Latin America Biometrics Market Report by Technology (Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris recognition, AFIS, Non-AFIS, and Others), Functionality (Contact, Non-contact, Combined), Component (Hardware, Software), Authentication (Single-Factor Authentication, Multifactor Authentication), End User (Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, and Others), and Country 2025-2033

Latin America Biometrics Market Size:

The Latin America biometrics market size reached USD 4,273.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,153.9 Million by 2033, exhibiting a growth rate (CAGR) of 14.35% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,273.2 Million |

|

Market Forecast in 2033

|

USD 15,153.9 Million |

| Market Growth Rate (2025-2033) | 14.35% |

Latin America Biometrics Market Analysis:

- Market Growth and Size: The market is experiencing substantial growth, driven by increasing security concerns and technological adoption. This market's expansion is further supported by the rising demand for secure and efficient identification and authentication solutions.

- Major Market Drivers: Enhanced security needs and the growing adoption of mobile devices are the primary drivers, fueling the demand for biometric solutions. Government initiatives for biometric implementations in various sectors, including banking, healthcare, and public services, significantly contribute to market growth.

- Key Market Trends: The shift towards mobile biometrics and the integration of AI in biometric systems are prevailing trends, enhancing both security and user convenience. Cloud-based biometric solutions are gaining traction, offering scalable, flexible, and cost-effective options for data management and authentication.

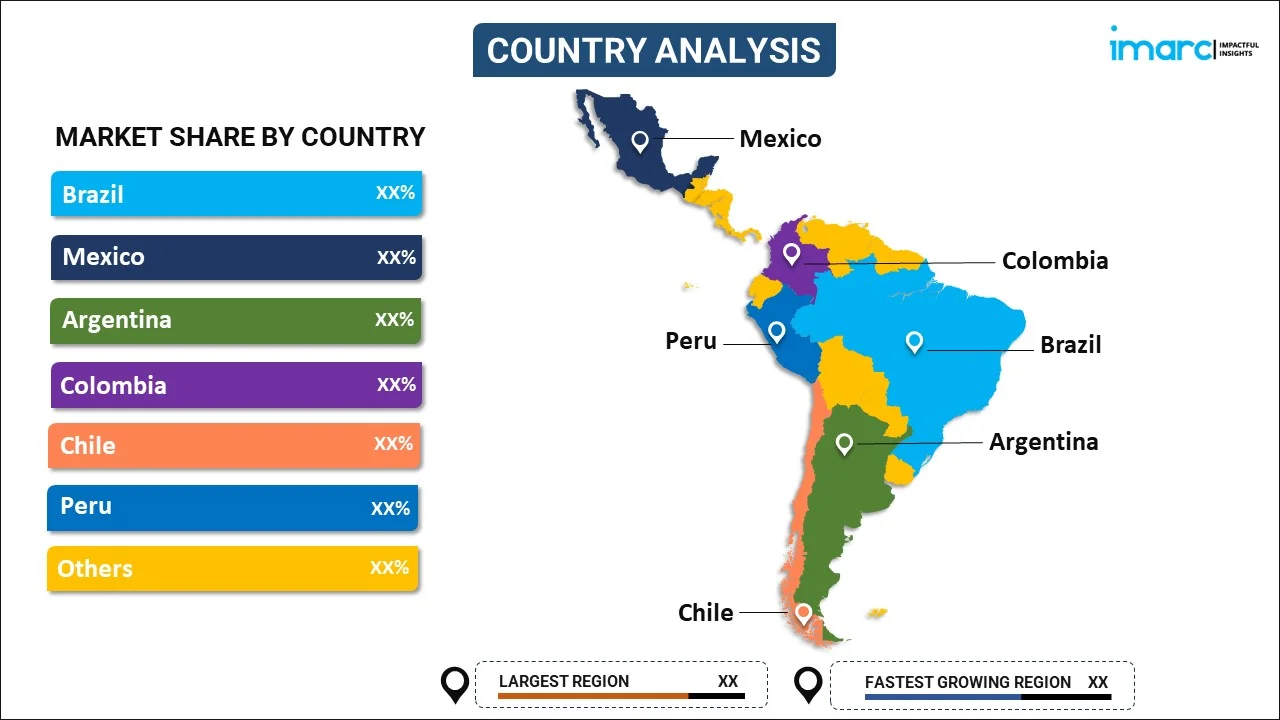

- Geographical Trends: Countries such as Brazil, Mexico, and Argentina are leading the market, with increased investments in biometric technology driven by economic growth and a focus on security. The region shows a strong preference for fingerprint recognition, although facial and iris recognition technologies are rapidly gaining ground due to their contactless nature and increased adoption in various applications.

- Competitive Landscape: The market is highly competitive, with a mix of local and international players focusing on innovation, customer acquisition, and expanding their technological capabilities. Strategic partnerships, mergers, and acquisitions are common, aiming to enhance product portfolios and strengthen market presence.

- Challenges and Opportunities: The market faces challenges such as concerns regarding privacy, data security, and the high cost of advanced biometric systems. However, the growing trend of digitalization and the untapped potential in sectors such as fintech, healthcare, and government services offer abundant opportunities for market expansion and the introduction of new, innovative biometric solutions.

Biometrics are utilized to verify the identity of users by analyzing their physical or behavioral characteristics, such as fingerprints and voice patterns. They are fast, secure, reliable and accurate as compared to conventional security systems. Consequently, they find extensive applications in schools, colleges and corporate and government facilities in Latin America.

The increasing security concerns on account of the rising instances of cybercrimes represent one of the key factors impelling the growth of the biometrics market in Latin America. Moreover, the deployment of biometric technology across borders and airports for more accurate citizen identification is bolstering the market growth. Additionally, governments of several countries in the region are investing in the manufacturing of their biometric national identity card (ID) systems to prevent identity fraud and theft. Furthermore, the increasing utilization of biometrics technology in restaurants, hotels and cafes for allowing users to register without an ID is contributing to the market growth. Apart from this, the rising demand for secure, remote and accurate access to medical records and treatment plans is increasing the adoption of biometrics technology in the healthcare industry.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Latin America biometrics market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on technology, functionality, component, authentication, and end user.

Breakup by Technology:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris recognition

- AFIS

- Non-AFIS

- Others

Breakup by Functionality:

- Contact

- Non-contact

- Combined

Breakup by Component:

- Hardware

- Software

Breakup by Authentication:

- Single-Factor Authentication

- Multifactor Authentication

Breakup by End User:

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Technology, Functionality, Component, Authentication, End User, Country |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America biometrics market was valued at USD 4,273.2 Million in 2024.

We expect the Latin America biometrics market to exhibit a CAGR of 14.35% during 2025-2033.

The introduction of multimodal biometrics to provide improved recognition and security performance by using more than one physiological or behavioral characteristic for authentication is primarily driving the Latin America biometrics market.

In Latin America, the sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from touch-based biometrics towards contactless biometrics systems that are based on facial recognition, sensors, voice stimulation, etc., for mitigating the risk of the coronavirus infection upon human intervention.

Based on the technology, the Latin America biometrics market can be segmented into face recognition, hand geometry, voice recognition, signature recognition, iris recognition, AFIS, non-AFIS, and others. Currently, non-AFIS holds the largest market share.

Based on the functionality, the Latin America biometrics market has been divided into contact, non-contact, and combined. Among these, contact currently exhibits a clear dominance in the market.

Based on the component, the Latin America biometrics market can be categorized into hardware and software. Currently, hardware accounts for the majority of the total market share.

Based on the authentication, the Latin America biometrics market has been segregated into single-factor authentication and multifactor authentication, where single-factor authentication currently exhibits a clear dominance in the market.

Based on the end user, the Latin America biometrics market can be bifurcated into government, defense services, banking and finance, consumer electronics, healthcare, commercial safety and security, transport/visa/logistics, and others. Currently, government holds the largest market share.

On a regional level, the market has been classified into Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)