Japan Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, distribution Channel, and Region, 2025-2033

Japan Whiskey Market Size and Share:

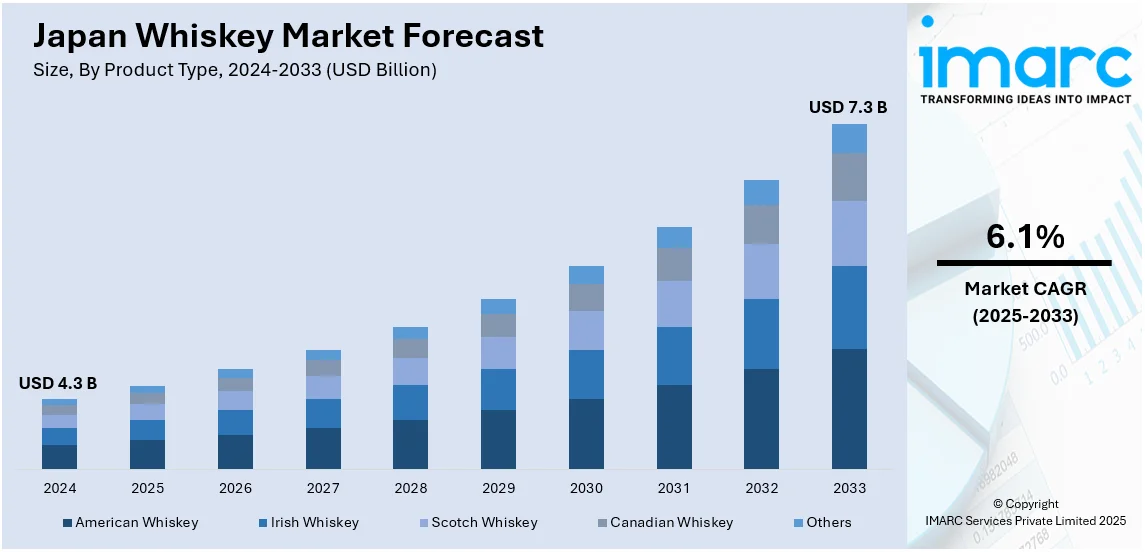

The Japan whiskey market size was valued at USD 4.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.3 Billion by 2033, exhibiting a CAGR of 6.1% from 2025-2033. The market is experiencing steady growth mainly driven by the rising global demand for premium and craft spirits, increasing consumer preference for authentic Japanese brands and the country’s rich tradition of whiskey craftsmanship. Growing export opportunities, innovative flavor profiles, and a surge in whiskey tourism further bolster the market's expansion making it a key player in the spirits industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.3 Billion |

| Market Forecast in 2033 | USD 7.3 Billion |

| Market Growth Rate (2025-2033) | 6.1% |

The Japan whiskey market is expanding due to rising global recognition and the demand for premium Japanese whiskey. Renowned for its exceptional quality and craftsmanship Japanese whiskey has gained a strong foothold among enthusiasts worldwide driving exports and enhancing its domestic market appeal. For instance, in June 2024, Nikka Whisky Distilling Co announced its plans to invest 6 billion yen ($38 million) in its storage facilities to expand production and boost exports amid the rising international demand. This investment will increase storage capacity by 10%. The growing popularity of high-end spirits among younger and affluent consumers is further fueling the demand as they seek unique and sophisticated beverage options that reflect Japanese tradition and innovation.

Additionally, the increasing interest in mixology and craft cocktails is boosting the market. Bars and restaurants are incorporating Japanese whiskey into creative drinks, broadening its consumer base. For instance, in October 2024, Suntory announced its plans to release a new canned cocktail the Suntory Premium Highball Yamazaki-Bright and Rich Flavor featuring its renowned Yamazaki single malt whisky, which is enhanced with Spanish oak flavors. The drink boasts a 9% alcohol content positioning it as a premium option in the canned cocktail market. Efforts by producers to experiment with aging techniques and unique ingredients, coupled with government support for exports, are contributing to the market's momentum. This strategic positioning has placed Japanese whiskey as a significant player in the global premium spirits industry.

Japan Whiskey Market Trends:

Rising Focus on Premiumization

The premiumization trend in the Japanese whiskey market is driven by a shift toward luxury and exclusivity. Consumers are increasingly drawn to high-end offerings including limited-edition releases and aged expressions, which symbolize sophistication and refined taste. For instance, in October 2024, Suntory launched Hibiki 40-Year-Old, its oldest blended whisky created by the combination of whiskies from Yamazaki, Hakushu, and Chita distilleries. Limited to 400 bottles it features complex aromas and flavors emphasizing Japanese craftsmanship and tradition. Japanese whiskey's reputation for meticulous craftsmanship and unique flavor profiles makes it particularly appealing to connoisseurs and collectors willing to pay a premium for exceptional quality. Distilleries cater to this demand by introducing innovative products and small-batch variants often with unique packaging that enhances their allure. This trend reflects a broader global movement toward indulgence in luxury spirits elevating Japan's status in the premium whiskey segment.

Rise in Collaborations and Partnerships

Collaborations and partnerships are reshaping the Japanese whisky industry by creating opportunities for innovation and global reach. Distilleries are teaming up with international brands, luxury establishments and renowned experts to enhance product offerings and attract diverse consumer segments. For instance, in September 2024, Nikka Whisky announced its partnership with Park Hyatt Niseko Hanazono hotel offering exclusive whisky experiences for guests. This collaboration arises amidst significant investment in Japan’s ski resorts enhancing the après ski scene. Such partnerships often lead to the creation of limited-edition whiskies leveraging unique production techniques or cultural elements from both parties. For instance, collaborations with global chefs or mixologists allow for pairing experiences that highlight Japanese whisky's versatility. These ventures not only bolster brand visibility in international markets but also position Japanese whisky as a premium and culturally rich product with broad cross-border appeal.

Rising Focus on Sustainability

Sustainable practices are becoming integral to the Japanese whisky industry as producers respond to rising consumer demand for environmentally friendly products. Distilleries are adopting green production methods such as utilizing renewable energy sources optimizing water usage and reducing carbon emissions during distillation. For instance, in April 2024, Suntory Spirits achieved a world-first in whisky production by successfully conducting a direct-fired distillation trial using 100% hydrogen at its Yamazaki Distillery. This milestone marks significant progress towards decarbonizing whisky manufacturing while preserving quality as the new spirits match those produced with traditional natural gas. Packaging innovations including recyclable materials and minimalistic designs aim to cut waste while maintaining a premium aesthetic. Some brands are investing in reforestation projects to offset their environmental impact particularly in preserving Mizunara oak forests vital for whisky aging. These efforts not only appeal to eco-conscious consumers but also demonstrate a commitment to long-term sustainability in whisky production.

Japan Whiskey Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan whiskey market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, quality, and distribution channel.

Analysis by Product Type:

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

American whiskey holds a growing presence in Japan driven by its bold flavors and the rising popularity of bourbon. Japanese consumers appreciate its distinct sweetness and notes of caramel which pair well with local cuisine. Brands like Jack Daniel's and Maker’s Mark enjoy significant demand due to premiumization trends. The younger demographic is increasingly exploring American whiskey as a base for cocktails boosting its appeal in urban areas. Limited edition releases and collaborations with Japanese distilleries further contribute to its expanding market share.

Irish whiskey is gaining traction in Japan for its smooth and approachable profile. Known for triple distillation and lighter flavors it appeals to both new and seasoned whiskey enthusiasts. Brands like Jameson dominate this segment leveraging innovative marketing campaigns and collaborations with local bars. The trend of highballs and whiskey-based cocktails also boosts its consumption. Irish whiskey's versatility in mixing and neat drinking aligns with Japanese drinking preferences fostering steady growth in this market segment.

Scotch whiskey remains a dominant category in Japan due to its rich heritage and diverse flavor profiles. From single malts to blended varieties Scotch caters to various consumer tastes. Prestigious brands like Macallan and Glenfiddich enjoy a loyal following supported by Japan's appreciation for craftsmanship. The market benefits from the popularity of Scotch in gift-giving and celebratory occasions. Japan's growing whiskey culture and affinity for premium spirits ensure that Scotch continues to be a favored choice.

Canadian whiskey is gradually carving a niche in the Japan market known for its smooth and mild flavor. Its affordability and mixability make it popular among younger consumers and those new to whiskey. Brands like Crown Royal are making inroads through partnerships with Japanese distributors and bar chains. Canadian whiskey's light profile complements Japan's preference for milder spirits making it a choice for highballs and casual drinking. This category sees potential for growth through targeted marketing and innovation.

Analysis by Quality:

- Premium

- High-End Premium

- Super Premium

Premium whiskey is a cornerstone of Japan's whiskey market appealing to a broad audience seeking quality at a reasonable price. This segment includes well-known brands like Suntory and Nikka offering smooth and balanced flavors suitable for casual drinking or cocktails. The growing trend of whiskey highballs has boosted demand for premium products especially in restaurants and bars. Japanese consumers appreciate the craftsmanship associated with this category often choosing premium whiskey for personal consumption or gifting. The segment benefits from the fusion of international and domestic brands making it a consistent performer in the market.

High-end premium whiskey caters to connoisseurs and discerning consumers who value refined flavors and exclusivity. This category includes renowned international labels such as Glenlivet and Macallan along with Japan's premium offerings like Yamazaki and Hakushu. The market for high end premium whiskey is fueled by the growing appreciation for whiskey as a sophisticated beverage. Collectors and enthusiasts drive demand for limited edition releases and aged whiskeys. This segment also thrives in Japan’s gifting culture where high end whiskey is seen as a status symbol. Strong marketing efforts and the rise of whiskey tourism further bolster its prominence.

Super premium whiskey represents the pinnacle of luxury in Japan’s whiskey market targeting affluent consumers and collectors. This segment includes rare, aged and exclusive offerings from both Japanese distilleries and international brands. Whiskeys such as Hibiki 21 and Karuizawa exemplify this category commanding high prices and immense prestige. Super premium whiskey is often associated with investment value and is prominently featured in auctions and specialized events. The growing global recognition of Japanese whiskey has amplified the demand for this segment positioning Japan as a significant player in the ultra-luxury whiskey market.

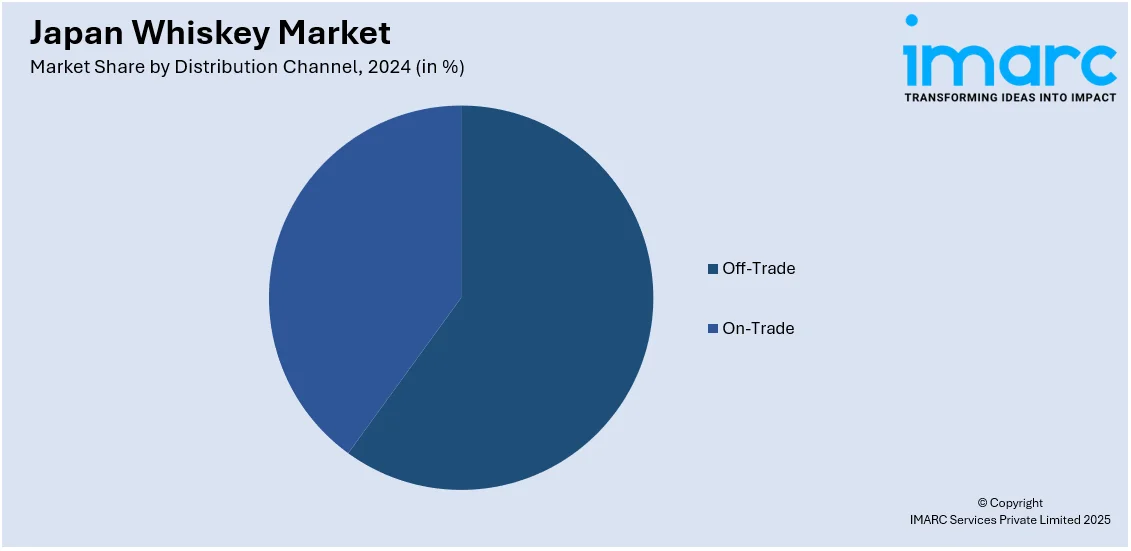

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

The off-trade channel dominates whiskey sales in Japan driven by supermarkets, hypermarkets and online platforms. Supermarkets and discount stores cater to budget conscious consumers seeking convenience and variety offering a wide selection of domestic and international brands. Online stores are rapidly gaining popularity providing access to exclusive labels and rare collections with doorstep delivery. Promotions, discounts and loyalty programs in these outlets boost consumer engagement. The rise in ecommerce and digital payment options further supports off-trade sales. This channel is particularly appealing for at-home consumption and gifting, ensuring steady growth in Japan's whiskey market.

The on-trade channel thrives in Japan with restaurants, bars and liquor stores playing key roles in whiskey distribution. Bars and high-end restaurants showcase whiskey’s versatility through curated cocktails and tasting menus attracting whiskey enthusiasts and casual drinkers alike. Whiskey highballs are especially popular aligning with Japan's preference for lighter and refreshing drinks. Liquor stores serve as a bridge for consumers seeking premium and exclusive options. On-trade channels benefit from Japan's strong social drinking culture where whiskey is often enjoyed during gatherings. Partnerships with local establishments and whiskey-focused events further amplify the presence of whiskey in this channel.

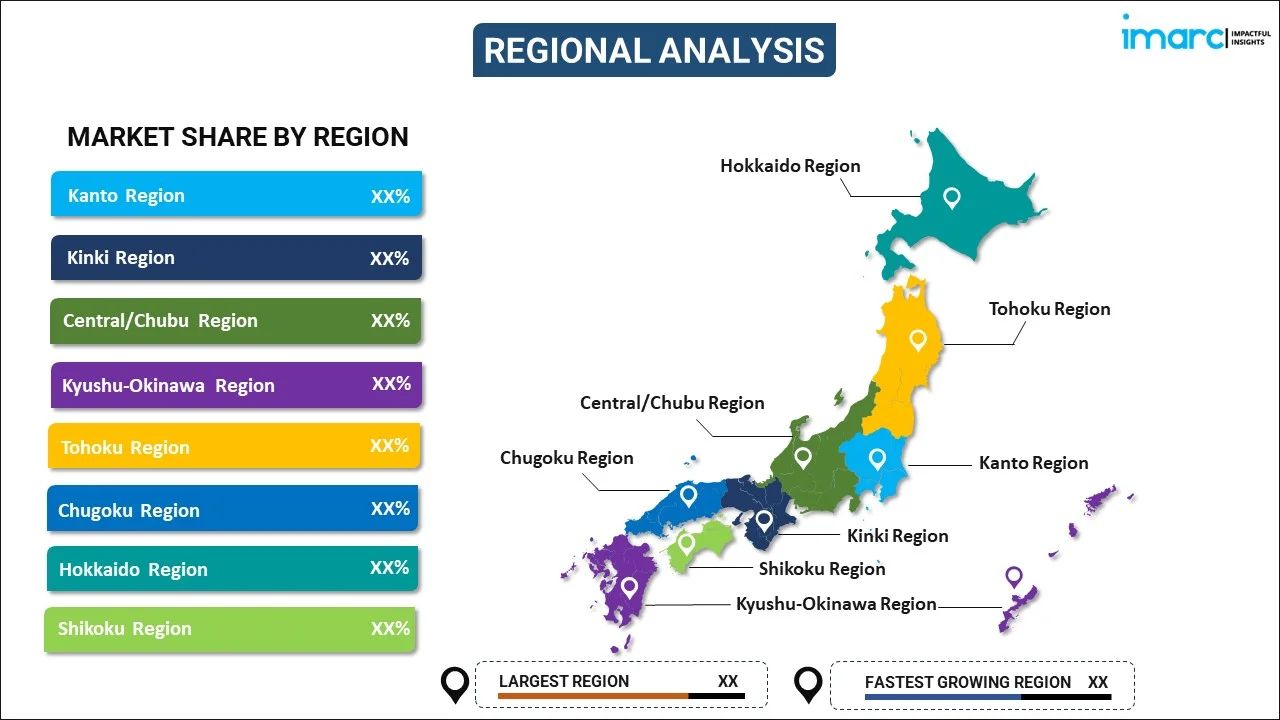

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, home to Tokyo is driven by its dense population, vibrant nightlife and corporate culture. High-end bars and restaurants contribute significantly to whiskey consumption with premium and super premium options in high demand. The region's cosmopolitan demographic fosters a taste for international and domestic brands alike. Retail outlets and online platforms thrive here due to urban convenience and accessibility. Whiskey tourism and events such as tastings and festivals further amplify the market's dynamic growth in Kanto.

The Kinki region centered around Osaka and Kyoto is a prominent whiskey market influenced by its cultural significance, heritage and robust hospitality sector. Kyoto’s rich whiskey history with iconic distilleries like Yamazaki enhances regional demand. Bars and izakayas drive the popularity of whiskey highballs while high-end restaurants cater to premium whiskey enthusiasts. The region’s strong economy supports the growth of super premium and collectible whiskey sales. Both local and international brands find a loyal consumer base in the Kinki region making it a strategic hub for whiskey marketing efforts.

The Chubu region known for cities like Nagoya is a growing whiskey market fueled by rising disposable income business activity and tourism. Its strategic location as a business hub fosters demand for premium whiskey in corporate gifting and celebratory events. Retail stores and discount outlets play a significant role in the off-trade segment, while bars and restaurants showcase whiskey's versatility through innovative cocktails and pairings. The region’s appreciation for fine craftsmanship aligns with the popularity of both Japanese and international premium whiskey brands ensuring steady growth.

The Kyushu-Okinawa region has an emerging whiskey market influenced by its unique culture, vibrant tourism appeal and evolving drinking trends. Okinawa’s tropical climate promotes lighter whiskey-based drinks like highballs while Kyushu’s urban centers see rising demand for premium brands. Restaurants and izakayas contribute to on-trade sales while local liquor stores focus on niche and affordable options. Tourism significantly boosts whiskey sales with visitors often seeking regional exclusives and collectibles. This region also sees increasing interest in whiskey pairings with local cuisine and culturally inspired beverages.

The Tohoku region known for its serene landscapes and traditional culture has a modest but growing whiskey market supported by local appreciation for spirits. The region’s cold climate complements the consumption of neat whiskey and warm whiskey-based cocktails during colder months. Local bars and small-scale liquor stores drive on-trade sales while supermarkets and online stores cater to off-trade demand. Tourism plays a key role with travelers seeking Japanese whiskey as souvenirs. Tohoku’s appreciation for craftsmanship and unique flavor profiles aligns with the rising popularity of domestic premium whiskey brands in the area.

The Chugoku region encompassing Hiroshima is a steadily growing market for whiskey supported by its robust dining culture, urbanization, and regional tourism. Restaurants and bars contribute significantly to on-trade sales offering whiskey in diverse forms, from highballs to exclusive tastings. Local liquor stores cater to consumers seeking premium options and collectibles. The region’s historical ties to sake and spirits make whiskey a natural addition to its beverage market. Chugoku's increasing urbanization and growing number of whiskey-themed events further stimulate demand for domestic and international whiskey brands alike.

Hokkaido, with its cool climate, natural beauty and tourism appeal fosters a growing whiskey market. The region’s preference for bold and rich flavors aligns with premium and super premium whiskey sales appealing to discerning consumers. Bars and izakayas are central to on-trade consumption while local stores emphasize domestic brands and affordable options. Hokkaido’s booming tourism industry also boosts whiskey sales with visitors often seeking regional exclusives and high-quality souvenirs. Whiskey pairings with Hokkaido’s renowned seafood and dairy based dishes are becoming increasingly popular further enhancing the market's steady and diverse growth.

The Shikoku region has a niche but growing whiskey market driven by a mix of local and tourist demand particularly in key urban centers. Small bars and izakayas lead the on-trade segment focusing on affordable and versatile whiskey offerings that appeal to casual drinkers. Liquor stores and supermarkets cater to everyday consumers while premium options find favor among whiskey enthusiasts. The region's cultural festivals and tourism bolster whiskey sales with visitors exploring local outlets for Japanese brands and regional exclusives. Shikoku’s appreciation for artisanal products and craftsmanship complements the rise of premium whiskey consumption.

Competitive Landscape:

The Japan whiskey market showcases a competitive landscape characterized by the presence of well-established distilleries and emerging craft producers. Companies focus on innovation, offering unique blends and flavors to meet the growing global demand for premium whiskey. For instance, in June 2024, the House of Suntory launched its 2024 Tsukuriwake Series featuring four exclusive expressions: Yamazaki Golden Promise, Yamazaki Islay Peated Malt, Hakushu 18 Year Old Peated Malt, and Yamazaki 18 Year Old Mizunara. The market sees significant export-driven growth, with producers leveraging Japan’s reputation for quality and craftsmanship. Aging techniques, sustainable practices, and local ingredient sourcing enhance product appeal. Additionally, strategic collaborations and the establishment of exclusive tasting experiences contribute to brand differentiation. The competition intensifies as new entrants challenge traditional players, fostering a dynamic environment that drives product innovation and global market expansion.

The report provides a comprehensive analysis of the competitive landscape in the Japan whiskey market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Tankyu Distillery Hong Kong's first homegrown gin brand announced its plans to open a distillery in Higashikawa, Hokkaido, Japan. The 19,741 square-foot facility will also produce single malt whisky.

- In July 2024, Kanosuke Distillery announced its plans to launch its core range of whiskies in the US featuring a single malt, a grain whisky, and a blended whisky. The products include a 48% ABV single malt, a 51% ABV grain whisky and a blended whisky at 53% ABV showcasing distinctive flavor profiles.

Japan Whiskey Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others |

| Qualities Covered | Premium, High-End Premium, Super Premium |

| Distribution Channels Covered |

|

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan whiskey market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan whiskey market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan whiskey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Whiskey is a distilled alcoholic beverage made from fermented grain mash, including barley, corn, rye, and wheat. It undergoes aging in wooden casks, typically oak, which imparts flavors and colors. Whiskey is used in various applications such as sipping neat, mixing in cocktails, or paired with food.

The Japan whiskey market was valued at USD 4.3 Billion in 2024.

IMARC estimates the Japan whiskey market to exhibit a CAGR of 6.1% during 2025-2033.

The Japan whiskey market is driven by rising global demand for premium spirits, increasing interest in Japanese craftsmanship, growing export opportunities, and innovations in whiskey flavors and aging techniques. Additionally, whiskey tourism and collaborations with international brands also fuel growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)