Latin America Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Latin America Data Center Market Summary:

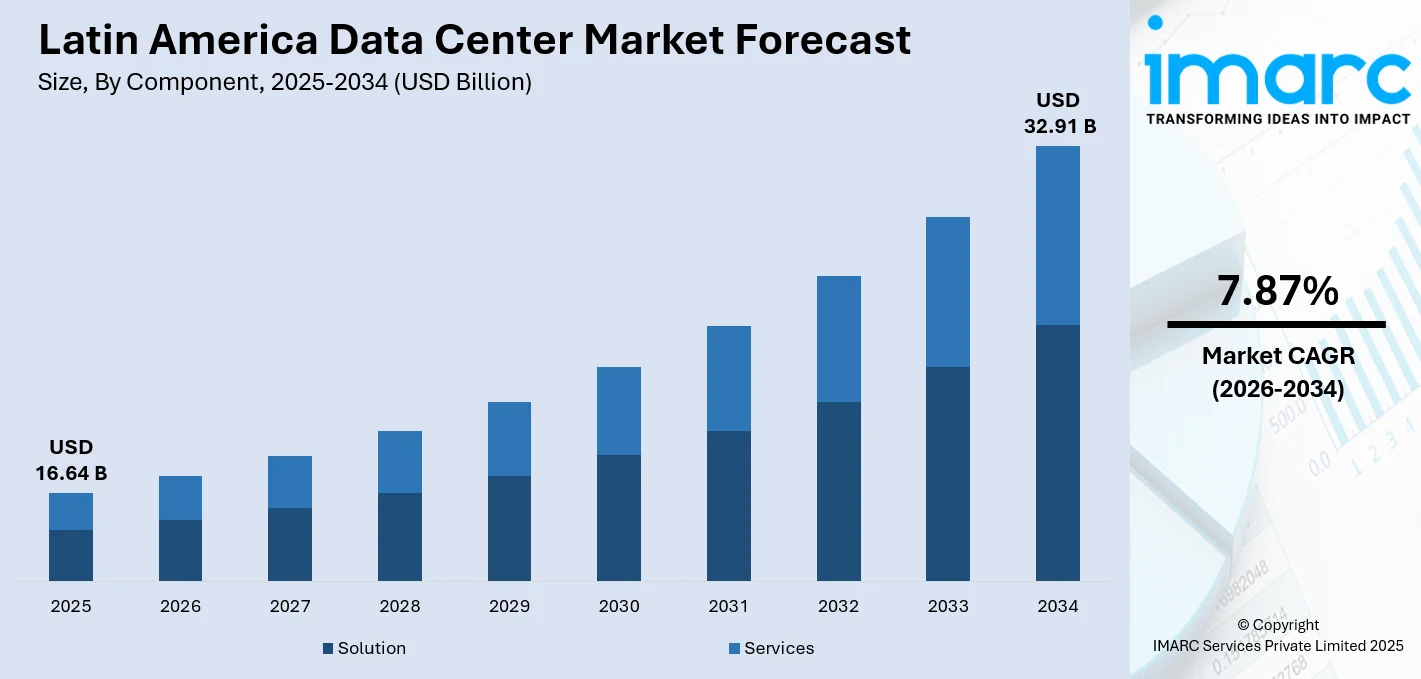

The Latin America data center market size was valued at USD 16.64 Billion in 2025 and is projected to reach USD 32.91 Billion by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034.

The Latin America data center market is experiencing strong expansion driven by accelerating digital transformation initiatives, rising cloud computing adoption, and substantial investments from global technology giants. The region's growing e-commerce sector, rapid fintech evolution, and expanding internet penetration are creating unprecedented demand for scalable computing infrastructure. Government-led digitization programs, nearshoring trends, and data localization regulations are reshaping the regional landscape, positioning Latin America as an emerging hub for next-generation digital infrastructure supporting artificial intelligence workloads and enterprise cloud migrations.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 63.01% in 2025, driven by the growing need for comprehensive infrastructure management, virtualization platforms, and integrated software ecosystems that enable efficient data processing and storage operations across enterprise environments.

- By Type: Hyperscale leads the market with a share of 40.9% in 2025, reflecting the expansion of major cloud service providers establishing large-scale facilities to meet surging demand for cloud computing, artificial intelligence workloads, and enterprise-grade digital infrastructure.

- By Enterprise Size: Large enterprises represent the biggest segment with a market share of 69.92% in 2025, owing to their substantial IT infrastructure requirements, digital transformation initiatives, and need for high-capacity data processing and storage capabilities to support complex business operations.

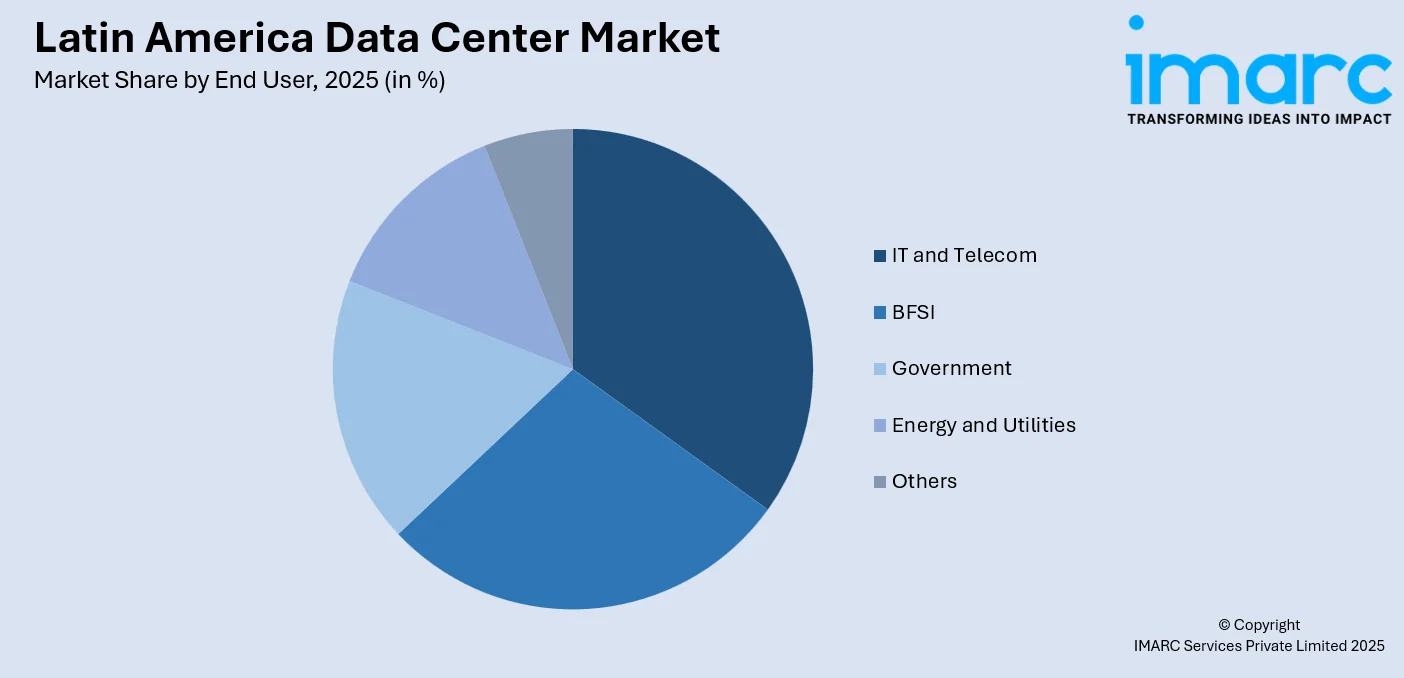

- By End User: IT and telecom exhibit a clear dominance with a 34.91% share in 2025, driven by the rapid expansion of telecommunications networks, 5G deployment, cloud service provisioning, and the increasing demand for edge computing infrastructure across the region.

- Key Players: Key players drive the Latin America data center market by expanding facility portfolios, investing in sustainable infrastructure, implementing advanced cooling technologies, and forming strategic partnerships with hyperscale cloud providers to accelerate regional digital transformation initiatives.

To get more information on this market Request Sample

The Latin America data center market is undergoing structural transformation as global technology companies and regional operators invest billions of dollars in new facilities across key metropolitan areas. São Paulo, Mexico City, Santiago, and Bogotá have emerged as primary hubs attracting substantial capital deployment from hyperscale operators seeking to establish cloud regions closer to end users. The region's renewable energy potential, particularly in Brazil and Chile, provides compelling sustainability credentials that align with corporate environmental commitments. In September 2024, Microsoft announced plans to invest 14.7 Billion Reais (USD 2.7 Billion) in Brazil and USD 1.3 Billion in Mexico to expand artificial intelligence and cloud infrastructure. The proliferation of digital banking services, e-commerce platforms, and streaming applications continues generating exponential data growth requiring localized processing capabilities. Edge computing deployments are expanding alongside fifth-generation wireless network rollouts, creating distributed infrastructure networks supporting low-latency applications across urban and semi-urban areas throughout the region.

Latin America Data Center Market Trends:

Sustainable Data Center Construction with Renewable Energy Integration

Latin American data center operators are increasingly prioritizing renewable energy integration through power purchase agreements and on-site generation capabilities. This sustainability-focused approach addresses rising energy costs while meeting corporate environmental commitments from hyperscale tenants. In August 2024, Scala Data Centers announced a renewable energy supply agreement with Serena in Bahia, Brazil, securing 393 megawatts of wind power capacity to support hyperscale facilities beginning in 2025. Major international operators including Google have committed to utilizing renewable energy sources for more than ninety percent of their regional energy matrix.

Advancement of Artificial Intelligence Infrastructure Requirements

Artificial intelligence workloads are fundamentally reshaping data center design requirements throughout Latin America, driving demand for high-density computing environments and liquid cooling solutions. AI applications require significantly higher power densities compared to traditional computing, compelling operators to redesign thermal architectures and electrical systems. This technological shift is prompting substantial investments in purpose-built facilities capable of supporting advanced machine learning operations. Data center developers are prioritizing scalable infrastructure that accommodates evolving computational demands while maintaining energy efficiency and operational reliability.

Fifth-Generation Network Rollout Driving Edge Computing Expansion

The rapid deployment of fifth-generation wireless networks across Latin America is accelerating demand for edge computing facilities positioned closer to end users. These distributed infrastructure nodes support ultra-low latency applications including autonomous systems, industrial automation, and real-time analytics. Telecommunications operators throughout the region are actively investing in micro-data centers near major population centers to support emerging connectivity requirements. This infrastructure expansion enables service providers to deliver enhanced performance for latency-sensitive applications while supporting the growing ecosystem of connected devices and enterprise digital services.

Market Outlook 2026-2034:

The Latin America data center market outlook remains exceptionally positive as regional digital transformation initiatives accelerate and hyperscale cloud providers expand their presence across key metropolitan areas. Increasing demand for cloud-based services, artificial intelligence applications, and enterprise digital solutions continues driving infrastructure investments throughout the forecast period. The market generated a revenue of USD 16.64 Billion in 2025 and is projected to reach a revenue of USD 32.91 Billion by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034. Nearshoring trends, data sovereignty requirements, and expanding submarine cable connectivity are positioning the region as a strategic destination for global technology investments. The convergence of sustainability initiatives, regulatory frameworks, and rising consumer data consumption creates favorable conditions for continued market expansion.

Latin America Data Center Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Solution |

63.01% |

|

Type |

Hyperscale |

40.9% |

|

Enterprise Size |

Large Enterprises |

69.92% |

|

End User |

IT and Telecom |

34.91% |

Component Insights:

- Solution

- Services

Solution dominates with a market share of 63.01% of the total Latin America data center market in 2025.

The solution segment encompasses comprehensive infrastructure management platforms, virtualization software, and integrated systems that enable efficient data center operations. Organizations across Latin America are increasingly investing in advanced software solutions that facilitate workload automation, resource optimization, and seamless hybrid cloud management. Scala Data Centers announced a renewable energy supply agreement with Serena for significant wind power capacity from Bahia, Brazil, highlighting the integration of sustainable solutions within modern data center infrastructure. These comprehensive solution deployments are essential for supporting the complex computing requirements of enterprise clients.

The growing demand for solution-based offerings reflects the increasing sophistication of data center requirements across the region. Enterprises are prioritizing integrated platforms that provide end-to-end visibility, security management, and performance monitoring capabilities. The shift toward software-defined infrastructure enables organizations to achieve greater operational flexibility while reducing capital expenditure requirements. Colocation providers are differentiating their offerings by bundling managed solution services that address networking, storage, and computing needs within unified frameworks, thereby enhancing customer value propositions and strengthening long-term partnership relationships with enterprise clients seeking comprehensive digital infrastructure support.

Type Insights:

- Colocation

- Hyperscale

- Edge

- Others

Hyperscale leads with a share of 40.9% of the total Latin America data center market in 2025.

The hyperscale segment is experiencing substantial growth driven by major cloud service providers establishing large-scale facilities across Latin America. These facilities are designed to accommodate massive computing workloads, support artificial intelligence applications, and deliver cloud services to regional enterprise and consumer markets. Microsoft announced plans to make significant investments in Brazil and Mexico to expand and upgrade AI infrastructure, demonstrating the commitment of global hyperscalers to the Latin American market. The construction of hyperscale campuses is transforming the regional data center landscape through unprecedented capacity additions.

Hyperscale operators are prioritizing locations with abundant renewable energy availability, stable regulatory environments, and robust connectivity infrastructure. The expansion of hyperscale facilities is creating positive spillover effects across the regional ecosystem, including increased demand for construction services, power infrastructure, and skilled technical workforce. These large-scale deployments are enabling enterprises throughout Latin America to access world-class cloud computing capabilities while meeting data sovereignty requirements through in-region processing. The hyperscale segment continues to attract substantial capital investments as operators compete to establish dominant market positions across key Latin American markets.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 69.92% share of the total Latin America data center market in 2025.

Large enterprises represent the primary demand driver for data center services across Latin America, reflecting their substantial IT infrastructure requirements and digital transformation initiatives. These organizations require high-capacity facilities capable of supporting complex workloads including enterprise resource planning, customer relationship management, and business intelligence applications. In August 2024, Google commenced construction of its new data center facility in Canelones, Uruguay with an investment of around USD 850 Million, underscoring the scale of infrastructure investments supporting large enterprise requirements. Major corporations across financial services, telecommunications, and retail sectors are expanding their data center footprints.

Large enterprises benefits from established relationships with colocation providers and hyperscale operators who can deliver the reliability, security, and compliance capabilities required for mission-critical applications. These organizations are increasingly adopting hybrid cloud strategies that combine on-premises infrastructure with colocation and public cloud services to optimize performance and cost efficiency. The growing emphasis on data sovereignty and regulatory compliance is driving large enterprises to maintain regional data processing capabilities. Their substantial purchasing power enables negotiation of favorable terms while ensuring access to premium infrastructure and support services.

End User Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

IT and telecom represent the leading segment with a 34.91% share of the total Latin America data center market in 2025.

The IT and telecom sector drives substantial demand for data center infrastructure across Latin America, reflecting the rapid expansion of telecommunications networks and digital services. Cloud service providers, internet companies, and telecommunications operators require extensive facility capacity to support their growing customer bases and expanding service portfolios. According to Ericsson's mobility report, Mexico accounted for 6.6 Million subscribers to the 5G network across 125 cities in 2024, illustrating the scale of telecommunications infrastructure expansion driving data center demand. The convergence of telecommunications and cloud computing continues to fuel infrastructure investments throughout the region.

Telecommunications operators are actively investing in edge data centers to support 5G network deployments and reduce latency for end users. The proliferation of streaming services, gaming platforms, and real-time applications is creating sustained demand for distributed infrastructure capable of delivering content efficiently across diverse geographic areas. IT and telecom companies are also establishing interconnection hubs that facilitate traffic exchange between networks and enable seamless connectivity between cloud platforms. These strategic investments are strengthening the regional digital ecosystem while supporting the growing bandwidth requirements of enterprise and consumer markets.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil is experiencing growth in the Latin America data center landscape since São Paulo is serving as the primary hub hosting the region's largest concentration of colocation facilities. The country benefits from abundant renewable energy resources, strong fiber connectivity through multiple submarine cables, and continued hyperscaler expansion establishing dedicated cloud regions across major metropolitan areas.

Mexico has emerged as a strategic data center destination, with Querétaro leading facility development due to low seismic risk and robust highway connectivity to Mexico City. The country's proximity to the United States, nearshoring trends driving manufacturing digitalization, and presence of all three major hyperscalers strengthen its competitive positioning regionally.

Argentina's data center infrastructure centers on Buenos Aires, leveraging strong connectivity through seven operational submarine cables and competitive industrial electricity rates. The Knowledge Economy Law provides tax incentives attracting operators, while telecom companies accelerate 5G deployment to support edge computing requirements and AI-driven workload expansion across enterprise sectors.

Colombia is rapidly developing as a key digital infrastructure hub, with Bogota hosting most colocation facilities built to Tier III standards. The National Digital Strategy supports smart city development and sustainability initiatives, while enhanced submarine cable connectivity linking to Jamaica, the United States, Brazil, and Panama strengthen regional data routing capabilities.

Chile positions itself as Latin America's green infrastructure capital, with Santiago anchoring data center expansion supported by the region's highest renewable energy penetration. The National Data Center Plan aims to significantly expand the industry, attracting hyperscaler investments leveraging abundant solar, wind, and hydroelectric power resources that enable sustainable operations and carbon neutrality commitments.

Peru represents an emerging data center market with activity concentrated in Lima, benefiting from strategic Pacific coast positioning and favorable climate conditions. Major infrastructure projects including the Chancay Port and airport expansion drive demand for localized digital infrastructure, while hydropower dominates electricity generation, supporting sustainable operations and attracting environmentally conscious investors.

Market Dynamics:

Growth Drivers:

Why is the Latin America Data Center Market Growing?

Hyperscale Cloud Provider Investments Accelerating Regional Infrastructure Development

Global technology giants are deploying unprecedented capital across Latin America to establish cloud regions meeting rising demand for locally hosted services. These investments enable enterprises to leverage cloud computing capabilities while complying with data sovereignty requirements mandating in-country processing. Hyperscale operators bring advanced technologies, operational expertise, and substantial financial resources accelerating regional infrastructure modernization. The establishment of availability zones across multiple metropolitan areas enhances service resilience while reducing latency for end users throughout the region. Major international cloud providers have disclosed significant capital outlays targeting data center expansion across primary Latin American markets, signaling sustained confidence in regional growth potential. These commitments establish the foundation for next-generation digital services supporting artificial intelligence and advanced analytics applications. The influx of hyperscale investment creates multiplier effects throughout local economies, stimulating demand for skilled workforce development, construction services, and supporting infrastructure. Regional operators benefit from knowledge transfer and elevated operational standards introduced by global players, raising overall market competitiveness while expanding service capabilities available to enterprise customers seeking reliable computing resources.

Rising Cloud Adoption and Digital Transformation Initiatives

Enterprises throughout Latin America are accelerating cloud migration strategies as digital transformation becomes essential for competitive positioning. Organizations across banking, retail, manufacturing, and healthcare sectors are implementing software-as-a-service applications, infrastructure-as-a-service solutions, and platform-as-a-service offerings requiring robust data center infrastructure. The proliferation of remote work arrangements, digital commerce platforms, and customer engagement applications generates exponential data growth necessitating scalable computing resources. Financial technology companies are revolutionizing payment processing with platforms handling substantial transaction volumes across the region. Instant payment systems demonstrate the scale of digital infrastructure requirements supporting modern financial services, driving continuous investment in processing capabilities. Small and medium enterprises increasingly leverage cloud-based business applications, expanding the addressable market for data center services beyond traditional enterprise customers. This democratization of cloud access creates sustained demand for colocation and managed services catering to organizations lacking resources for dedicated infrastructure investments. The convergence of consumer digital adoption and enterprise modernization initiatives generates compounding data volumes requiring scalable storage and processing capabilities. Service providers responding to these requirements are expanding facility portfolios while enhancing connectivity options enabling seamless integration between on-premises systems and cloud-hosted applications throughout the region.

Nearshoring Trends and Data Localization Requirements

Manufacturing supply chain realignment and proximity to North American markets are driving infrastructure investments as global companies establish regional operations. Data localization regulations requiring sensitive information storage within national boundaries compel multinational corporations to deploy localized computing resources. These requirements create sustained demand for data center capacity as organizations establish compliant infrastructure supporting cross-border operations. Governments throughout the region are implementing frameworks mandating specific data categories remain within territorial boundaries. Brazil's data protection authority adopted standard contractual clauses for international transfers, restricting outbound movement of sensitive information without explicit safeguards. These regulatory developments support continued data center construction as organizations establish compliant hosting environments meeting evolving legal requirements while maintaining operational efficiency.

Market Restraints:

What Challenges is the Latin America Data Center Market Facing?

Power Infrastructure Constraints Limiting Expansion Capacity

Securing adequate and reliable power supply remains a significant challenge for data center development across Latin America. Grid infrastructure limitations in many regions create bottlenecks preventing rapid capacity expansion despite strong market demand. Operators must coordinate extensively with utility regulators while often investing in dedicated transmission infrastructure and on-site power generation capabilities. These requirements increase project complexity and development timelines while elevating capital expenditure requirements beyond facility construction costs.

Water Scarcity Affecting Cooling System Operations

Traditional data center cooling systems consuming substantial water volumes face increasing scrutiny in regions experiencing drought conditions. Several key markets including Mexico's Querétaro state faced severe water shortages in 2024, prompting regulatory concerns regarding facility development. Operators are transitioning toward air-based cooling technologies reducing water consumption, though these alternatives often require higher capital investments and operational expenditures. Balancing sustainability requirements with operational efficiency presents ongoing challenges for facilities serving water-stressed communities.

High Construction and Development Costs

Data center construction costs in primary Latin American markets rank among the highest in emerging regions, creating barriers for new market entrants and capacity expansion. São Paulo development costs averaging more than ten dollars per watt exceed many comparable global markets while requiring substantial upfront capital commitments. Currency volatility, import tariffs on specialized equipment, and limited local supply chains contribute to elevated project budgets. These financial requirements favor established operators with access to institutional capital while limiting competition from smaller regional providers.

Competitive Landscape:

The Latin America data center market features an increasingly competitive landscape as global operators expand regional presence alongside established local providers. Market leaders maintain substantial portfolios while actively investing in capacity expansion across primary metropolitan markets. Competition intensifies as new entrants seek opportunities in underserved secondary markets and emerging technology segments. Operators differentiate through sustainability credentials, interconnection capabilities, high-density computing support, and strategic partnerships with hyperscale cloud providers. Consolidation activities continue reshaping competitive dynamics as financial investors pursue platform acquisitions enabling rapid scale achievement while established players strengthen market positions through organic expansion.

Recent Developments:

- In December 2025, TERRANOVA, a new hyperscale data center platform established by Actis, announced its official launch in Latin America. The platform plans to invest USD 1.5 Billion over three years, developing modern campuses in Brazil, Mexico, and Chile, with the first facility in Querétaro scheduled for early 2026.

Latin America Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America data center market size was valued at USD 16.64 Billion in 2025.

The Latin America data center market is expected to grow at a compound annual growth rate of 7.87% from 2026-2034 to reach USD 32.91 Billion by 2034.

Solution dominated the market with a share of 63.01%, driven by the growing demand for comprehensive infrastructure management platforms, virtualization software, and integrated systems that enable efficient data center operations across the region.

Key factors driving the Latin America data center market include hyperscale cloud provider investments, rising cloud adoption, digital transformation initiatives, nearshoring trends, data localization requirements, and expanding fifth-generation network deployments.

Major challenges include power infrastructure constraints limiting expansion capacity, water scarcity affecting traditional cooling operations, high construction costs in primary markets, regulatory complexity across multiple jurisdictions, and skilled workforce availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)