Japan Video Surveillance Systems Market Size, Share, Trends and Forecast by System Type, Component, Application, Enterprise Size, Customer Type, and Region, 2026-2034

Japan Video Surveillance Systems Market Overview:

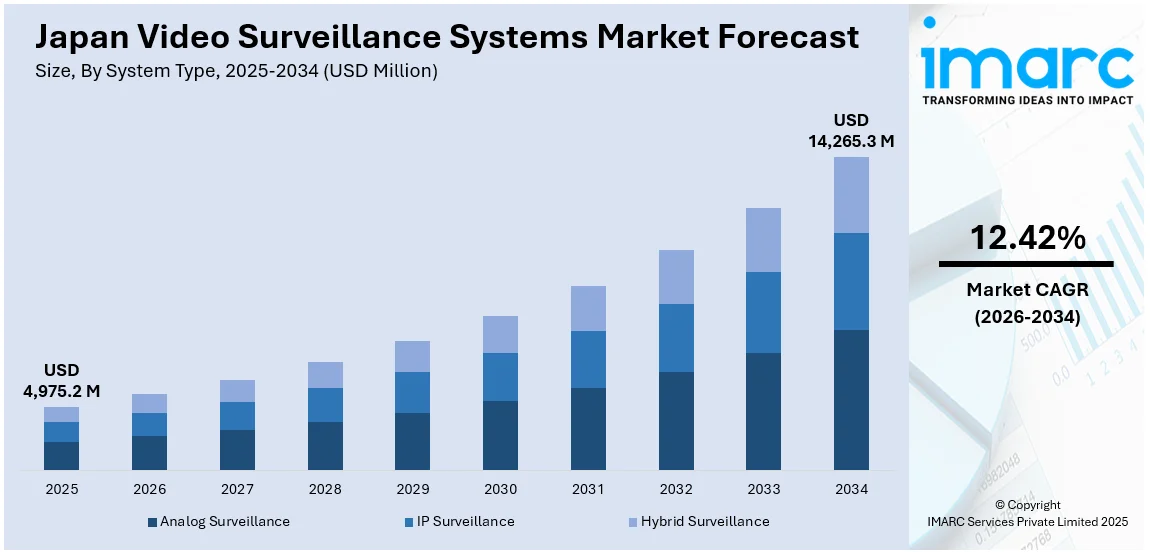

The Japan video surveillance systems market size reached USD 4,975.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,265.3 Million by 2034, exhibiting a growth rate (CAGR) of 12.42% during 2026-2034. The market is driven by rising security concerns, government smart city initiatives, and advancements in AI and cloud technologies. Moreover, the increasing adoption of facial recognition, IoT integration, growing demand for remote monitoring solutions, Strict data privacy laws, and the need for efficient public safety measures are some of the major factors expanding the Japan video surveillance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,975.2 Million |

| Market Forecast in 2034 | USD 14,265.3 Million |

| Market Growth Rate 2026-2034 | 12.42% |

Japan Video Surveillance Systems Market Trends:

Rising Adoption of AI-Powered Surveillance Systems

The market is experiencing significant growth due to the rising adoption of AI-powered solutions. Businesses and government agencies are increasingly integrating AI-driven analytics, such as facial recognition, object detection, and behavioral analysis, to enhance security and operational efficiency. AI-enabled cameras can automatically identify suspicious activities, thereby reducing reliance on manual monitoring and improving response times. On February 8, 2025, Japan announced it would invest USD 1 Trillion in the United States by 2025 in key sectors such as artificial intelligence, defense, and trade. The funding will go towards improving AI technologies, from autonomous flying drones to enhanced surveillance systems to support national security. Moreover, collaboration between Japanese and U.S. defense firms will likely speed the development of AI-enabled surveillance and military technology. Additionally, the demand for smart city initiatives in urban areas such as Tokyo and Osaka are accelerating the deployment of intelligent surveillance systems. These systems help in traffic management, crowd control, and crime prevention, aligning with Japan’s focus on public safety and technological innovation. Furthermore, advancements in deep learning algorithms and cloud-based video analytics are making AI surveillance more accessible to small and medium enterprises. As cybersecurity threats and security concerns grow, the shift toward AI-enhanced surveillance is expected to continue, driving the Japan video surveillance systems market growth.

To get more information on this market Request Sample

Increasing Defense Sector Adoption of Advanced Surveillance for Border and Critical Infrastructure Security

Japan's defense sector is driving the demand for advanced, rugged video surveillance systems bridged with high-border protection performance, protecting military assets and critical infrastructure. Amid escalating regional conflicts and cyber threats, the government has funneled money into AI-powered surveillance tools, including long-range thermal imaging, drone integration, and real-time threat assessment. These systems are being deployed along coastal areas and sensitive facilities to detect unauthorized intrusions and potential threats. In 2024, Japan allocated USD 33 Million under its Official Security Assistance (OSA) program to supply the Philippines, Mongolia, Indonesia, and Djibouti with advanced defense technology, including maritime surveillance radar systems and coastal radars. This initiative aims to bolster security by incorporating Japanese-made video surveillance systems, including Mitsubishi's J/FPS-3 radar. This points to Japan changing its defense posture and deepening regional alliances amid rising geopolitical tensions. In addition, integration of surveillance networks with command-and-control centers allows defense operations to respond more rapidly. The push for defense technological independence has also created partnership efforts between Japanese manufacturers and government agencies to develop secure surveillance solutions made in Japan. As Japan strengthens its national defense strategy under changing geopolitical challenges, the demand for military-grade surveillance systems is expected to grow, creating a positive Japan video surveillance systems market outlook.

Japan Video Surveillance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on system type, component, application, enterprise size, and customer type.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

The report has provided a detailed breakup and analysis of the market based on the system type. This includes analog surveillance, IP surveillance, and hybrid surveillance.

Component Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and services.

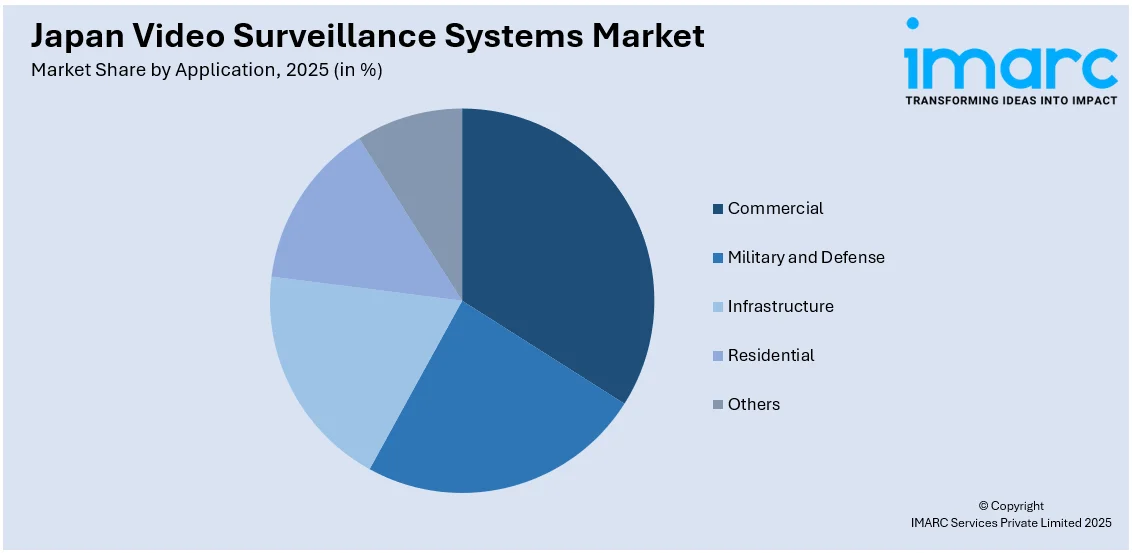

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, military and defense, infrastructure, residential, and others.

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small scale enterprise, medium scale enterprise, and large scale enterprise.

Customer Type Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the customer type. This includes B2B and B2C.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Video Surveillance Systems Market News:

- January 22, 2025: Shield AI secured a deal from Japan's naval forces that will make V-BAT drones the first ship-launched intelligence, surveillance, and reconnaissance (ISR) system of the Japanese Maritime Self-Defense Force. Sold as a pack, these are designed to enhance maritime surveillance and ISR operations, as they come with artificial intelligence ability. Under a multi-year contract, Shield AI plans to deliver the first V-BAT later this year, with production of the drones to take place in the United States, potentially with local partners.

Japan Video Surveillance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Surveillance, IP Surveillance, Hybrid Surveillance |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial, Military and Defense, Infrastructure, Residential, Others |

| Enterprise Sizes Covered | Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise |

| Customer Types Covered | B2B, B2C |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan video surveillance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan video surveillance systems market on the basis of system type?

- What is the breakup of the Japan video surveillance systems market on the basis of component?

- What is the breakup of the Japan video surveillance systems market on the basis of application?

- What is the breakup of the Japan video surveillance systems market on the basis of enterprise size?

- What is the breakup of the Japan video surveillance systems market on the basis of customer type?

- What is the breakup of the Japan video surveillance systems market on the basis of region?

- What are the various stages in the value chain of the Japan video surveillance systems market?

- What are the key driving factors and challenges in the Japan video surveillance systems market?

- What is the structure of the Japan video surveillance systems market and who are the key players?

- What is the degree of competition in the Japan video surveillance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan video surveillance systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan video surveillance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan video surveillance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)