Latin America Air Conditioning Systems Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Technology, End Use, and Country, 2025-2033

Latin America Air Conditioning Systems Market Overview:

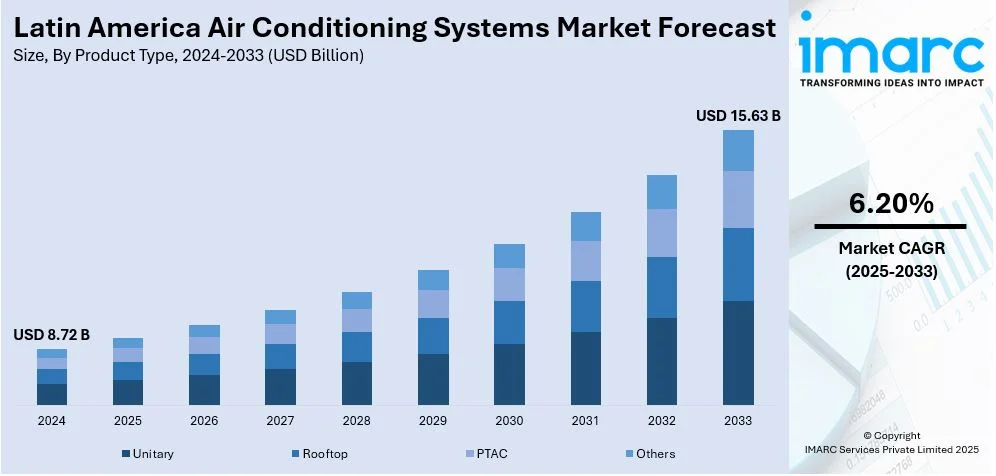

The Latin America air conditioning systems market size reached USD 8.72 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.63 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The expanding urbanization, increased focus on energy-efficient systems, ongoing technological advancements, inflating disposable incomes, rise in construction projects, government incentives for eco-friendly solutions, and a thriving commercial sector are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.72 Billion |

| Market Forecast in 2033 | USD 15.63 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

Latin America Air Conditioning Systems Market Trends:

Rising Demand Driven by Urbanization and Economic Growth

The rapid urbanization in various Latin American countries is acting as a significant growth-inducing factor, as new properties often incorporate built-in AC systems. For instance, as per the UNDP, 82% of the total population in Latin America and the Caribbean resides in urban regions as of 2024, in comparison to 58% of the global average. In line with this, the expanding middle class, with greater purchasing power and changing lifestyle preferences, is boosting the demand for AC systems in homes, offices, and public buildings. For instance, as per industry reports, air conditioners demand across Honduras, Cuba, and El Salvador, key countries in Latin America, is anticipated to elevate significantly, reaching to 3.5 Million unites by the year 2030, depicted an increase of 51% from the installed units in 2020. Moreover, the region’s extreme climate conditions have heightened the need for reliable cooling solutions, as consumers seek improved comfort and better quality of life. These factors contribute to the steady rise in the market for AC systems, meeting the region's growing need for efficient, modern solutions that cater to evolving living and working environments, thus supporting the market expansion.

Shift Toward Energy-Efficient and Environmentally Friendly Technologies

The growing awareness of climatic changes and environmental sustainability has led consumers and businesses to prioritize air conditioning (AC) units, that deliver high performance with minimal ecological impact. In line with this, higher energy prices have encouraged them to opt for AC systems that help reduce electricity consumption and lower utility bills. This economic pressure is driving the market toward solutions that offer substantial long-term savings, making energy-saving technologies, such as inverter systems and smart control features, more appealing choices. Additionally, stringent government regulations and incentives encouraging the adoption of eco-friendly cooling solutions to support environmental goals as consumers seek sustainable alternatives that reduce energy consumption and carbon footprints, are fueling the market growth. For instance, as per industry reports, increasing installation of better climate-friendly and energy-saving air conditioners across Latin America's residential segment will aid in reduction of carbon emissions by more than 35 Million Tons, along with electricity costs saving of more than USD 6 Billion.

Latin America Air Conditioning Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, technology, and end use.

Product Type Insights:

- Unitary

- Rooftop

- PTAC

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes unitary, rooftop, PTAC, and others.

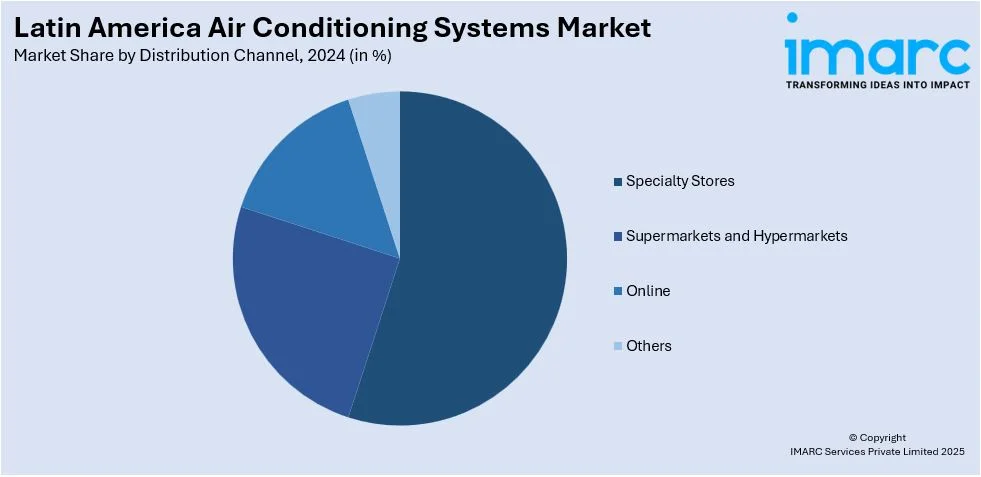

Distribution Channel Insights:

- Specialty Stores

- Supermarkets and Hypermarkets

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets and hypermarkets, online, and others.

Technology Insights:

- Inverter

- Non-Inverter

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes inverter and non-inverter.

End Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and industrial.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Air Conditioning Systems Market News:

- In January 2025, Mojave Energy Systems, a firm specializing in air conditioning systems, announced expansion across Latin America to address the heightening requirement for cost-effective, high-performance, and energy-efficient HAVC services in the region.

- In July 2024, Midea Group, a leading global home appliance manufacturer, opened a new facility in Pouso Alegre, Minas Gerais. The plant is part of the company's expansion globally, with plans to invest heavily in strategic markets like Brazil. Midea Group has a, equity in two factories across Brazil, one in Manaus/AM that is focused on manufacturing residential air-conditioners, and other one in Canoas/RS, where production of commercial air-conditioning systems is carried out.

Latin America Air Conditioning Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Unitary, Rooftop, PTAC, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Online, Others |

| Technologies Covered | Inverter, Non-Inverter |

| End Uses Covered | Residential, Commercial, Industrial |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America air conditioning systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America air conditioning systems market on the basis of product type?

- What is the breakup of the Latin America air conditioning systems market on the basis of distribution channel?

- What is the breakup of the Latin America air conditioning systems market on the basis of technology?

- What is the breakup of the Latin America air conditioning systems market on the basis of end use?

- What is the breakup of the Latin America air conditioning systems market on the basis of country?

- What are the various stages in the value chain of the Latin America air conditioning systems market?

- What are the key driving factors and challenges in the Latin America air conditioning systems market?

- What is the structure of the Latin America air conditioning systems market and who are the key players?

- What is the degree of competition in the Latin America air conditioning systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America air conditioning systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America air conditioning systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America air conditioning systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)