Latin America Smart Grid Infrastructure Market Size, Share, Trends and Forecast by Offering, End-Use Application, Communication Technology, and Country, 2025-2033

Latin America Smart Grid Infrastructure Market Overview:

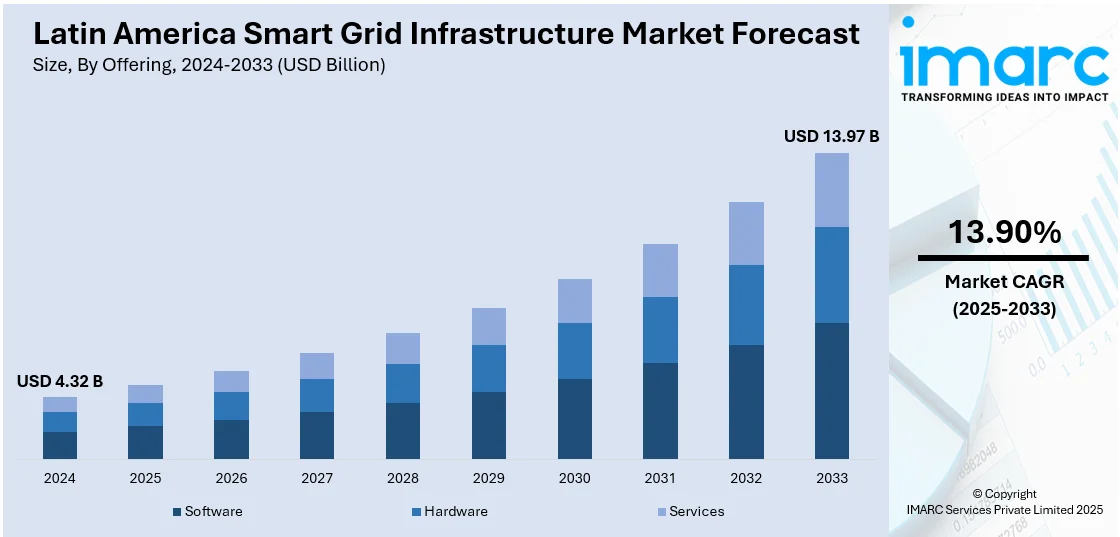

The Latin America smart grid infrastructure market size was valued at USD 4.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.97 Billion by 2033, exhibiting a CAGR of 13.90% from 2025-2033. The growing need to modernize aging electricity distribution networks and improve service quality, rising focus on electricity access to rural and underserved areas, and increasing individual engagement by offering greater control over energy usage are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.32 Billion |

| Market Forecast in 2033 | USD 13.97 Billion |

| Market Growth Rate 2025-2033 | 13.90% |

Latin America Smart Grid Infrastructure Market Trends:

Grid Modernization and Infrastructure Optimization

The growing need to modernize aging electricity distribution networks and improve service quality is offering a favorable Latin America smart grid infrastructure market outlook. The nations of the region are embracing smart metering and cutting-edge grid technologies to boost the efficiency, reliability, and robustness of their power supply systems. The smart grids provide for real-time monitoring, enhanced energy management, and decreased operation losses, all of which are important to achieve optimized electricity delivery. Furthermore, these technologies facilitate the integration of renewable sources of energy to promote a more elastic and greener grid. Utilities and governments are investing in grid modernization as part of larger initiatives to meet increasing energy demand, reduce outages, and lower carbon emissions. The shift toward the digitalization of utility operations is encouraging the adoption of smart infrastructure, as it enables data-driven decision-making and more efficient grid management, positioning the region for long-term energy security and sustainability. In 2024, Ecuador's Centrosur partnered with Gridspertise to modernize its distribution network through smart metering and advanced grid infrastructure. The collaboration focuses on improving electricity services and optimizing infrastructure.

Increasing Electrification of Rural Areas

Many governing bodies in the region are prioritizing the expansion of electricity access to rural and underserved areas, with smart grid infrastructure becoming essential in these efforts. Conventional grid systems are often costly and challenging to implement in remote regions, while smart grids provide more adaptable and efficient solutions through technologies like distributed energy resources and microgrids. According to the Latin America smart grid infrastructure market forecast, these advanced systems allow for better management of energy distribution, reducing power losses and enhancing overall reliability. Additionally, smart grids facilitate the integration of renewable energy sources, improving sustainability and reducing dependency on centralized power plants. This modernization of energy infrastructure not only improves access but also attracts further investment as governments and energy providers recognize the long-term benefits of a flexible, resilient, and cost-effective grid system. In 2024, Coopesantos RL completed Costa Rica's first cooperative advanced metering infrastructure (AMI) deployment, installing 50,000 smart meters across its rural service area. This project enhances grid visibility, automates processes, and improves response to outages. The deployment is part of efforts to modernize energy distribution and support a future smart grid.

Improved User Engagement and Energy Management

Smart grid technology is playing a pivotal role in enhancing individual engagement by offering greater control over energy usage. Through AMI and real-time monitoring, people gain access to detailed data about their electricity usage, fostering more informed decisions and promoting energy-saving behaviors. This increased transparency allows users to participate in demand-side management actively, adjusting their usage to optimize efficiency and reduce costs. By facilitating demand response programs, smart grids enable users to adapt their utilization patterns based on grid conditions, contributing to a more balanced and efficient energy distribution. Additionally, these technologies help utilities manage peak demand more effectively, minimizing strain on the grid while improving service reliability. In 2024, Luma launched an island-wide smart meter assessment in Puerto Rico as part of a plan to deploy 1.5 million smart meters. This initiative aims to enhance grid reliability, improve outage detection, and provide individuals with better energy management tools. The assessment also evaluates infrastructure readiness for optimal deployment.

Latin America Smart Grid Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on offering, end-use application, and communication technology.

Offering Insights:

- Software

- Advanced Metering Infrastructure Systems

- Smart Grid Distribution Management Systems

- Smart Grid Network Management System

- Grid Asset Management System

- Substation Automation System

- Smart Grid Security System

- Billion and Customer Information System

- Hardware

- Smart Meters

- Sensors

- Programmable Logic Controllers

- Others

- Services

- Consulting

- Deployment and Integration

- Support and Maintenance

The report has provided a detailed breakup and analysis of the market based on the offering. This includes software (advanced metering infrastructure systems, smart grid distribution management systems, smart grid network management system, grid asset management system, substation automation system, smart grid security system, and billion and customer information system), hardware (smart meters, sensors, programmable logic controllers, and others, and service (consulting, deployment and integration, and support and maintenance).

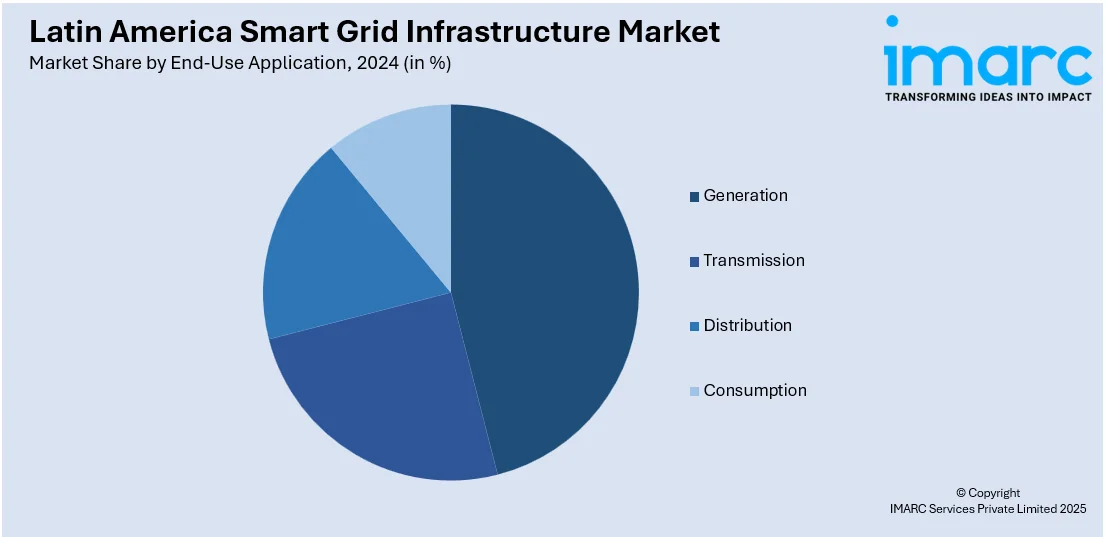

End-Use Application Insights:

- Generation

- Transmission

- Distribution

- Consumption

A detailed breakup and analysis of the market based on the end-use application have also been provided in the report. This includes generation, transmission, distribution, and consumption.

Communication Technology Insights:

- Wireline

- Wireless

A detailed breakup and analysis of the market based on the communication technology have also been provided in the report. This includes wireline and wireless.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Smart Grid Infrastructure Market News:

- In June 2023, Hidrandina in Peru announced plans to procure nearly 32,000 smart meters for its use and other Distriluz group companies. This initiative was part of Peru's broader effort to digitalize its energy sector, focusing on improving energy management and reducing losses.

- In December 2023, Brazil officially joined the International Smart Grid Action Network (ISGAN) during a signing ceremony at the 28th Conference of the Parties (COP28) in Dubai. This membership strengthened international collaboration on smart grid advancements and helped address grid challenges, particularly in South America. Brazil's involvement aimed to enhance renewable energy integration and regional energy trade within ISGAN.

- In August 2024, Mexico's National Energy Control Center (CENACE) collaborated with Huawei to implement an advanced 10 Gbps Smart Power Campus Solution. This collaboration intends to transform CENACE's communications network, providing the stability, security, and efficiency required for the National Electricity System of Mexico to function reliably.

Latin America Smart Grid Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| End-Use Applications Covered | Generation, Transmission, Distribution, Consumption |

| Communication Technologies Covered | Wireline, Wireless |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America smart grid infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America smart grid infrastructure market on the basis of offering?

- What is the breakup of the Latin America smart grid infrastructure market on the basis of end-use application?

- What is the breakup of the Latin America smart grid infrastructure market on the basis of communication technology?

- What is the breakup of the Latin America smart grid infrastructure market on the basis of country?

- What are the various stages in the value chain of the Latin America smart grid infrastructure market?

- What are the key driving factors and challenges in the Latin America smart grid infrastructure market?

- What is the structure of the Latin America smart grid infrastructure market and who are the key players?

- What is the degree of competition in the Latin America smart grid infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America smart grid infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America smart grid infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America smart grid infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)