Latin America Offshore Wind Energy Market Size, Share, Trends and Forecast by Component, Location, Capacity, and Country, 2025-2033

Latin America Offshore Wind Energy Market Overview:

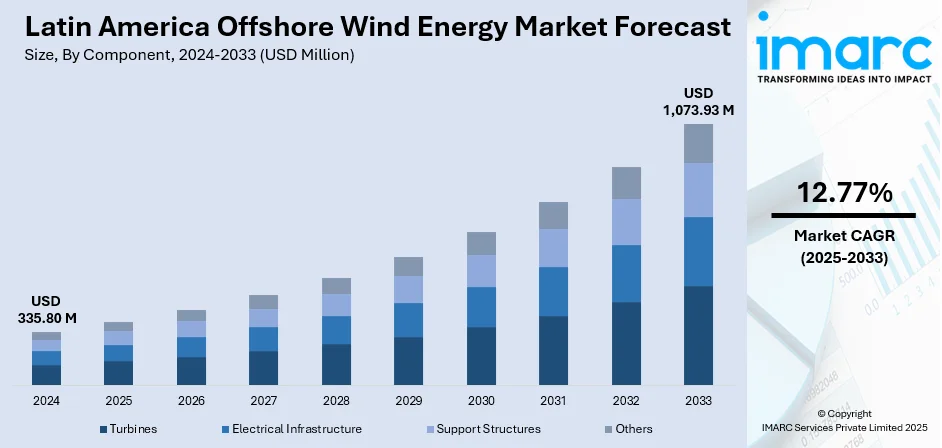

The Latin America offshore wind energy market size reached USD 335.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,073.93 Million by 2033, exhibiting a growth rate (CAGR) of 12.77% during 2025-2033. Government incentives, rising energy demand, decarbonization goals, technological advancements, falling installation costs, corporate renewable procurement, increasing foreign investments, grid infrastructure expansion, and strong wind resources are driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 335.80 Million |

| Market Forecast in 2033 | USD 1,073.93 Million |

| Market Growth Rate 2025-2033 | 12.77% |

Latin America Offshore Wind Energy Market Trends:

Regulatory Advancements and Government Initiatives

The development of offshore wind energy within Latin America is propelled by favorable regulatory frameworks combined with government programs aimed at promoting renewable energy. In January 2025, Brazilian President Luiz Inácio Lula da Silva enacted a law approving the development of offshore wind farms, providing incentives and regulatory guidelines for projects within the country’s territorial waters. The law provided for consultation with communities affected beforehand to stimulate respect for local maritime practices and cultures. Brazil has about 1,228 GW potential for offshore wind. Meanwhile, Colombia is also developing its offshore wind industry, with the Colombian Ministry of Energy, in October 2024, announcing that nine companies are interested in developing their offshore wind projects, including local firms for Ecopetrol and international players such as Spain's BlueFloat Energy and Denmark's Copenhagen Infrastructure Partners. Official bids are expected during the first half of 2025 to allocate marine spots with capacity between 1,000 and 3,000 megawatts. This is part of Colombia's strategy to reduce reliance on fossil fuels and reach their self-sufficiency in energy provision, more so on the island country's northern tourist-laden Caribbean shores. These regulatory advancements are considered regional from the beginning to promote renewable energy on behalf of Latin America, which is emerging as a hotspot for offshore wind intentions.

Increased Foreign Investment and Strategic Partnerships

The burgeoning offshore wind energy market in Latin America is attracting significant foreign investment and fostering strategic partnerships between local and international companies. In October 2024, Eletrobras, one of the most prominent power companies in Latin America, signed a preliminary agreement with Ocean Winds which is a joint venture of EDP Renováveis and Engie. This cooperation is supposed to make use of Brazil’s long coastline and good wind conditions in order to satisfy the rising demand for renewable energy. According to the World Bank estimates, the large Latin American coastline has the potential to produce as much as 8,000 GW of offshore wind energy, with Argentina and Brazil leading the way at 1,870 GW and 1,228 GW, respectively. Growingly international investors are now aware of the huge potential of the region. For example, in October 2024, the Colombian offshore wind project was the center of interest for seven foreign companies, including Belgium's DEME and China's PowerChina, thus, indicating the global lure of the renewable energy investments of Latin America. As investments and partnerships are being established, the development of offshore wind infrastructure accelerates, and additionally, technology transfer, local expertise enhancement, and economic growth of the region are the gains. With this development, Latin America will be a key player in the world offshore wind energy market in the future.

Latin America Offshore Wind Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, location, and capacity.

Component Insights:

- Turbines

- Electrical Infrastructure

- Support Structures

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes turbines, electrical infrastructure, support structures, and others.

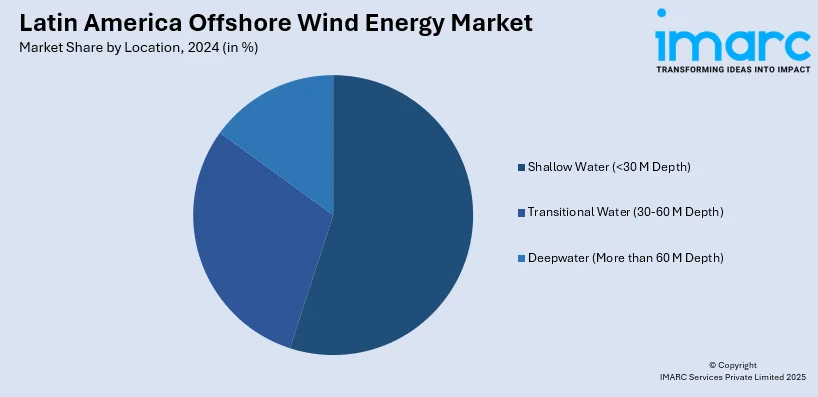

Location Insights:

- Shallow Water (<30 M Depth)

- Transitional Water (30-60 M Depth)

- Deepwater (More than 60 M Depth)

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes shallow water (<30 M depth), transitional water (30-60 M depth), and deepwater (more than 60 M depth).

Capacity Insights:

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 3 MW, 3 MW to 5 MW, and above 5 MW.

Country Insights:

- Brazil,

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Offshore Wind Energy Market News:

- January 2025: Brazilian President Luiz Inácio Lula da Silva signed a bill establishing a regulatory framework for offshore wind energy. The law defines permissible locations, promotes investment, and mandates community consultations. Lula vetoed provisions that could increase energy tariffs.

- June 2024: Vestas secured a 95 MW wind turbine order in Argentina, supplying 21 V150-4.5 MW turbines. Delivery starts in Q2 2025, with commissioning by Q4 2025. A 30-year service agreement ensures optimized energy output and long-term operational stability.

Latin America Offshore Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbines, Electrical Infrastructure, Support Structures, Others |

| Locations Covered | Shallow Water (<30 M Depth), Transitional Water (30-60 M Depth), Deepwater (More than 60 M Depth) |

| Capacities Covered | Up to 3 MW, 3 MW to 5 MW, Above 5 MW |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America offshore wind energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America offshore wind energy market on the basis of component?

- What is the breakup of the Latin America offshore wind energy market on the basis of location?

- What is the breakup of the Latin America offshore wind energy market on the basis of capacity?

- What are the various stages in the value chain of the Latin America offshore wind energy market?

- What are the key driving factors and challenges in the Latin America offshore wind energy market?

- What is the structure of the Latin America offshore wind energy market and who are the key players?

- What is the degree of competition in the Latin America offshore wind energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America offshore wind energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America offshore wind energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America offshore wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)