Latin America Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Country, 2025-2033

Latin America Bioplastics Market Overview:

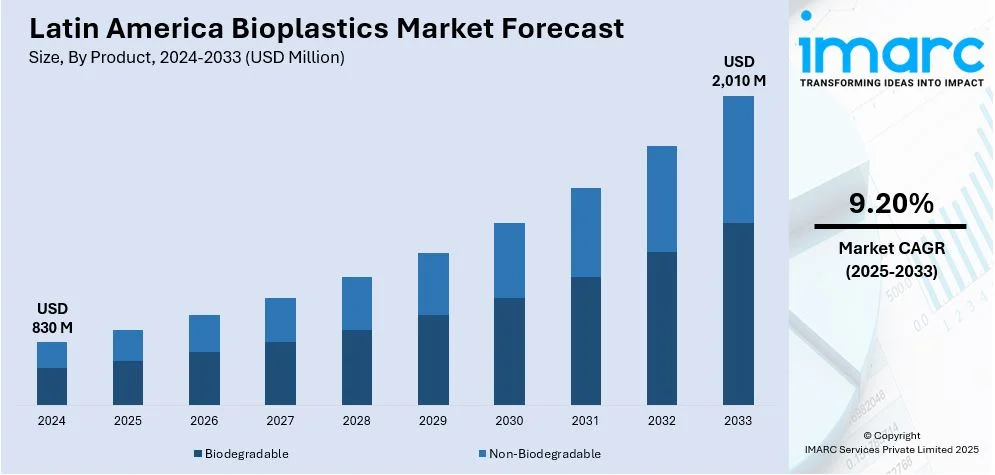

The Latin America bioplastics market size reached USD 830 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,010 Million by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is growing steadily due to the advancements in bio-based materials and supportive government policies. Additionally, increased demand for sustainable packaging and eco-friendly alternatives is driving regional production, thus positioning Latin America as a significant player in the global shift toward renewable, biodegradable plastics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 830 Million |

| Market Forecast in 2033 | USD 2,010 Million |

| Market Growth Rate 2025-2033 | 9.20% |

Latin America Bioplastics Market Trends:

Rising Consumer Awareness and Preference for Eco-friendly Products

In Latin America, the increasing awareness among consumer about environmental concerns is escalating the demand for eco-friendly products, including bioplastics. With increased public concern over plastic pollution and its harmful effects on ecosystems consumers are shifting toward sustainable alternatives. Bioplastics which offer biodegradable and bio-based options are gaining traction in industries such as personal care, retail and food packaging. For instance, according to industry reports, BRF SA poultry processing company participates in recycling incentive programs such as "Reciclar pelo Brazil" and the "Eurociclo" seal for Qualy packaging to minimize unnecessary post-consumer waste. In 2023, the company reduced waste from 83% to 87% in Brazil and reached 93% internationally i.e., 88% in the index; hence, it is aiming to achieve 100% recyclable, reusable and biodegradable packaging by 2025. Additionally, the rising trend toward green products is encouraging younger consumers who are environment conscious to pay more for eco-friendly products. This shift toward sustainability is expanding the Latin America bioplastics market share as industries adopt biodegradable and bio-based materials to meet rising consumer demand for eco-friendly packaging and products. However, the rise of social media and global environmental movements has amplified awareness making sustainability a key purchasing criterion. As a result, consumer-driven demand is significantly contributing to the growth of the bioplastics market in the region.

Increased Investment in Local Bioplastic Manufacturing

Investment in local bioplastic manufacturing is rising in Latin America as the region seeks to reduce reliance on imported materials and build self-sufficiency in sustainable production. Countries like Brazil and Argentina are becoming key players in bio-based polymer production, capitalizing on their abundant agricultural resources such as sugarcane, corn, and other biomass materials used as feedstock. Local production is fostering cost competitiveness and reducing supply chain disruptions, which are critical factors for Latin America bioplastics market growth. Multinational corporations and regional startups are establishing partnerships and production facilities to support this trend, creating jobs and stimulating economic development. In 2023, Yara entered into an agreement with a supplier to collaboratively create an innovative type of big bag in Brazil. These bags will be constructed from 100% recycled PET (polyethylene terephthalate), significantly lowering their environmental impact by nearly halving greenhouse gas emissions compared to traditional bags, all while keeping the same technical specifications. This initiative is designed to eliminate approximately 2,000 tons of virgin plastic and decrease greenhouse gas emissions by around 4,000 tons annually. One of the main advantages of using PET over other plastics for big bag production is its ability to be recycled indefinitely without degrading its strength and quality. Therefore, increased local capacity is expected to drive market expansion and enhance Latin America’s role in the global bioplastics supply chain.

Technological Advancements and Innovations in Bioplastic Materials

Technological advancements are reshaping the bioplastics market in Latin America, driving the development of new materials with enhanced performance characteristics. Innovations in the production of bio-based polymers, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are creating alternatives with improved durability, flexibility, and biodegradability. These advancements are expanding the potential applications of bioplastics in industries beyond packaging, including automotive, agriculture, and textiles. The rising investment in research and development, along with partnerships between academia and private companies, is accelerating the adoption of cutting-edge bioplastic technologies. For instance, in 2023, Braskem allocated US$ 87 million to enhance production capacity at its bio-based ethylene plant situated in the Petrochemical Complex of Triunfo, Rio Grande do Sul, Brazil. This expansion represents a 30% increase in Braskem's total production capacity and is designed to address the rising global demand for bio-based products. The facility is projected to generate approximately 200,000 to 260,000 tonnes of products annually. As these innovations continue to evolve, they are likely to reduce costs and improve scalability, making bioplastics more competitive with conventional plastics, thereby creating a positive Latin America bioplastics market outlook.

Latin America Bioplastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, application and distribution channel.

Product Insights:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biodegradable (polylactic acid, starch blends, polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS) and others) and non-biodegradable (polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate and others).

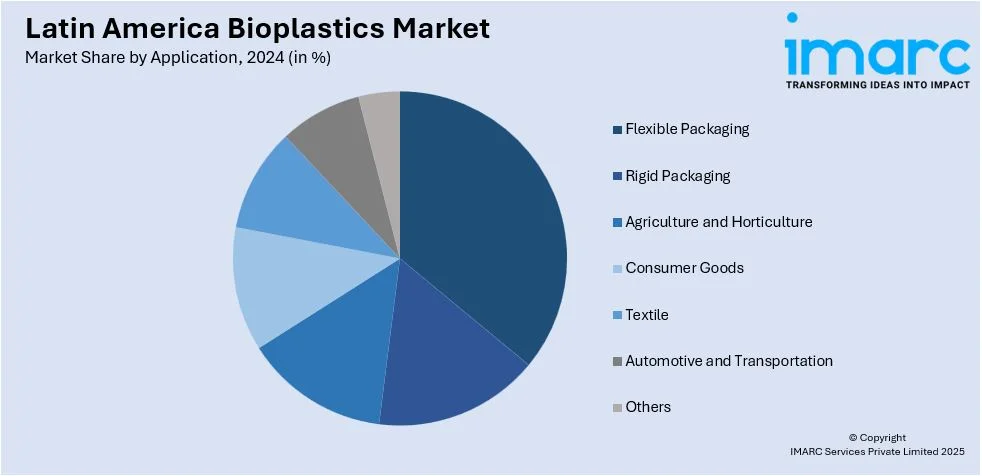

Application Insights:

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flexible packaging, rigid packaging, agriculture and horticulture, consumer goods, textile, automotive and transportation and others.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Bioplastics Market News:

- In September 2024, Braskem, the Brazilian petrochemical giant, introduced a bio-attributed polypropylene (PP) derived from used cooking oil for the US market. Targeting packaging in the restaurant and snack food sectors, this ISCC-plus certified resin aims to enhance sustainability and circularity while offering the same performance as traditional fossil-based PP.

- In June 2024, the Thailand Board of Investment approved a 19.3 Billion Baht bio-ethylene plant project by Braskem Siam Co., a joint venture with Brazil's Braskem. The facility will produce 200,000 tons/year from agricultural materials. This is part of a 56.95 Billion Baht investment in key industries supporting Thailand's economic growth.

Latin America Bioplastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America bioplastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America bioplastics market on the basis of product?

- What is the breakup of the Latin America bioplastics market on the basis of application?

- What is the breakup of the Latin America bioplastics market on the basis of distribution channel?

- What is the breakup of the Latin America bioplastics market on the basis of country?

- What are the various stages in the value chain of the Latin America bioplastics market?

- What are the key driving factors and challenges in the Latin America bioplastics?

- What is the structure of the Latin America bioplastics market and who are the key players?

- What is the degree of competition in the Latin America bioplastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America bioplastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America bioplastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America bioplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)