Japan Water Treatment Chemicals Market Report by Type (Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, and Others), End User (Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, and Others), and Region 2026-2034

Market Overview:

Japan water treatment chemicals market size reached USD 1.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.80% during 2026-2034. The increasing demand for various advanced technologies, such as membrane filtration, chemical formulations, and digital monitoring systems, which are enhancing the adoption of new and more efficient water treatment chemicals, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.3 Billion |

|

Market Forecast in 2034

|

USD 2.0 Billion |

| Market Growth Rate 2026-2034 | 4.80% |

Water treatment chemicals are substances used to purify and improve the quality of water for various industrial, municipal, and domestic purposes. These chemicals play a crucial role in treating raw water from natural sources like rivers, lakes, and wells to make it safe for consumption, industrial processes, and environmental discharge. Common water treatment chemicals include coagulants, flocculants, disinfectants, pH adjusters, and corrosion inhibitors. Coagulants like aluminum sulfate or ferric chloride are added to clump together particles in water, making them easier to remove. Flocculants such as polyacrylamide aid in forming larger flocs for efficient filtration. Disinfectants like chlorine or ozone help kill harmful microorganisms, while pH adjusters maintain water's acidity or alkalinity levels within safe limits. Corrosion inhibitors safeguard distribution systems and plumbing from deterioration. By using these chemicals, water treatment facilities can ensure that the water supplied to homes and industries meets regulatory standards for safety, taste, and odor, promoting public health and environmental protection.

Japan Water Treatment Chemicals Market Trends:

The water treatment chemicals market in Japan is experiencing robust growth, primarily driven by a growing regional population and increasing urbanization. Firstly, as urbanization continues to accelerate, there is a surge in demand for clean and potable water, leading to higher investments in water treatment infrastructure. Moreover, the rising awareness of waterborne diseases and the need for safe drinking water propel the adoption of water treatment chemicals. Secondly, stringent environmental regulations play a pivotal role in driving the market forward. Governments in Japan are imposing strict guidelines on water quality and pollution control, necessitating the use of advanced treatment chemicals to meet compliance standards. Consequently, this regulatory pressure encourages industries to invest in water treatment solutions, further boosting the market. Furthermore, industrial expansion, particularly in sectors like manufacturing, energy, and pharmaceuticals, is another critical driver. These industries require substantial water volumes for their processes, making efficient water treatment indispensable. As a result, the demand for specialized chemicals for wastewater treatment and recycling is on the rise. Lastly, the regional emphasis on sustainable practices and the adoption of eco-friendly water treatment chemicals that are fostering innovation and diversification within the water treatment chemicals sector is expected to drive the market in Japan.

Japan Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- Ph Adjusters and Softeners

- Defoaming Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, Ph adjusters and softeners, defoaming agents, and others.

End User Insights:

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others.

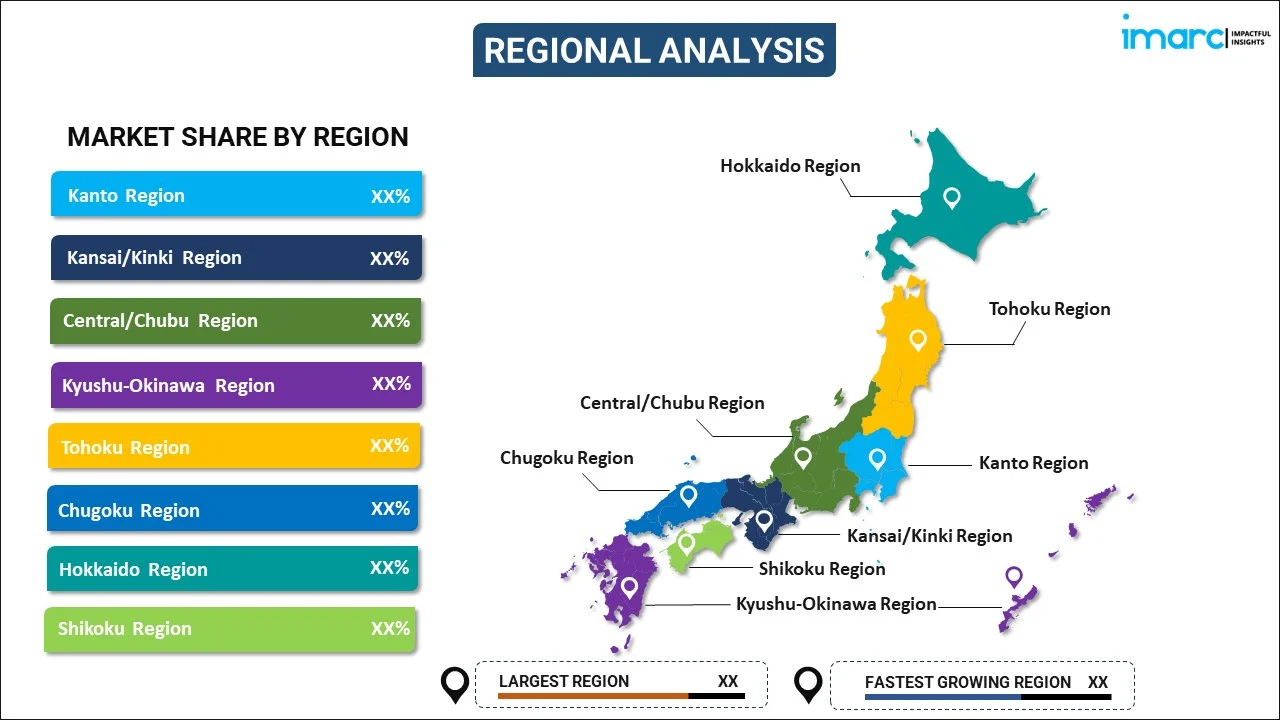

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Japan water treatment chemicals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan water treatment chemicals market?

- What is the breakup of the Japan water treatment chemicals market on the basis of type?

- What is the breakup of the Japan water treatment chemicals market on the basis of end user?

- What are the various stages in the value chain of the Japan water treatment chemicals market?

- What are the key driving factors and challenges in the Japan water treatment chemicals?

- What is the structure of the Japan water treatment chemicals market and who are the key players?

- What is the degree of competition in the Japan water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan water treatment chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)