Latin America Telehealth Market Report by Type (Hardware Components, Software Components, Services), Communication Technology (Video Conferencing, mHealth Solutions, and Others), Hosting Type (Cloud-Based and Web-based, On-Premises), Application (Teleconsultation and Tele-mentoring, Medical Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology, and Others), End User (Providers, Patients, Payers, and Others), and Country 2025-2033

Latin America Telehealth Market Overview:

The Latin America telehealth market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 14.7% during 2025-2033. The market is driven by factors such as Brazil’s regulatory support through Law No. 14,510/2022, Mexico’s focus on addressing rural healthcare needs, technological advancements, government initiatives, and increased demand for accessible healthcare, especially post-COVID. These elements foster the rapid expansion of remote healthcare services across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate 2025-2033 | 14.7% |

Telehealth refers to the remotely delivered medical services that are provided by the healthcare professionals to their patients using information and communication technologies. It is widely adopted by healthcare professionals for providing consultation, care management, patient monitoring, administrative meetings, imparting medical education, etc. Telehealth services are generally offered via video conferencing, electronic transmission of data, mobile health (mHealth) applications, remote patient monitoring (RPM), etc. These services are extensively used across numerous medical specialties, including radiology, cardiology, neurology, psychiatry, dermatology, etc.

In Latin America, the high prevalence of various chronic ailments, such as cardiovascular diseases, arthritis, cancer, etc., that require continual medical supervision is catalyzing the demand for telehealth services. Additionally, the growing geriatric population, who are more prone to serious medical conditions, is also driving the need for homecare-based medical treatment, thereby propelling the market in the region. Apart from this, the increasing penetration of digitalization trends in the healthcare sector is further augmenting the market growth. Moreover, the emergence of smart wearable devices has enabled healthcare professionals to track real-time patient statistics and provide accurate telehealth services. Additionally, with the sudden outbreak of the COVID-19 pandemic, several healthcare professionals, as well as patients, are opting for telehealth services to mitigate the risk of coronavirus infection upon the hospital or clinic visits. Besides this, the government bodies across Latin America are introducing various health initiatives for promoting the adoption of telehealth solutions which are also catalyzing the market growth in the region. Moreover, the rising integration of telehealth services with several innovative technologies, such as AI, predictive analytics, picture archiving and communication system (PACS), etc., will continue to drive the market in Latin America during the forecast period.

Latin America Telehealth Market Trends:

Growing Demand for Telemedicine Solutions

The Latin American healthcare landscape is undergoing a major shift with the rise of telemedicine in Latin America. As communities in rural places have limited access to medical specialists, telemedicine has emerged as a lifeline, connecting patients with healthcare practitioners. The rise of digital infrastructure has aided this shift, resulting in an increase in adoption rates. Telemed technologies allow for more efficient consultations, diagnoses, and treatments, making healthcare more accessible and inexpensive. Telemedicine also helps manage chronic illnesses by providing continuous monitoring and prompt treatment. This trend is projected to continue as internet usage rises and digital health services spread throughout the area, allowing for more equitable healthcare access.

Rise of mHealth Solutions

With the fast growth of mobile technology, Latin America mHealth solutions are becoming more integrated into the region's healthcare ecosystem. By utilizing mobile applications and wearables, mHealth provides individualized treatment solutions that are suited to individual requirements. These technologies enable patients to monitor vital signs, measure physical activity, and receive medical advice right from their smartphones. The growth of these mobile solutions is especially advantageous to underprivileged groups, who may lack access to traditional healthcare institutions. Furthermore, telemedicine in Latin America is rapidly being combined with mobile health solutions, allowing for a more holistic approach to patient treatment. As a result, Latin American countries are seeing improved healthcare delivery through effective data gathering, real-time feedback, and more patient participation.

Expansion of Virtual Healthcare Services

Virtual healthcare services are rapidly reshaping the way healthcare is delivered in Latin America. Through telemed and telemedicine platforms, patients are no longer required to visit physical clinics for many medical needs, making it easier for them to access high-quality care from the comfort of their homes. This trend is particularly noticeable in urban areas where busy lifestyles make it difficult to find time for in-person appointments. Additionally, telemedication services are gaining traction, allowing patients to receive prescriptions and medications digitally after consultations, enhancing convenience and efficiency. As healthcare providers embrace these technologies, the region is moving toward a more accessible and patient-centric model of care, improving outcomes and reducing the burden on traditional healthcare infrastructures.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Latin America telehealth market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on type, communication technology, hosting type, application and end user.

Breakup by Type:

- Hardware Components

- Software Components

- Services

Breakup by Communication Technology:

- Video Conferencing

- mHealth Solutions

- Others

Breakup by Hosting Type:

- Cloud-Based and Web-based

- On-Premises

Breakup by Application:

- Teleconsultation and Tele-mentoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Tele-ICU

- Tele-Psychiatry

- Tele-Dermatology

- Others

Breakup by End User:

- Providers

- Patients

- Payers

- Others

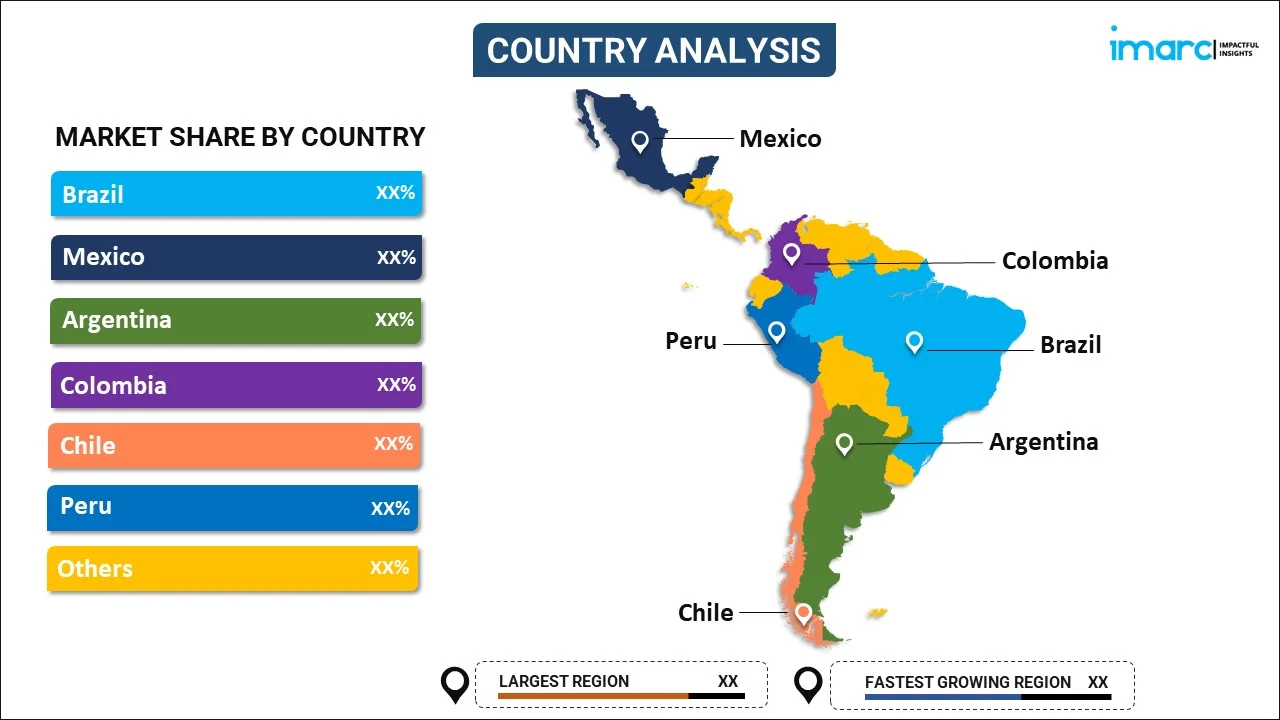

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Aerotel Medical Systems, Boston Scientific Corporation, Cerner Corporation, Cisco Systems Inc., GE Healthcare (General Electric Company), GlobalMed (Schauenburg International GmbH), Honeywell International Inc., Medtronic, Philips Healthcare (Philips) and Siemens Healthineers (Siemens).

Latin America Telehealth Market News:

- In February 2025, IDB Lab and 19Labs piloted a drone delivery system in Guyana, a key step in improving telemedicine across Latin America. The initiative would deliver critical medical supplies to remote communities, benefiting over 20,000 people. This partnership addresses rural healthcare challenges in Latin America, enhancing supply chain efficiency and access to care. The success of this pilot could lead to wider adoption of drone technology in the region’s healthcare systems.

- In January 2025, SK Biopharmaceuticals partnered with Brazilian pharma giant Eurofarma to create a joint venture focused on digital healthcare. The venture would develop an AI-driven platform to predict seizures and manage epilepsy patients. SK Biopharm's CEO highlighted the importance of real-time seizure detection for timely intervention. The collaboration builds on their existing 2022 licensing agreement to commercialize the anti-seizure drug Cenobamate in Latin America.

- In November 2024, Latin America turned to AI to tackle health challenges, such as aging populations and resource shortages. Countries like Brazil, Argentina, Chile, and Colombia are implementing AI initiatives to improve diagnostics, especially in oncology and pathology, and expand telehealth services. Brazil leads with an AI strategy focused on research, while collaborations with Chinese companies are enhancing affordable AI-driven health technologies. AI is seen as crucial for bridging health disparities and improving system efficiency.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Communication Technology, Hosting Type, Application, End User, Country |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Companies Covered | Aerotel Medical Systems, Boston Scientific Corporation, Cerner Corporation, Cisco Systems Inc., GE Healthcare (General Electric Company), GlobalMed (Schauenburg International GmbH), Honeywell International Inc., Medtronic, Philips Healthcare (Philips) and Siemens Healthineers (Siemens) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The telehealth market in Latin America was valued at USD 1.4 Billion in 2024.

The Latin America telehealth market is projected to exhibit a CAGR of 14.7% during 2025-2033, reaching a value of USD 4.7 Billion by 2033.

The growth of the Latin America telehealth market is driven by increased smartphone and internet penetration, rising healthcare costs, demand for accessible services, government support, and the need for efficient healthcare solutions. The COVID-19 pandemic further accelerated the adoption of telehealth services in the region.

Brazil accounted for the largest share of the market in 2024 due to its large population, growing healthcare needs, widespread internet access, and government support for digital health initiatives, driving adoption and market growth.

Some of the major players in the Latin America telehealth market include Aerotel Medical Systems, Boston Scientific Corporation, Cerner Corporation, Cisco Systems Inc., GE Healthcare (General Electric Company), GlobalMed (Schauenburg International GmbH), Honeywell International Inc., Medtronic, Philips Healthcare (Philips), and Siemens Healthineers (Siemens).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)