Kraft Paper Market Size, Share, Trends and Forecast by Product Type, Packaging, Application, Distribution Channel, and Region, 2025-2033

Kraft Paper Market Size and Share:

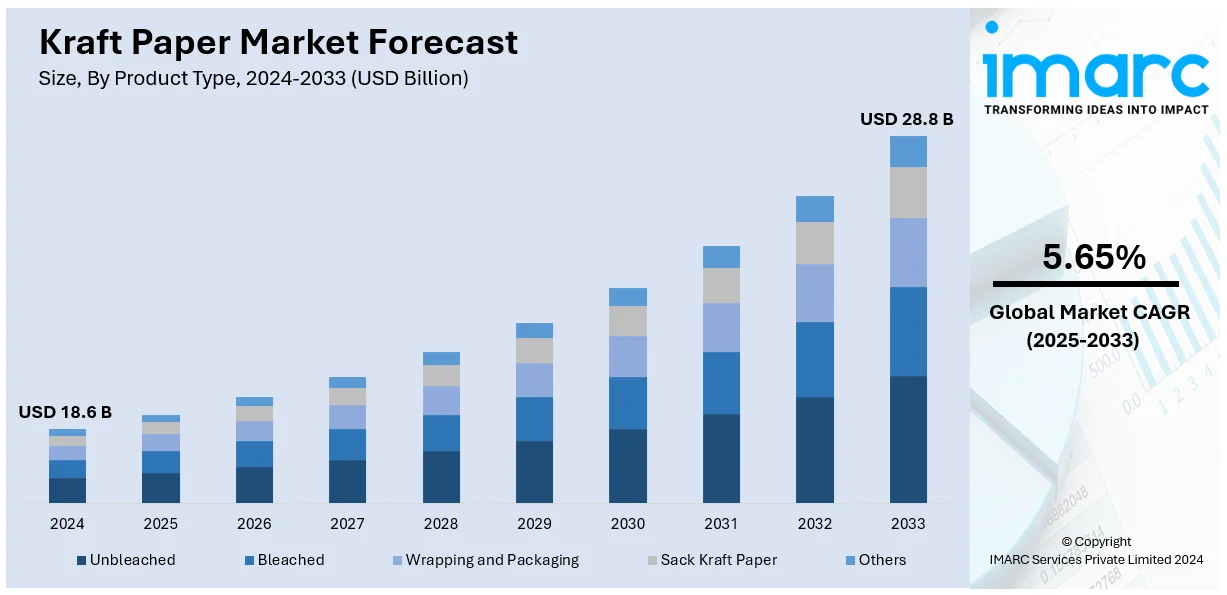

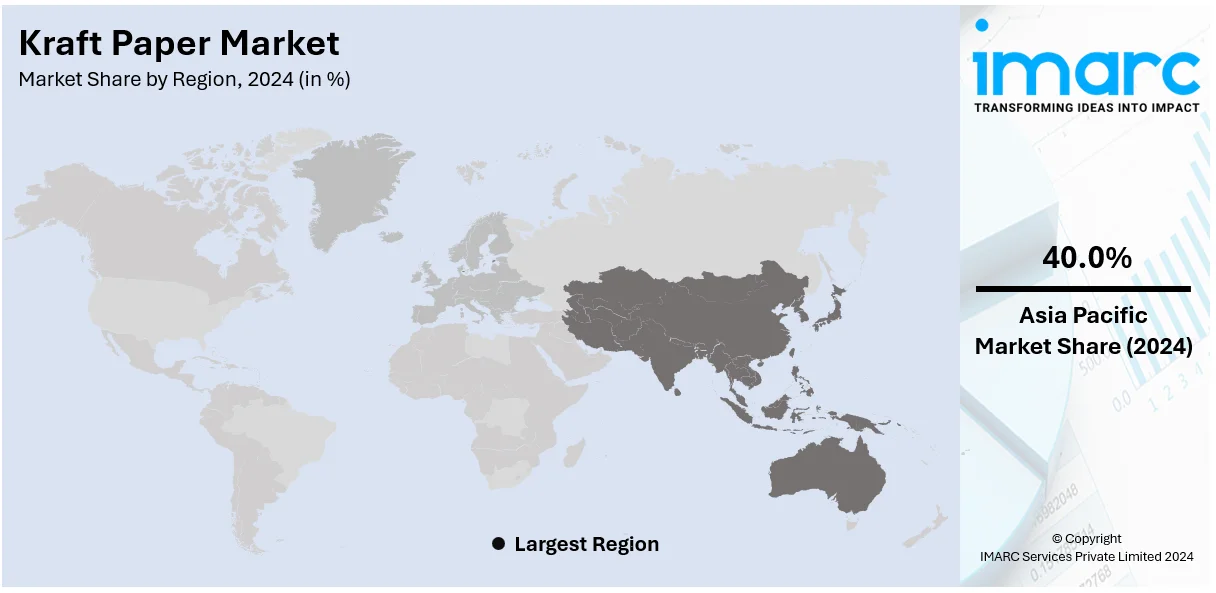

The global kraft paper market size was valued at USD 18.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.8 Billion by 2033, exhibiting a CAGR of 5.65% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The shifting consumer preferences toward compostable and sustainable packaging materials, the expanding e-commerce sector, rising urbanization and the need for convenience, the ongoing shift toward lightweight packaging, and the rising consumer preference for aesthetic and natural packaging are some of the major factors propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.6 Billion |

| Market Forecast in 2033 | USD 28.8 Billion |

| Market Growth Rate 2025-2033 | 5.65% |

The global kraft paper market is driven by increasing demand for eco-friendly and sustainable packaging solutions. As environmental concerns grow, consumers and businesses are seeking alternatives to plastic packaging, and kraft paper is a preferred choice due to its recyclability and biodegradability. The rise of e-commerce has further heightened the demand for kraft paper, as it is widely used in packaging, shipping, and protective materials. According to the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024 and is projected to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. Besides this, advancements in production technologies have also improved the quality and cost-effectiveness of kraft paper, contributing to market growth.

The United States has emerged as a key regional market for kraft paper, driven by the increasing demand for sustainable packaging solutions across industries. As environmental awareness grows, consumers and businesses are prioritizing eco-friendly materials, making kraft paper a preferred choice due to its recyclability and biodegradability. The rise of e-commerce has further heightened demand, as kraft paper is extensively used for packaging, shipping, and protective materials. As per a report published by the IMARC Group, the United States e-commerce market size is forecasted to reach USD 2,083.97 Billion by 2032, exhibiting a CAGR of 6.80% during 2024-2032. Additionally, the food and beverage, retail, and logistics sectors are key drivers, as they seek cost-effective, eco-conscious packaging alternatives that meet both consumer preferences and regulatory standards.

Kraft Paper Market Trends:

Increasing demand for sustainable packaging solutions

The main stimulus driving the kraft paper market share is the burgeoning demand for ecological and environmentally safe packaging. Consciousness among customers and companies continues to grow, wherein people are stepping away from plastics for packaging needs to sustainable means of packaging that would not impact the environment in any negative way. As per a report by the World Bank (2016), global annual waste generation is expected to jump to 3.4 Billion Tonnes over the next 30 years. Out of this, the world generated 242 Million Tonnes of plastic waste, boosting the demand for sustainable packaging solutions. Kraft paper, made with wood pulp and which can be destroyed and recycled again, is totally biodegradable and reusable. Secondly, as various food, beverages, and retailers industries embrace packaging made of kraft paper with relatively minimum environmental influence, its acceptance keeps increasing. As more developed and developing nations work hard to avoid plastic wastage and toward attaining sustainable objectives, there will be enhanced demand for products made out of kraft paper.

Expanding e-commerce sector and protective packaging needs

Large-scale growth in the e-commerce sector has boosted demand for kraft paper. The global e-commerce industry is growing at a rate of 27.16% annually, reaching USD 183.8 Trillion by 2032. More people are shopping online, which means a rise in the demand for packaging materials, primarily in shipping and protection. Kraft paper is used, given its durability and strength, for wrapping and cushioning goods while shipping. Its ability to guard products during shipment and prevent damage while being lightweight and cost-effective has made it increasingly popular within the e-commerce market. Most e-commerce transactions have packaging requirements that are strong yet sustainable in nature, placing kraft paper in a strategic position where businesses are likely to seek reliable packaging alternatives that meet consumer demand for eco-friendly material.

Increased urbanization and changing lifestyles

Increased urbanization and shifts in lifestyles are significantly driving the kraft paper market growth. The urban populace and the subsequent need for packaged products create greater demand in sectors such as food and beverages, retail, as well as electronics. According to the World Bank, 56% of the world's population, accounting for 4.4 Billion inhabitants, live in cities. This trend is expected to continue, with the urban population more than doubling its current size by 2050, when 7 of 10 people will live in cities. This increased trend to live within cities raises the demand for efficient, durable, and sustainable packaging solutions, with kraft paper growing in demand due to its strength and recyclability. The changing consumer lifestyle, including the increased desire for convenience foods, online shopping, and the more eco-friendly purchasing decisions, also propels the demand for sustainable packaging. Changes in consumer behavior along with the increase in urbanization are thereby driving the market growth for kraft paper as an important packaging material that meets both practical and environmental needs.

Kraft Paper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kraft paper market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, packaging, application, and distribution channel.

Analysis by Product Type:

- Unbleached

- Bleached

- Wrapping and Packaging

- Sack Kraft Paper

- Others

Unbleached stands as the largest component in 2024, holding around 32.0% of the kraft paper market share. Based on the kraft paper market industry analysis, the unbleached segment dominated the market share, attributed to its versatility and robustness. Unbleached kraft paper boasts exceptional strength and tear resistance due to the kraft pulping process that retains a substantial portion of the wood's inherent fibers. It is utilized in a wide range of applications, such as packaging and shipping, boosting the kraft paper industry. Moreover, the growing demand for reliable packaging solutions among industries is boosting the adoption of unbleached kraft paper due to its capacity to protect products during transit, favoring the kraft paper market scope. Furthermore, its coarser texture enhances grip and cushioning, making it suitable for wrapping delicate items or serving as a filler in packages.

Analysis by Packaging:

- Corrugated Box

- Grocery Bags

- Industrial Bags

- Wraps

- Pouches

- Others

Corrugated box leads the market with around 36.5% of market share in 2024. According to the kraft paper market industry outlook, corrugated boxes accounted for the largest segment as they serve as an essential means of packaging and protecting a diverse range of products. Moreover, their adaptability to different shapes, sizes, and weights, combined with the ability to be customized with various printing options, is boosting the kraft paper market demand. Additionally, the eco-friendliness of corrugated boxes contributes significantly to their market prevalence. Along with this, the growing consumer demand for sustainable and environmentally responsible packaging choices is propelling their adoption. The recycling infrastructure for corrugated material is well-established, further adding to its appeal and contributing to the circular economy. Besides this, the rising recognition among businesses about the importance of branding and aesthetic presentation is boosting the use of corrugated boxes as they offer opportunities for creative design and customization, enhancing the overall kraft paper market growth rate.

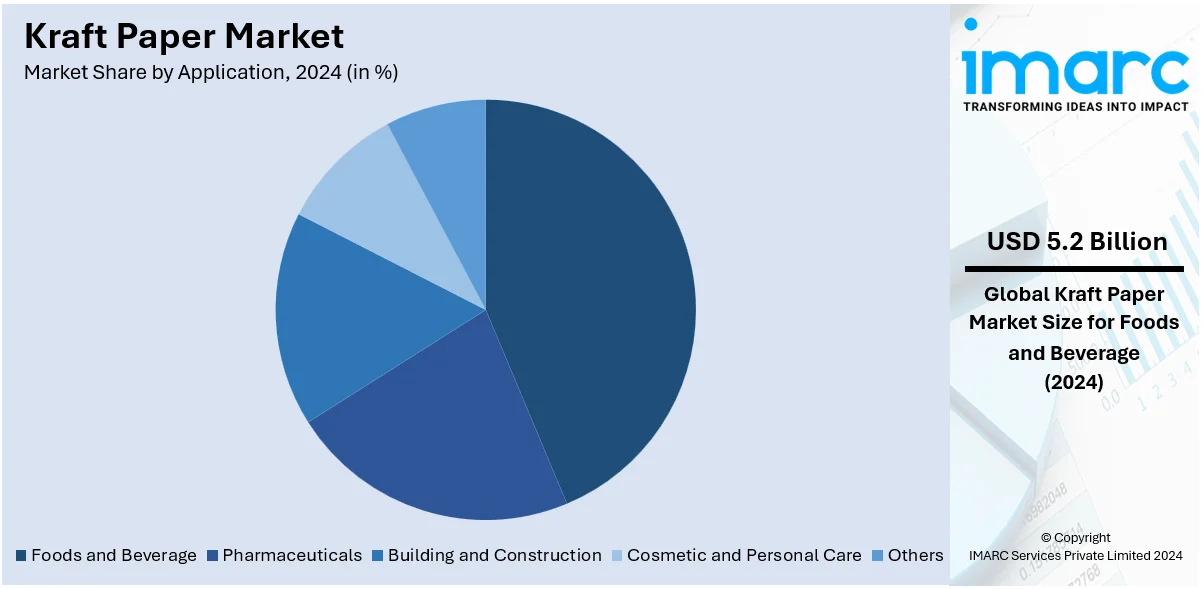

Analysis by Application:

- Foods and Beverage

- Pharmaceuticals

- Building and Construction

- Cosmetic and Personal Care

- Others

Foods and beverage leads the market with around 27.8% of market share in 2024. As per the kraft paper market industry outlook, the foods and beverage (F&B) sector represented the largest market share. Kraft paper possesses a degree of resistance to grease, moisture, and oil, which helps in maintaining the integrity of food products during storage and transportation. Moreover, it is an ideal choice for packaging items, including baked goods, snacks, confectioneries, and dry foods. Additionally, the aesthetic appeal of the paper complements the organic and wholesome image that several food and beverage brands strive to convey, thereby positively impacting the kraft paper market revenue. The earthy brown color and textured surface resonate with consumers who associate these attributes with natural and eco-friendly choices. This alignment between kraft paper's visual appeal and the values of health-conscious and environmentally aware consumers is bolstering the global kraft paper market size. Furthermore, the growing trend of sustainable packaging solutions has been a key driver for kraft paper's dominance in the foods and beverage industry.

Analysis by Distribution Channel:

- Offline

- Online

distribution encompasses a wide range of traditional methods, including brick-and-mortar stores, specialty paper shops, wholesalers, and distributors. It is integral in catering to a diverse array of businesses and consumers who prefer a hands-on approach to purchasing kraft paper. Additionally, offline outlets serve as a hub for professional clientele, such as packaging designers, artists, and crafters, who are seeking tailored solutions and expert advice.

On the other hand, the convenience, accessibility, and wide variety offered by online platforms have contributed to the prominence of this distribution segment. E-commerce platforms and online marketplaces provide a virtual marketplace for consumers and businesses to explore a vast range of kraft paper options, compare prices, read reviews, and place orders from the comfort of their homes or offices, thus enhancing the overall kraft paper market share.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. According to the kraft paper market price analysis and trends, Asia Pacific dominated the market share due to its economic dynamism, characterized by robust manufacturing, industrialization, and urbanization. Moreover, rapidly expanding sectors such as e-commerce, retail, and consumer goods rely heavily on kraft paper for its durability, eco-friendliness, and versatility. Additionally, the growing middle-class population across countries in the region has further fueled consumption, while increased urbanization has led to greater demand for efficient packaging solutions. Furthermore, Asia Pacific's status as a manufacturing hub has impelled the demand for industrial packaging, boosting the use of kraft paper due to its strength and suitability. Besides this, the region's commitment to sustainability and heightened initiatives to reduce plastic waste are driving businesses and consumers toward environmentally responsible alternatives and stimulating the kraft paper market growth opportunities.

Key Regional Takeaways:

United States Kraft Paper Market Analysis

In 2024, the United States accounts for over 72.80% of the kraft paper market in North America. The U.S. kraft paper market is significantly driven by the rapid growth of the e-commerce sector, which accounts for a substantial portion of the demand for packaging solutions. According to industry reports, the U.S. is home to nearly 14 Million e-commerce sites, accounting for approximately 53% of all websites worldwide, far exceeding any other country. This rise in online shopping has led to a growing need for kraft paper for packaging, particularly for shipping and product protection. The increasing preference for sustainable packaging materials is also a major driver, with businesses opting for eco-friendly alternatives to plastic. Kraft paper, known for its biodegradability and recyclability, has become a leading choice for companies aiming to align with consumer demand for environmentally responsible products. Additionally, the food and beverage sector, particularly for takeout packaging, and advancements in manufacturing technologies, which improve production efficiency and reduce costs, further contribute to industry expansion. The U.S. government's regulatory focus on waste reduction and recycling further strengthens the adoption of kraft paper as a sustainable packaging option. Combined with the robust logistics infrastructure, these factors are driving significant growth in the U.S. kraft paper market.

Asia Pacific Kraft Paper Market Analysis

The Asia Pacific region's kraft paper market is driven by the rapid growth of the packaging industry, particularly in countries such as China, India, and Japan. East Asia and the Pacific are the world's most rapidly urbanizing regions, averaging 3% per annum, as per the World Bank. Urban growth highly increases packaging demand, specifically for e-commerce and food and beverage. Kraft paper has become an essential material since it is deemed friendly to the environment. It was noticed that these developments in China and India created massive e-commerce growth and that more food was ordered for home delivery, adding impetus to the demand for kraft paper. Governments supporting sustainability and recycling activities also influence the increasing acceptance of kraft paper as a possible packaging material. The advancement of manufacturing technologies, as well as demands for quality, are enhancing production processes while reducing costs of production, making kraft paper cheaper and more sustainable.

Europe Kraft Paper Market Analysis

Increasing demands for sustainable packaging solutions are driving the kraft paper market in the European region. In 2023, about 70% of the population of the EU aged 16-74 years shopped or placed orders for products and services via e-commerce, evidencing a great rise in its usage. This is a key driver for the kraft paper market since packaging materials, particularly for shipping and product protection, are in higher demand. The consumer preference for sustainable packaging, driven by government regulations on plastic usage and waste management, has further increased the adoption of kraft paper. The expanding food and beverage sector, particularly in takeaway and delivery services, contributes to the growth of the market. In addition, technological advancements in kraft paper have made its product quality more improved and less costly, making it more competitive. This trend is likely to continue, particularly with European governments continuing to implement sustainability initiatives and encouraging recycling, thus driving up the demand for kraft paper through both environmental concerns and growing e-commerce.

Latin America Kraft Paper Market Analysis

In Latin America, the kraft paper market is driven by the increasing demand for sustainable packaging solutions, particularly in the food and beverage sector. As consumer awareness about environmental issues grows, businesses are increasingly adopting eco-friendly packaging alternatives, fueling the demand for kraft paper. For instance, the Latin America online grocery market reached USD 3.4 Billion in 2023, contributing to the expansion of sustainable packaging needs. The rise of e-commerce in countries such as Brazil and Mexico further propels this demand, particularly for shipping and product packaging. Additionally, government initiatives promoting sustainability and reducing plastic waste support the growing adoption of kraft paper.

Middle East and Africa Kraft Paper Market Analysis

The growing Middle East beverage packaging market is a key driver of the kraft paper market, as the demand for sustainable packaging solutions continues to rise. Projected to grow at a compound annual growth rate (CAGR) of 4.27% from 2024 to 2032, the beverage packaging sector significantly increases the need for eco-friendly materials such as kraft paper. As the beverage industry expands, particularly in takeout and delivery services, there is a notable shift toward environmentally responsible packaging options. The demand for alternatives to plastic, alongside increasing consumer awareness and government regulations promoting recycling, positions kraft paper as an ideal solution for the region's packaging needs.

Competitive Landscape:

To increase their market growth, key players operating in the kraft paper market are following various strategies. Many companies are raising their production levels by investing in advanced manufacturing technology to fulfill the greater demand for green and long-lasting packaging products. Several players aim to enhance their product lines by adding differentiated kraft paper products. These differentiated options include recycled as well as biodegradable options, targeted specifically at consumers who are becoming increasingly concerned about the environment. In addition, the leading manufacturers are entering into strategic partnerships and collaborations with e-commerce and retail companies to supply packaging materials. Such activities, coupled with efforts at improving the quality and sustainability of their products, are driving growth in the market and ensuring a steady supply of Kraft paper across diverse industries.

The report provides a comprehensive analysis of the competitive landscape in the kraft paper market with detailed profiles of all major companies, including:

- Ahlstrom-Munksjö Oyj

- BillerudKorsnäs AB

- Canadian Kraft Paper Ltd.

- Canfor Corporation

- CMPC

- Gascogne Papier

- International Paper Company

- Mondi PLC

- SCG International Corporation Co. Ltd.

- Segezha-Group

- Smurfit Kappa Group plc

- Stora Enso Oyj

- Tokushu Tokai Paper Co. Ltd.

- WestRock Company

Latest News and Developments:

- October 2024: Lintec has introduced an unbleached and uncolored kraft paper to its range of water-repellent materials designed to resist rainwater permeation. This new offering is particularly well-suited for applications such as carrier bags and envelopes. Targeted primarily at the logistics sector, sales commenced on October 25th.

- February 2024: Fourniture Industrie Service (FIS) has developed a bubble wrap alternative made from recycled kraft paper, addressing the growing demand for sustainable packaging solutions without compromising product protection. This innovation aligns with the packaging sector's shift toward sustainability, with FIS citing initiatives such as Amazon’s collaboration with the US Department of Energy’s BOTTLE Consortium to recover and recycle mixed waste materials as evidence of increasing industry focus on eco-friendly practices.

Kraft Paper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Unbleached, Bleached, Wrapping and Packaging, Sack Kraft Paper, Others |

| Packagings Covered | Corrugated Box, Grocery Bags, Industrial Bags, Wraps, Pouches, Others |

| Applications Covered | Foods and Beverage, Pharmaceuticals, Building and Construction, Cosmetic and Personal Care, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ahlstrom-Munksjö Oyj, BillerudKorsnäs AB, Canadian Kraft Paper Ltd., Canfor Corporation, CMPC, Gascogne Papier, International Paper Company, Mondi PLC, SCG International Corporation Co. Ltd., Segezha-Group, Smurfit Kappa Group plc, Stora Enso Oyj, Tokushu Tokai Paper Co. Ltd., WestRock Company etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kraft paper market from 2019-2033.

- The kraft paper market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kraft paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kraft paper market was valued at USD 18.6 Billion in 2024.

The kraft paper market is projected to exhibit a CAGR of 5.65% during 2025-2033, reaching a value of USD 28.8 Billion by 2033.

The global market is largely driven by rising demand for sustainable packaging, the rapid expansion of e-commerce, increasing urbanization, advancements in production technologies, and growing consumer preferences for lightweight, aesthetic, and environmentally friendly materials across various industries such as food, beverages, and logistics.

Asia Pacific currently dominates the kraft paper market, accounting for a share exceeding 40.0%. This dominance is fueled by robust manufacturing, e-commerce growth, urbanization, and rising demand for eco-friendly packaging in China, India, and Southeast Asia.

Some of the major players in the kraft paper market include Ahlstrom-Munksjö Oyj, BillerudKorsnäs AB, Canadian Kraft Paper Ltd., Canfor Corporation, CMPC, Gascogne Papier, International Paper Company, Mondi PLC, SCG International Corporation Co. Ltd., Segezha-Group, Smurfit Kappa Group plc, Stora Enso Oyj, Tokushu Tokai Paper Co. Ltd., and WestRock Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)