Latin America Sustainable Packaging Market Size, Share, Trends and Forecast by Material, Type, Packaging Format, Process, and Country, 2025-2033

Latin America Sustainable Packaging Market Size and Share:

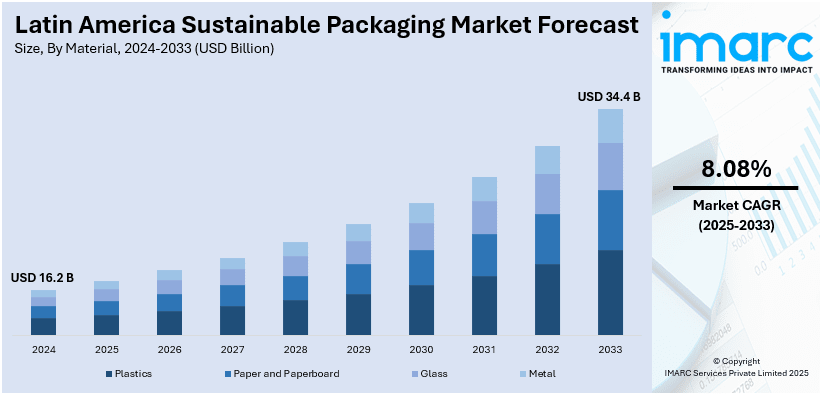

The Latin America sustainable packaging market size reached USD 16.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.08% during 2025-2033. The growing consumer awareness about environmental sustainability, rising government regulations on plastic waste and packaging materials, increasing demand for recyclable and biodegradable packaging solutions, and expanding retail and e-commerce sectors are some of the major factors positively impacting the Latin America sustainable packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.2 Billion |

| Market Forecast in 2033 | USD 34.4 Billion |

| Market Growth Rate (2025-2033) | 8.08% |

Latin America Sustainable Packaging Market Trends:

Growing Consumer Demand for Environment-Friendly Products

The increasing demand for environmentally friendly products among consumers propels the Latin America sustainable packaging market growth. Awareness about environmental issues such as plastic pollution and waste accumulation is growing. According to an industry report, Brazil can avoid 18 million tons of CO2 emissions and gain BRL 6 Billion in market value by decreasing disposable plastic. Due to this, consumers are becoming more conscious of the products they buy and their resultant impact on the planet. This shift in consumer behavior has heightened the demand for sustainable packaging solutions. These include recyclable, biodegradable, and compostable materials. Latin American consumers, particularly in urban areas, are opting for products packaged in eco-friendly materials more often. This is prompting businesses in industries such as food and beverages, cosmetics, and retail to adopt sustainable packaging practices. Brands that incorporate sustainable packaging are perceived more positively by environmentally conscious consumers. This further helps them in building stronger relationships and brand loyalty. As consumers prioritize sustainability in their purchasing decisions, this trend is driving the adoption of sustainable packaging in Latin America.

Stringent Government Regulations on Plastic Waste

Government regulations aimed at reducing plastic waste are vital in shaping the Latin America sustainable packaging market outlook. According to industry reports, about 44% of the 7 million tons of plastic products produced in Brazil each year are single-use, throwaway plastics, such as straws, cutlery, and packaging, among other things that are frequently used just once. Several countries in the region have imposed strict policies to reduce plastic pollution and increase the use of sustainable materials. For instance, Brazil, Chile, Colombia, and Mexico have passed bans or limitations on single-use plastics and plastic bags, prompting manufacturers and retailers to seek alternative and eco-friendly packaging solutions. These regulations make sure that plastic waste is curbed and recycling is encouraged while biodegradable material usage is increased. The government is also conducting public campaigns and raising awareness about waste reduction and recycling. This is encouraging more businesses to switch to sustainable packaging. The growing regulatory pressure in the region is propelling industries to find more sustainable options and embrace eco-friendly packaging practices to comply with legal requirements, facilitating overall industry expansion.

Latin America Sustainable Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material, type, packaging format and process.

Material Insights:

- Plastics

- Paper and Paperboard

- Glass

- Metal

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastics, paper and paperboard, glass, and metal.

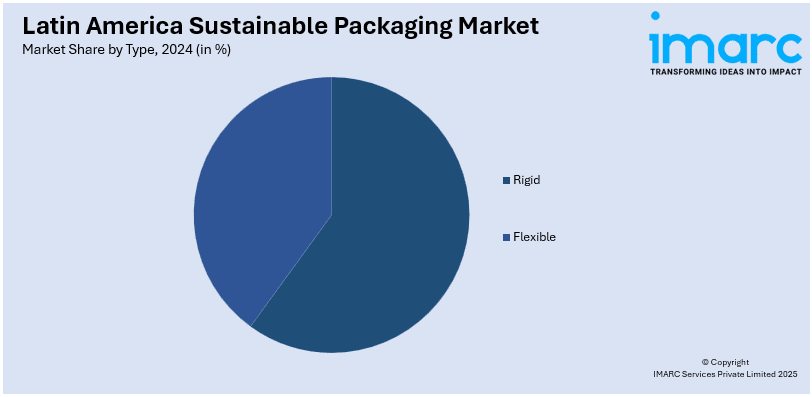

Type Insights:

- Rigid

- Flexible

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes rigid and flexible.

Packaging Format Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging format. This includes primary packaging, secondary packaging, and tertiary packaging.

Process Insights:

- Recyclable

- Reusable

- Biodegradable

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes recyclable, reusable, and biodegradable.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Sustainable Packaging Market News:

- August 29, 2024: Coca-Cola plans to invest USD 35 Million in a new recycling factory in Chile called ‘Re-Ciclar.’ A major milestone in sustainable packaging solutions for the region, Re-Ciclar is the most advanced Coca-Cola facility in Latin America. The plant will annually recycle 350 million plastic bottles and turn them into 100% recycled PET resin.

- June 6, 2024: Nefab, a Sweden-based supplier of sustainable packaging solutions, is expanding its business in Latin America by establishing a new plant in Chile with an investment of USD 1 Million. The facility will manufacture a broad range of sustainable packaging options for the energy, mining, manufacturing, and telecommunications sectors and create up to 80 new jobs in the area.

Latin America Sustainable Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastics, Paper and Paperboard, Glass, Metal |

| Types Covered | Rigid, Flexible |

| Packaging Formats Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| Processes Covered | Recyclable, Reusable, Biodegradable |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America sustainable packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America sustainable packaging market on the basis of material?

- What is the breakup of the Latin America sustainable packaging market on the basis of type?

- What is the breakup of the Latin America sustainable packaging market on the basis of packaging format?

- What is the breakup of the Latin America sustainable packaging market on the basis of process?

- What is the breakup of the Latin America sustainable packaging market on the basis of country?

- What are the various stages in the value chain of the Latin America sustainable packaging market?

- What are the key driving factors and challenges in the Latin America sustainable packaging market?

- What is the structure of the Latin America sustainable packaging market and who are the key players?

- What is the degree of competition in the Latin America sustainable packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America sustainable packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America sustainable packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America sustainable packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)