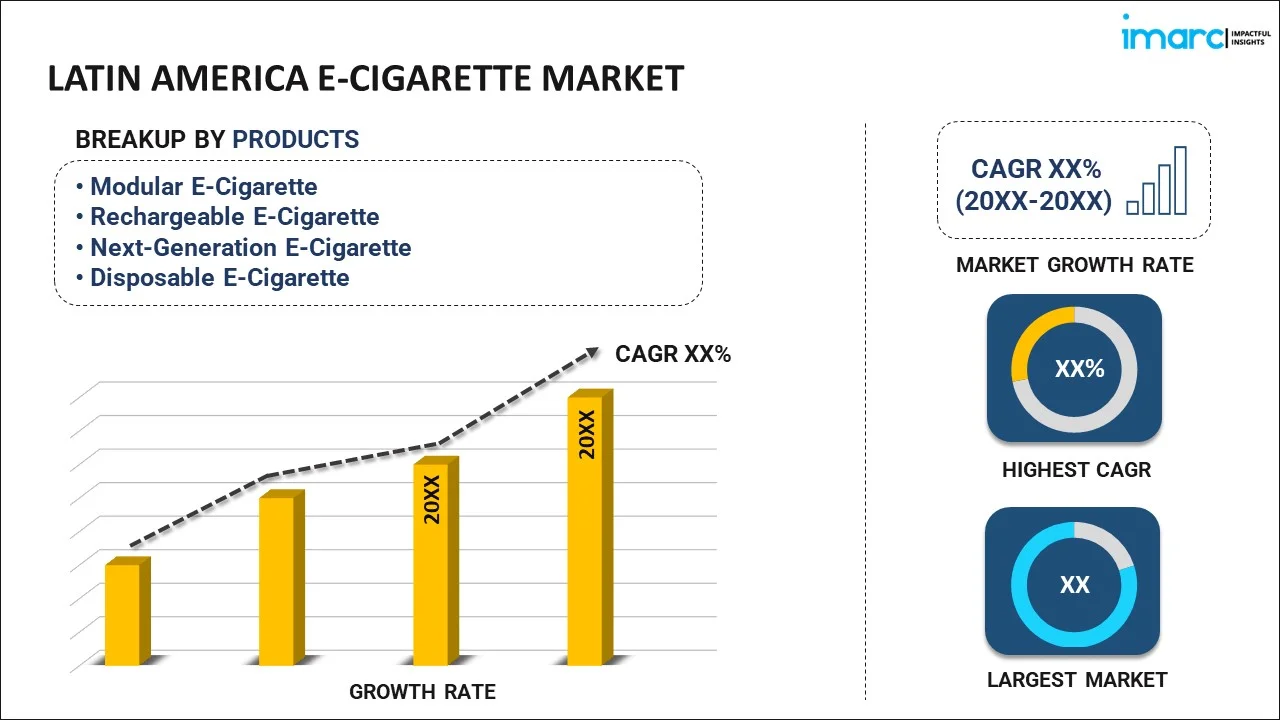

Latin America E-Cigarette Market Report by Product (Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette), Flavor (Tobacco, Botanical, Fruit, Sweet, Beverage, and Others), Mode of Operation (Automatic E-Cigarette, Manual E-Cigarette), Distribution Channel (Specialist E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, and Others), and Country 2025-2033

Latin America E-Cigarette Market Summary:

The Latin America e-cigarette market size reached USD 190 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 370 Million by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The market is driven by rising health concerns over traditional smoking, increasing awareness of vaping as a less harmful alternative, expanding distribution via online and specialty stores, targeted marketing by global brands, and changing regulatory frameworks. Brazil’s urban vaping culture and Mexico’s evolving regulations also shape market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 190 Million |

|

Market Forecast in 2033

|

USD 370 Million |

| Market Growth Rate 2025-2033 | 7.05% |

Also known as e-cigs and vape pens, e-cigarettes are battery-operated devices manufactured using cartridge, mouthpiece, atomizer and batteries. These devices contain nicotine, humectant and flavorings, which are heated at a high temperature to retain moisture and produce an aerosol. They can resemble cigars or USB memory sticks and provide a sensation of smoking tobacco. At present, they are increasingly being adopted by young adults in the Latin American region on account of their cost-effectiveness.

Rising awareness about respiratory illness and diseases is increasing the willingness among individuals to quit smoking, which, in turn, is positively influencing the overall sales of e-cigarettes in the Latin America region. This can be attributed to the positive perception toward e-cigarettes. Apart from this, the easy availability of a wide range of product flavors via online distribution channels is catalyzing the market growth. Furthermore, leading players in the industry are relying on social media platforms to implement innovative promotional strategies and expand their consumer base in the region. Besides this, they are also introducing next-generation product variants that involve refillable, pre-filled pod systems, which is anticipated to fuel the market growth in the upcoming years.

Latin America E-Cigarette Market Trends:

Organic Vaping Products Gaining Ground in Latin America

In Latin America, organic vaping products are carving out a solid user base among health-aware consumers. These products, free from synthetic chemicals, artificial flavors, and heavy metals, are being promoted as cleaner alternatives to traditional e-liquids. Younger adults and former smokers are showing high interest, especially in countries like Brazil and Argentina, where vaping is being used as a tool for reducing tobacco use. Local brands are capitalizing by offering botanical extracts and eco-certified ingredients. One impact of this is a noticeable dent in the cigarette market, where former users are opting for non-tobacco alternatives with transparent labeling. Retailers and online shops are featuring these organic lines more prominently, often pricing them as premium options due to natural ingredients. Government oversight is still inconsistent, but awareness around product safety is growing steadily through social channels. Sales are also accelerating via e-commerce in Latin America, which allows niche organic brands to reach customers in areas where vape retail infrastructure is limited or absent. As buyers look for authenticity and safety, organic vapes are becoming a standout segment across the region.

Eco-Friendly Devices Driving Design Innovation

Sustainability has become a priority in the Latin American vape market, where users are seeking devices with lower environmental impact. Many manufacturers now offer refillable vapes, recyclable pods, and biodegradable packaging. This trend is particularly strong in urban areas, where waste reduction is gaining momentum. Reusable batteries and modular components are also making it easier for consumers to stick with a single device long-term. The move aligns with a broader retreat from smoking in the US, where wasteful disposables and chemical-heavy products still dominate. Users are turning to brands that emphasize circular product design and transparent supply chains. Local companies are also starting to adapt by reducing single-use materials in packaging and offering recycling take-back programs. Brands once tied to the America cigarette space are being challenged by upstarts prioritizing green engineering. Sustainability is no longer a niche pitch; it’s a core part of what many buyers now expect, especially when shopping online. This push toward eco-conscious vaping is reshaping what counts as premium and ethical in the region’s evolving vape scene.

Nicotine-Free Vaping Seeing Strong Momentum

Nicotine-free vapes are gaining traction across Latin America as ex-smokers and health-minded users look for satisfying, non-addictive options. These devices still offer flavor and habit replication without chemical dependency. With popular varieties ranging from fruity blends to herbal infusions, these products are popular among young adults trying to quit or avoid nicotine altogether. Their appeal lies in flexibility and reduced health risks. The growing appetite for nicotine-free options is now reflected in the Latin America e-commerce market, where platforms are expanding their wellness-oriented vape catalogs. With easy access to detailed product descriptions, users are more informed and selective about what they’re buying. This segment also sees strong support from influencers and digital communities focused on personal wellness. Traditional players in the cigarette Americano sector are beginning to lose ground in this area. New vape startups are designing product lines that focus entirely on zero-nicotine content, often tying their marketing to mental clarity, productivity, and lifestyle balance. The shift is part of a larger cultural turn away from cigarette American branding, toward vaping models that serve new user identities and wellness goals.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Latin America e-cigarette market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product, flavor, mode of operation and distribution channel.

Breakup by Product:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

Breakup by Flavor:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

Breakup by Mode of Operation:

- Automatic E-Cigarette

- Manual E-Cigarette

Breakup by Distribution Channel:

- Specialist E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

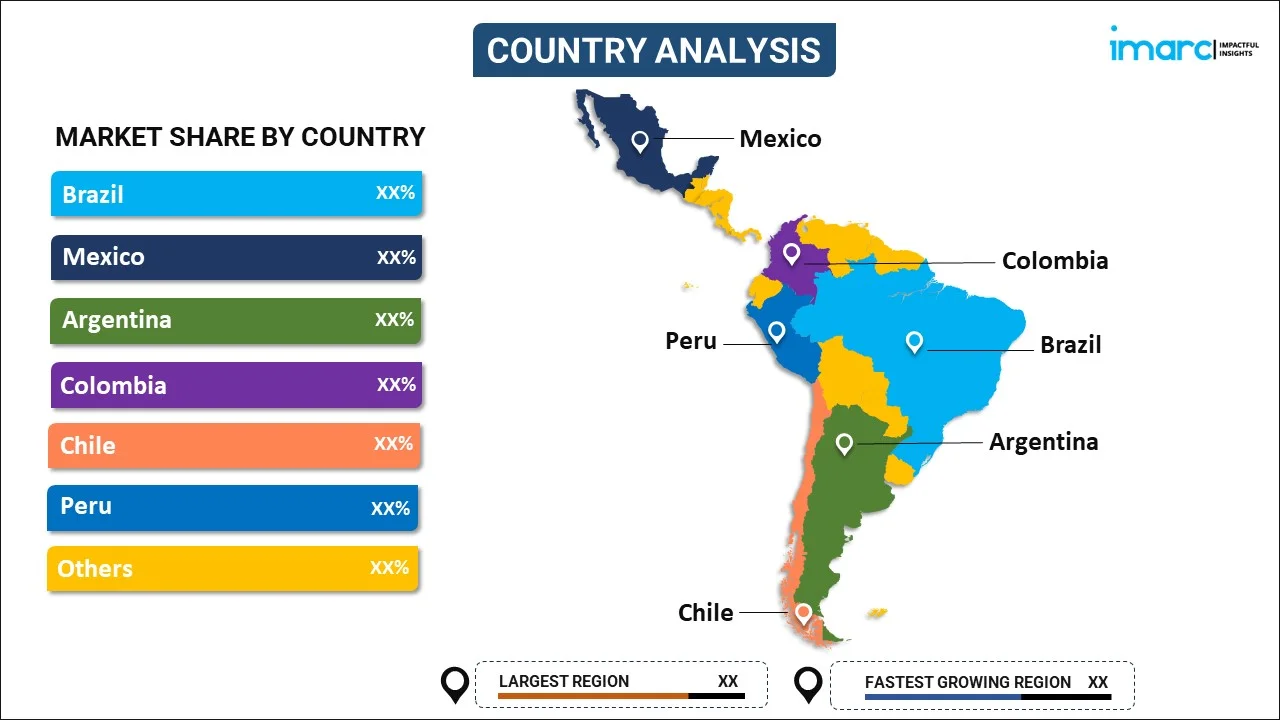

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product, Flavor, Mode Of Operation, Distribution Channel, Country |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The e-cigarette market in Latin America was valued at USD 190 Million in 2024.

The Latin America e-cigarette market is projected to exhibit a CAGR of 7.05% during 2025-2033, reaching a value of USD 370 Million by 2033.

The Latin America e-cigarette market is driven by rising health concerns over traditional smoking, increasing awareness of vaping as a less harmful alternative, expanding distribution via online and specialty stores, targeted marketing by global brands, and changing regulatory frameworks that are gradually permitting or clarifying the sale of such products.

Chile accounted for the largest share of the market in 2024 due to its permissive regulations, high urban smoking rates, growing consumer interest in alternatives, and early retail penetration compared to neighboring countries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)