Laboratory Automation Market Size, Share, Trends and Forecast by Type, Equipment and Software Type, End-User, and Region, 2025-2033

Laboratory Automation Market Size and Share:

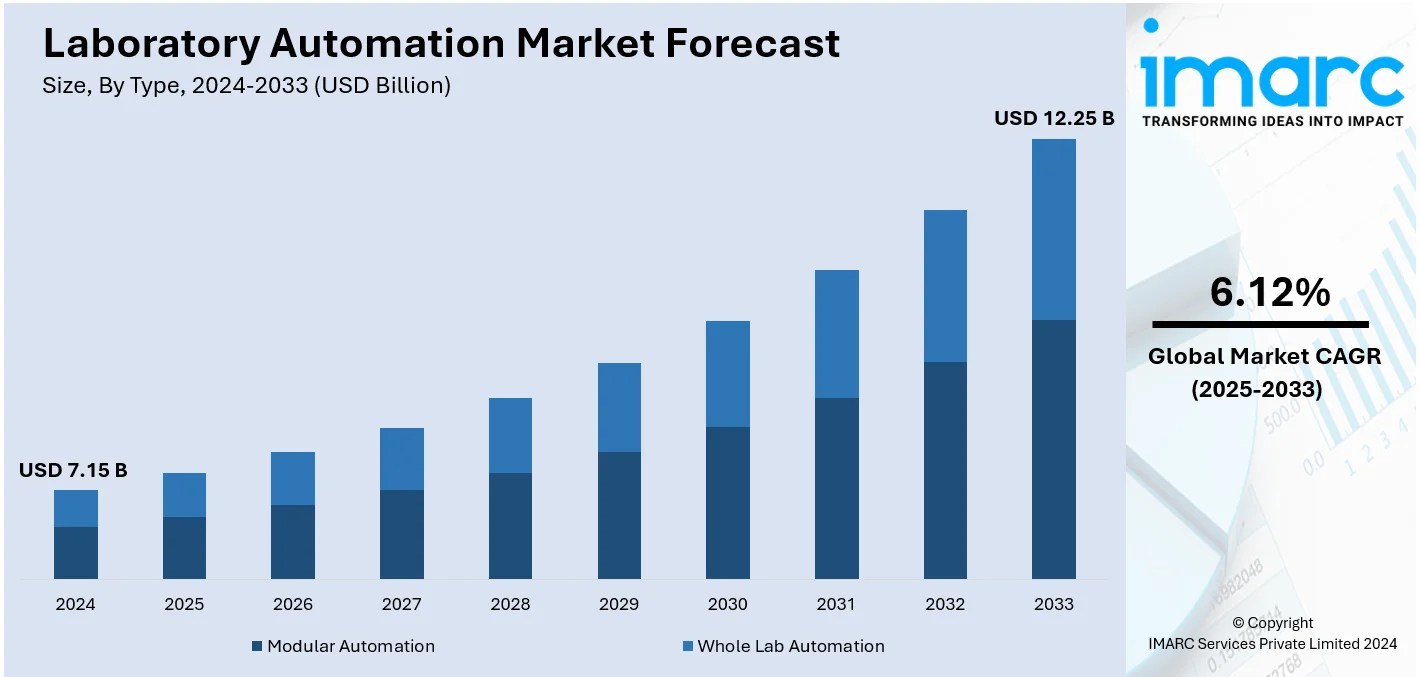

The global laboratory automation market size was valued at USD 7.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.25 Billion by 2033, exhibiting a CAGR of 6.12% from 2025-2033. North America currently dominates the market, holding a market share of over 51.6% in 2024. The market is experiencing steady growth driven by the escalating demand for enhanced efficiency, rising focus on data-driven decision-making, and integration of advanced technologies to analyse data and improve the accuracy and reliability of results.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.15 Billion |

|

Market Forecast in 2033

|

USD 12.25 Billion |

| Market Growth Rate (2025-2033) | 6.12% |

The laboratory automation market is rapidly growing because of the increasing incorporation of new technologies, such as robotics, artificial intelligence, and data analysis. The inclination towards high-throughput solutions in drug discovery, genomic studies, and clinical diagnostics is bolstering the deployment of automated systems. Additionally, some of the primary industries using automation include the pharmaceutical and biological processing companies that possess vast market share and need automation to increase efficiency, decrease inaccuracies, and bring products to market faster. The adoption of cloud solutions and modular automation platforms is consequently stimulating the growth of the market and providing improved scalability of data management. Further, advancement to precision medicine and personalized healthcare also increased the need for automating research and diagnostics laboratories to accomplish enhanced operational efficiency.

In the United States, the laboratory automation market is experiencing significant growth, driven by the magnifying biopharmaceutical sector, workforce shortages, and the rising demand for accurate and rapid testing solutions. Automation technologies are increasingly being adopted to enhance efficiency and reliability in clinical diagnostics, particularly for high-volume testing. For instance, in June 2024, Keragon, a HIPAA-compliant AI automation platform, launched out of stealth, one of the first no-code workflow automation platform, with USD 3 million in funding, to streamline U.S. healthcare workflows. Moreover, it is available with 100 pre-built integrations, smart error debugging capabilities, and several data transformation helpers, improving efficiency, reducing costs, and enhancing outcomes for providers and patients. The strong presence of leading biotechnology companies, coupled with robust regulatory support, further accelerates advancements in laboratory automation technologies, ensuring the sector continues to address the evolving needs of healthcare axwnd research.

Laboratory Automation Market Trends:

Rising demand for enhanced efficiency

The growing demand for laboratory automation on account of the increasing focus on enhanced efficiency is offering a positive market outlook. In line with this, laboratories across various industries are constantly seeking ways to optimize their operations. According to the United States Geological Survey, the USGS operates a network of more than 500 laboratories across the United States. Moreover, automation plays a pivotal role by reducing manual labor, minimizing errors, and streamlining processes, which is bolstering the market growth. Besides this, laboratories can significantly increase throughput while maintaining a high level of accuracy by automating routine and repetitive tasks, such as sample handling, data collection, and analysis. Additionally, there is a rise in the demand for efficiency in applications like clinical diagnostics, where precise and rapid results are crucial. With automation, laboratories can process a large number of samples simultaneously, leading to quicker turnaround times. Apart from this, automation assists in eliminating human intervention and ensuring that laboratories can operate efficiently and effectively, ultimately enhancing their productivity and competitiveness.

Technological advancements

Innovations, such as robotics, artificial intelligence (AI), and machine learning (ML) benefit in improving laboratory processes, which is contributing to the growth of the market. According to the government of UK, the proportion of companies offering machine learning-driven products and services across sectors has increased from 21% in 2022 to 35% in 2023. In addition, robotics enables the automation of intricate and delicate tasks that were performed exclusively by skilled technicians. Apart from this, AI and ML algorithms are used to analyze data and make real-time decisions, thereby improving the accuracy and reliability of results. Moreover, drug discovery and high-throughput screening systems can rapidly test thousands of compounds for potential therapeutic effects, accelerating the drug development process. Similarly, automated analyzers can process and analyze large volumes of patient samples with unmatched precision, leading to more accurate diagnoses and treatment decisions in clinical laboratories. In line with this, the Internet of Things (IoT) devices are integrated into laboratory equipment to monitor and control experiments remotely. This connectivity enables real-time data access and management. Additionally, advanced data analytics tools help researchers interpret large datasets more effectively, which is impelling the market growth.

Increasing focus on data-driven decision making

The rising focus on data-driven decision-making is propelling the growth of the market. Apart from this, laboratories are focusing on collecting, analyzing, and leveraging data to make informed decisions. In addition, laboratory automation systems play a vital role as they generate vast amounts of data with high precision and consistency. This data can be utilized for research, quality control, and process optimization. Moreover, laboratory automation facilitates the seamless integration of data collection and analysis, allowing researchers and analysts to access real-time information and insights. This not only improves research and development (R&D) but also enables laboratories to spot trends, identify outliers, and make adjustments promptly. In line with this, the increasing focus on maintaining detailed records and traceability and ensuring compliance with stringent standards, particularly in the pharmaceuticals and food and beverage (F&B) sectors is supporting the growth of the market. For instance, in September 2024, ACD/Labs announced the release of version 2024 of its Spectrus Platform, enhancing data-driven decision-making, AI integration, and workflow automation, improving productivity and collaboration in life sciences and pharmaceutical industries. Additionally, data-driven decision-making systems can provide real-time insights during experiments, which is strengthening the market growth.

Laboratory Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global laboratory automation market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type, equipment and software type, and end-user.

Analysis by Type:

- Modular Automation

- Whole Lab Automation

Modular automation stands as the largest component in 2024, holding around 63.1% of the market. It involves the use of individual automated modules or components within a laboratory workflow. These modules can include automated liquid handling systems, sample preparation stations, analytical instruments, and robotic arms. Laboratories often adopt modular automation to enhance specific parts of their processes while maintaining some manual operations. Modular automation provides flexibility, allowing labs to customize and expand their automation solutions as per their needs. This approach is particularly popular in research and development (R&D) settings where workflows can vary.

Analysis by Equipment and Software Type:

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

Automated clinical laboratory systems lead the market with around 61.5% of market share in 2024. These systems are used in clinical diagnostic laboratories, healthcare facilities, and medical research centers. It includes a range of equipment and software solutions, from automated analyzers and sample processors to diagnostic instruments and laboratory information management systems (LIMS). Automated clinical laboratory systems are important because they carry out many kinds of different diagnostic tests, including blood chemistry analysis, hematology, microbiology, immunology, and molecular diagnostics. In addition, they are streamlining the testing process, reducing turnaround times, increasing accuracy, and improving patient care through rapid and reliable test results for healthcare professionals.

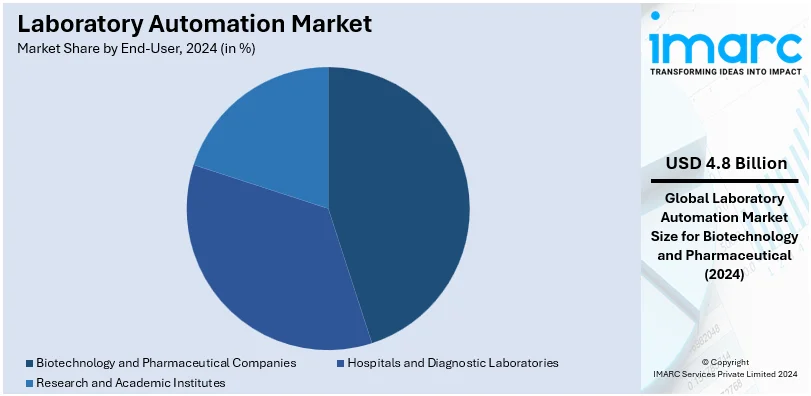

Analysis by End-User:

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

Biotechnology and pharmaceutical companies lead the market with around 67.0% of market share in 2024. These sectors use automating systems to optimize their crucial activities, such as drug discovery, development, and production to achieve higher efficiency and precision. High-throughput screening systems, compound pooling and storage, method development or optimization, quality check, and data management and analysis are common applications of laboratory automation systems. Through the use of automated technologies, these companies have enhanced the time taken in bringing the new drugs to market, decreased on production blunders and enhanced operational efficiency. In addition, automation is scalable, speeds up research turnaround times, and supports compliance with stricter government regulations, making it an important pillar for propelling modern biotechnology and pharmaceutical operations.

Regional Analysis:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 51.6%. According to the report, North America accounted for the largest market share on account of the presence of major pharmaceutical and biotechnology companies, research institutions, and healthcare facilities. Furthermore, these organizations have incorporated laboratory automation technology to modify their drug discovery programs, clinical diagnosis, and research activities. Moreover, the increased need for higher-throughput screening, data accuracy, and efficient operations is driving the growth of the market within the region. Additionally, factors such as quality control and accuracy of data are becoming important factors in the development of the market.

Key Regional Takeaways:

United States Laboratory Automation Market Analysis

In 2024, United States accounted for 88.90% of the market share in North America. The laboratory automation market in the United States is experiencing significant growth as healthcare institutions and research organizations are increasingly adopting automation technologies to enhance productivity and efficiency. Rising demand for high-throughput testing, especially in diagnostics and pharmaceutical research, is driving the market's expansion. Laboratories are integrating robotic systems, artificial intelligence, and advanced data analytics to streamline workflows and reduce human error. The increasing focus on precision medicine and personalized treatments is driving the adoption of automation to manage the complexity of testing and data analysis. Additionally, the ongoing push for reducing operational costs and improving laboratory safety is prompting the adoption of automated systems. The need for faster and more accurate results in clinical and research environments is accelerating the integration of automation solutions, which are enhancing laboratory performance. As regulatory requirements become stricter, laboratories are investing in automation to meet compliance standards more efficiently. According to the U.S. Department of Energy, the United States Department of Energy operates 17 national laboratories.

Europe Laboratory Automation Market Analysis

The growing demand for enhanced efficiency and accuracy in laboratory processes is driving significant growth in the laboratory automation market across Europe. To streamline workflows, reduce human error, and boost productivity, companies are increasingly turning to automated solutions. The rising need for faster and more reliable diagnostic results in healthcare and pharmaceutical industries is driving the adoption of automation technologies. According to the Office for National Statistics, in 2020, the total healthcare expenditure in the UK amounted to £257.6 Billion (USD 324.2 Billion), representing a per capita expenditure of £3,840 (USD 4,761.60). Moreover, the capabilities of laboratory automation systems are being enhanced by advancements in robotics, artificial intelligence, and machine learning, which are making these systems more precise and versatile. Laboratories are also focusing on meeting stringent regulatory standards, prompting them to integrate automation to ensure compliance and consistency. The growing trend of personalized medicine and the increasing volume of data generated in research and diagnostics are further fueling the market.

Asia Pacific Laboratory Automation Market Analysis

The laboratory automation market in Asia Pacific is experiencing rapid growth due to several key drivers. Increasing demand for high-throughput testing in pharmaceutical and biotechnology sectors is driving the adoption of automated systems. According to the India Brand Equity Foundation (IBEF), the Indian pharmaceutical industry is currently experiencing a compound annual growth rate (CAGR) of 6-8% from FY18 to FY23, driven by an ongoing 8% increase in exports and a 6% rise in the domestic market. Governments and research institutions are investing heavily in improving laboratory efficiency, which is encouraging the integration of automation technologies. The rising focus on minimizing human error and enhancing accuracy in laboratory processes is fostering automation adoption. Additionally, advancements in robotics and artificial intelligence are making laboratory automation solutions more accessible and cost-effective.

Latin America Laboratory Automation Market Analysis

The laboratory automation market in Latin America is expanding as healthcare institutions are increasingly adopting advanced technologies to improve efficiency and accuracy in diagnostic testing. Companies are investing in automation systems to streamline laboratory operations and reduce human errors. The growing demand for high-throughput testing, coupled with the need for faster results in clinical and research environments, is driving this trend. Additionally, rising healthcare expenditures and a focus on improving laboratory productivity are further fueling market growth across the region. According to the International Trade Administration, Brazil is Latin America’s largest healthcare market, allocating 9.47% of its GDP, equivalent to USD 161 billion, to healthcare expenditures.

Middle East and Africa Laboratory Automation Market Analysis

The laboratory automation market in the Middle East and Africa is experiencing significant growth due to increasing demand for advanced technologies in healthcare, pharmaceuticals, and research sectors. Organizations are adopting automated systems to improve efficiency, reduce human error, and enhance precision in testing and analysis. Rising investments in healthcare infrastructure and government initiatives supporting research and development are further driving the market. According to the International Trade Administration, in the 2022 federal budget, a total of USD 17.18 Billion (AED 63.066 Billion) was approved for public spending, out of which 7.6% was dedicated to healthcare.

Competitive Landscape:

The market is challenging and competitive, accompanied by various major stakeholders and emerging companies exerting effort for development and market share. The competitions for improvement have run into technology advancements for robotics, artificial intelligence, and data analytics, equipping laboratories with efficiency and precision in activities. Companies are emphasizing on establishing automation solutions with modularity and scalability to fulfill several functions in healthcare, pharmaceutical, and research industries. Furthermore, the dynamics in this industry include strategic partnerships, mergers, and acquisitions because firms aim at achieving a wide geographical market reach and offering diverse products. For instance, in May 2024, Beckman Coulter Diagnostics and MeMed expanded their partnership in the United States and Europe, with Beckman Coulter distributing the MeMed BV assay and MeMed Key, enhancing rapid, accurate infection diagnostics and clinical decision-making. Additionally, the growing demand for high-throughput solutions and integration of cloud-based technologies further intensify competition, fostering continuous advancements in the market.

The report provides a comprehensive analysis of the competitive landscape in the laboratory automation market with detailed profiles of all major companies, including:

- Danaher

- PerkinElmer

- Tecan Group

- Thermo Fisher

- Abbott Diagnostics

- Agilent Technologies

- Aurora Biomed

- Becton, Dickinson and Company

- Biomatrix

- Biotech Instruments

- Brooks Automation

- Cerner

- Eppendorf

- Hamilton Storage Technologies

- LabVantage Solutions

- Labware

- Olympus

- Qiagen

- Roche Holding

- Siemens Healthcare

Latest News and Developments:

- February 2024: Carbon, 3D printing technology company, launched its Automatic Operation (AO) suite, enhancing dental lab automation. Key components include the Automatic Print Preparation, which automates model print project setups, and the AO Backpack, enabling up to 14 hours of overnight production with a print turnover of under 5 minutes. This suite aims to significantly boost efficiency and reduce labor in dental labs.

- April 2024: Agilent Technologies launched the Advanced Dilution System (ADS 2), enhancing laboratory efficiency. The system integrates with Agilent autosamplers and analytical instruments, promoting productivity and cost-effectiveness. The ADS 2 is particularly beneficial for food, environmental, pharmaceutical testing, and advanced materials sectors, including battery research.

- March 2023: Brooks Automation US, LLC ("Brooks") has successfully signed and completed the acquisition of Aim Lab Automation Technologies Pty Ltd. ("Aim Lab"). This acquisition is in line with Brooks' strategic growth objectives to enhance its portfolio of solutions within the lab automation sector.

- June 2023: Kokilaben Dhirubhai Ambani Hospital in Mumbai has implemented Total Lab Automation (TLA) technology, powered by Roche Diagnostics. This advanced system aims to enhance patient care, with a particular focus on advancing preventive healthcare initiatives.

Laboratory Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Modular Automation, Whole Lab Automation |

| Equipment and Software Types Covered |

|

| End-Users Covered | Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research and Academic Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Danaher, PerkinElmer, Tecan Group, Thermo Fisher, Abbott Diagnostics, Agilent Technologies, Aurora Biomed, Becton, Dickinson and Company, Biomatrix, Biotech Instruments, Brooks Automation, Cerner, Eppendorf, Hamilton Storage Technologies, LabVantage Solutions, Labware, Olympus, Qiagen, Roche Holding, Siemens Healthcare, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the laboratory automation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global laboratory automation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the laboratory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The laboratory automation market was valued at USD 7.15 Billion in 2024.

The laboratory automation market is projected to exhibit a CAGR of 6.12% during 2025-2033, reaching a value of USD 12.25 Billion by 2033.

The market is primarily driven by the increasing demand for high-throughput testing, rising adoption of advanced diagnostic technologies, and a focus on reducing errors and costs., workforce shortages in laboratories and growing biopharmaceutical research.

North America currently dominates the market, accounting for a share of over 51.6%, driven by advanced healthcare infrastructure, increasing R&D activities, rising demand for high-throughput screening, technological advancements, and growing adoption of automated systems in diagnostics.

Some of the major players in the laboratory automation market include Danaher, PerkinElmer, Tecan Group, Thermo Fisher, Abbott Diagnostics, Agilent Technologies, Aurora Biomed, Becton, Dickinson and Company, Biomatrix, Biotech Instruments, Brooks Automation, Cerner, Eppendorf, Hamilton Storage Technologies, LabVantage Solutions, Labware, Olympus, Qiagen, Roche Holding, and Siemens Healthcare, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)