Latin America Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Country, 2026-2034

Latin America Air Freight Market Summary:

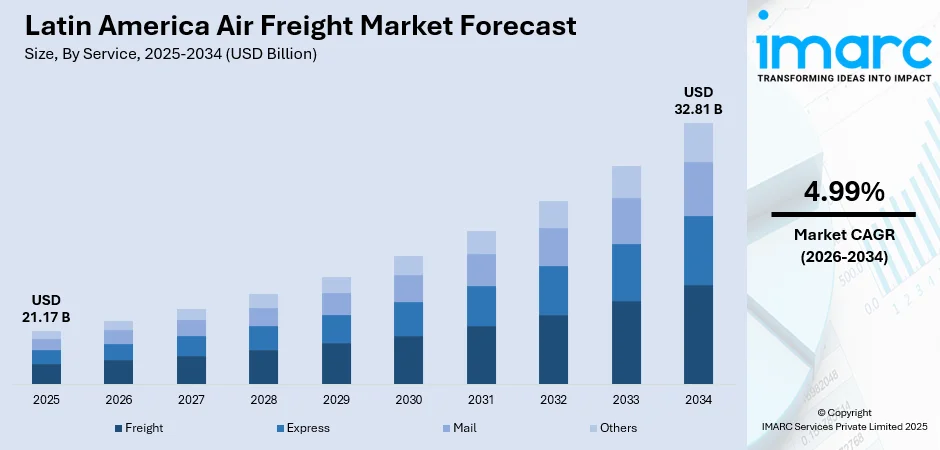

The Latin America air freight market size was valued at USD 21.17 Billion in 2025 and is projected to reach USD 32.81 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

The market is driven by fast-growing e-commerce, rising cross-border trade, and increasing demand for time-sensitive, high-value cargo movement. Latin America’s strategic connectivity to major global regions, expanding manufacturing activity, and the movement of perishables are reshaping logistics patterns. Infrastructure upgrades, digital transformation, and nearshoring are further boosting efficiency and strengthening the Latin America air freight market share.

Key Takeaways and Insights:

- By Service: The freight segment dominates the market with 55% in 2025, establishing itself as the leading service category driving operational efficiency and comprehensive logistics solutions across the Latin America air freight market.

- By Destination: International air freight commands the largest market share at 65% in 2025, reflecting the region's strong cross-border trade activities with North America, Europe, and Asia through established trade corridors.

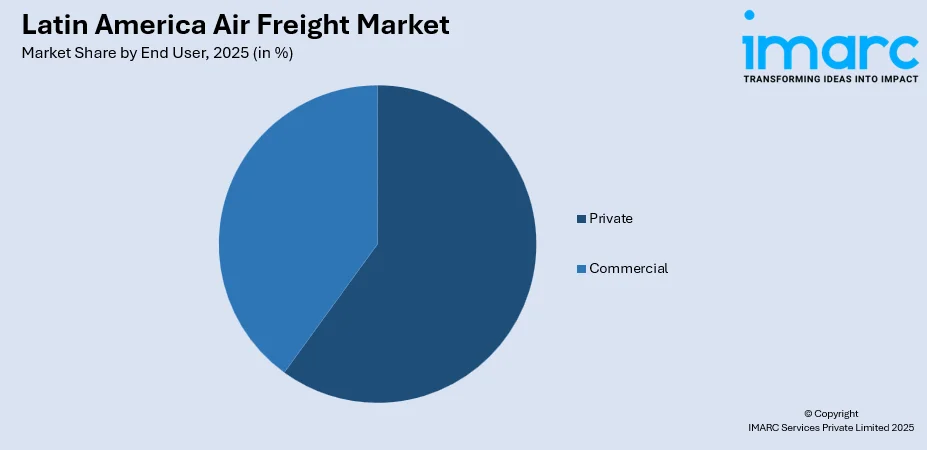

- By End User: Commercial cargo leads the market with 70% share in 2025, driven by robust manufacturing sectors, expanding retail distribution networks, and the growing need for rapid delivery of consumer goods.

- Key Players: The Latin America air freight market features a competitive landscape with major global integrators expanding their regional presence, investing in specialized cargo capture growing demand across key trade routes.

To get more information on this market, Request Sample

The Latin America air freight market is advancing as businesses, logistics providers, and governments embrace efficient cargo solutions to meet evolving trade demands. A major driver shaping this progress is the region's integration into global supply chains through nearshoring initiatives, particularly in Mexico and Central America, which has redirected manufacturing flows closer to North American markets. The expansion of e-commerce platforms has intensified demand for expedited delivery services, with major platforms investing billions in logistics infrastructure across Brazil and Mexico. As per sources, in August 2025, levu Air Cargo in Brazil advanced its launch plans, unveiling its website in April 2024 to outline new domestic and international cargo routes, signalling expanding freight capacity in the region. Moreover, policy encouragement through trade agreements, expanding airport cargo facilities, and rising interest in temperature-controlled logistics for pharmaceuticals and perishables are contributing to a more favorable environment for air freight adoption across the region.

Latin America Air Freight Market Trends:

E-Commerce Driven Logistics Expansion

Latin America is witnessing a transformative shift in air cargo demand driven by the rapid expansion of e-commerce platforms and digital retail channels. Consumer expectations for faster deliveries are compelling businesses to adopt air freight solutions for time-sensitive shipments. Cross-border e-commerce has become a vital component of regional trade, with online retailers prioritizing speed and reliability to serve customers across diverse markets. For example, in November 2024, FedEx expanded Latin American operations with new flights connecting Argentina, Chile, Ecuador, Guatemala, and Honduras to Miami, enhancing air freight capacity, cross-border connectivity, and support for key export sectors.

Nearshoring Reshaping Trade Corridors

The region is benefiting from global supply chain diversification as manufacturers relocate production closer to end markets. Mexico, Central America, and Colombia are emerging as preferred destinations for companies seeking alternatives to distant manufacturing hubs. This trend is driving increased air freight volumes, particularly for high-value electronics, automotive components, and medical devices moving through regional corridors to North American destinations. For instance, in the first four months of 2023, the total trade in manufactured goods between Mexico and the United States amounted to USD 234.2 billion.

Cold Chain Infrastructure Development

Temperature-controlled logistics capabilities are expanding across Latin America to support the growing trade in perishables and pharmaceutical products. Airports are upgrading their cold storage facilities and implementing advanced monitoring systems to ensure product integrity. The region's significant exports of flowers, seafood, fruits, and pharmaceutical products require sophisticated cold chain solutions that maintain quality standards throughout the transportation process, supporting Latin America air freight market growth.

Market Outlook 2026-2034:

The Latin America air freight market demonstrates strong growth potential throughout the forecast period, underpinned by rapid e-commerce expansion, nearshoring trends, and increasing demand for time-sensitive, high-value cargo. Further, Investments in infrastructure upgrades, cold chain logistics, and digital transformation are expected to drive higher revenue streams and foster a more competitive, efficient market ecosystem across Latin America. The market generated a revenue of USD 21.17 Billion in 2025 and is projected to reach USD 32.81 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

Latin America Air Freight Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Freight |

55% |

|

Destination |

International |

65% |

|

End User |

Commercial |

70% |

Service Insights:

- Freight

- Express

- Others

The freight segment dominated the market with a share of 55% of the total Latin America air freight market in 2025.

Freight leads the Latin America air freight market as rising e-commerce demand, expanding industrial activity, and the growing need for fast cargo movement strengthen reliance on efficient air logistics. High-value goods, perishables, and manufacturing components increasingly depend on timely air transport, reinforcing the segment’s dominant role in regional and international supply chain connectivity.

Infrastructure upgrades, improved cargo handling facilities, and investments in digital logistics continue to enhance freight operations across Latin America. Strengthened trade corridors and expanding export opportunities further support growth, as businesses prioritize speed and reliability. These developments ensure freight remains a core driver of market expansion and maintains its leading share.

Destination Insights:

- Domestic

- International

The international destination segment held the largest revenue share of approximately 65% of the total Latin America air freight market in 2025.

The international segment dominates due to Latin America's strategic geographic position linking major global markets. Strong trade relationships with North America, Europe, and Asia sustain high demand for cross-border air cargo. In August 2025, Aeroméxico Group led Mexico’s international cargo growth, moving 52,469.49 tons in H1 2025, achieving 5.2% year-over-year growth and capturing a 50.5% market share, AFAC reported. Moreover, export growth in perishables, electronics, and premium goods reinforces the importance of international routes within the region’s logistics ecosystem.

Enhanced airport infrastructure, streamlined customs processes, and supportive trade agreements continue to strengthen international air freight efficiency. Rising global supply chain integration and increased participation in worldwide commerce drive segment growth further. As companies seek rapid global deliveries, the international segment maintains its largest share in the regional air freight industry.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Private

- Commercial

The commercial segment commanded the highest share of 70% of the total Latin America air freight market in 2025.

The commercial segment holds the highest share as businesses depend on rapid, secure transportation for time-critical shipments. In November 2024, Modern Logistics partnered with ATC Aviation, adding two 737-800 cargo jets to expand routes to Chile, Argentina, Colombia, Ecuador, and Uruguay, boosting commercial freight capacity. Expanding manufacturing, retail, and e-commerce industries fuel consistent demand for air cargo services. High-value goods such as pharmaceuticals, electronics, and precision machinery further increase commercial reliance on fast and reliable air freight solutions.

Digitalization, advanced tracking technologies, and improved cargo management systems enhance operational reliability for commercial users. Companies prioritize efficiency and delivery accuracy, strengthening their dependence on air logistics. Growing industrial activity and expanding trade relationships ensure the commercial segment continues to dominate the market and retain its leading position.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil benefits from growing e-commerce, industrial exports, and high-value cargo movement. Airport infrastructure improvements, logistics technology adoption, and regional trade connections support efficient operations and steady activity.

Mexico experiences growth due to cross-border trade, industrial shipments, and time-sensitive cargo. Modernized airports, nearshoring trends, and expanding logistics networks enhance efficiency and overall performance. In June 2025, AeroUnion rebrands as Avianca Cargo Mexico, unveiling a second Airbus A330 P2F to expand capacity for perishables, pharmaceuticals, and oversized cargo, strengthening Mexico’s global air‑freight connectivity.

Argentina grows with rising agricultural exports, consumer goods transport, and e-commerce shipments. Upgraded cargo facilities, improved supply chains, and regional connectivity strengthen operational efficiency and activity.

Colombia expands through exports of perishables, industrial goods, and increasing e-commerce. Investments in modern cargo handling, trade partnerships, and logistics infrastructure support smoother operations and steady growth.

Chile sees growth from high-value exports, e-commerce shipments, and efficient international connectivity. Airport technology, cargo management systems, and logistics improvements strengthen regional operations.

Peru benefits from mining and agricultural exports, consumer goods transport, and e-commerce demand. Enhanced supply chains, infrastructure upgrades, and global connectivity support efficiency and development.

Other Latin American countries grow due to rising industrial shipments, e-commerce transport, and expanding logistics networks. Infrastructure improvements, trade facilitation, and regional connectivity strengthen performance and operations.

Market Dynamics:

Growth Drivers:

Why is the Latin America Air Freight Market Growing?

Rising E-Commerce and Retail Demand

The Latin America air freight market is growing due to the rapid expansion of e-commerce and retail sectors. In November 2025, LATAM Cargo boosted its Brazil capacity by 12% to support Black Friday e-commerce demand, adding new routes, extra frequencies, and expanded teams. The move increased domestic transport capability by 3.8 million kg, strengthening its leadership in Brazil’s fast-growing cargo market. Further, increasing online shopping, fast delivery expectations, and high-value product shipments have boosted the need for reliable air transport. Furthermore, companies are investing in faster and more efficient logistics solutions to meet these demands.

Expanding consumer markets and shifting purchasing behaviors are driving air freight growth. Businesses rely on air transport to ensure timely deliveries of electronics, apparel, and perishable goods. The combination of convenience, speed, and reliability has positioned air freight as a critical solution supporting the evolving retail and e-commerce landscape.

Increasing Cross-Border Trade

Growing international trade flows are a key driver for the market. Latin America’s strategic location as a link between North America, Europe, and Asia facilitates the movement of goods across borders. This has heightened the demand for air cargo solutions capable of handling time-sensitive shipments efficiently.

Trade agreements and regional economic integration further stimulate air freight activity. Export of perishables, industrial products, and high-value goods requires speed and reliability, making air transport essential. Increasing global connectivity ensures that Latin America continues to benefit from enhanced trade volumes, reinforcing market expansion and logistical importance.

Infrastructure Development and Technological Advancements

Investments in airport infrastructure, cargo handling facilities, and logistics hubs are driving market growth. Modernized airports and improved connectivity enable efficient operations, reduce transit times, and increase overall capacity, supporting the rising demand for air freight across the region.

Technological innovations such as digital tracking systems, automated cargo handling, and supply chain management tools enhance efficiency and reliability. In April 2025, Brazil became the first country in the Americas to fully adopt the electronic air waybill (eAWB), modernizing air cargo processes, improving efficiency, reducing costs, and enhancing competitiveness in the cargo sector. Additionally, these advancements reduce operational bottlenecks and allow real-time monitoring, attracting more businesses to use air freight. Combined with improved infrastructure, technology strengthens the market’s competitiveness and growth prospects.

Market Restraints:

What Challenges the Latin America Air Freight Market is Facing?

Infrastructure Limitations and Capacity Constraints

Despite ongoing investments, many airports in the region still lack modern cargo handling facilities and sufficient capacity to accommodate sudden surges in demand. Infrastructure gaps in certain countries create bottlenecks that delay logistics operations and increase costs. The inadequate development of cold chain infrastructure remains particularly problematic for regions heavily dependent on perishable exports.

Regulatory Complexity and Customs Procedures

Cross-border logistics operations face challenges from inconsistent customs procedures and regulatory frameworks that vary significantly across different countries. Processing inefficiencies, inadequate digital infrastructure for documentation, and limited coordination between public and private sectors create delays and additional costs. These regulatory hurdles hamper the seamless flow of goods across the region.

Economic Volatility and Cost Pressures

Economic fluctuations in certain Latin American markets impact air freight volumes and create uncertainty for logistics planning. Currency depreciation, rising fuel costs, and inflationary pressures affect operational expenses and profitability. The relatively high cost of air transportation compared to other modes continues to influence shipper decisions, particularly for less time-sensitive cargo.

Competitive Landscape:

The Latin America air freight market features a dynamic competitive environment as global logistics providers, regional carriers, and specialized operators expand their presence across the region. Companies are focusing on diversifying service offerings, improving operational efficiency, and enhancing technological capabilities to attract a wider customer base. Competition is driven by investments in cargo infrastructure, cold chain solutions, and digital platforms that provide real-time visibility and booking capabilities. Strategic partnerships and acquisitions are reshaping the market landscape, enabling companies to strengthen their network coverage and improve service quality. Regional carriers are investing in fleet modernization and specialized handling capabilities to compete effectively with global integrators while leveraging their local expertise and established relationships to serve customers across diverse industry segments. As per sources, in February 2025, Total Linhas Aéreas expanded its fleet with a fourth Boeing 737-400 freighter, bringing its total to five, averaging 28.5 years, supporting cargo and Petrobras operations in Brazil.

Recent Developments:

- In June 2025, Aliança Navegação e Logística, a Maersk subsidiary, launched its air freight service in Brazil, operating between Manaus and São Paulo. The service targets high-value automotive, electronics, technology, and food cargo, integrating with existing multimodal operations for efficient door-to-door logistics.

- In February 2025, Azul Cargo Express introduced two Airbus A321P2F freighters at Viracopos International Airport, Campinas, Brazil. The aircraft, serving domestic routes between Campinas, Recife, and Manaus, increase payload capacity by 39%, reduce fuel consumption per tonne by 27%, and provide annual CO₂ savings of up to 9,000 tonnes per aircraft.

- In September 2024, Scan Global Logistics’ acquisition of Blu Logistics Brasil strengthens air freight capacity, expands regional logistics networks, and enhances cross-border connectivity, all of which contribute to the growth of Latin America’s air freight ecosystem. This development aligns with key market drivers such as increasing trade flows, improving logistics infrastructure, and rising demand for efficient air cargo services across the region.

- In May 2024, DHL Supply Chain partnered with Levu Air Cargo in a €90.5 million project to launch a domestic air transport network in Brazil, deploying four freighter aircraft and starting routes from Campinas to Manaus and Recife, strengthening express logistics capacity.

Latin America Air Freight Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America air freight market size was valued at USD 21.17 Billion in 2025.

The Latin America air freight market is expected to grow at a compound annual growth rate of 4.99% from 2026-2034 to reach USD 32.81 Billion by 2034.

Freight services, holding the largest revenue share of 55%, remains pivotal for Latin America's air cargo operations, enabling efficient transportation of commercial goods, manufactured products, and time-sensitive shipments across domestic and international routes.

Key factors driving the Latin America air freight market include rapid e-commerce expansion, nearshoring and supply chain diversification, increasing cross-border trade, infrastructure modernization, growing demand for cold chain logistics, rising exports of perishables and pharmaceuticals, and digital transformation of logistics operations.

Major challenges include infrastructure limitations at certain airports, regulatory complexity and inconsistent customs procedures, economic volatility in some regional markets, high transportation costs compared to other modes, inadequate cold chain facilities in certain areas, and limited digital integration across supply chain participants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)