workforce combined with declining interest in traditional electrical engineering creates knowledge transfer difficulties. Training requirements for digital monitoring systems and emerging transformer technologies add complexity to workforce development efforts across the industry.

Competitive Landscape:

The Japan transformer market exhibits a consolidated competitive structure characterized by established domestic manufacturers and international energy technology providers competing across product segments and applications. Market participants differentiate through technological innovation, manufacturing quality, and comprehensive service capabilities supporting installation, maintenance, and lifecycle management. Strategic partnerships between manufacturers and utilities facilitate collaborative development of customized solutions addressing specific grid requirements and operational challenges. The market emphasizes energy efficiency, environmental sustainability, and smart technology integration as key competitive factors. Manufacturers invest substantially in research and development advancing transformer performance, digital monitoring capabilities, and eco-friendly materials. Regional manufacturing presence and localized supply chains provide competitive advantages enabling responsive customer support and reduced delivery timelines for replacement and expansion projects nationwide.

Recent Developments:

- In May 2025, Fuji Electric announced plans to reorganize its transmission and distribution equipment production, transferring switchgear manufacturing to Kawasaki Factory and expanding transformer and switchgear capacity at Chiba and Kawasaki factories, aiming to meet growing demand from renewable energy expansion, data centers, semiconductor facilities, and generative AI-driven infrastructure projects.

Japan Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | Large, Medium, Small |

| Cooling Types Covered | Air-cooled, Oil-cooled |

| Transformer Types Covered | Power Transformer, Distribution Transformer |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan transformer market size was valued at USD 4,728.36 Million in 2025.

The Japan transformer market is expected to grow at a compound annual growth rate of 7.72% from 2026-2034 to reach USD 9,236.45 Million by 2034.

Medium power rating transformers held the largest share of the Japan transformer market, driven by their versatility across industrial, commercial, and utility applications. Their balanced capacity, efficiency, and suitability for urban grids and modernizing industrial facilities supported widespread adoption nationwide.

Key factors driving the Japan transformer market include accelerating renewable energy integration, expanding electric vehicle charging infrastructure, aging infrastructure replacement, smart grid technology adoption, and government energy efficiency regulations.

Major challenges include supply chain constraints affecting specialized materials, high capital investment requirements for advanced technologies, skilled workforce shortages, extended project timelines, raw material price volatility, and regulatory compliance complexities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)