Latin America Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Region, 2026-2034

Latin America Electric Bus Market Summary:

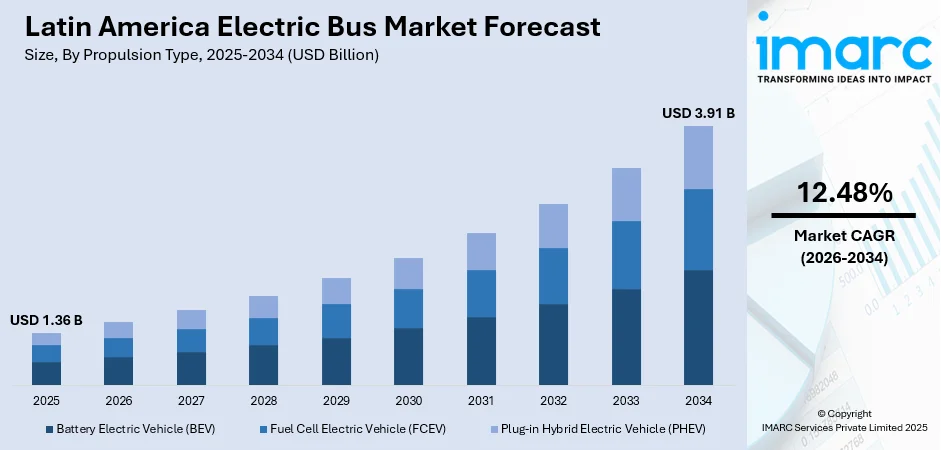

The Latin America electric bus market size was valued at USD 1.36 Billion in 2025 and is projected to reach USD 3.91 Billion by 2034, growing at a compound annual growth rate of 12.48% from 2026-2034.

The Latin America electric bus market is shaped by rapid urbanization, sustainability goals, and efforts to reduce air pollution across major cities. Governments are encouraging clean mobility through supportive regulations and investment in public transportation upgrades. Growing awareness of operational cost benefits and improvements in battery performance further strengthen adoption, as fleet operators shift toward efficient, low-emission transit solutions suited to diverse regional conditions.

Key Takeaways and Insights:

- By Propulsion Type: Battery Electric Vehicles (BEVs) hold the largest share in the Latin American electric bus market at 78%, emerging as the leading zero-emission solution. Adoption is propelled by stringent environmental policies and rising urban transit demands.

- By Battery Type: Lithium-ion batteries are dominating the market with a 92% share, offering high energy density, long lifecycle, and reliable performance. This technology underpins the largest expansion of electric bus networks across the region.

- By Length: Buses measuring 9–14 meters represent the largest segment, accounting for 65% of the market. Their optimal balance of passenger capacity and maneuverability makes them ideal for urban routes and high-demand city corridors.

- By Range: Electric buses with ranges under 200 miles are the leading choice for city operations, enabling daily routes without frequent charging. They support cost-effective, reliable, and sustainable urban transportation.

- By Battery Capacity: Buses equipped with batteries up to 400 kWh provide sufficient energy for urban routes while ensuring manageable charging times. This capacity drives operational efficiency, reliability, and reduced downtime, positioning them as the largest contributors to fleet performance.

- Key Players: The Latin American electric bus market is shaped by global and regional leaders competing on battery performance, durability, charging infrastructure, and after-sales support. Strategic partnerships and operational excellence are dominating the market, fostering differentiation and accelerating adoption.

To get more information on this market, Request Sample

The Latin America electric bus market is advancing as cities prioritize cleaner, quieter, and more efficient transportation solutions to address rising environmental and operational demands. Governments, transit agencies, and private operators are increasingly embracing electrified mobility to enhance urban air quality, modernize public transit, and reduce long-term operating expenses. In 2025, the region’s e-bus fleet reached over 7,000 vehicles, with major investments exceeding US$ 4.3 billion toward fleet electrification, highlighting strong adoption momentum. Improvements in battery reliability, charging accessibility, and overall vehicle performance are strengthening confidence in electric fleets. Growing emphasis on sustainable mobility strategies and the need to optimize energy use across dense urban corridors further support this transition. As infrastructure planning evolves, electric buses are becoming a central component of the region’s future transit landscape.

Latin America Electric Bus Market Trends:

Shift Toward Zero-Emission Public Transit

Latin America is steadily prioritizing zero-emission transport, with cities integrating electric buses to reduce pollution and modernize fleets. By the end of 2024, the region’s e‑bus fleet reached 6,055 vehicles — up from just 801 in 2017 — underscoring rapid adoption over the past several years. This transition is supported by improved charging infrastructure, growing environmental awareness, and long-term operational advantages that make electric mobility increasingly practical.

Expansion of Fleet Electrification Programs

Public and private operators are accelerating fleet electrification to enhance efficiency and lower lifecycle costs. Procurement models, maintenance partnerships, and route optimization strategies are evolving, enabling smoother integration of electric buses into diverse urban and intercity transport networks across the region.

Advancements in Battery and Charging Technologies

Improved battery durability, faster charging solutions, and adaptable power systems are driving wider adoption of electric buses. In October 2024, Santiago expanded Latin America’s largest zero-emission bus fleet as the RED system deployed 150 new BYD electric buses along Avenida Bernardo O’Higgins, operated by Metbus. With 455 BYD units now running and the city’s e-bus fleet nearing 800 by year-end, Chile continues advancing toward its goal of fully electrifying public transport by 2040. These technological enhancements help operators achieve better range, higher reliability, and reduced downtime, supporting consistent and scalable operations in Latin America’s varied transit environments.

Market Outlook 2026-2034:

The Latin America electric bus market is poised for sustained growth, with revenues projected to reach USD 1.36 Billion in 2025, and is expected to reach USD 3.91 Billion by 2034, growing at a compound annual growth rate of 12.48% from 2026 to 2034. As cities pursue cleaner and more efficient transportation solutions. Rising focus on sustainability, supportive mobility policies, and advancements in battery performance and charging infrastructure are expected to drive revenue growth and further adoption. Fleet operators are likely to prioritize long-term operational benefits, positioning electric buses as an increasingly vital contributor to the region’s modern public transit landscape.

Latin America Electric Bus Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Propulsion Type | Battery Electric Vehicle (BEV) | 78% |

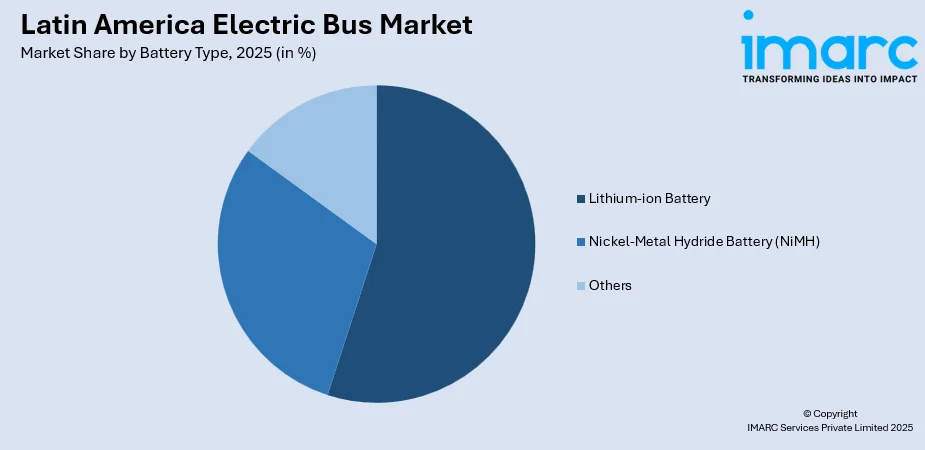

| Battery Type | Lithium-ion Battery | 92% |

| Length | 9-14 Meters | 65% |

| Range | Less than 200 Miles | 80% |

| Battery Capacity | Up to 400 kWh | 85% |

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

The battery electric vehicle (BEV) segment accounted for a revenue share of 78% of the total Latin America electric bus market in 2025, representing the largest propulsion type category.

Battery electric vehicles (BEVs) are at the forefront of Latin America’s urban mobility transformation. Their zero-emission operation aligns with environmental goals while reducing maintenance costs due to fewer moving parts. Operators benefit from improved fleet reliability, simplified scheduling, and lower operational complexity, making BEVs a practical and sustainable choice for public transport networks seeking to modernize and expand their electrified fleets. In October 2025, the ZEBRA Association reported that Latin America operates over 7,000 battery electric buses, with São Paulo, Santiago, and Bogotá leading 75% of investments, highlighting the rapid adoption of BEVs across the region.

Cities are increasingly adopting BEVs to replace conventional combustion buses. The technology supports integration with renewable energy, enhances energy efficiency, and allows for scalable fleet deployment. Urban authorities value BEVs for predictable performance, operational flexibility, and long-term sustainability, making them a cornerstone of regional efforts to reduce emissions and promote cleaner, more efficient public transportation systems across dense city corridors.

Battery Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

The lithium-ion battery accounted for the largest revenue share of approximately 92% in the Latin America electric bus market in 2025.

Their lightweight nature improves vehicle efficiency and operational performance on demanding urban routes. Operators benefit from consistent service, extended battery lifespan, and the ability to integrate these batteries into various bus models, enhancing fleet flexibility while maintaining reliability. In June 2024, Toshiba, Sojitz, and CBMM unveiled an ultra-fast-charging electric bus prototype in Araxá, Brazil, powered by next-generation lithium-ion batteries with niobium titanium oxide anodes, demonstrating how advanced chemistries can further enhance durability and charging efficiency.

Advanced battery management systems optimize safety, regulate energy use, and reduce downtime. Modular battery designs allow easy replacement and upgrades, ensuring long-term efficiency. Coupled with compatibility for fast-charging infrastructure, lithium-ion batteries provide the necessary reliability, performance, and flexibility to support growing electric bus networks and daily transit demands in Latin American cities.

Length Insights:

- Less than 9 Meters

- 9-14 Meters

- Above 14 Meters

The 9-14 meters segment accounted for a revenue share of 65% of the total Latin America electric bus market in 2025, representing the largest length category.

Electric buses with lengths of 9–14 meters provide an ideal balance between passenger capacity and maneuverability. Their moderate size enables navigation through congested streets while accommodating sufficient passengers and essential amenities, ensuring operational efficiency and comfort. Transit authorities can deploy these buses on diverse routes without compromising service quality, providing flexible solutions for urban and suburban networks. In June 2025, 121 King Long M8 electric buses rolled off the production line in Xiamen, set for Copiapó, Chile, creating Latin America’s first fully electric city bus system.

This segment also allows the integration of advanced battery systems and interior features while maintaining manageable vehicle weight. Operators can adjust deployments according to ridership patterns, ensuring cost-effective fleet utilization. Mid-sized buses remain a strategic choice for cities pursuing sustainable, efficient, and adaptable public transport solutions that meet growing mobility demands.

Range Insights:

- Less than 200 Miles

- More than 200 Miles

The less than 200 miles accounted for the largest revenue share of approximately 80% in the Latin America electric bus market in 2025.

Electric buses with ranges under 200 miles are suited for daily urban and suburban routes with frequent stops. Their range ensures that operators can complete scheduled routes without mid-day charging, improving service predictability and reducing downtime. These buses provide a practical, efficient solution for densely populated areas, optimizing energy consumption and fleet management.

Shorter-range buses also offer lower vehicle weight, increasing efficiency and reducing operating costs. Charging can be effectively managed at depots or during off-peak hours, minimizing disruption to service. This segment addresses operational needs while enabling the adoption of electrified fleets in cities with established transit networks and constrained route distances.

Battery Capacity Insights:

- Up to 400 kWh

- Above 400 kWh

The up to 400 kWh segment accounted for a revenue share of 85% of the total Latin America electric bus market in 2025, representing the largest battery capacity category.

Buses with battery capacities of up to 400 kWh allow operators to maintain full-day urban operations without frequent interruptions for charging. This capacity ensures consistent performance across varied routes and stop-and-go traffic, supporting reliable service delivery and operational planning. Batteries of this size balance energy storage with vehicle weight, optimizing efficiency and passenger comfort.

Modular designs and advanced energy management systems extend battery life and facilitate maintenance or upgrades. Regenerative braking enhances overall energy efficiency, allowing buses to operate economically while minimizing environmental impact. This capacity segment supports sustainable and cost-effective fleet operations, ensuring that electric buses can meet urban transit demands while reducing emissions.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil is rapidly adopting electric buses to reduce urban emissions and modernize transit. Investment in charging infrastructure, renewable energy integration, and fleet electrification is expanding, supporting sustainable mobility solutions in major cities like São Paulo, Rio de Janeiro, and Curitiba.

Mexico focuses on electrifying public transport to improve air quality in metropolitan areas. Pilot programs, government incentives, and private sector participation drive the deployment of battery electric buses across cities such as Mexico City and Guadalajara, enhancing energy-efficient urban transit networks.

Argentina is integrating electric buses in Buenos Aires and other urban centers to modernize fleets and reduce pollution. Adoption is supported by municipal programs, improving operational efficiency while aligning with environmental and energy sustainability objectives for public transportation.

Colombia emphasizes electric bus deployment in Bogotá and Medellín to decrease urban emissions and promote sustainable mobility. Government incentives and infrastructure development support fleet modernization, enabling reliable, cost-effective, and environmentally friendly public transportation solutions.

Chile advances electric bus adoption, particularly in Santiago, through pilot projects and energy-efficient transit initiatives. Integration with renewable energy and supportive policies enhances fleet sustainability, operational efficiency, and reduced urban pollution levels.

Peru is gradually incorporating electric buses in Lima and other cities to modernize urban transit. Investment in charging infrastructure and environmental policies supports low-emission, energy-efficient public transportation, contributing to cleaner and more sustainable city mobility.

Other Latin American countries, including Ecuador, Uruguay, and Bolivia, are exploring electric bus programs. Focused on pilot deployments, infrastructure development, and sustainability initiatives, these markets are gradually adopting electrified fleets to improve urban transport and reduce emissions.

Market Dynamics:

Growth Drivers:

Why is the Latin America Electric Bus Market Growing?

Growing Demand for Modernized Urban Transport

Rapid urban expansion across Latin America is putting significant pressure on existing public transport systems. Cities are increasingly seeking cleaner, more efficient mobility solutions to manage growing commuter demand while minimizing environmental impact. Electric buses have emerged as a key solution, offering quieter operations and smoother rides that enhance passenger comfort in densely populated urban areas. According to a 2024 report by International Council on Clean Transportation (ICCT), the region’s electric‑bus fleet reached 6,055 vehicles by the end of 2024 — up sharply from just 801 in 2017.

In addition to improved comfort, electric buses reduce maintenance complexity and operational costs compared with conventional diesel fleets. Their adoption allows cities to modernize transit networks, improve air quality, and support sustainability goals. With growing government incentives and infrastructure development, electric buses are becoming a practical and strategic choice for Latin American cities aiming to upgrade public transportation efficiently.

Rising Focus on Energy Diversification

Countries across Latin America are actively seeking alternatives to conventional fuel dependence, driving the integration of electric mobility into public transport fleets. Electric buses offer a strategic solution by reducing reliance on fossil fuels, lowering emissions, and supporting national sustainability targets, making them increasingly attractive for modern urban transit systems. For example, in November 2025, a €80 million fund was launched in Brazil, backed by public and private partners, to deploy more than 1,700 electric buses and associated charging infrastructure by 2030.

The appeal of electric buses is further strengthened by growing interest in pairing them with renewable energy sources, which enhances energy efficiency and reduces exposure to fuel price volatility. Additionally, improved grid readiness and charging infrastructure make electric buses a reliable long-term transport option, helping cities achieve cleaner, more resilient, and cost-effective public transportation networks.

Improved Total Cost of Ownership Benefits

Fleet operators across Latin America are increasingly recognizing the financial advantages of electric buses throughout their lifecycle. Reduced mechanical wear, lower fueling expenses, and flexible charging schedules help create more predictable and manageable operating costs, making electric buses a financially attractive option.

These economic benefits are accelerating the shift from traditional combustion fleets to electric alternatives across the region. By lowering long-term expenses and improving operational efficiency, electric buses offer a sustainable and cost-effective solution for urban transit. This growing recognition among operators is driving broader adoption, supporting cleaner mobility, and reinforcing the modernization of public transportation networks across Latin American cities.

Market Restraints:

What Challenges the Latin America Electric Bus Market is Facing?

High Initial Capital Requirements

Electric buses require significant upfront investment in both vehicles and charging systems, creating financial barriers for transit agencies. Limited budgets and lengthy approval cycles make it difficult for operators to justify immediate adoption despite long-term cost advantages.

Limited Grid Capacity and Reliability Issues

Many regions face inconsistent power availability and underdeveloped electrical infrastructure, complicating large-scale fleet electrification. Insufficient grid strength increases operational risks and demands costly upgrades, slowing efforts to integrate electric buses into daily transit networks.

Technical Skill Gaps in Maintenance

Electric buses rely on advanced battery systems and digital components that require specialized expertise. Many operators lack trained technicians, resulting in longer maintenance cycles, dependence on external support, and operational uncertainty during the early stages of fleet electrification.

Competitive Landscape:

The competitive landscape of the Latin America electric bus market features a mix of global manufacturers, regional assemblers, and technology providers focused on delivering reliable, energy-efficient mobility solutions. Companies compete on battery performance, charging compatibility, vehicle durability, and after-sales support. Partnerships with transit agencies, financing institutions, and infrastructure developers are increasingly influencing market positioning. As adoption expands, differentiation is driven by operational efficiency, maintenance capabilities, and the ability to tailor solutions to diverse urban environments.

Recent Developments:

- In July 2025, Santiago, Chile’s Red Movilidad added over 300 new electric buses under its Mobility Network Renewal Plan, advancing the city’s goal of a 68% electric fleet by early 2026, potentially exceeding 4,400 zero-emission buses. The expansion reflects Chile’s commitment to sustainable urban transport and enhanced public mobility.

- In May 2024, Volvo Buses deployed its first bi‑articulated electric buses in Latin American cities, including Bogotá, Mexico City, and Curitiba, using the “BZR” electromobility platform. The trials aim to validate performance, battery efficiency, and suitability for high-capacity urban transport, reinforcing Volvo’s commitment to expanding electric mobility solutions across the region.

Latin America Electric Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-ion Battery, Nickel-Metal Hydride Battery (NiMH), Others |

| Lengths Covered | Less than 9 Meters, 9-14 Meters, Above 14 Meters |

| Ranges Covered | Less than 200 Miles, More than 200 Miles |

| Battery Capacities Covered | Up to 400 kWh, Above 400 kWh |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America electric bus market size was valued at USD 1.36 Billion in 2025.

The Latin America electric bus market is expected to grow at a compound annual growth rate of 12.48% from 2026-2034 to reach USD 3.91 Billion by 2034.

The battery electric vehicle (BEV) propulsion type segment accounted for the largest market share of 78% due to zero-emission operation, lower maintenance requirements, operational reliability, and compatibility with renewable energy, making it the preferred choice for urban electric bus fleets.

Key factors driving market growth include strong sustainability commitments, increasing demand for cleaner urban transit, and improvements in battery durability and charging infrastructure. Supportive government policies, operational cost benefits, and expanding fleet modernization initiatives further accelerate the adoption of electric buses across Latin America.

Major challenges facing the Latin America electric bus market include high initial investment for vehicles and charging infrastructure, limited grid capacity, unreliable power supply, and insufficient technical expertise for maintenance. These factors create financial, operational, and logistical barriers, slowing widespread fleet electrification.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)