Kidney/Renal Function Test Market Size, Share, Trends and Forecast by Test Type, Product, End Use, and Region, 2025-2033

Kidney/Renal Function Test Market Size and Share:

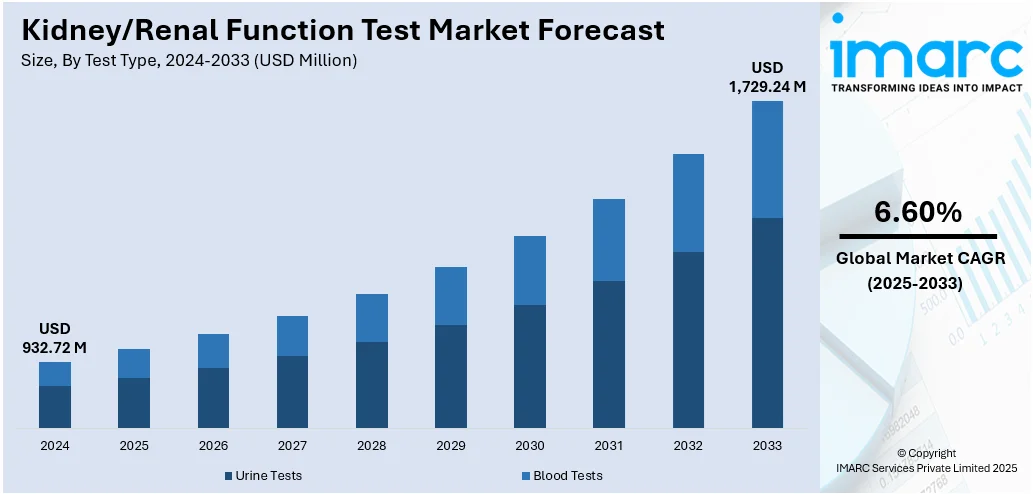

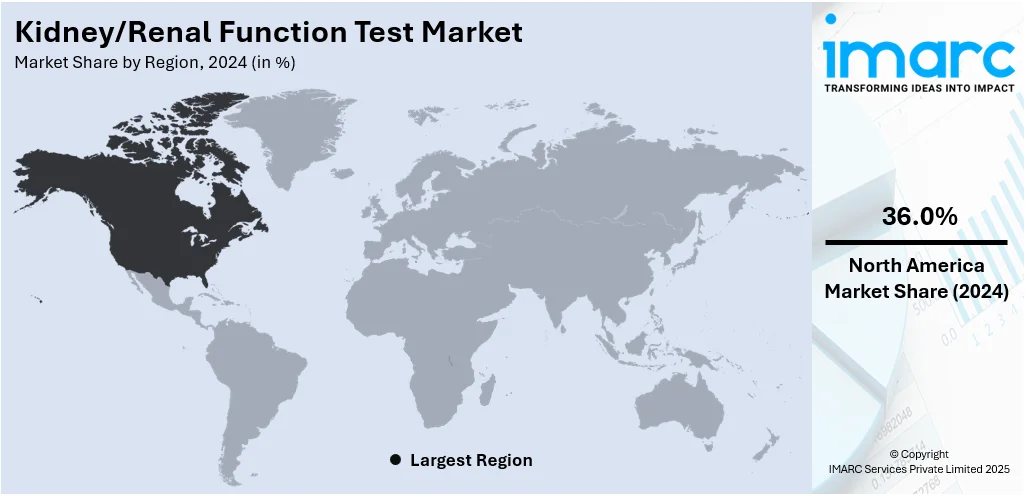

The global kidney/renal function test market size was valued at USD 932.72 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,729.24 Million by 2033, exhibiting a CAGR of 6.60% from 2025-2033. North America currently dominates the market, holding a market share of 36.0% in 2024. The dominance of the region is attributed to sophisticated healthcare systems, widespread use of innovative diagnostic technologies, strong healthcare reimbursement policies, and a well-established medical research ecosystem. These factors, combined with a significant focus on healthcare innovation, contribute to its market leadership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 932.72 Million |

| Market Forecast in 2033 | USD 1,729.24 Million |

| Market Growth Rate (2025-2033) | 6.6% |

With an increase in kidney-related diseases, there is a rise in the need for diagnostic evaluations to assess renal function, leading to an increasing demand for kidney function assessments. Moreover, the growing awareness about the significance of early identification of kidney diseases is encouraging more people to partake in routine kidney function assessments. Educational campaigns by health organizations and governments about chronic kidney diseases (CKD) risks foster a culture of proactive health management, catalyzing the demand for renal function testing globally. Besides this, advancements in technology, including enhanced testing equipment, quicker and more precise results, and point-of-care (POC) testing options, are enhancing the accessibility and efficiency of renal function testing. These developments result in higher adoption, as healthcare systems look for dependable tools for prompt diagnosis and therapy.

To get more information on this market, Request Sample

The United States represents a vital part of the market, propelled by the accessible healthcare, which improves the distribution of renal diagnostic tests. Enhanced healthcare facilities, such as hospitals, clinics, and diagnostic centers, guarantee that a greater number of people can obtain kidney/renal function testing. Moreover, heightened understanding about the significance of early kidney disease detection motivates more people to have regular kidney function examinations. Health organizations and government-led educational campaigns regarding CKD risks promote a culture of proactive health management. In 2025, coinciding with National Safety Month, the American Association of Kidney Patients (AAKP) initiated the “Every Patient Safe” campaign to highlight safety hazards for kidney patients. The year-long program focuses on infection control, disaster preparedness, and overall enhancements in healthcare systems.

Kidney/Renal Function Test Market Trends:

Rising Prevalence of Kidney Diseases

The increasing worldwide prevalence of kidney diseases, particularly chronic kidney disease (CKD) and renal failure, is driving the need for kidney function tests. Unhealthy eating patterns, elevated blood pressure, and diabetes lead to kidney impairment, necessitating consistent monitoring and prompt identification. As the number of individuals diagnosed with kidney diseases rises, the need for accurate diagnostic tests to assess kidney health becomes critical. CKD now impacts approximately 13.4% of the world population and ranks as the 12th leading cause of death globally, with forecasts indicating it may become the fifth leading cause by 2040, as reported by Kidney Research and Clinical Practice. This growing strain on healthcare systems highlights the necessity for effective diagnostic tools to guarantee timely diagnosis and action. The rising demand for proactive management and long-term care of kidney health is bolstering the kidney/renal function testing market growth, ensuring timely disease prevention and improved patient outcomes.

Growing Geriatric Population

As individuals age, they become more prone to chronic conditions like hypertension, diabetes, and kidney disease, which can impair kidney function. Older adults are at a higher risk of kidney complications, making regular screening essential for early detection and effective management. The increasing number of elderly individuals is encouraging healthcare systems to concentrate more on preventing and managing age-related health problems, such as kidney dysfunction. According to information published by the World Health Organization (WHO) in 2024, by 2030, one in six individuals worldwide will be 60 years or older, with the number of people aged 60 and above rising from 1 billion in 2020 to 1.4 billion. By the year 2050, this number will increase to 2.1 billion. This change in demographics is driving the need for reliable and accessible kidney/renal function tests, emphasizing the importance of more regular monitoring to maintain long-term kidney health.

Advancements in Non-Invasive Testing Technologies

The development of advanced diagnostic tools, like non-invasive urine tests utilizing biosensors, offers a more precise and readily available approach for the early detection of kidney disease. These innovations remove the necessity for conventional invasive techniques, resulting in quicker, more cost-effective testing that is simpler to implement on a broader scale. As a result, the wider implementation of these technologies fosters early detection, improves patient results, and boosts the need for kidney/renal function tests, thereby strengthening the market growth. In 2024, researchers from Chung-Ang University in South Korea introduced a non-invasive urine test that employed a biosensor to identify early kidney disease by measuring SDMA, which was a more precise indicator than creatinine. The examination was cost-effective, quick, and ideal for extensive application. Its goal was to facilitate early detection and improved treatment results worldwide.

Kidney/Renal Function Test Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kidney/renal function test market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, product, and end use.

Analysis by Test Type:

- Urine Tests

- Blood Tests

Urine tests lead the market because they are non-invasive, easy to collect, and offer valuable information on kidney function. Urine is an easily accessible biological sample that can be gathered with little discomfort, making it a popular option for routine assessments and tracking kidney health. These tests are very efficient at identifying early indicators of kidney impairment, like protein or blood present in the urine, which are critical signs of diseases, such as chronic kidney disease. Furthermore, urine tests can be conducted rapidly and affordably, ensuring they are available in diverse healthcare environments. The capacity to evaluate several kidney-related factors with a single urine sample enhances their appeal. With increasing awareness about the significance of early detection, urine tests remain prevalent in the market for their ease of use, cost-effectiveness, and efficiency in identifying kidney disease.

Analysis by Product:

- Dipsticks

- Reagents

- Disposables

Dipsticks hold the biggest market share owing to their straightforwardness, low cost, and user-friendly nature. These assessments provide a quick and dependable approach for evaluating kidney function, especially in identifying issues like proteinuria, an early sign of kidney disease. Dipsticks are very affordable compared to alternative diagnostic instruments, enabling their use in various healthcare contexts, including hospitals, primary care facilities, and even point-of-care situations. Their simple use enables healthcare professionals to swiftly gather results, aiding in prompt decision-making for additional diagnostic procedures or treatments. Furthermore, dipsticks need little training to operate, making them suitable for extensive, regular testing, particularly in resource-limited regions. The rising need for quick, easy, and cost-effective renal function tests boosts the appeal of dipsticks, establishing them as a leading product in the market.

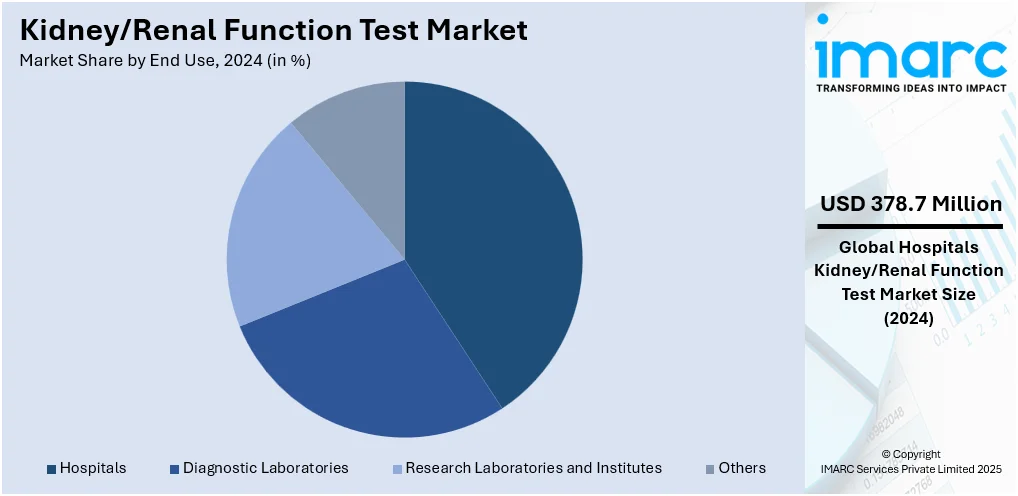

Analysis by End Use:

- Hospitals

- Diagnostic Laboratories

- Research Laboratories and Institutes

- Others

Hospitals represent the largest segment, accounting 40.6% market share. The dominance of the segment attributed to their pivotal role in patient diagnosis and care. As the main healthcare center for people with chronic and acute health issues, hospitals carry out a large number of renal function tests, both for regular monitoring and for patients receiving treatment for kidney-related ailments. These facilities provide access to sophisticated diagnostic tools and skilled healthcare specialists who can accurately analyze test outcomes. Furthermore, hospitals have the capability to manage severe cases, positioning them as the main option for intricate kidney evaluations and treatment strategies. The rising population of patients with kidney issues, especially those needing continuous treatment, enhances the need for renal function assessments in hospitals. Additionally, hospitals are essential in preventive care, often serving as the primary contact for those seeking diagnosis and treatment for kidney health problems, thus fostering ongoing development in this area.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market owing to its advanced healthcare infrastructure, significant technological adoption rates, and robust governmental backing for healthcare programs. The area enjoys a robust healthcare system, with both public and private sectors investing in cutting-edge diagnostic technologies. Moreover, North America has a substantial and aging demographic, heightening the need for consistent kidney health assessments. The existence of top healthcare providers, research organizations, and prominent medical device manufacturers further strengthens the market growth. Additionally, leading companies are increasingly integrating advanced technologies into their testing platforms to enhance accuracy and predict disease progression. For instance, in 2024, LifeLabs partnered with Klinrisk to launch the Klinrisk Score in Ontario, a predictive AI-based test using blood and urine samples to assess CKD progression risk. The tool provided a five-year outlook and clinical recommendations, enabling early intervention.

Key Regional Takeaways:

United States Kidney/Renal Function Test Market Analysis

In North America, the market portion held by the United States was 89.70%, due to an increasing demand for early diagnostics in preventive healthcare. The quick implementation of automated analyzers in outpatient environments enables quicker processing, while telehealth systems expand opportunities for at-home sample gathering. As per the National Kidney Foundation, its CKD Intercept initiative increased testing volumes by 60% and diagnoses by 25% at pilot locations within one year, underscoring the significance of proactive screening. This momentum is strengthened by a growing elderly population that regularly tracks age-related kidney deterioration, along with personalized medicine approaches that incorporate detailed kidney assessments. The increasing popularity of POC devices in retail clinics, along with the growth of employer-sponsored wellness programs, is leading to greater test utilization. Ongoing investment in biomarker research improves diagnostic precision, and the incorporation of cloud-based laboratory information systems is reducing clinical decision timelines. Additionally, partnerships between research institutions and diagnostic companies are accelerating the validation of innovative microfluidic tests that need small sample sizes, maintaining the country's leadership in global kidney function testing income.

Europe Kidney/Renal Function Test Market Analysis

The market for kidney/renal function tests in Europe is advancing consistently, driven by increasing kidney issues, strong public spending on laboratory upgrades, and comprehensive screening programs integrated into universal health systems. The European Health Kidney Alliance assesses that approximately 100 Million individuals currently have kidney disease, with an additional 300 Million at risk, highlighting the extent of unmet diagnostic requirements. Mobile diagnostic units are progressively accessing isolated communities, and the integration of electronic health records (EHRs) facilitates the exchange of data across borders. In reply, local health authorities are broadening occupational monitoring initiatives for workers with high exposure and encouraging metabolomic analysis to identify early kidney damage. Teleconsultation platforms integrate algorithm-based triage with home sample management, improving patient comfort. Collaborations between academia and industry are advancing the development of next-generation biomarkers, while increased public awareness initiatives aimed at metabolic wellness are driving the need for precise and swift renal panels in both primary and secondary care.

Asia Pacific Kidney/Renal Function Test Market Analysis

The Asia Pacific market for kidney/renal function tests is growing swiftly as urban living, consumption of processed foods, and inactive lifestyles increase metabolic risks. Industry reports suggest that one in seven people in the region's largest demographic could have chronic kidney disease, with more than 60% of instances associated with unmanaged diabetes or hypertension, and most individuals identified only at Stage 4 or 5, figures that highlight the urgency for earlier detection. Public health organizations are utilizing mobile labs to address diagnostic deficiencies in rural areas, as private investors expand high-capacity central laboratories in large metropolitan regions. Insurance reforms supporting preventive panels and the increasing access to affordable point-of-care analyzers are enhancing test volumes. Moreover, academic partnerships are advancing AI-based urinalysis algorithms designed for various genetic groups, enhancing result processing times and facilitating personalized kidney care.

Latin America Kidney/Renal Function Test Market Analysis

The market for kidney/renal function tests in Latin America is gaining traction as primary healthcare networks expand their diagnostic services, and health education initiatives promote preventive screenings. Community labs incorporate semi-automated analyzers that provide quicker eGFR and microalbumin results to healthcare professionals. A recent report in Brazil indicates that nearly all government financing for chronic kidney disease treatment is routed through the SUS system, with seven out of ten people, more than 150 million citizens, depending solely on this method, highlighting the necessity for accessible screening. Ongoing professional development in early kidney evaluation and the expansion of telepathology services are enhancing result uniformity in urban and semiurban regions. These elements together promote consistent adoption of kidney function testing across the region.

Middle East and Africa Kidney/Renal Function Test Market Analysis

The market for kidney/renal function tests in the Middle East and Africa is progressing due to significant investments in laboratory facilities and increasing urban lifestyles that highlight the importance of regular health assessments. Data indicates that total healthcare spending in the region is expected to reach approximately USD 77 Billion by 2027, demonstrating significant financial capability for enhanced diagnostics. The implementation of fully automated chemistry systems is reducing turnaround times, while screening outreach initiatives integrated into primary care facilities are increasing test volumes. Community health worker-led education programs are enhancing public knowledge about kidney health, supporting the market expansion.

Competitive Landscape:

Major participants in the market are concentrating on various tactics to enhance their standing. They are investing significantly in research and development (R&D) to launch cutting-edge and more precise diagnostic technologies, including non-invasive tests and sophisticated biosensors. Numerous companies are broadening their product ranges by launching new testing devices, platforms, and test kits to serve a wider patient population. Moreover, businesses are establishing strategic alliances with healthcare providers, broadening distribution channels, and improving their international presence. Their focus also lies in enhancing test affordability, making their products accessible to diverse healthcare systems, which further promotes market adoption. In 2024, Simple HealthKit launched a new kidney disease testing program at ViVE 2024, aimed at early detection in diabetic patients through at-home or in-clinic tests. The initiative supported underserved populations via a multi-language platform and real-time data integration.

The report provides a comprehensive analysis of the competitive landscape in the kidney/renal function test market with detailed profiles of all major companies, including:

- 77 Elektronika Kft.

- Abbott Laboratories

- Acon Laboratories, Inc.

- Arkray, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings

- Nova Biomedical

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Siemens Healthcare GmbH

- Sysmex Corporation.

Latest News and Developments:

- April 2025: Healthy.io acquired Labrador Health to enhance its at-home diagnostic capabilities. The integration aimed to develop the first-ever quantitative, home-based ACR test by 2026, addressing global gaps in chronic kidney disease care with smartphone-powered, lab-quality testing aligned with care pathways and international reimbursement frameworks.

- March 2025: Proteomics International launched PromarkerD, a predictive blood test for diabetic kidney disease, in Australia. The test identified risk in type 2 diabetes patients up to four years early. Initially offered in select regions, it marked a major step in the company’s global commercialization and accessibility efforts.

- March 2025: CareDx expanded AlloSure testing to pediatric heart transplant and simultaneous pancreas-kidney (SPK) patients. AlloSure Kidney was validated to detect rejection in SPK recipients, offering non-invasive monitoring. The launch aimed to enhance transplant care and reduce reliance on invasive biopsies while improving long-term patient outcomes.

- February 2025: Quest Diagnostics agreed to acquire kidney disease testing assets from Fresenius Medical Care's Spectra Laboratories. The deal included dialysis-related water testing and aimed to enhance Quest's end-stage kidney disease services. It enabled operational efficiencies and faster results through Quest’s nationwide lab network, with the full transition expected by early 2026.

- January 2025: Medtronic announced that CMS initiated a national coverage analysis for its Symplicity™ Spyral Renal Denervation System. This followed FDA approval and strong clinical data demonstrating long-term blood pressure reduction. The move aimed to expand Medicare access to minimally invasive treatment for patients with hypertension-related kidney complications.

Kidney/Renal Function Test Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Urine Tests, Blood Tests |

| Products Covered | Dipsticks, Reagents, Disposables |

| End Uses Covered | Hospitals, Diagnostic Laboratories, Research Laboratories and Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 77 Elektronika Kft., Abbott Laboratories, Acon Laboratories, Inc., Arkray, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, Nova Biomedical, Quest Diagnostics Incorporated, Randox Laboratories Ltd., Siemens Healthcare GmbH, Sysmex Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kidney/renal function test market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global kidney/renal function test market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kidney/renal function test industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kidney/renal function test market was valued at USD 932.72 Million in 2024.

The kidney/renal function test market is projected to exhibit a CAGR of 6.60% during 2025-2033, reaching a value of USD 1,729.24 Million by 2033.

The growth of the kidney/renal function test market is attributed to the rising occurrence of kidney diseases, higher awareness about early detection, advancements in diagnostic technology, and a growing aging population. Additionally, the demand for point-of-care testing and personalized medicine further contributes to the market expansion and development.

North America currently dominates the kidney/renal function test market, accounting for a share of 36.0%. The dominance of the region is attributed to sophisticated healthcare systems, widespread use of innovative diagnostic technologies, strong healthcare reimbursement policies, and a well-established medical research ecosystem. These factors, combined with a significant focus on healthcare innovation, contribute to its market leadership.

Some of the major players in the kidney/renal function test market include 77 Elektronika Kft., Abbott Laboratories, Acon Laboratories, Inc., Arkray, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, Nova Biomedical, Quest Diagnostics Incorporated, Randox Laboratories Ltd., Siemens Healthcare GmbH, Sysmex Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)