Latin America Blockchain in Financial Services Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

Latin America Blockchain in Financial Services Market Overview:

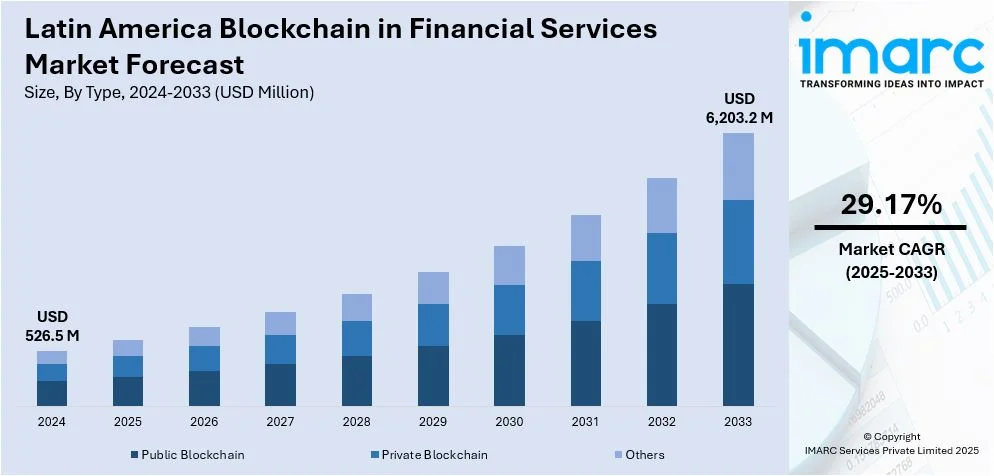

The Latin America blockchain in financial services market size reached USD 526.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,203.2 Million by 2033, exhibiting a growth rate (CAGR) of 29.17% during 2025-2033. The market is growing significantly due to the convergence of financial inclusion, evolving regulatory government and financial support, and enhanced efficiency and cost reductions. Consequently, these factors foster greater adoption of blockchain technologies across various financial applications and improve accessibility for underserved populations in the Latin America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 526.5 Million |

| Market Forecast in 2033 | USD 6,203.2 Million |

| Market Growth Rate 2025-2033 | 29.17% |

Latin America Blockchain in Financial Services Market Trends:

Financial Inclusion and Accessibility

The pressing need for financial inclusion is one potential motivator for blockchain adoption within Latin America. Many people are either unbanked or underbanked with severely restricted access to conventional banking methods. Blockchain technology provides a way out through allowing secure transactions at a very low cost and with minimum intermediaries. In fact, decentralized finance (De-Fi) platforms are gaining ground in that these platforms actually enable people to deal with financial products and services directly via their smartphones. For instance, in March 2024, Mercado Libre, a Latin American e-commerce leader, announced plans to invest a record 23 billion reais ($4.6 billion) in Brazil. This investment aims to enhance financial inclusion by broadening access to its platform and services for underserved populations.

Regulatory Evolution and Support

As blockchain technology advances, regulatory frameworks across Latin America are evolving. Governments and financial authorities recognize blockchain's potential to enhance transparency, reduce fraud, and boost operational efficiency in financial systems. Countries like Brazil and Mexico are creating regulatory sandboxes that allow fintech companies to innovate while ensuring compliance with current regulations. For instance, in 2024, Mexican fintech unicorn Clip announced a $100 million investment from Morgan Stanley Tactical Value and a prominent West Coast mutual fund to enhance product development and drive financial inclusion for SMBs. This supportive regulatory environment promotes blockchain-based financial services growth, attracting domestic and foreign investments. Collaboration between regulators and the blockchain community is essential for creating a stable ecosystem that fosters innovation while protecting consumer interests.

Efficiency and Cost Reduction

The traditional financial services model relies on multiple intermediaries, which raises transaction costs and creates inefficiencies. Blockchain technology provides a solution by simplifying processes with smart contracts and decentralized ledger systems. These innovations allow for real-time transaction settlement, significantly lowering the time and costs related to cross-border payments and remittances. As a result, financial institutions are increasingly adopting blockchain solutions to boost their operational efficiency, enhancing profitability and competitiveness in the market. For instance, in mid-June 2023, the Central Bank of Brazil selected 14 institutions, including major banks and multinational companies, to participate in the digital real pilot, beginning integration into the Real Digital Pilot platform. This implementation can streamline processes, minimize reliance on intermediaries, and provide secure, real-time transactions, fostering a more cost-effective financial ecosystem in Brazil.

Latin America Blockchain in Financial Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Public Blockchain

- Open And Permissionless Blockchains

- Decentralized Finance (DeFi) Platforms

- Cryptocurrencies And Tokens

- Private Blockchain

- Consortium Blockchains

- Permissioned Blockchains

- Enterprise Blockchain Solutions

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes public blockchain (open and permissionless blockchains, decentralized finance (defi) platforms, cryptocurrencies and tokens) private blockchain (consortium blockchains, permissioned blockchains, enterprise blockchain solutions) and others.

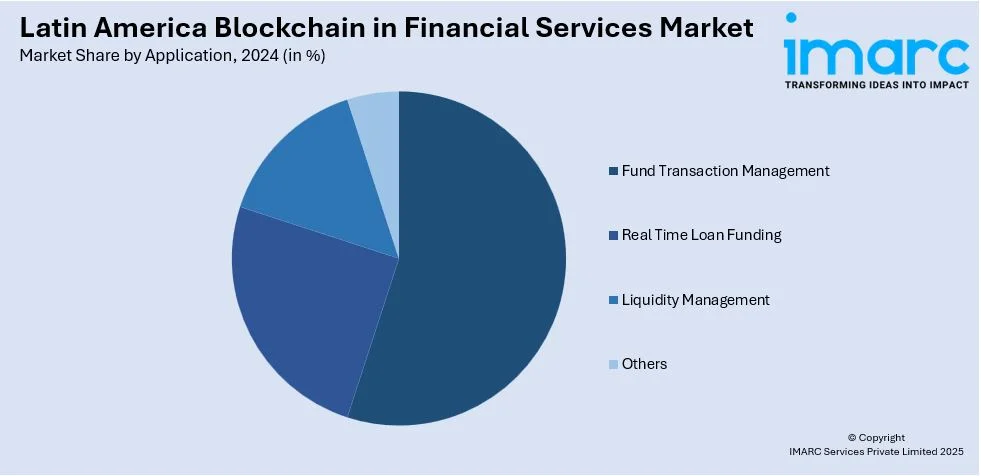

Application Insights:

- Fund Transaction Management

- Real Time Loan Funding

- Liquidity Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fund transaction management, real time loan funding, liquidity management, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Blockchain in Financial Services Market News:

- In 2023, Finerio Connect, a Mexico City-based fintech startup, announced securing $6.5 million in funding to further develop its open finance ecosystem in Latin America. This platform seeks to offer access to personalized financial products and services, even amid the regulatory ambiguities surrounding open banking in Mexico.

- In November 2023, Bitcoin Argentina, a non-governmental organization, announced unveiling a draft bill in Buenos Aires to regulate the cryptocurrency market, prioritizing decentralization preservation, and enhancing public trust. This proposal signifies a shift in the organization's perspective regarding the need for regulation to uphold the integrity of blockchain technology and ensure accountability among industry stakeholders.

Latin America Blockchain in Financial Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fund Transaction Management, Real Time Loan Funding, Liquidity Management, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America blockchain in financial services market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America blockchain in financial services market on the basis of type?

- What is the breakup of the Latin America blockchain in financial services market on the basis of application?

- What is the breakup of the Latin America blockchain in financial services market on the basis of country?

- What are the various stages in the value chain of the Latin America blockchain in financial services market?

- What are the key driving factors and challenges in the Latin America blockchain in financial services?

- What is the structure of the Latin America blockchain in financial services market and who are the key players?

- What is the degree of competition in the Latin America blockchain in financial services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America blockchain in financial services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America blockchain in financial services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America blockchain in financial services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)