K-Beauty Products Market Size, Share, Trends, and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

K-Beauty Products Market Size and Trends:

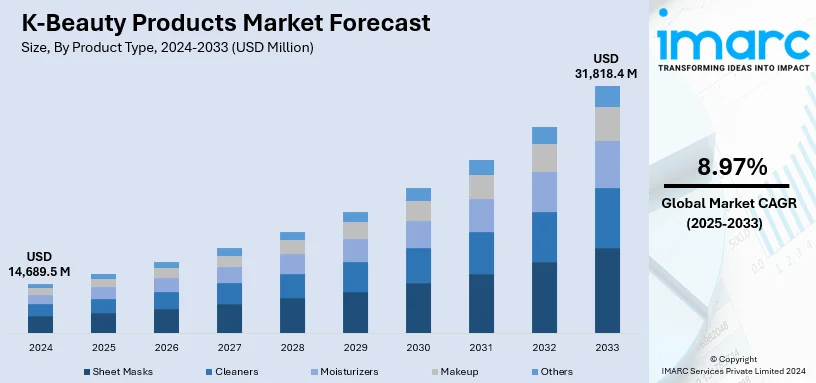

The global K-beauty products market size reached USD 14,689.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 31,818.4 Million by 2033, exhibiting a growth rate (CAGR) of 8.97% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.0% in 2024. The increasing influence of social media platforms, along with the rising consciousness towards a comprehensive skincare routine, is primarily bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14,689.5 Million |

|

Market Forecast in 2033

|

USD 31,818.4 Million |

| Market Growth Rate (2025-2033) | 8.97% |

The global K-beauty products market is driven by rising consumer interest in innovative and high-quality skincare and cosmetic solutions. This can be supported by the popularity of Korean culture, including K-pop and K-dramas. The demand for natural and organic ingredients, sophisticated skincare routines, and the development of effective formulations for diverse skin types are also contributing to the market growth. Extensive digital marketing, influencer endorsements, and increasing penetration of e-commerce platforms are making these products widely accessible, benefiting the industry. As consumers with rising disposable incomes are becoming increasingly aware of the benefits of skincare, along with their preference for customized beauty regimes, there has been a significant uptake of k-beauty products globally. The appeal of unique packaging, combined with a strong emphasis on product innovation, is also enhancing consumer engagement and brand loyalty.

The United States market has emerged as a key market for k-beauty products, propelled by increasing consumer preference for multi-step skincare regimens that prioritize hydration, anti-aging, and skin health. Along with this, growing awareness of Asian beauty philosophies emphasizing preventative care and gentle, science-backed formulations is fueling the market demand. Retail expansion through specialty beauty stores and mainstream chains is making these products more accessible, further supported by high visibility on social media platforms. For instance, on 25th July 2024, Dr. Jart+, the Korean skincare brand known for its high-performance derma skincare products that deliver instant results and garner viral social media buzz, announced its debut in the U.S. Amazon Premium Beauty store. Dr. Jart+ products and ingredients address various skin concerns. Besides this, American consumers' shift toward cruelty-free, sustainable, and clean beauty products aligns with the eco-consciousness of many K-Beauty brands, which is creating a positive outlook for the market. Additionally, the U.S. market benefits from a strong millennial and Gen Z customer base, drawn to innovative textures, multifunctional products, and affordable luxury that K-beauty offers, aiding the k-beauty products market growth.

K-Beauty Products Market Trends:

Shift Towards Natural Ingredients

The rising demand for organic ingredients is encouraging consumers to opt for cosmetic and skincare products that are free from harmful chemicals and synthetic additives. For example, in October 2023, SUGAR Cosmetics launched Quench Botanics, a Korean brand tailor-made for Indian skin and weather conditions with natural ingredients. Besides this, in September 2023, OLIVIAUMMA LLC developed the skincare brand OLIVIAUMMA, Glass Skin Tanghulu that is extracted from apple, papaya, heartleaf, shine muscat, and green plum with high-frequency technology, thereby making the face tone even, clean, moisturized, etc. Additionally, in January 2024, one of the leading Korean premium personal care companies, KUNDAL, known for its usage of macadamia and honey, introduced its K-Beauty Halal hairline that features an anti-sebum P + hyalocta complex, providing an instant refreshing sensation to the scalp. Apart from this, in March 2024, LG Household & Health Care-owned CNP Laboratory aimed to strengthen its position in Japan with the launch of exclusive products, which contain propolis as the main ingredient. Furthermore, brands like Whamisa and Innisfree are incorporating natural ingredients, including honey, green tea, and numerous botanicals, which is anticipated to create a k-beauty products market outlook.

Personalized Skincare Regimes

K-beauty products are known for their targeted treatments and innovative formulations, thereby catering to a wide range of skin types and issues. For example, in June 2024, Lady K Malaysia introduced halal and vegan skincare products that are free from animal-based ingredients. Additionally, in May 2024, Sapphire Beauty & Wellness (SB&W), one of the companies dedicated to providing high-quality beauty and wellness items in the Philippines, unveiled two South Korean skincare brands, Désembre and Dermagarden. According to the Environmental Working Group, the average person applies nine personal care products to their body daily. One-quarter of women apply 15 or more products each day. Besides this, individuals are willing to invest time and effort in their beauty routines, which is acting as another significant growth-inducing factor. For instance, in November 2023, South Korean nutricosmetics company Vital Beautie, owned by Amorepacific, introduced a retinol-based dietary supplement that claims to be safe even for people who are sensitive to the ingredient. Moreover, IOPE's lab-tailored solution usually involves skin analysis and personalized consultations to recommend products that address individual skin concerns. In line with this, the rising popularity of single-use masks soaked in nutrient-rich serums by brands like Mediheal and Dr. Jart+ is contributing to the K-beauty products market share.

Wide Accessibility of Products

Evolving consumer demand is inflating the use of e-commerce and digital platforms, which is driving the market. The global eCommerce market shows no signs of slowing down. According to an industrial report, with online sales projected to reach USD 5 trillion by 2024 and continue to grow at a compound annual rate of 15%, the digital shopping landscape is becoming increasingly dominant. In April 2024, one of the prominent beauty retailers, Tira, exclusively launched the K-beauty brand Kundal on its e-commerce platform and in select stores to introduce its hair and body care products to the Indian market and bolster its international brand selection. Similarly, in March 2024, Skin1004 unveiled its offerings that are commonly available via the Tirra App. Besides this, other websites, such as Soko Glam, YesStyle, Amazon, etc., are becoming crucial in reaching a wider audience, thereby allowing individuals from all over the world to access K-beauty products easily. Moreover, the growing number of brick-and-mortar stores is also propelling the market. For instance, in May 2024, CJ Olive Young Corp., South Korea’s prominent beauty store chain, announced to set up its subsidiary in Japan to supply cosmetics offerings to local distributors across the country. Apart from this, brand-specific online stores, such as Laneige’s and Innisfree’s websites, offer direct-to-consumer sales, which is projected to fuel the global market in the coming years.

K-Beauty Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global K-beauty products market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, distribution channel, end user, and region.

Analysis by Product Type:

- Sheet Masks

- Cleaners

- Moisturizers

- Makeup

- Others

Sheet masks lead the market due to their convenience, efficacy, and ability to cater to a wide range of skin concerns. These masks are easy to use, providing a quick and effective skincare solution that fits into any routine. The hydrating and nutrient-rich formulations found in sheet masks deliver immediate visible results, making them a popular choice among consumers seeking instant skin benefits. The variety of options available, from moisturizing and brightening to anti-aging and soothing, thereby ensuring that there is a sheet mask for every skin type and concern. For instance, brands, including Dr. Jart+ and Innisfree, incorporate the latest skincare trends and scientific advancements. Additionally, in February 2022, Atman created a unique sheet mask called Kosk that allows the wearer to cover the nose and comfortably eat and drink whenever they want to remove it completely.

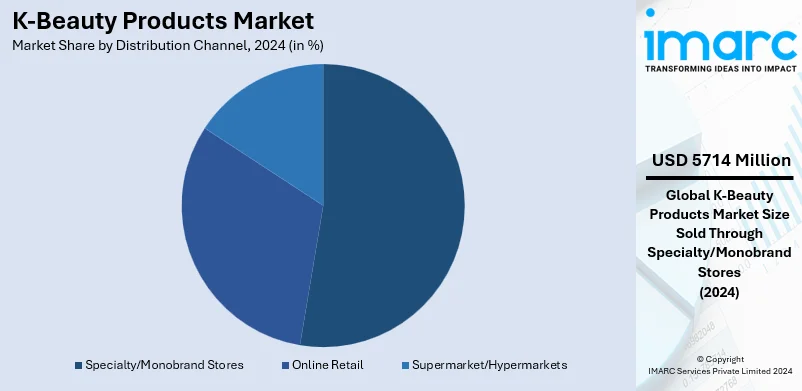

Analysis by Distribution Channel:

- Online Retail

- Supermarket/Hypermarkets

- Specialty/Monobrand Stores

Specialty/monobrand stores leads the market with around 38.9% of market share in 2024. The ability of specialty/ mono-brand stores to provide a tailored and immersive shopping experience that aligns with the high standards and unique identity of each brand is augmenting the segment's growth. This dedicated retail environment helps in building strong brand loyalty and trust among consumers, as they receive personalized service and expert advice tailored to their specific skincare needs. For example, Innisfree's flagship stores provide an immersive experience that includes in-store demonstrations, skin consultations, and an extensive selection of their natural ingredient-based products. Similarly, Amorepacific's Aritaum stores offer an exclusive showcase of their various brands, like Laneige, Sulwhasoo, Mamonde, etc., ensuring that customers have access to the latest products and innovations.

Analysis by End User:

- Male

- Female

Female end users lead the market with around 62.7% of the market share in 2024. The K-beauty industry is known for its focus on skincare routines and beauty solutions that cater specifically to women's diverse skincare needs and aesthetic preferences. With a wide array of products designed to address various skin concerns such as hydration, anti-aging, brightening, and acne prevention, K-beauty brands have successfully captured the attention of female consumers who prioritize skincare as an essential aspect of their daily routine. For example, brands like Etude House and Missha offer extensive product lines that include serums, moisturizers, and makeup items that appeal to different skin types and beauty goals. Additionally, the K-beauty market's emphasis on natural ingredients, innovative formulations, and appealing packaging resonates strongly with women seeking both effectiveness and aesthetic pleasure in their skincare products.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the K-beauty products market forecast, Asia Pacific accounted for the largest market share of over 35.0%. The rising cultural emphasis on skincare, along with the expanding middle-class population, is primarily propelling the market in Asia Pacific. In China, the use of e-commerce platforms like Tmall and JD.com has made it easier for consumers to access a wide range of K-beauty products, leading to robust sales growth. Moreover, continuous collaborations among key players are also acting as significant growth-inducing factors. For example, in July 2022, Saturday Skin partnered with Nykaa to expand its presence in India and offer a wide array of K-beauty products via the Nykaa website and mobile app. Similarly, in November 2022, L'Oréal announced the collaboration with Shihyo, a Korean brand that includes 24 herbal ingredients steeped in fermented rice and other innovative Asian techniques.

Key Regional Takeaways:

United States K-Beauty Products Market Analysis

The United States accounted for 75.5% of the market share in North America. Growing customer demand for innovative, natural skincare products is fuelling the US market for K-beauty products. Because of their emphasis on multi-step skincare regimens, lightweight formulations, and unusual ingredients like fermented yeast, snail mucus, and Centella asiatica, K-beauty companies have become quite popular. The growing popularity of skincare routines on social media sites like YouTube, Instagram, and TikTok has increased demand for K-beauty goods, especially among Gen Z and millennials.

According to an industrial report, in 2024, the skin care market in the United States is projected to generate a revenue of USD 24.35 Billion with K-beauty contributing significantly due to its innovation in sheet masks, serums, and cleansers. Increased accessibility has resulted from collaborations between Korean companies and US retailers like Sephora and Ulta Beauty. Moreover, the proliferation of e-commerce platforms has made it possible for customers to investigate genuine K-beauty products straight from Korea. U.S. ecommerce represented 22.0% of total retail sales, according to Digital Commerce 360 analysis of U.S. Department of Commerce data. The focus that K-beauty places on vegan, cruelty-free, and environmentally friendly formulas is in line with the rising demand from consumers for sustainable beauty products.

Europe K-Beauty Products Market Analysis

A growing propensity toward creative beauty routines and a preference for skincare over color cosmetics are driving the rapid rise of the K-beauty business in Europe. Because K-beauty emphasizes healthy, dewy skin with multi-step procedures that include toners, essences, ampoules, and sheet masks, it appeals to European consumers. A 2022 study of the Cosmetics European, Personal Care Association found that over USD 46 Billion worth of cosmetics were traded in the region. According to the report, 72% of Europeans use cosmetics and personal care items to boost their self-esteem and quality of life. Since the need for multipurpose cosmetics remains high on the priority list, Korea's innovations dominate the industry. Therefore, major chains of cosmetics stores, such as Sephora, carry Korean beauty products in 825 of its locations in 14 European nations. The market for K-beauty products in Europe is growing as a result of these reasons combined.

With the rise in popularity of companies like COSRX, Laneige, and Innisfree, K-beauty products have been widely available in European nations like Germany, France, and the UK. Consumer confidence is increased by the European Union's stringent skincare product laws, which complement K-beauty products' superior, dermatologist-tested formulas.

Asia Pacific K-Beauty Products Market Analysis

The popularity of Korean pop culture, particularly K-dramas and K-pop, which have a significant impact on beauty trends, is what propels the K-beauty market throughout the Asia-Pacific region. K-beauty's adaptable routines accommodate the wide range of skin types and issues seen in the area. Growing disposable incomes and the popularity of Korean celebrities have increased demand for K-beauty in China, the country with the biggest market for the product outside of Korea. According to an industrial report, in 2023, K-beauty exports to China totalled more than USD 2.7 Billion, indicating the growing demand for these goods. Third largest importer of K-Beauty products was Japan with imports valued at USD 800 Million, a year-on-year increase of 7.5 percent in 2023. The emphasis on radiant skin and creative packaging increases the allure of K-beauty in nations like Japan and India.

Latin America K-Beauty Products Market Analysis

Growing knowledge of Korean skincare practices and rising disposable incomes in nations like Brazil and Mexico are driving the growth of the K-beauty business in Latin America. K-beauty's emphasis on natural-looking, lightweight skincare and makeup complements local tastes for understated beauty. K-beauty has gained popularity in this area thanks to social media platforms and partnerships with beauty influencers. The market has grown as a result of local merchants and online marketplaces making genuine Korean goods more accessible. As per industrial report estimation, K-beauty firms have a significant chance in Brazil's sizable beauty market, which is worth nearly USD 30 Billion in 2024.

Middle East and Africa K-Beauty Products Market Analysis

Premium, natural skincare products are becoming more and more popular in this area, which is driving the K-beauty sector. K-beauty formulations are very popular because of the region's hot temperature, which highlights the necessity for moisturizing and lightweight cosmetics. K-beauty's high-end skincare products are in line with the preference for luxury skincare in the Gulf Cooperation Council (GCC) nations. According to an industrial report, the e-commerce sector in the Middle East has been growing at a remarkable rate, with projections suggesting a compound annual growth rate of above 11.5% between 2022 and 2027. Access to Korean brands is becoming easier thanks to e-commerce sites and neighbourhood beauty salons. For instance, the 28th edition of Beautyworld Middle East took place from 28-30 October 2024 at Dubai World Trade Centre, featuring three Korean pavilions showcasing multiple South Korean beauty brands.

Competitive Landscape:

The key players in the market are focusing on continuous innovations to meet changing consumer preferences and are launching multi-purpose products that integrate skincare and cosmetics for ease of use. They are leveraging social media platforms and influencers to increase brand visibility and consumer engagement. Additionally, manufacturers are introducing sustainable, vegan, and cruelty-free lines of products and adopting eco-friendly packaging to capture a larger audience. In addition to this, the increasing number of partnerships and collaborations among e-commerce platforms and retailers is strengthening distribution networks. Furthermore, research and development investments for new, sophisticated, concern-based formulations such as anti-aging, hydration, and brightening are also being done by the key players to compete with the fast-changing consumer demands for beauty products.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Able C & C Ltd.

- Adwin Korea Corporation

- Amorepacific Corporation

- CLIO COSMETICS Co. Ltd.

- Cosrx Inc.

- LG H&H Co. Ltd. (LG Coproration)

- The Crème Shop Inc.

- The Face Shop Inc.

- Tonymoly Co. Ltd.

Recent Developments:

- September 2024: K-beauty brand Kahi is set to launch a new sun stick product as part of its strategy to expand its presence in the sun care market, which is projected to reach USD 12.5 Billion by 2025. The brand aims to leverage its popularity through endorsements and appearances in K-dramas, targeting a youthful demographic that values innovative skincare solutions.

- September 2024: Lady K Malaysia held an event at Sunway Velocity Mall to introduce L'Soulle, their groundbreaking kosher and vegan skincare brand. The new product line, which focuses on ethical beauty, includes six essential items that meet the market's rising need for cruelty-free and environmentally friendly skincare products.

- August 2024: Reliance Retail's Tira has launched the premium Korean skincare brand Mixsoon in India, which is now available both online and offline, as part of its strategy to expand its portfolio of global brands. Launched in 2020, Mixsoon is currently generating quarterly revenues of over USD 10 Million, with its best-selling product, the Mixsoon Bean Essence, recognized as a top-selling serum on platforms like Amazon in the U.S.

- May 2024: Sapphire Beauty & Wellness (SB&W), one of the companies dedicated to providing high-quality beauty and wellness items in the Philippines, developed two South Korean skincare brands, Désembre and Dermagarden.

- April 2024: One of the prominent beauty retailers, Tira, exclusively launched the K-beauty products brand Kundal on its e-commerce platform to unveil its hair and body care products to the Indian market and bolster its international brand selection.

K-Beauty Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sheet Masks, Cleansers, Moisturizers, Makeup, Others |

| Distribution Channels Covered | Online Retail, Supermarket/Hypermarket, Specialty/Monobrand Stores |

| End Users Covered | Male, Female |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Able C & C Ltd., Adwin Korea Corporation, Amorepacific Corporation, CLIO COSMETICS Co. Ltd., Cosrx Inc., LG H&H Co. Ltd. (LG Coproration), The Crème Shop Inc., The Face Shop Inc., Tonymoly Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the K-Beauty Products market from 2019-2033.

- The K-Beauty products market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the K-Beauty Products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

K-beauty products refer to skincare and cosmetic items originating from South Korea. They are known for their innovation, multi-step skincare routines, and use of natural and effective ingredients. They emphasize gentle, science-backed formulations designed for diverse skin types and concerns.

The K-beauty products market was valued at USD 14,689.5 Million in 2024.

IMARC estimates the global K-beauty products market to exhibit a CAGR of 8.97% during 2025-2033.

The market is driven by rising consumer interest in natural and innovative skincare, the global influence of Korean culture, increasing disposable incomes, and the accessibility of products via e-commerce and digital platforms.

In 2024, sheet masks represented the largest segment by product type, driven by their convenience, efficacy, and suitability for addressing a variety of skin concerns.

Specialty/monobrand stores lead the market by distribution channel due to their ability to provide tailored shopping experiences, expert advice, and an immersive retail environment.

The female segment is the leading end-user category, driven by a wide range of products designed to address specific skincare needs such as anti-aging, hydration, and acne prevention.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global K-beauty products market include Able C & C Ltd., Adwin Korea Corporation, Amorepacific Corporation, CLIO COSMETICS Co. Ltd., Cosrx Inc., LG H&H Co. Ltd. (LG Coproration), The Crème Shop Inc., The Face Shop Inc., Tonymoly Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)