Latin America Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Latin America Aquaculture Market Overview:

The Latin America aquaculture market size reached 4.97 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 7.14 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is growing, supported by advanced farming technologies that boost productivity and sustainability, as well as trade agreements that ease exports. According to the 2024 State of World Fisheries and Aquaculture (SOFIA), the region produced 17.7 Million Tonnes from fisheries and aquaculture farming, equal to 8% of global output, increasing to 9% when only aquatic animal production is considered.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 4.97 Million Tons |

| Market Forecast in 2033 | 7.14 Million Tons |

| Market Growth Rate (2025-2033) | 4.10% |

Latin America Aquaculture Market Trends:

Increasing Focus on Fish Farming

The rising focus on fish farming is impelling the aquaculture in Latin America. In 2023, Brazil saw that its fish farming output reached 887,029 Metric Tons, as stated by the Rio Times. Fish farming is essential to meet the high demand for seafood items both domestically and internationally. Governing agencies of Latin America are supporting agriculture fish farming and supplying steady, affordable, and high-quality seafood products. In addition, they are encouraging the adoption of advanced fish farming technologies to improve productivity and sustainability. Innovations, such as recirculating aquaculture systems (RAS), automated feeding systems, and disease monitoring, help fish farms to maximize output and minimize environmental impact. These technologies make it feasible to expand operations in areas with water constraints or sensitive ecosystems. Furthermore, with overfishing becoming a significant concern, fish farming offers a controlled and sustainable alternative. Many Latin American countries, including Chile, Brazil, and Ecuador, are prioritizing aquaculture practices that reduce pressure on wild fish stocks and contribute to environmental conservation. Sustainable fish farming practices also align with consumer preferences for eco-friendly seafood items.

Rising Export Potential

The growing export potential is offering a favorable Latin America aquaculture market outlook. In comparison to the same period in 2023, Brazilian fish farming exports increased by 48% in value and 20% in weight during the first three months of 2024, according to Embrapa. Latin America has access to lucrative international markets for seafood exports. Latin American aquaculture production, which includes farmed salmon, shrimp, tilapia, and other species, is in high demand due to the region's commitment to sustainability and quality. By following sustainable practices that appeal to eco-conscious buyers overseas, Latin American companies are profiting from this trend. Latin America also benefits from advancements in aquaponic systems, which improve efficiency and sustainability in seafood cultivation for export. On top of this, the region has a logistical advantage due to its proximity to key markets, particularly North America. Shorter transport times and lower shipping costs as compared to Asian suppliers make Latin American seafood exports more competitive. Besides this, trade agreements between Latin American countries and larger regions facilitate smoother and tariff-reduced exports. These agreements also incentivize producers to expand aqua farming operations and enhance quality standards to meet export requirements.

Latin America Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

To get more information on this market, Request Sample

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish types. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environments have also been provided in the report. This includes fresh water, marine water, and brackish water.

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channels. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

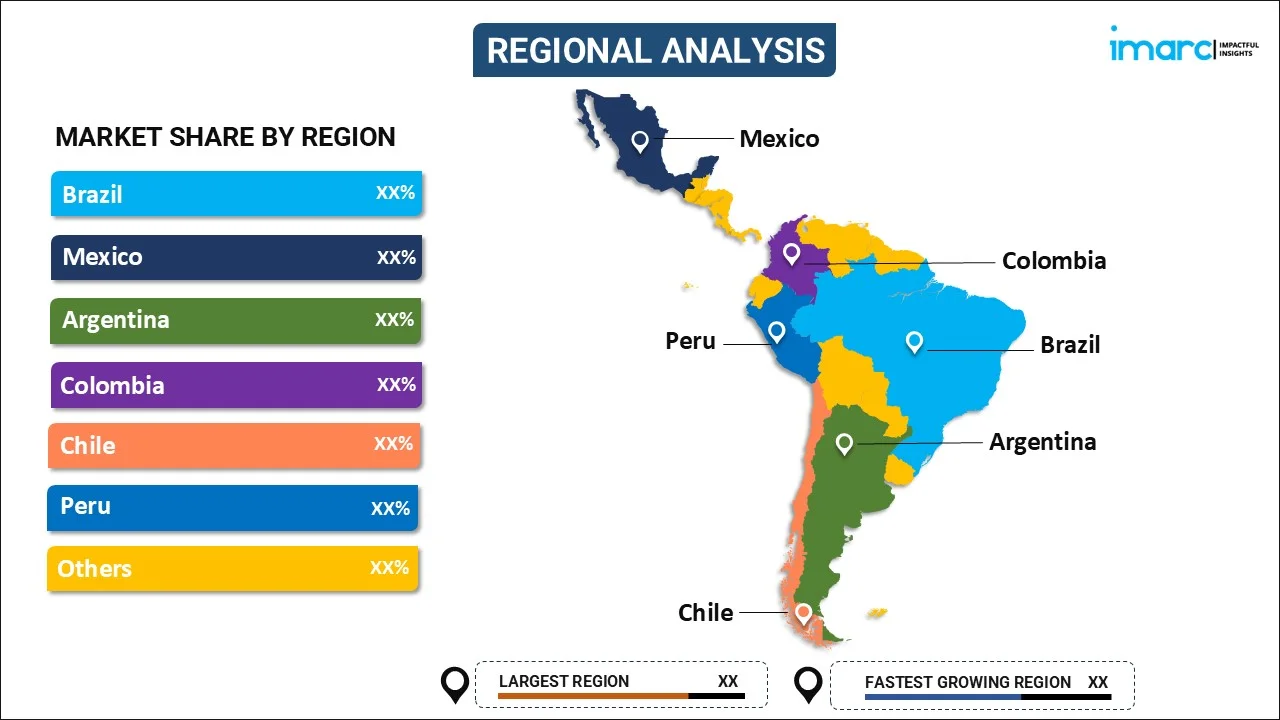

Regional Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Columbia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Aquaculture Market News:

- In July 2025, the World Aquaculture Society’s Latin American & Caribbean Chapter (LACC‑WAS) confirmed “Latin American & Caribbean Aquaculture 2025” (LACQUA25), slated for October in Puerto Varas, Chile, bringing together scientists and industry to share innovations, governance strategies, and climate-resilient aquaculture practices.

- In June 2025, at the Blue Economy and Finance Forum in Monaco, the Development Bank of Latin America and the Caribbean (CAF) announced it would double its blue economy investment target to support marine sanitation work and energy transition efforts in shrimp farming across Ecuador, Brazil, and El Salvador.

- In July 2024, Earth Ocean Farms, the Mexican company focused on regenerative aquaculture, unveiled a new brand identity ‘Totoaba Santomar’. This was set to be the consumer-facing brand for its main product, ‘farmed totoaba’.

- In November 2023, Pacifico Aquaculture obtained financing from Butterfly Equity, a private equity firm located in Los Angeles and Equilibrium Capital, a public pension fund in the US. Its purpose was to support the development of the company's new nursery facility in Baja California, Mexico. This investment enabled 20,000 Metric Tons of yearly production capacity to satisfy the increasing global need for healthy and nutritious seafood. This funding would also help to fulfill the need for sustainably raised striped bass.

Latin America Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Countries Covered | Brazil, Mexico, Argentina, Columbia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aquaculture market in Latin America reached 4.97 Million Tons in 2024.

The Latin America aquaculture market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching 7.14 Million Tons by 2033.

The Latin America aquaculture market is driven by rising seafood demand, population growth, and urbanization. Expansion of export opportunities, government support programs, and technological improvements in farming practices strengthen the sector. Sustainability concerns and growing investments in environmentally friendly aquaculture systems also shape its development, alongside improved feed efficiency and disease control.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)