Lithium-Ion Battery Separator Market Size, Share, Trends and Forecast by Material, Thickness, End User, and Region, 2025-2033

Lithium-Ion Battery Separator Market Size and Share:

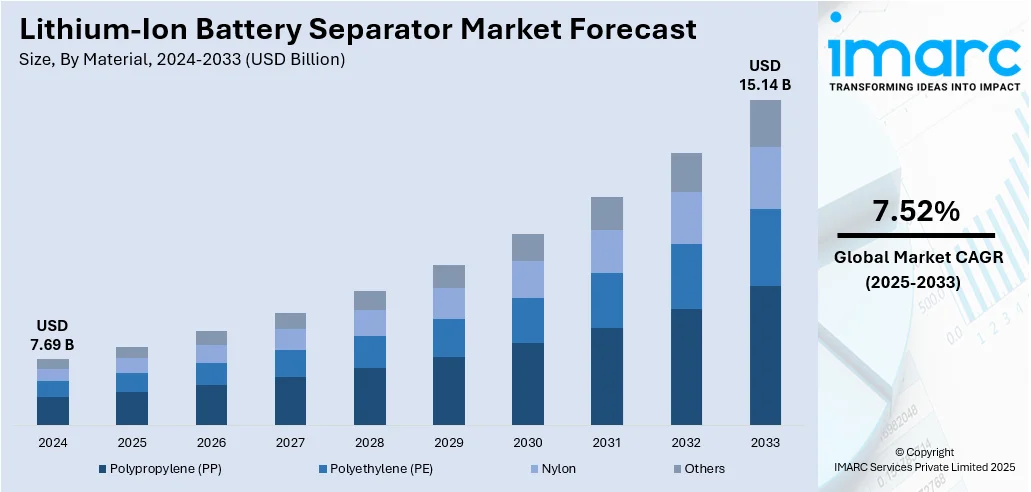

The global lithium-ion battery separator market size was valued at USD 7.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.14 Billion by 2033, exhibiting a CAGR of 7.52% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 43.8% in 2024. The dominance of the market is attributed to its strong manufacturing infrastructure, supportive government policies, and increasing investments in battery technologies. It also benefits from a robust supply chain, skilled workforce, and the growing demand for energy storage solutions, contributing to its leading market position.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.69 Billion |

|

Market Forecast in 2033

|

USD 15.14 Billion |

| Market Growth Rate 2025-2033 | 7.52% |

With the global energy landscape transitioning towards renewable sources like solar and wind, the need for dependable energy storage solutions is becoming more vital to handle variations in energy supply. Lithium-ion batteries are considered a highly efficient option for this application. In these systems, battery separators are crucial as they guarantee the safe storage of energy and uphold consistent performance. Moreover, ongoing research activities are leading to the production of sophisticated separator materials that feature better thermal stability, increased mechanical strength, and higher compatibility with different electrolytes. These advancements in technology results in higher battery longevity and improved operational safety, making lithium-ion batteries more appropriate for various uses. Besides this, in response to safety concerns such as overheating, thermal runaway, and potential fire hazards, governments and regulatory bodies are enforcing stringent safety standards for lithium-ion batteries. Battery separators are essential for meeting these standards, as they prevent direct contact between the anode and cathode, reducing the risk of short circuits.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the growing adoption of smartphones, smart home technologies, and Internet of Things (IoT) devices, which require small, high-capacity lithium-ion batteries. Separators play a vital role in guaranteeing prolonged battery life and safety during operation in these devices, highlighting the increasing significance of their production and technological development. Furthermore, the governing body in the country is focusing on decreasing dependence on international battery supply chains by promoting local battery manufacturing. There is a rise in effort to localize the production of battery components, such as separators, through policies, subsidies, and investments in infrastructure. For instance, in 2024, Microporous announced a $1.35 billion investment to build a lithium-ion battery separator plant in Pittsylvania County, Virginia. The plant focused on both lead-acid and lithium-ion separators for various applications.

Lithium-Ion Battery Separator Market Trends:

Increasing Adoption of Electric Vehicles (EVs)

A major factor propelling growth of the lithium-ion battery separator market is the swift worldwide uptake of electric vehicles (EVs), which require high-performance, reliable separators for enhanced battery efficiency and safety. The International Energy Agency states that worldwide registrations of new EVs totaled 14 million in 2023, reflecting a 35% rise from 2022. In 2023, EVs represented 18% of overall car sales, rising from 14% in 2022 and merely 5% in 2018. This growing demand is driven by more rigorous emission regulations, in addition to favorable government programs like tax breaks, purchase grants, and the enlargement of EV charging networks. The performance, safety, and lifespan of EVs rely significantly on the quality of their lithium-ion batteries, where separators are crucial. These dividers function as a safeguard, assisting in the prevention of internal short circuits and thermal runaway. In reaction to the increased demand for EVs, manufacturers are boosting output and investing in cutting-edge separator technologies to comply with rigorous automotive standards.

Rapid Advancements in Consumer Electronics

The consumer electronics sector is influencing the market as the growing need for compact, efficient, and high-performance batteries in devices require advanced separator technologies. A report by the IMARC Group indicates that India's consumer electronics market hit USD 83.70 Billion in 2024 and is expected to expand to USD 152.59 Billion by 2033, with a compound annual growth rate (CAGR) of 6.90% from 2025 to 2033. With the rise of digitalization, gadgets like smartphones, laptops, and smartwatches are becoming crucial, all depending significantly on lithium-ion batteries for dependable energy. With ongoing technological progress, these devices need batteries that offer greater energy densities and quicker charging speeds. Battery separators are essential in meeting these requirements by facilitating effective ion movement and ensuring thermal stability. As a result, the growing user demands for improved battery performance are encouraging manufacturers to create high-performance separators, further emphasizing the significance of this component in the changing consumer electronics environment.

Stringent Safety Regulations and Standards

Safety issues linked to lithium-ion batteries, especially dangers of overheating and potential fire threats, are resulting in the establishment of strict safety regulations and standards worldwide. The quality and reliability of a separator significantly influence the performance and safety of a lithium-ion battery. A properly designed separator is crucial in avoiding internal short circuits and offers important thermal shutdown features, thus lowering the chances of thermal incidents. Regulatory agencies and standardization organizations are placing greater emphasis on creating and implementing stringent safety standards for all significant applications, such as consumer electronics, EVs, and industrial systems. This heightened regulatory oversight is driving battery and separator manufacturers to invest in innovative materials and technologies that not only meet but frequently surpass these safety standards. As a result, increased attention to safety regulations is emerging as a key factor in driving innovation and expansion in the lithium-ion battery separator industry.

Lithium-Ion Battery Separator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lithium-ion battery separator market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, thickness, and end user.

Analysis by Material:

- Polypropylene (PP)

- Polyethylene (PE)

- Nylon

- Others

Polyethylene (PE) stands as the largest component in 2024, holding 46.4% of the market, attributed to its superior chemical stability and mechanical strength, which are crucial for maintaining battery safety and lifespan. PE separator exhibits significant resistance to electrolyte degradation and offers efficient thermal shutdown features, aiding in the prevention of thermal runaway and improving overall battery dependability. Its beneficial porosity and consistent pore architecture promote effective ion movement, enhancing battery performance and energy efficiency. Moreover, the lightweight characteristics of PE facilitates the creation of compact, high-energy-density batteries that cater to the growing need for portable electronics and EVs. The affordability of the material and the simplicity of its manufacturing also enhance its common use in the production of separators. Improvements in material processing and coating techniques are further improving the effectiveness of PE separator, reinforcing their status as the favored option in the industry.

Analysis by Thickness:

- 16µm

- 20µm

- 25µm

20µm leads the market with a share of 53.0% in 2024 because it offers an ideal mix of mechanical strength and ion permeability, boosting overall battery efficiency. This thickness ensures adequate durability to avert short circuits while preserving effective ionic conductivity, essential for high energy density and rapid charging uses. The 20µm separator enables compact battery configurations, aiding in lightweight and space-efficient solutions vital for contemporary devices and EVs. In addition, it enhances thermal stability and safety, lowering the risks linked to battery overheating. Improvements in manufacturing technologies allow for the dependable production of uniform 20µm separator that adhere to strict quality standards. The blend of enhanced safety, performance, and design versatility makes the 20µm thickness particularly favored by battery producers. This growing preference reflects broader lithium-ion battery separator market trends, where manufacturers are prioritizing optimized thickness levels to meet evolving performance, safety, and design requirements across various end-use sectors.

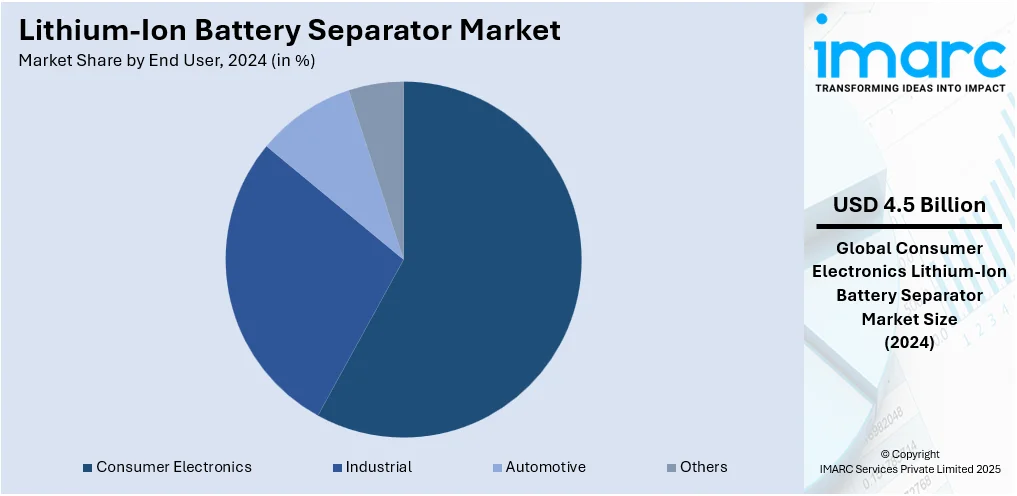

Analysis by End User:

- Industrial

- Consumer Electronics

- Automotive

- Others

Consumer electronics represent the largest segment, accounting 58.0% due to the growing demand for portable and smart devices worldwide. The increasing adoption of smartphones, tablets, laptops, and wearable technology is driving the need for reliable, efficient, and safe battery components. High-performance separators are vital for maintaining the lifespan and safety of batteries in these compact devices, which need lightweight and thin materials while still ensuring durability. Innovations and technological progress in separator materials improve battery performance and energy density, addressing the changing demands of consumer electronics. Additionally, the continuous trend of miniaturization and enhanced device functionality encourages manufacturers to prioritize advanced separator technologies. The lithium-ion battery separator market forecast indicates growth, driven by the increasing demand across consumer electronics, EVs, and energy storage systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 43.8% owing to its advanced manufacturing infrastructure, efficient production capabilities, and significant technological proficiency. The region benefits from a high concentration of key industry players, supported by a skilled workforce and a robust supply chain network. Additionally, governing bodies across the region actively support the battery sector through favorable policies, incentives, and investments in research and development (R&D). This proactive approach fosters innovation and ensures continuous improvement in separator technology, performance, and safety. Moreover, the presence of large-scale production facilities enables economies of scale, making the region highly competitive in international markets. In 2024, Senior Technology Material, a leading Chinese producer of lithium-ion battery separators, signed a deal to supply Volkswagen's battery subsidiary, PowerCo, with 2.09 billion square meters of separators through 2032. This deal was a part of Senior Tech's expanding international presence, with clients including CATL, Northvolt, and LG Energy.

Key Regional Takeaways:

United States Lithium-Ion Battery Separator Market Analysis

In North America, the market portion held by the United States was 89.60%, propelled by the swift EV adoption and large-scale renewable energy storage. As reported by the American Clean Power Association (ACP), renewable energy battery storage in the US grew from 47 MW in 2010 to 17,380 MW in 2023. Additionally, the extensive battery storage capacity is expected to rise from 1 GW in 2019 to 98 GW by 2030. This is catalyzing the demand for high-performance batteries, thereby enhancing the necessity for advanced separators that guarantee both safety and efficiency. Furthermore, favorable federal policies, including significant grants and incentives encouraging domestic battery production and reshoring, are driving investments in major separator manufacturing plants. Regulatory demands for elevated safety standards and reduced carbon footprints are encouraging advancements in separator materials and production techniques. Moreover, the market is benefiting from cross-industry applications in aviation, marine, and industrial backup systems that require robust and high-performance battery components. Initiatives to localize and ensure the supply chain are boosting collaborations between separator manufacturers and battery producers, frequently backed by public-private programs.

North America Lithium-Ion Battery Separator Market Analysis

The North American lithium-ion battery separator market is driven by the growing EV demand, progress in energy storage innovations, and robust government backing for clean energy efforts. The area is seeing substantial investments in battery production infrastructure, aimed at strengthening local supply chains and decreasing dependence on imports. A notable instance of this momentum is the 2024 declaration by Asahi Kasei Battery Separator Corporation, which initiated construction on a new lithium-ion battery separator facility in Port Colborne, Ontario, in collaboration with Honda. Set to start production in 2027, the facility aimed to generate 700 million square meters of separators each year and create more than 300 jobs. Furthermore, it will be Canada’s inaugural large-scale wet-process separator facility, highlighting its critical role in fulfilling the area's increasing demands for EV and energy storage solutions. This advancement highlights the growing trend of heightened industrial operations in North America focused on improving battery efficiency, increasing domestic manufacturing capabilities, and facilitating the shift towards a sustainable energy future.

Europe Lithium-Ion Battery Separator Market Analysis

The expansion of the Europe lithium-ion battery separator market is mainly driven by the increasing need for EVs, as the region actively works towards decarbonization and sustainable transportation objectives. The European Environment Agency reports that 22.7% of all new car registrations and 7.7% of all new van registrations in the European Union in 2023 were EVs. In total, new EV registrations in the EU hit 2.4 million in 2023, showing significant growth compared to 2 million in 2022. Policies encouraging EV adoption, coupled with tighter emissions standards, are driving automakers to accelerate the transition towards electric mobility, thus enhancing the demand for high-performance lithium-ion batteries and their essential components, such as separators. Advancements in battery technology are impacting the market dynamics, with producers aiming for separators that offer greater thermal stability, mechanical strength, and ion conductivity to enhance overall battery efficiency and safety. Moreover, the quick growth of gigafactories in Europe, focused on localizing battery manufacturing and decreasing reliance on imports, is catalyzing the demand for separator materials. Collaborative efforts between battery producers and material providers are enhancing innovation in separator technology, addressing performance as well as environmental criteria. With sustainability as a primary emphasis, there is higher interest in environment-friendly separator materials, driving the industry towards more eco-conscious production methods and recyclable parts.

Asia Pacific Lithium-Ion Battery Separator Market Analysis

The market for lithium-ion battery separators in the Asia-Pacific region is growing as energy storage systems are being implemented, driven by solar and wind projects. This is leading to a rise in the demand for efficient batteries and dependable separators. For example, industry reports indicate that China accounted for more than 50% of the worldwide increase in solar and wind power capacity in 2024. In 2024, solar and wind installations accounted for 18% of total renewable energy capacity in China, 11% in Japan, and 6% in South Korea. The rise in local manufacturing, bolstered by significant gigafactory investments and the integration of regional supply chains, is driving the need for advanced separator materials. Moreover, ongoing material advancements are influencing the lithium-ion battery separator market growth as producers put greater emphasis on separators that provide enhanced thermal and chemical stability, elevated ionic conductivity, and reduced thicknesses to improve battery energy density and safety. In addition, regional start-ups and academic institutions are increasingly participating in the innovation pipeline, accelerating progress in separator technologies and facilitating industry growth.

Latin America Lithium-Ion Battery Separator Market Analysis

The lithium-ion battery separator market in Latin America is witnessing growth owing to the region's significant lithium deposits, especially in Argentina, Chile, and Bolivia, establishing it as an important contributor to the worldwide battery supply chain. According to a 2025 report from the Intelligence and Security Institute (BISI), Argentina represents 20% of the world's lithium reserves, amounting to 20 million metric tons. The plentiful availability of raw materials is driving considerable investments from local and global firms, striving to build a strong lithium extraction and processing framework. In addition, improvements in separator technologies, such as the creation of ultra-thin and ceramic-coated separators, are improving battery performance and safety, conforming to global standards and offering a positive lithium-ion battery separator market outlook in the region.

Middle East and Africa Lithium-Ion Battery Separator Market Analysis

The market for lithium-ion battery separators in the Middle East and Africa is influenced by rising investments in energy storage infrastructure and grid modernization. For example, Saudi Arabia possesses the world's third-largest battery energy storage capacity at 22 gigawatt-hours (GWh), as reported by the King Abdullah Petroleum Studies and Research Center (KAPSARC). By the year 2030, the Kingdom intends to boost its battery energy storage capacity to 48 GWh. As nations in the area strive to diversify their energy sources and lessen reliance on oil, there is a higher focus on incorporating lithium-ion batteries into renewable energy frameworks. The growing demand for efficient energy storage solutions is being propelled by urban development and the emergence of smart cities, with advanced battery separators being crucial for performance and safety.

Competitive Landscape:

Major actors in the industry are prioritizing strategic efforts to enhance their market presence and address the increasing worldwide demand. They are funding R&D to improve separator efficiency, focusing on thermal stability, mechanical durability, and ion permeability. For instance, in 2024, Noco-noco and Greenfuel Energy Solutions announced a partnership to integrate Noco-noco's X-SEPA™ separator technology into EV batteries, enhancing their lifespan and efficiency. Apart from this, businesses are increasing their production capabilities and refining manufacturing methods to attain cost-effectiveness and scalability. Additionally, major stakeholders are prioritizing sustainable methods and creating eco-conscious materials owing to environmental issues and regulatory demands. These initiatives together seek to guarantee sustained competitiveness and creativity in a fast-changing market environment.

The report provides a comprehensive analysis of the competitive landscape in the lithium-ion battery separator market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- Beijing SOJO Electric Co. Ltd

- Cangzhou Mingzhu Plastic Co.

- ENTEK International

- Mitsubishi Paper Mills, Ltd

- SK Inc.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Industries Inc.

- UBE Corporation

- W-SCOPE Corporation

- Yunnan Energy New Material Co., Ltd.

Latest News and Developments:

- July 2025: Mircroporous LLC officially inaugurated its new lithium-ion battery separator production line at its facility. The manufacturing line was established for the production of battery separators for backup power and electric vehicles (EVs) in order to promote green energy solutions and lower emissions.

- June 2025: INV New Material Technology Sdn Bhd officially launched a new lithium-ion battery separator plant with an estimated investment of RM 3.2 Billion. The recently opened plant is expected to manufacture 1.3 Billion square meters of coated and wet-processed lithium-ion separators, which are vital components for the production of EV batteries.

- May 2025: Natrion announced that it will start taking pre-orders for its first-generation flagship lithium-ion battery separator product in an effort to address the present dynamics of the global supply network. Manufactured in the United States, the Gen-1 active separator, which leverages Natrion's unique lithium solid ionic composite (LISIC) technologies, is the very first and only one of its kind that reduces common Li-ion battery cell deterioration processes.

- January 2025: Yunnan Energy New Materials Co., Ltd., a distributor of lithium-ion battery separator films based in China, disclosed that it has entered into a supply agreement with South Korea-based LG Energy Solution (LGES) through its subsidiary Shanghai SEMCORP. As part of this partnership, LGES intends to purchase approximately 3.55 Billion square meters of lithium-ion battery separators from Shanghai SEMCORP and its affiliated companies from 2025 to 2027.

Lithium-Ion Battery Separator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polypropylene (PP), Polyethylene (PE), Nylon, Others |

| Thicknesses Covered | 16µm, 20µm, 25µm |

| End Users Covered | Industrial, Consumer Electronics, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, Beijing SOJO Electric Co. Ltd, Cangzhou Mingzhu Plastic Co., ENTEK International, Mitsubishi Paper Mills, Ltd, SK Inc., Sumitomo Chemical Co., Ltd., Teijin Limited, Toray Industries Inc., UBE Corporation, W-SCOPE Corporation, Yunnan Energy New Material Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lithium-ion battery separator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global lithium-ion battery separator market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lithium-ion battery separator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lithium-ion battery separator market was valued at USD 7.69 Billion in 2024.

The lithium-ion battery separator market is projected to exhibit a CAGR of 7.52% during 2025-2033, reaching a value of USD 15.14 Billion by 2033.

The lithium-ion battery separator market is driven by rising demand for energy storage in electronics and electric vehicles, increasing focus on safety and performance, advancements in separator materials, and the growing adoption of renewable energy solutions. Additionally, regulatory support and continuous innovation contribute significantly to the market growth and enhanced battery efficiency.

Asia Pacific currently dominates the lithium-ion battery separator market, accounting for a share of 43.8%. The dominance of the region is attributed to its strong manufacturing infrastructure, supportive government policies, and increasing investments in battery technologies. The region benefits from a robust supply chain, skilled workforce, and the growing demand for energy storage solutions, contributing to its leading market position.

Some of the major players in the lithium-ion battery separator market include Asahi Kasei Corporation, Beijing SOJO Electric Co. Ltd, Cangzhou Mingzhu Plastic Co., ENTEK International, Mitsubishi Paper Mills, Ltd, SK Inc., Sumitomo Chemical Co., Ltd., Teijin Limited, Toray Industries Inc., UBE Corporation, W-SCOPE Corporation, Yunnan Energy New Material Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)