Latin America Organic Coffee Market Size, Share, Trends and Forecast by Type, Packaging Type, Sales Channel, and Country, 2025-2033

Latin America Organic Coffee Market Overview:

The Latin America organic coffee market size reached USD 0.59 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.17 Billion by 2033, exhibiting a growth rate (CAGR) of 7.76% during 2025-2033. The rising government support and certification programs, along with expanding specialty coffee are propelling the market growth. Besides this, Latin America organic coffee market share is driven by increasing demand for sustainable and ethically produced coffee, and the region’s commitment to environment-friendly farming practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.59 Billion |

| Market Forecast in 2033 | USD 1.17 Billion |

| Market Growth Rate (2025-2033) | 7.76% |

Latin America Organic Coffee Market Trends:

Growing Government Support and Certifications Programs

Countries such as Peru, Mexico, and Colombia are playing a significant role in supporting the organic coffee sector through financial incentives and structured programs. In Peru, the National Organic Coffee Plan is a key initiative that encourages farmers to shift toward organic cultivation. According to market report, Peru stands as the top global producer of certified Fair Trade and organic arabica coffee. The coffee-growing areas are primarily located along the eastern slopes of the Andes and span 17 out of the country's 24 regions. Coffee production is crucial to Peru's agriculture sector, employing a third of its agricultural workforce. The national strategy for coffee, which extends from 2018 to 2030, focuses on improving productivity through sustainable methods, enhancing quality consistency, and increasing global recognition and demand for Peruvian coffee. This initiative is designed to strengthen Latin America organic coffee market growth. Governments are also offering grants and subsidies to ease the transition for farmers from conventional to organic farming methods, aiming to improve sustainability and economic stability for smallholders. Additionally, certifications like USDA organic and fair trade are gaining prominence in the region. These certifications assure consumers of organic quality and allow farmers to access premium pricing in international markets, enhancing profitability.

Expansion of Specialty Coffee

The rise of specialty coffee shops in Latin America is transforming the local coffee landscape, particularly with a focus on organic and sustainably sourced beans. Additionally, the growing consumer demand for ethically sourced and high-quality coffee reflects global changes in consumer preferences toward sustainability. According to the United States Department of Agriculture (USDA), Peru, with around 90,000 certified organic hectares, holds the title of the world’s top exporter of organic coffee. Beyond these certified areas, much of Peru's coffee export is naturally organic as small-scale farmers cannot afford expensive chemical fertilizers and pesticides. Moreover, the international demand for specialty coffee encourages some of these smaller producers to pursue specific certifications, enhancing their market appeal and potentially increasing their earnings. These specialty cafes are increasing the local consumption of organic coffee and setting new standards within the industry by collaborating with certified local producers. Besides, the easy availability of local certifications ensures that organic coffee meets strict standards, further enhancing its appeal. This proliferation of organic-focused coffee shops is positively influencing the Latin America organic coffee market outlook by supporting the livelihoods of local farmers while contributing to the broader movement toward sustainable agricultural practices in the region.

Latin America Organic Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, packaging type, and sales channel.

Type Insights:

- Arabic

- Robusta

The report has provided a detailed breakup and analysis of the market based on the type. This includes Arabic and robusta.

Packaging Type Insights:

- Stand-Up Pouches

- Jars and Bottles

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes stand-up pouches, jars and bottles, and others.

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

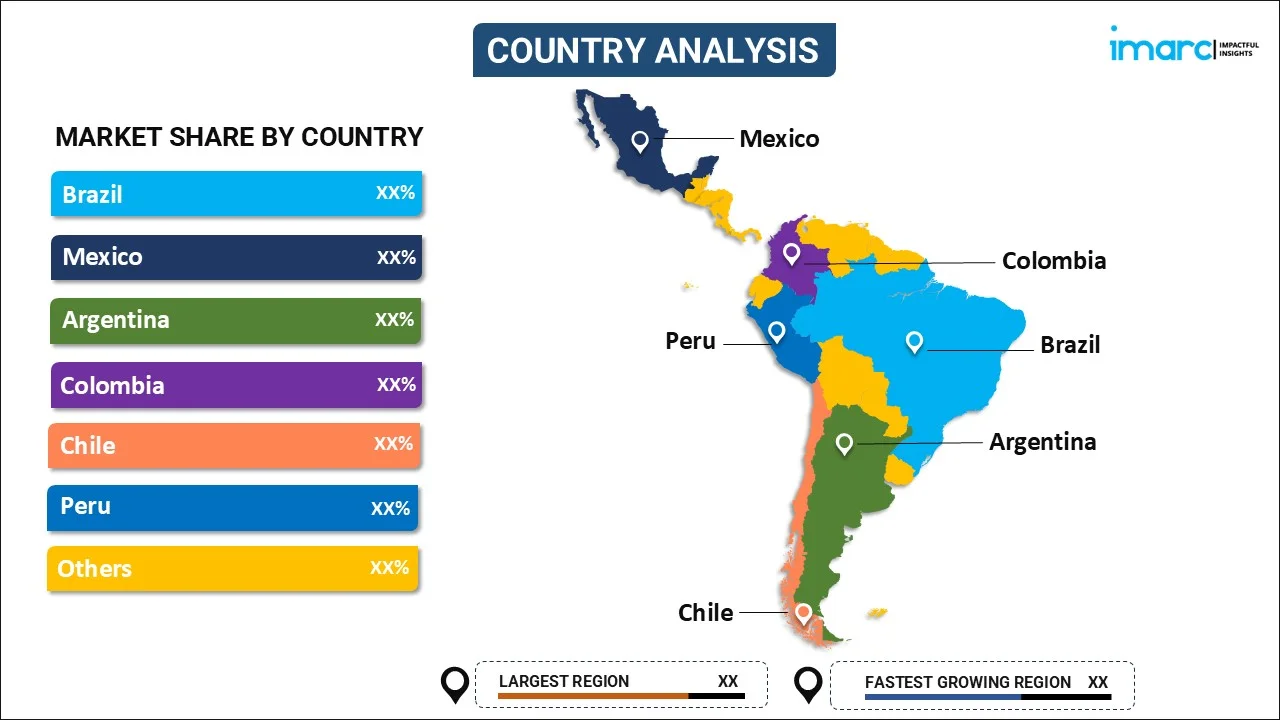

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Organic Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Arabic, Robusta |

| Packaging Types Covered | Stand-Up Pouches, Jars and Bottles, Others |

| Sales Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America organic coffee market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America organic coffee market on the basis of type?

- What is the breakup of the Latin America organic coffee market on the basis of packaging type?

- What is the breakup of the Latin America organic coffee market on the basis of sales channel?

- What are the various stages in the value chain of the Latin America organic coffee market?

- What are the key driving factors and challenges in the Latin America organic coffee market?

- What is the structure of the Latin America organic coffee market and who are the key players?

- What is the degree of competition in the Latin America organic coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America organic coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America organic coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America organic coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)