Japan Vision Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Japan Vision Care Market Overview:

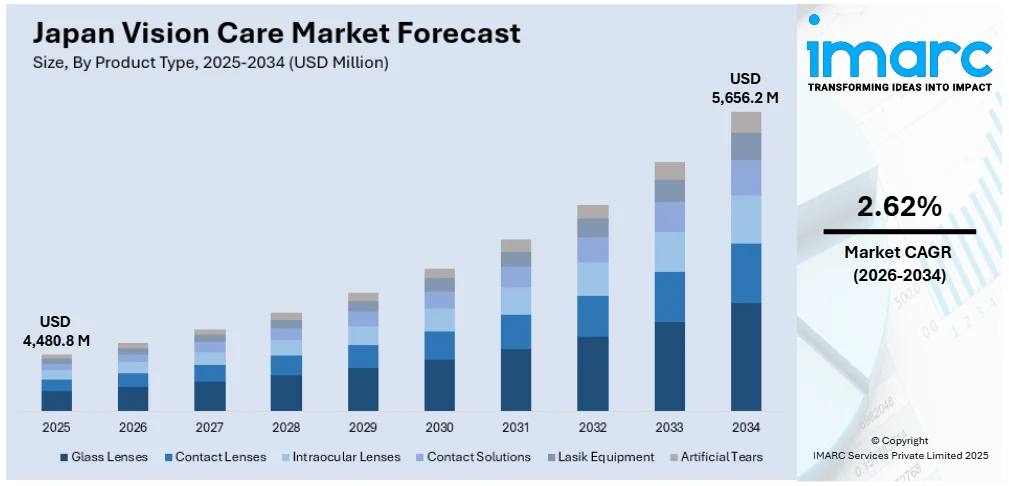

The Japan Vision Care Market size reached USD 4,480.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,656.2 Million by 2034, exhibiting a growth rate (CAGR) of 2.62% during 2026-2034. The market outlook is driven by rising cases of myopia due to increased screen exposure, an aging population with heightened demand for presbyopia correction, and growing consumer awareness of eye health. Advancements in optical technology and the popularity of fashion-forward eyewear further stimulate market expansion and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,480.8 Million |

| Market Forecast in 2034 | USD 5,656.2 Million |

| Market Growth Rate 2026-2034 | 2.62% |

Japan Vision Care Market Trends:

Increased Digital Device Usage and Myopia Growth

The widespread use of digital devices in Japan has significantly contributed to the rise in vision-related issues, particularly among individuals exposed to prolonged screen time. This trend is especially evident among younger demographics, where digital eye strain and early-onset myopia are becoming increasingly common. Notably, based on research, nearly 95% of junior high school students in Tokyo are affected by myopia, underscoring the urgent need for vision correction. In response, demand is growing for solutions such as blue-light blocking glasses and anti-fatigue lenses specifically designed to combat screen-induced discomfort. This heightened awareness around preventive eye care is driving more frequent eye examinations and broader adoption of protective eyewear across all age groups. As a result, technology-focused vision care products are becoming vital components of Japan vision care market growth.

To get more information on this market Request Sample

Lifestyle Shifts and Fashion-Driven Eyewear Preferences

In Japan, eyewear has transitioned from a purely functional item to a key element of personal style, especially in urban areas. Consumers now prioritize aesthetics alongside vision correction, choosing frames that reflect fashion trends and individual identity. This shift has fueled demand for designer eyewear, seasonal collections, and diverse frame options, transforming optical retail spaces into fashion destinations. At the same time, younger consumers are embracing contact lenses for both practicality and cosmetic enhancement, with colored lenses and daily disposables gaining popularity. This fusion of fashion and functionality is reshaping buying behavior, driving frequent upgrades and increasing overall spending. As style becomes a central factor in eyewear choices, the vision care market continues to benefit from evolving lifestyle and aesthetic preferences.

Aging Population and Demand for Presbyopia Solutions

Japan’s aging population is significantly shaping the vision care market, with age-related vision conditions becoming increasingly prevalent. Issues such as presbyopia, cataracts, and dry eye syndrome are common among seniors, driving heightened demand for specialized eyewear like bifocals, progressive lenses, and magnifying reading glasses. Notably, based on research that 73.5% of examined eyes among elderly Japanese individuals showed signs of definite dry eye disease, highlighting the condition's widespread presence in this age group. Older adults are also more inclined to undergo regular eye check-ups and seek treatment to maintain visual health. In response, optical brands and clinics are focusing on comfort, ease of use, and aesthetic appeal in product and service design. This demographic shift is aiding the Japan vision care market share as companies cater to the evolving needs and preferences of senior consumers.

Japan Vision Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- Lasik Equipment

- Artificial Tears

The report has provided a detailed breakup and analysis of the market based on the product type. This includes glass lenses, contact lenses, intraocular lenses, contact solutions, lasik equipment, and artificial tears.

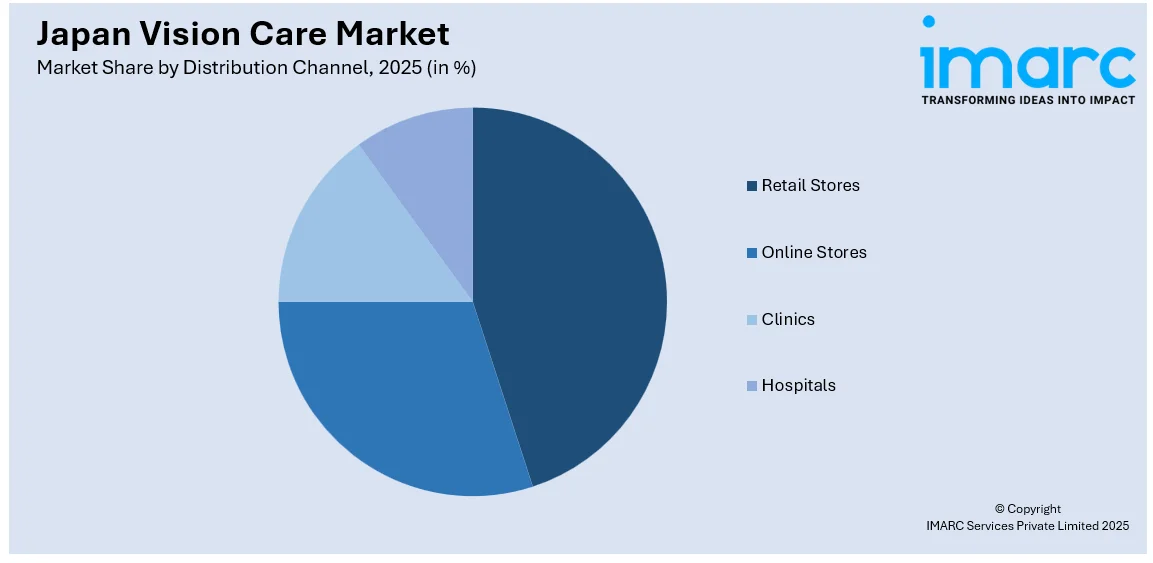

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Stores

- Online Stores

- Clinics

- Hospitals

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, online stores, clinics, and hospitals.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Vision Care Market News:

- In March 2025, Vision Care Inc. proudly announces that President Masayo Takahashi has received the 2025 ISSCR Public Service Award from the International Society for Stem Cell Research. This honor recognizes her impactful contributions as a member of the Organizing Committees for the 2024 and 2025 ISSCR International Symposia. Notably, it marks the ISSCR’s first group award, celebrating her dedication to advancing stem cell science and global collaboration in regenerative medicine.

- In September 2024, HOYA Japan celebrated One Vision Day 2024 by engaging with students at Tokyo Optometric College through volunteer-led classes on lens engineering, product knowledge, progressive lenses, and eyewear fashion. Employees from various departments participated, aiming to inspire future opticians and promote sustainable eye care. The event began with a virtual kick-off for the academic year, reinforcing HOYA’s commitment to education, innovation, and supporting the next generation of vision care professionals.

Japan Vision Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Glass Lenses, Contact Lenses, Intraocular Lenses, Contact Solutions, Lasik Equipment, Artificial Tears |

| Distribution Channels Covered | Retail Stores, Online Stores, Clinics, Hospitals |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan vision care market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan vision care market on the basis of product type?

- What is the breakup of the Japan vision care market on the basis of distribution channel?

- What is the breakup of the Japan vision care market on the basis of region?

- What are the various stages in the value chain of the Japan vision care market?

- What are the key driving factors and challenges in the Japan vision care market?

- What is the structure of the Japan vision care market and who are the key players?

- What is the degree of competition in the Japan vision care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan vision care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan vision care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan vision care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)