Latin America Customs Brokerage Market Size, Share, Trends and Forecast by Mode of Transport, End Users, and Country, 2026-2034

Latin America Customs Brokerage Market Overview:

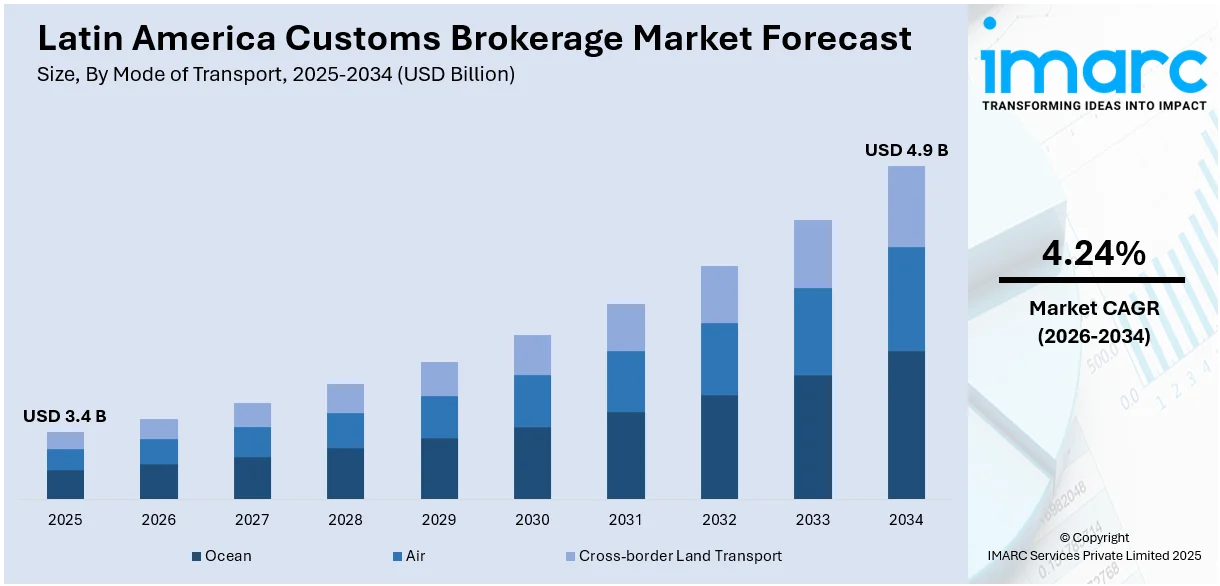

The Latin America customs brokerage market size was valued at USD 3.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.9 Billion by 2034, exhibiting a CAGR of 4.24% from 2026-2034. The market is expanding, driven by growing international trade, regulatory complexities, digitalization of customs processes, and technological advancements and digital solutions that enhance service efficiency, and support businesses in managing cross-border trade effectively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 4.9 Billion |

| Market Growth Rate 2026-2034 | 4.24% |

Latin America Customs Brokerage Market Trends:

Growth of E-Commerce and Cross-Border Shipments

The rise of e-commerce platforms like MercadoLibre and Amazon is fueling demand for customs brokerage services in Latin America. Cross-border online retail shipments require efficient customs documentation, duty classification, and fast clearance to meet consumer expectations for quick deliveries. Governments are implementing digital customs solutions to manage the surge in small-package imports, increasing reliance on brokerage services. Additionally, the growth of direct-to-consumer shipping models and last-mile delivery solutions has intensified the need for automated customs platforms, regulatory compliance, and duty optimization strategies.

To get more information on this market Request Sample

Digitalization and Automation in Customs Processes

Governments in Brazil, Mexico, and Colombia are investing in customs automation, AI-driven risk assessment, and digital trade platforms to improve efficiency and reduce clearance times. The adoption of electronic customs filing (e-customs) and blockchain-based trade solutions simplifies documentation, reducing fraud and errors. Logistics providers and customs brokers are increasingly leveraging AI, cloud-based solutions, and real-time tracking to enhance compliance, reduce paperwork, and expedite customs processing. According to the Latin America customs brokerage market , these innovations are making customs brokerage services more efficient, benefiting industries with high-volume cross-border trade. For instance, in September 2024, Brazilian authorities announced changes to customs controls and procedures for express services companies, aiming to make the entry process faster and more cost-efficient for operators, following the decision by the Brazilian Congress to end duty-free treatment for low-value shipments on August 1.

Nearshoring and Supply Chain Shifts

Nearshoring trends, driven by supply chain disruptions and geopolitical shifts, are increasing Latin America's role in regional manufacturing and logistics hubs. Mexico is benefiting from USMCA-driven investments, leading to higher demand for customs clearance and trade compliance solutions. Companies relocating production to Latin America require specialized customs brokerage services to navigate local regulations, tariffs, and import/export procedures. Additionally, growing intra-regional trade within Mercosur and the Pacific Alliance is boosting cross-border land transport, further increasing demand for customs brokerage expertise and regulatory advisory services. For instance, in March 2023, Nuvocargo, the first all-in-one digital platform for cross-border trade between the United States and Mexico, announced the debut of its Customs Brokerage offering. This product aims to streamline customs operations between the United States and Mexico, as customs clearance is a vital point in all cross-border activities that is prone to costly errors and miscommunications.

Latin America Customs Brokerage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on mode of transport and end users.

Mode of Transport Insights:

- Ocean

- Air

- Cross-border Land Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transport. This includes ocean, air, and cross-border land transport.

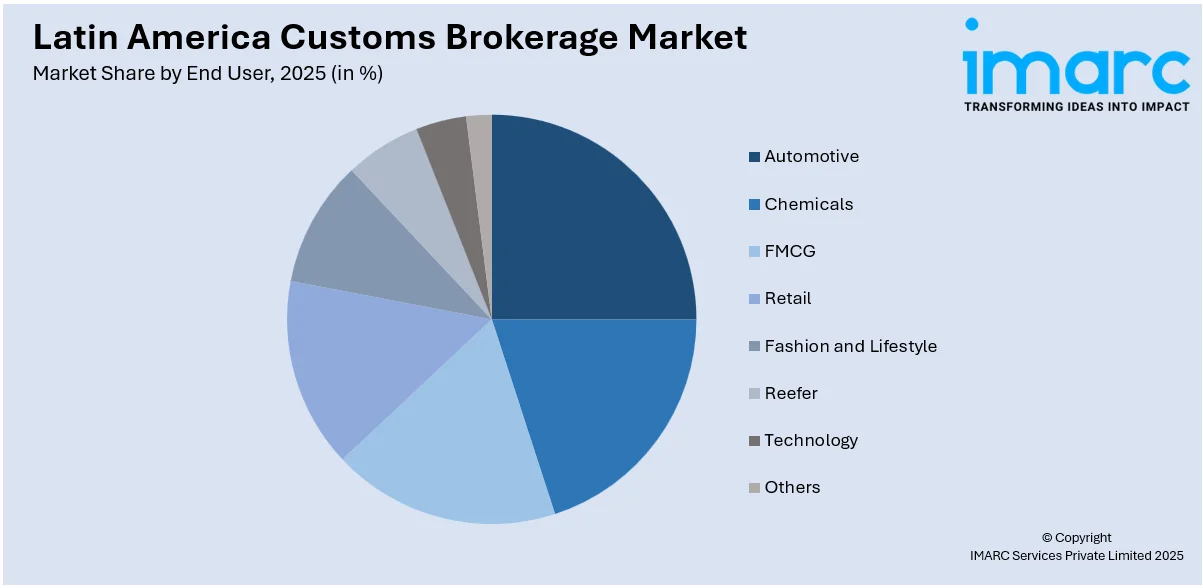

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Chemicals

- FMCG

- Beauty and Personal Care

- Soft Drinks

- Home Care

- Retail

- Supermarkets

- Convenience Stores

- E-commerce Channels

- Fashion and Lifestyle

- Apparel

- Footwear

- Reefer

- Fruits

- Vegetables

- Pharmaceuticals

- Meat

- Fish

- Seafood

- Technology

- Consumer Electronics

- Home Appliances

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, chemicals, FMCG (Beauty and Personal Care, Soft Drinks, Home Care), retail (Supermarkets, Convenience Stores, E-commerce Channels), fashion and lifestyle (Apparel and Footwear), reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, Seafood), technology (Consumer Electronics, Home Appliances), and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Customs Brokerage Market News:

- In June 2024, DHL Express launched a R$23 million facility at Brazil’s Viracopos International Airport, featuring a 2,500 m² warehouse in a 10,000 m² complex within the airport’s Primary Zone. This first-of-its-kind operation in Brazil integrates transportation, clearance, and storage, processing up to 3,000 items per hour. Operating nearly 24/7 with six weekly flights, it handles formal B2B imports and e-commerce, which accounts for 10% of operations. Advanced equipment enables same-day cargo clearance, serving clients of all sizes.

Latin America Customs Brokerage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transports Covered | Ocean, Air, Cross-border Land Transport |

| End Users Covered |

|

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America customs brokerage market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America customs brokerage market on the basis of transport?

- What is the breakup of the Latin America customs brokerage market on the basis of end users?

- What is the breakup of the Latin America customs brokerage market on the basis of region?

- What are the various stages in the value chain of the Latin America customs brokerage market?

- What are the key driving factors and challenges in the Latin America customs brokerage market?

- What is the structure of the Latin America customs brokerage market and who are the key players?

- What is the degree of competition in the Latin America customs brokerage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America customs brokerage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America customs brokerage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America customs brokerage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)