Latin America Two-Wheeler Components Market Report by Components (Filters, Drivetrain and Components, Engine and Exhaust Components, Fuel Injection Systems, Ignition System, Tires, Brakes and Components, Suspension Systems, and Others), Vehicle Type (Motorcycle, Scooters), Engine Capacity (Up-To 125cc, 126-250cc, 251-500cc, Above 500cc), Distribution Channel (OEM, Aftermarket), and Country 2025-2033

Market Overview:

The Latin America two-wheeler components market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2033, exhibiting a growth rate (CAGR) of 2.7% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.5 Billion |

| Market Growth Rate (2025-2033) | 2.7% |

Two-wheeler components refer to automotive parts that are mainly installed in scooters, motorcycles, and mopeds. They are primarily manufactured by using steel, aluminum, carbon fiber, titanium, polymers, etc. Some of the common two-wheeler components include filters, drivetrain, engine, exhaust components, fuel injection systems, ignition systems, tires, brakes, suspension systems, etc. These components are widely adopted for providing enhanced vehicle performance, better fuel efficiency, compact design, etc. In Latin America, the rising adoption of two-wheelers for their lower cost, fuel efficiency and easy maneuvering through congested roads is propelling the market for two-wheeler components.

The emerging trend of personal vehicle ownership, particularly among the millennial population, is currently driving the demand for two-wheelers in the region. Furthermore, the growing number of women commuters in Latin America is also augmenting the market growth. Several regional manufacturers are introducing specialized vehicles with compact and lightweight components to cater to the preferences of the women population, thereby bolstering the market. Apart from this, the rising sales of secondhand two-wheelers are also catalyzing the demand for automotive components in repair and refurbishment activities. Moreover, the increasing penetration of various international two-wheeler OEMs in the region has led to the launch of advanced and highly-powered components for two-wheelers. Besides this, the growing environmental concerns towards rising vehicular pollution levels have led to a gradual shift from fuel-based two-wheelers towards their electric alternatives. This has led to the emergence of hybrid and battery-based automotive components for reducing carbon emissions and enhancing vehicular performance of two-wheelers.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America two-wheeler components market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on components, vehicle type, engine capacity and distribution channel.

Breakup by Components:

- Filters

- Drivetrain and Components

- Engine and Exhaust Components

- Fuel Injection Systems

- Ignition System

- Tires

- Brakes and Components

- Suspension Systems

- Others

Breakup by Vehicle Type:

- Motorcycle

- Scooters

Breakup by Engine Capacity:

- Up-To 125cc

- 126-250cc

- 251-500cc

- Above 500cc

Breakup by Distribution Channel:

- OEM

- Aftermarket

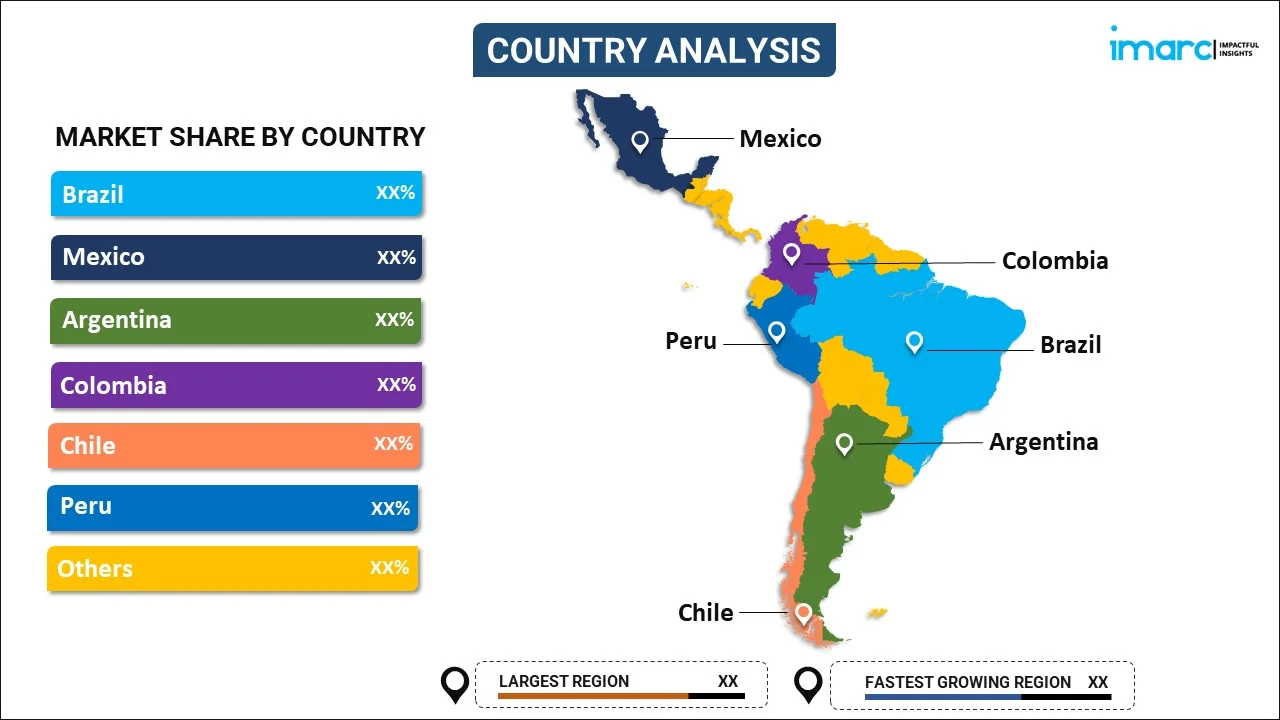

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Bajaj Auto Limited, Fras Le. Brazil, Harley-Davidson Inc, Hella KGaA Hueck & Co (HELLA GmbH & Co. KGaA), KYB Corporation, Robert Bosch (Robert Bosch Stiftung Gmbh), Tenneco Inc, TVS Motor Company (Sundaram- Clayton Limited), Yamaha Motor Co. Ltd. and ZF Friedrichshafen AG.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Components, Vehicle Type, Engine Capacity, Distribution Channel, Country |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Companies Covered | Bajaj Auto Limited, Fras Le. Brazil, Harley-Davidson Inc, Hella KGaA Hueck & Co (HELLA GmbH & Co. KGaA), KYB Corporation, Robert Bosch (Robert Bosch Stiftung Gmbh), Tenneco Inc, TVS Motor Company (Sundaram- Clayton Limited), Yamaha Motor Co. Ltd. and ZF Friedrichshafen AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America two-wheeler components market performed so far and how will it perform in the coming years?

- What are the key regional markets?

- What has been the impact of COVID-19 on the Latin America two-wheeler components market?

- What is the breakup of the market based on the components?

- What is the breakup of the market based on the vehicle type?

- What is the breakup of the market based on the engine capacity?

- What is the breakup of the market based on the distribution channel?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the market?

- What is the structure of the Latin America two-wheeler components market and who are the key players?

- What is the degree of competition in the market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)