Latin America Green Energy Investments Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Latin America Green Energy Investments Market Overview:

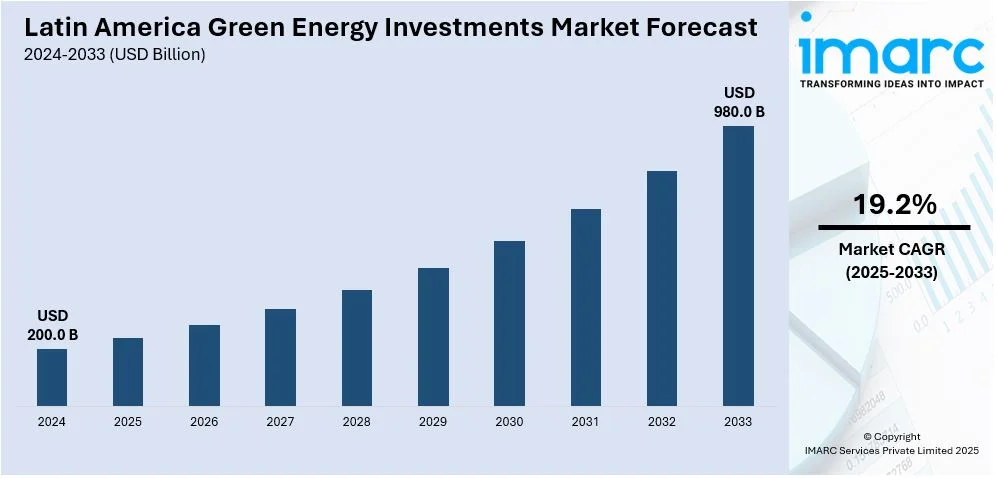

The Latin America green energy investments market size reached USD 200.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 980.0 Billion by 2033, exhibiting a growth rate (CAGR) of 19.2% during 2025-2033. The growing green energy investments in Latin America, increasing technological advancements and economies of scale, and rising foreign direct investment (FDI) and multinational involvement are some of the factors positively impacting the Latin America green energy investment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.0 Billion |

| Market Forecast in 2033 | USD 980.0 Billion |

| Market Growth Rate 2025-2033 | 19.2% |

Latin America Green Energy Investments Market Trends:

Declining Costs of Renewable Energy Technologies

Technological advancements and economies of scale are significantly reducing the costs of renewable energy technologies, which is creating a positive Latin America green energy investments market outlook. Apart from this, the cost of solar photovoltaic (PV) panels and wind turbines is decreasing, which is encouraging both private and public sector investments in the region. According to industry reports, the price of solar PV panels has decreased by 40% in Brazil. This further increased the confidence of Brazilians and the attractiveness of installing solar panels on rooftops. Moreover, reducing costs is making it easier for Latin American nations to accelerate their transition to green energy while attracting international investors who are increasingly interested in cost-effective, scalable renewable projects in the region. In 2024, Brenntag, the industry leader in the distribution of chemicals and ingredients worldwide, inaugurated a solar park at its site in Queretaro, Mexico. This project emerges as Brenntag's largest solar park in Latin America and one of the ten largest globally.

Government Policies and Renewable Energy Targets

Increasing green energy investments in Latin America are primarily driven by government policies and ambitious renewable energy targets across the region. Several Latin American countries are enacting legislation aimed at driving the adoption of renewable energy sources, such as solar, wind, and hydropower, to meet national energy needs and climate commitments. Various renewable projects are made possible through favorable policy environments, which include subsidies for renewable energy development and public-private partnerships that support infrastructure expansion. According to a 2024 report published by the International Energy Agency (IEA), energy investments in Latin America and the Caribbean are anticipated to reach USD 185 Billion in 2024. Nearly half of the 33 Latin American and Caribbean nations, including Brazil, Chile, Costa Rica, and Colombia have committed to achieving net zero emissions by 2050. Furthermore, the Brazilian Association of Photovoltaic Solar Energy (ABSOLAR) estimates that as of February 2024, Brazil's installed solar power will amount 38.4 GW, or almost 17.0% of the nation's electrical supply.

Foreign Direct Investment (FDI) and Multinational Involvement

The adoption of green energy in Latin America is greatly aided by foreign direct investment (FDI), as international financial institutions and multinational corporations supply vital funding for large-scale renewable projects. This is driving the Latin America green energy investments market growth. In recent years, there has been a rise in FDI directed toward the renewable energy sector in countries such as Colombia, Peru, and Uruguay, where political stability and favorable investment climates have attracted global players. Renewable Energy Association SER Colombia, in 2024, announced that up to USD 2.2 Billion could be invested in Colombia's renewable energy sector, spread across 66 projects that are either awaiting final paperwork or about to go into production. Additionally, international energy companies are expanding their portfolios in the region, driven by favorable regulations, stable returns, and Latin America's high renewable energy potential. The involvement of multinational corporations and financial institutions not only brings the necessary capital but also introduces technical expertise and innovative business models.

Latin America Green Energy Investments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type.

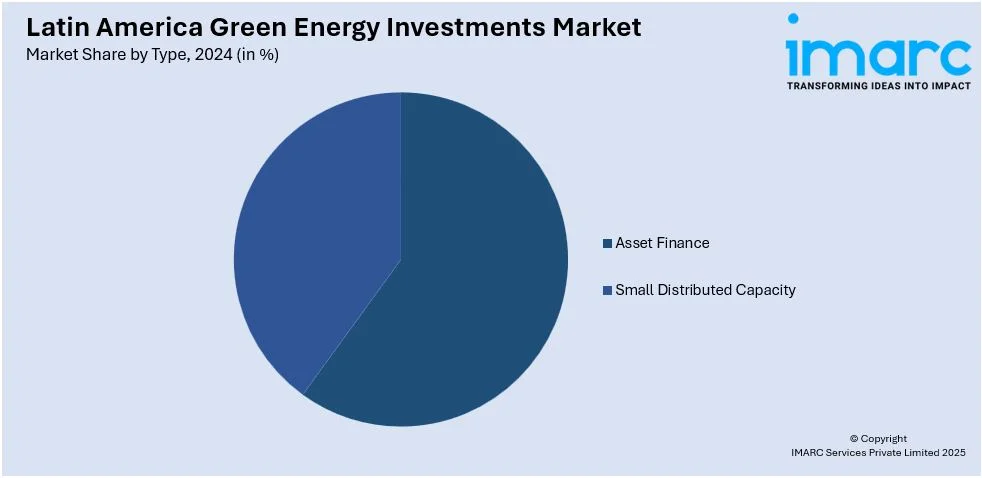

Type Insights:

- Asset Finance

- Small Distributed Capacity

The report has provided a detailed breakup and analysis of the market based on the type. This includes asset finance, and small distributed capacity.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Green Energy Investments Market News:

- August 2024: At a meeting of the National Energy Policy Council (Conselho Nacional de Política Energética, or CNPE), Brazilian President Luiz Inácio Lula da Silva unveiled the National Energy Transition Policy. Over a ten-year period, Brazil could receive an estimated BRL 2 Trillion in investments in the green economy, according to Alexandre Silva, Minister of Mines and Energy.

- August 2024: Two solar energy projects totaling 465 MW in capacity or 14% of its current electricity needs were contracted to be developed by ArcelorMittal Brazil. The first project expands upon ArcelorMittal Brazil's current partnership with Casa dos Ventos, while the second is a collaboration with Atlas Renewable Energy, Latin America's second-largest independent renewable energy developer.

Latin America Green Energy Investments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Asset Finance, Small Distributed Capacity |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America green energy investments market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America green energy investments market on the basis of type?

- What is the breakup of the Latin America green energy investments market on the basis of region?

- What are the various stages in the value chain of the Latin America green energy investments market?

- What are the key driving factors and challenges in the Latin America green energy investments market?

- What is the structure of the Latin America green energy investments market and who are the key players?

- What is the degree of competition in the Latin America green energy investments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America green energy investments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America green energy investments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America green energy investments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)