Latin America Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industries, and Region, 2026-2034

Latin America Digital Banking Market Size and Share:

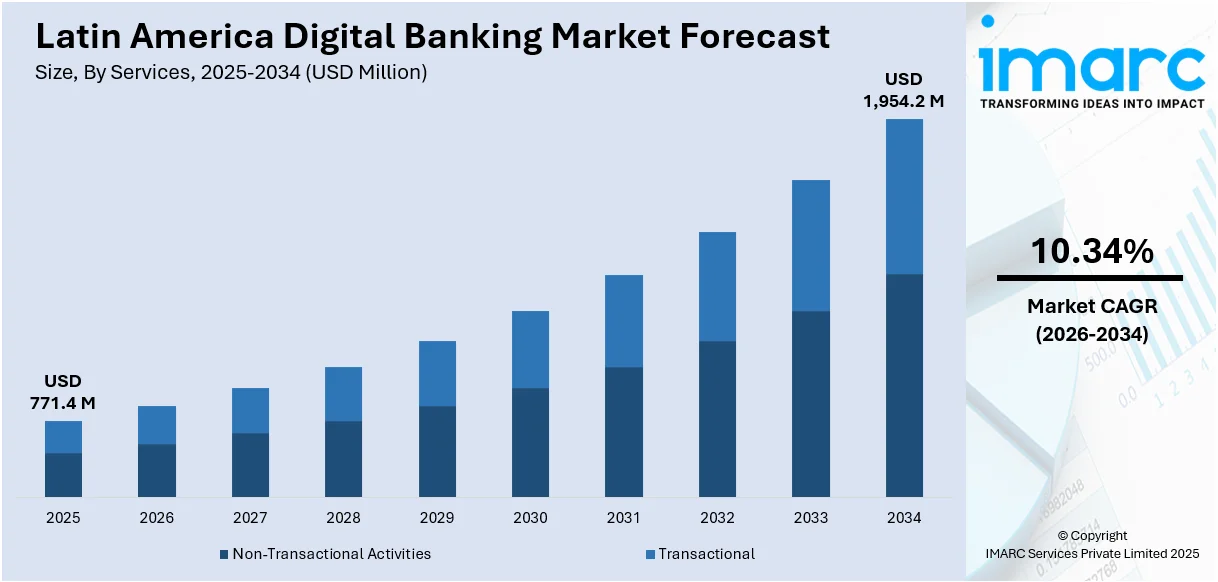

The Latin America digital banking market size was valued at USD 771.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,954.2 Million by 2034, exhibiting a CAGR of 10.34% during 2026-2034. The market is driven by the rising smartphone penetration and expanding internet coverage, enabling seamless access to online financial platforms across urban and rural regions. Additionally, the strong presence of fintech startups offering innovative, customer-centric services is accelerating digital adoption, particularly among unbanked and underbanked population. Moreover, supportive regulatory frameworks promoting cashless ecosystems and the rapid advancement of digital payment solutions are expected to propel future expansion, further augmenting the Latin America digital banking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 771.4 Million |

| Market Forecast in 2034 | USD 1,954.2 Million |

| Market Growth Rate 2026-2034 | 10.34% |

The market in Latin America is primarily driven by the growing penetration of smartphones and internet connectivity across both urban and rural areas. In line with this, the widespread availability of affordable data plans and mobile devices is also providing an impetus to the market. Moreover, the considerable rise in consumer preference for convenient, on-the-go financial services is also acting as a significant growth-inducing factor for the market. On September 23, 2024, Nasdaq announced an expanded partnership with Nubank, providing its AxiomSL regulatory reporting solution to the digital bank, which serves over 100 million customers across Brazil, Mexico, and Colombia. Nasdaq now supports more than 50 banking and payment services clients in Latin America, offering technology solutions that facilitate compliance across 55 countries and 110 regulators. In addition to this, the expanding young and tech-savvy population resulting in higher adoption of online financial platforms is resulting in increased traction for digital-only banking solutions, which is contributing to the Latin America digital banking market growth. Over the past year, more than half of these clients have expanded their use of Nasdaq's AxiomSL and Calypso platforms, reflecting the region's rapid digital banking growth, with fintech startups increasing by over 340% in the last six years.

To get more information on this market Request Sample

Besides this, the growing demand for faster and more secure payment experiences due to the increasing e-commerce activities is creating lucrative opportunities in the market. Also, the increasing influence of fintech startups offering innovative, user-friendly platforms is impacting the market positively. The market is further driven by the implementation of supportive regulatory frameworks that encourage the development of cashless ecosystems across the region. On March 11, 2025, Prometeo launched its Borderless Banking solution to support business-to-business financial operations between the U.S. and Latin American markets. The platform enables businesses to manage cross-border payments, automate collections, and optimize treasury management with real-time tracking, aiming to enhance transparency and security in financial transactions. This solution comes at a time when LatAm imports from North America reached USD 507 billion in 2022, with intra-regional trade at USD 228 billion. Apart from this, easy access to financial products via mobile applications and online platforms is creating a positive Latin America digital banking market outlook. Some of the other factors contributing to the market include rapid urbanization and rising disposable incomes, the cultural shift towards embracing digital solutions for daily transactions, and extensive technological advancements in the banking sector.

Latin America Digital Banking Market Trends:

Advancements in technology

In the rising smartphone penetration and expanding internet coverage across Latin America are driving the market growth. For instance, 72.5 Million households in Brazil had access to the Internet in 2023, recording a penetration rate of 92.5%, according to the Agência IBGE Notícias. With affordable mobile devices and increasing internet coverage, more people are accessing online banking platforms. Countries like, Brazil, Mexico, and Argentina have seen rapid growth in smartphone penetration, which has allowed urban and rural communities to access financial services without having to rely on conventional banking infrastructure. For instance, according to industry reports, approximately 34% of Brazilian consumers are anticipated to embed digital wallets for identity verification in the coming three years. Additionally, this digital access is empowering individuals who previously faced barriers to financial inclusion, allowing them to manage accounts, transfer money, and conduct transactions via mobile apps. Moreover, the convenience of mobile banking, coupled with the increasing availability of affordable smartphones bolstering the higher adoption rates of digital banking services across the region is one of the key Latin America digital banking market trends that are impelling the market growth.

Changing consumer behavior

The growing presence of fintech companies in Latin America spurring competition and innovation in the digital banking sector is acting as another significant growth-inducing factor. As such, the fintech market in Latin America reached USD 13.14 Billion in 2024 and is projected to grow at a CAGR of 15.90% during 2025-2033, as per a report by the IMARC Group. These fintech startups, leveraging technology to deliver financial services, are challenging traditional banks by offering faster and more user-friendly solutions. Fintech companies are particularly adept at catering to the region’s large unbanked and underbanked population, providing solutions such as digital wallets, peer-to-peer lending platforms, and payment apps. Their focus on customer-centric services and streamlined processes has led to increased adoption of digital banking solutions, especially among younger, tech-savvy consumers. As per Latin America digital banking market forecast, traditional banks have been forced to boost their digital transformation strategies to stay competitive, investing in new technologies like artificial intelligence (AI), blockchain, and data analytics to improve service offerings, thus aiding in market expansion. For instance, in February 2025, Brazil's Pix announced that it will launch Pix Automatico in June 2025, which enables 150 Million users to automate recurring payments like streaming and utility bills. This feature is expected to unlock USD 30 Billion in e-commerce transactions and expand Pix's reach to the unbanked.

Latin America Digital Banking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America digital banking market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on services, deployment type, technology, and industries.

Analysis by Services:

- Non-Transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

Non-transactional activities, such as information security, risk management, and financial planning, play a critical role in shaping the Latin America digital banking market. As users increasingly rely on digital platforms for sensitive financial activities, robust security frameworks and advanced risk mitigation strategies are vital for trust-building. Additionally, financial planning tools and stock advisory services offered via digital interfaces are enhancing customer engagement. These non-transactional offerings foster deeper client relationships and drive platform loyalty, thereby encouraging users to conduct more complex financial activities through digital banks, strengthening market competitiveness across the region.

Transactional services form the backbone of digital banking adoption in Latin America, facilitating routine yet essential operations like cash deposits, fund transfers, and automated debit or credit functionalities. The increasing reliance on these services stems from the demand for faster, safer, and more convenient financial transactions without visiting physical branches. Furthermore, the integration of loan services through digital platforms is simplifying credit access for individuals and small businesses. By offering these critical financial functions digitally, banks can attract a broader customer base, improve retention, and accelerate financial inclusion, which continues to drive significant market expansion.

Analysis by Deployment Type:

- On-premises

- On cloud

On-premises deployment of digital banking solutions in Latin America allows financial institutions greater control over their IT infrastructure and data security. This model is particularly favored by larger, traditional banks handling high volumes of sensitive customer information and adhering to strict compliance standards. By maintaining in-house systems, banks can customize features and manage data privacy more effectively, enhancing institutional trust. Although cloud-based solutions are growing, on-premises setups still appeal to institutions prioritizing security and operational autonomy, contributing to steady growth in specific segments of the regional market, especially in countries with stringent regulatory environments.

Cloud deployment is rapidly gaining traction across Latin America’s digital banking landscape due to its flexibility, scalability, and cost-effectiveness. Fintech startups and forward-looking banks increasingly leverage cloud infrastructure to launch new digital services quickly, handle growing customer bases, and adapt to market changes. The ability to access cutting-edge technologies, including AI-powered analytics and real-time fraud detection, makes cloud solutions especially attractive. Moreover, cloud-based deployment reduces upfront capital expenditures, making digital transformation accessible to mid-sized financial entities, thereby accelerating digital inclusion and service outreach, positioning cloud services as a key growth driver in the sector.

Analysis by Technology:

- Internet Banking

- Digital Payments

- Mobile Banking

Internet banking remains a foundational component of the digital banking ecosystem in Latin America, offering consumers direct access to their financial information and services via web platforms. Its widespread adoption stems from its familiarity and convenience, allowing users to perform transactions, monitor accounts, and manage finances remotely. Established banks continue to invest in modernizing their internet banking portals, focusing on enhanced user interfaces and improved security protocols. As digital literacy improves across the region, especially among older demographics, internet banking is expected to retain relevance alongside emerging digital payment innovations, sustaining strong market momentum.

Digital payments are revolutionizing financial transactions across Latin America, driven by the proliferation of mobile wallets, contactless cards, and QR code-based solutions. The rise of e-commerce, particularly in countries like Brazil and Mexico, has catalyzed widespread adoption of digital payment platforms. Financial institutions are capitalizing on this trend by integrating seamless digital payment features into their banking apps, enhancing customer convenience. Additionally, partnerships between fintech firms and traditional banks are expanding the availability of secure, real-time payment methods. These developments are fostering financial inclusion, streamlining commerce, and solidifying digital payments as a cornerstone of the region’s digital banking growth.

Mobile banking is at the forefront of financial innovation in Latin America, largely driven by increasing smartphone usage and mobile internet penetration. Consumers are increasingly conducting financial activities on mobile apps, ranging from simple balance inquiries to complex loan applications. The mobile-first approach by banks and fintechs caters particularly to younger, tech-savvy populations, ensuring convenient access to financial services without the need for physical branches. Furthermore, mobile banking plays a pivotal role in financial inclusion by reaching underserved populations in remote areas. This continued expansion positions mobile banking as a key contributor to market development.

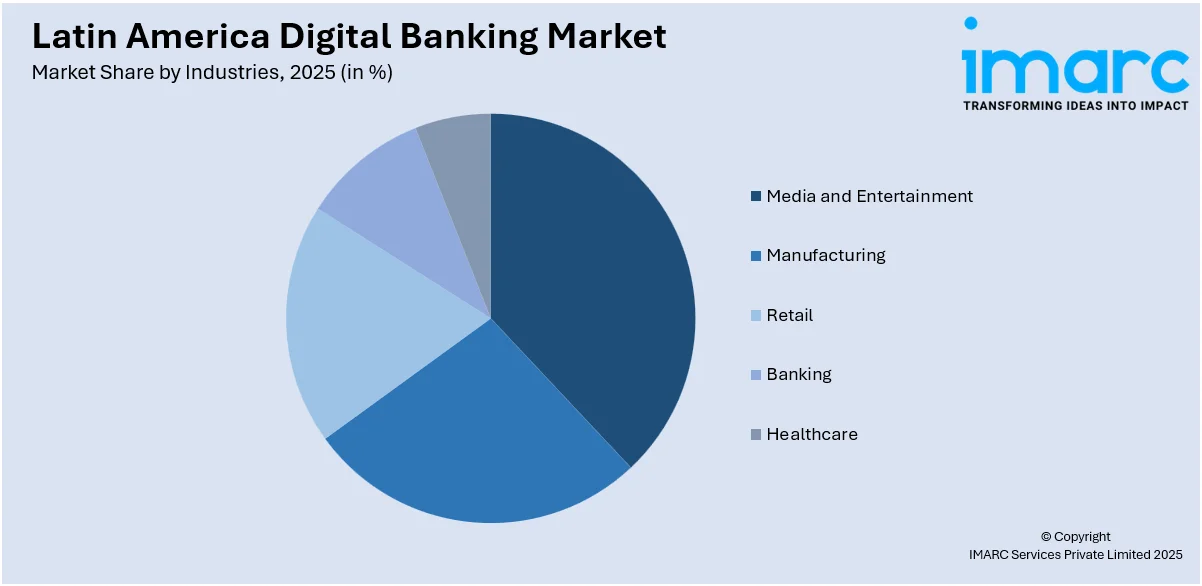

Analysis by Industries:

Access the comprehensive market breakdown Request Sample

- Media and Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

The media and entertainment industry contributes to the digital banking market by driving demand for seamless, instant payment solutions for subscription services, online content purchases, and event ticketing. Digital banks are increasingly integrating specialized financial services to cater to content creators, including revenue management and royalty payments. As online entertainment consumption rises, partnerships between streaming platforms and digital banking providers are emerging, offering exclusive deals or integrated payment features. This synergy between entertainment consumption and financial services enhances user engagement, expands the digital transaction ecosystem, and strengthens digital banking’s relevance in everyday consumer experiences across Latin America.

Manufacturing companies in Latin America are embracing digital banking to streamline financial operations, manage supply chain payments, and simplify payroll processes. The integration of digital banking platforms with enterprise resource planning (ERP) systems enables manufacturers to optimize cash flow, manage transactions efficiently, and reduce operational costs. Additionally, manufacturers increasingly leverage digital credit facilities for equipment financing and capital investments. The adoption of digital solutions in the manufacturing sector contributes to overall market growth by fostering greater financial transparency, efficiency, and resilience, particularly in competitive industries seeking to modernize operations while navigating fluctuating regional economic conditions.

The retail sector in Latin America significantly propels the digital banking market as both small businesses and large chains embrace digital transactions to enhance sales and improve customer experience. The rise of e-commerce platforms necessitates seamless, secure digital payment systems, with digital banks providing tailored solutions such as instant settlements and merchant financing. Retailers are also adopting digital point-of-sale (POS) systems integrated with banking platforms, enabling real-time tracking of sales and payments. As consumer expectations evolve toward cashless shopping, the partnership between retail enterprises and digital financial services is further boosting adoption and supporting sustained market growth.

Regional Analysis:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil stands as one of the largest contributors to Latin America’s digital banking sector, supported by robust fintech activity, high smartphone usage, and the widespread adoption of Pix, the national instant payment system. With nearly universal internet access in urban areas and growing outreach in rural regions, the country offers fertile ground for digital banking innovations. Banks and fintechs are aggressively expanding their service portfolios to address unbanked populations. Furthermore, regulatory bodies actively foster an open banking ecosystem, driving competition and efficiency. These factors position Brazil as a critical driver of digital banking advancements across the region.

Mexico’s digital banking market is witnessing remarkable expansion, propelled by increasing smartphone penetration and supportive government initiatives aimed at enhancing financial inclusion. Fintech companies in Mexico are rapidly developing innovative solutions to reach the country’s large unbanked population, offering mobile-based banking and digital wallets. Additionally, the growing e-commerce industry is driving demand for secure online payment services. With rising consumer trust in digital financial platforms, traditional banks are also accelerating their digital transformation efforts. These combined trends contribute to Mexico’s emergence as a key growth hub for digital banking within the Latin American financial ecosystem.

Argentina’s digital banking market is expanding steadily, driven by the country’s tech-savvy population and rising reliance on digital transactions amidst economic challenges. The growing demand for secure, inflation-resistant financial products has pushed consumers toward digital banks offering innovative savings and investment tools. Additionally, partnerships between fintech startups and traditional banks have introduced flexible credit options and digital lending platforms. Regulatory initiatives supporting digital financial ecosystems are also gaining momentum. As a result, Argentina’s evolving financial behavior and increasing adoption of digital payment channels are contributing positively to the overall growth of the regional market.

Colombia is rapidly emerging as a significant player in Latin America’s digital banking space, fueled by widespread smartphone adoption and targeted government programs aimed at improving financial inclusion. The fintech ecosystem in Colombia is vibrant, with startups focusing on streamlining everyday banking services, such as fund transfers, mobile payments, and microloans. Additionally, initiatives like the Financial Inclusion Law are reinforcing institutional commitment to expanding banking access digitally. As both urban and rural communities embrace digital finance, Colombia continues to foster greater economic participation and technological innovation, positioning itself as an essential growth market for digital banking services.

Chile’s digital banking market benefits from a well-developed telecommunications infrastructure and a consumer base receptive to technological innovations. Financial institutions are expanding their digital offerings to meet the growing demand for online banking, particularly for fund transfers, bill payments, and investment services. Furthermore, fintech collaborations are accelerating service diversification, targeting unbanked and underbanked populations. The government’s active engagement in promoting digital payments through regulatory modernization further supports market advancement. With a stable economic environment and high internet penetration, Chile is emerging as a leader in fostering digital financial services adoption within the region.

Peru is witnessing a significant shift toward digital banking, supported by an expanding fintech ecosystem and rising smartphone usage among underserved populations. Mobile-first financial services are addressing gaps in traditional banking, providing consumers with easier access to savings, credit, and insurance products. Additionally, initiatives like the National Financial Inclusion Policy are reinforcing the move toward cashless transactions, especially in rural communities. Collaboration between banks and fintech firms is introducing new, customer-centric products tailored to local needs. These developments are solidifying Peru’s position as a promising market within Latin America’s evolving digital banking landscape.

Competitive Landscape:

Major market players in the Latin America digital banking sector are actively leveraging technological advancements, strategic partnerships, and service diversification to drive market expansion. Leading banks and fintech firms are heavily investing in mobile-first platforms, artificial intelligence, and data analytics to improve customer engagement, streamline operations, and offer personalized financial solutions. Several established banks are forming collaborations with fintech startups to integrate innovative features such as real-time payments, digital wallets, and automated financial planning tools. Additionally, these players are expanding their services to underserved populations by launching simplified, low-cost digital banking products tailored to local needs, further accelerating regional market growth.The report provides a comprehensive analysis of the competitive landscape in the Latin America digital banking market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Mercado Pago, the FinTech division of Mercado Libre, announced plans to seek a banking license in Argentina in order to launch the largest digital bank in the country and significantly expand its range of digital banking services. With a banking license from the Central Bank of Argentina, Mercado Pago will be able to offer new credit lines and more investment instruments in the country. This approach is similar to current initiatives in Mexico and Brazil, where the business has already established substantial fintech operations.

- April 2025: Nu Mexico, a subsidiary of digital banking services provider Nubank, successfully secured its banking license from the National Banking and Securities Commission (CNBV). This achievement makes Nu the first Popular Financial Society (SOFIPO) to be granted permission to become a bank. With this accomplishment, the business is one step closer to introducing a payroll account and expanding its product range across Mexico.

- March 2025: Due to investor demand, Ualá, a provider of digital banking services across Latin America, expanded its Series E investment round, raising an extra USD 66 Million to reach a total of USD 366 Million. The additional investment further demonstrates Ualá's dedication to expanding its digital banking services in Argentina, Colombia, and Mexico while advancing its innovation in digital financial services.

- March 2025: Mexican digital bank Plata completed its Series A equity financing round with a USD 1.5 Billion valuation. Through a combined equity round, the Series A round secured USD 160 Million. Since its founding, Plata has raised USD 750 Million in loan and equity investment to deploy in Mexico, including this deal. With this funding, Plata reaffirms its dedication to the digitization of financial services in Mexico.

- November 2024: Openbank, the digital banking service of Grupo Santander, officially began operations in Mexico with the release of its website and mobile application in the country. Openbank offers one of the most cutting-edge technological platforms in the world, featuring a competitive selection of debit and savings products with no minimum balance and no hidden fees.

Latin America Digital Banking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Deployment Types Covered | On-Premises, On Cloud |

| Technologies Covered | Internet Banking, Digital Payments, Mobile Banking |

| Industries Covered | Media and Entertainment, Manufacturing, Retail, Banking, Healthcare |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America digital banking market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Latin America digital banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America digital banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America digital banking market was valued at USD 771.4 Million in 2025.

The digital banking market in Latin America is expected to exhibit a CAGR of 10.34% during 2026-2034, reaching a value of USD 1,954.2 Million by 2034.

The growth of the Latin America digital banking market is driven by increasing internet penetration, rising smartphone adoption, government initiatives promoting financial inclusion, evolving consumer preferences for digital banking services, and the expansion of secure, user-friendly mobile banking platforms

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)