Low Speed Electric Vehicle Market Size, Share, Trends and Forecast by Product, Vehicle Type, Voltage, Battery, End User, and Region 2025-2033

Low Speed Electric Vehicle Market Size and Share:

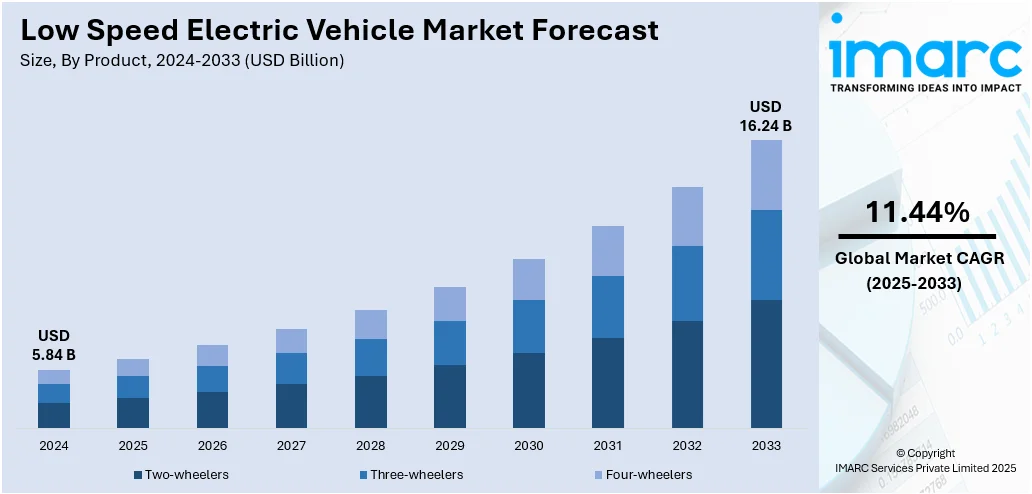

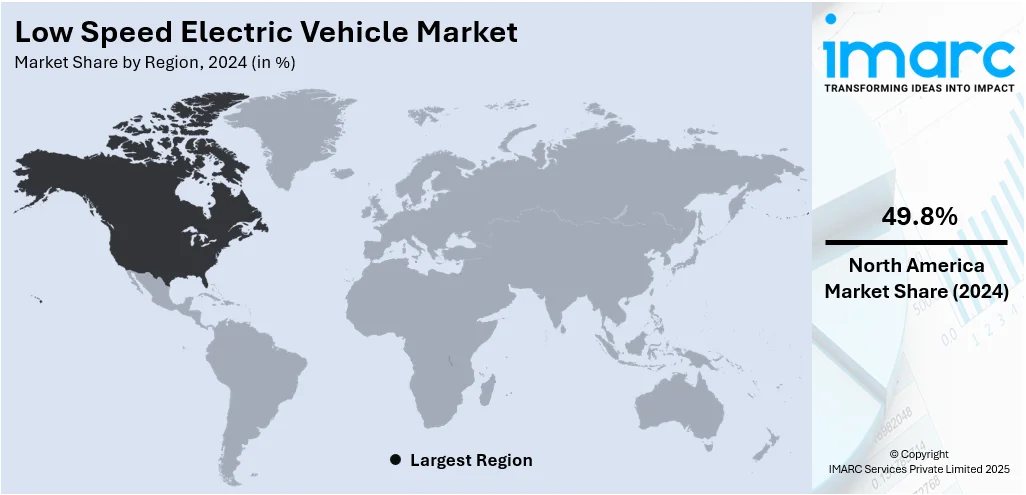

The global low speed electric vehicle market size was valued at USD 5.84 Billion in 2024. Looking forward, the market is expected to reach USD 16.24 Billion by 2033, exhibiting a CAGR of 11.44% during 2025-2033. North America currently dominates the market, holding a significant market share of 49.8% in 2024. The market is being propelled by mounting environmental issues, rising fuel prices, and urban congestion. Governments worldwide are providing incentives and lenient regulations to encourage the use of these vehicles, especially for short trips. Advances in battery efficiency, lightweight materials, and vehicle design are also improving performance and affordability. Shifting consumer preferences toward low-maintenance and sustainable transport means are driving adoption in both commercial and personal segments, increasing the overall low speed electric vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.84 Billion |

|

Market Forecast in 2033

|

USD 16.24 Billion |

| Market Growth Rate (2025-2033) | 11.44% |

Government incentives and increasing urban mobility demands are among the major drivers of the low speed electric vehicle (LSEV) market, especially in areas emphasizing eco-friendly transport and space-saving commuting options. In China and India, for instance, where traffic jams and pollution are chronic problems, LSEVs are gaining recognition as viable options for short-distance transportation, especially within city boundaries and semi-urban zones. Their low cost, minimal maintenance needs, and energy efficiency make them well-suited to a broad spectrum of uses including campus shuttles, intracity deliveries, and mobility for senior citizens. Moreover, local authorities in these areas are implementing supportive regulations like subsidies, taxation incentives, and easing of licensing constraints to promote LSEV use. In Europe, especially in urban areas with a concentrate on zero-emission zones, LSEVs present a good means of fulfilling regulations and maintaining last-mile logistics and car-sharing schemes. Their reduced size and reduced noise level are also virtues that will help them trundle through tight lanes and minimize noise pollution, making them an integral part of urban transportation systems of the low speed electric vehicle market outlook.

To get more information on this market, Request Sample

The United States is a primary disruptor in the market for low speed electric vehicles (LSEVs) due to its unique combination of technological advancement, regulatory environments, and changing consumer tastes. Contrary to conventional markets where LSEVs are mainly adopted for mere transportation, the U.S. is revolutionizing their use with applications in gated communities, resorts, corporate campuses, and retirement villages. Florida, Arizona, and California are observing greater adoption of LSEVs for recreational purposes as well as for regular commutes in planned communities. The inclusion of sophisticated features like GPS, telematics, and solar charging capability—created by American technology companies—has improved the functionality and popularity of LSEVs. In addition, the culture of early technology adoption in the U.S. and its mature EV infrastructure are facilitating the transition of LSEVs to more mainstream mobility offerings. Local regulations in certain cities even permit street-legal LSEVs on roads with speed limits below specific levels, creating more adaptable transport modes.

Low Speed Electric Vehicle Market Trends:

Integration of 3D Printing Technology in LSEV Manufacturing

The growing use of 3D printing technology in vehicle design and manufacturing is one of the most innovative developments in the low-speed electric vehicle (LSEV) sector. According to an industry analysis by the IMARC Group, the global 3D printing market reached USD 28.5 billion in 2024 and is expected to increase at a CAGR of 17.9% over 2025–2033. The trend is gaining popularity in technologically driven regions like North America and some sections of Europe, where automakers and startups are using 3D printing to accelerate prototyping and reduce manufacturing costs. 3D printing allows for customization of parts, quick iteration of designs, and major elimination of materials waste—all that are in alignment with the sustainability objectives that pertain to electric mobility. In the case of LSEVs, which tend to be smaller in size and less complicated compared to conventional vehicles, 3D printing facilitates more localized and efficient manufacturing paradigms. In the United States alone, several firms are employing 3D-printed components in urban utility LSEVs, addressing delivery fleets and personal mobility markets. While this is accelerating the manufacturing process, it is also improving design flexibility and personalization, further providing a new standard for the development of LSEVs and their introduction to market.

Growth of the Automobile Industry and Its Impact on LSEVs

The growing global automotive sector is directly impacting the low speed electric vehicle market trends, especially in areas of fast urbanization and rising demand for green transport mode. In Asia-Pacific nations like China and India, the strong expansion of the automotive industry is generating supply chain efficiencies, technology spillovers, and innovation systems that advantage the LSEV sector. For instance, the automotive industry in India reached a total production of 19,21,268 units of passenger vehicles, two-wheelers, three-wheelers, and quadricycles in December 2024, highlighting a robust automotive production rate in the country, as per the India Brand Equity Foundation (IBEF). Major vehicle makers are now starting to invest in low-speed electric vehicle ranges as an adjunct product line, responding to the increasing demand for short-distance, affordable mobility alternatives for city driving. This development is also evident in some areas of Europe, where mainstream automakers are venturing into the LSEV category with smaller, purpose-designed models for city and last-mile delivery use. In the United States, pressure from the overall EV market is driving battery technology advances and component standardization, having an indirect positive effect on LSEV quality and performance. When the mainstream automotive sector adopts electrification, LSEVs are being considered a critical element in a multimodal, multi-party mobility system.

Government Support Through Relaxed Licensing and Age Regulations

Governments in several nations are acknowledging the advantages of low speed electric vehicles and are actively encouraging their use through policy changes, especially in licensing and age requirements. In nations such as Japan, Germany, and certain regions in the United States, governments have added clauses to permit young people or those with non-full driving permits to drive LSEVs under certain circumstances. This renders LSEVs a desirable mode of mobility for youth, older adults, and others who may not be eligible for traditional vehicle operation. For instance, in 2024, the Government of India introduced the PM E-DRIVE initiative in order to expedite the adoption of electric vehicles (EVs) in India, build extensive EV charging infrastructure, and establish an ecosystem for EV production in the country. With a USD 1.30 billion budget, the project will be carried out between October 1, 2024, and March 31, 2026. In the United States, some states allow street-legal use on lower-speed roads, and local regulations have also softened registration and insurance stipulations to increase access to these vehicles. Likewise, in certain regions of Europe, license categories are being realigned to facilitate embracing micro-mobility options. These lenient rules decrease the entry barrier, increase the possible user base, and encourage safer and more environmentally friendly transport options, especially in semi-urban and suburban communities, which further contribute to the low speed electric vehicle market growth.

Low Speed Electric Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global low speed electric vehicle market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, vehicle type, voltage, battery, and end user.

Analysis by Product:

- Two-wheelers

- Three-wheelers

- Four-wheelers

Two-wheelers are the leading segment in the low speed electric vehicle market owing to their affordability, ease in navigating traffic, and adaptability for short distance commutes. They are particularly favorite in areas with high population density such as Southeast Asia, where electric scooters and bicycles are an efficient, environmentally friendly option compared to conventional gasoline-powered versions.

Three-wheelers are becoming popular in the low-speed electric vehicle segment, mainly for last-mile delivery and shared mobility. Mostly found in India and certain African nations, these vehicles have improved stability compared to two-wheelers and reduced operational expenses compared to four-wheelers. Their carrying capacity and flexibility make them a necessity in urban and semi-urban transport.

Four-wheelers in the LSEV class are intended for low-speed urban transport, retirement villages, and gated complexes. Usually as small as cars, they offer enhanced comfort, protection from weather, and safety compared to two- or three-wheelers. The vehicles are gaining more popularity in areas such as North America and Europe where the regulations allow them on low-speed routes.

Analysis by Vehicle Type:

- Passenger LSEV

- Heavy-duty LSEV

- Utility LSEV

- Off-road LSEV

Off-road LSEV leads the market share in 2024. Off-road low speed electric vehicles (LSEVs) are the leading segment of the overall LSEV market due to their adaptability and increasing application across various industries. The vehicles find extensive application in agricultural fields, mines, construction areas, and recreational environments like golf courses, resorts, and nature parks. Their low noise, reduced emissions, and rugged terrain capability make them particularly suitable for places where conventional fuel-operated vehicles would be inappropriate or uneconomic. In extensive rural areas of countries such as the United States and Australia, off-road LSEVs are being more commonly employed for agricultural purposes, maintenance, and short-distance transportation on large private estates. Manufacturers are also combining enhanced battery technologies, improved suspension systems, and all-terrain capabilities to make them perform better. Increasing demand for environmentally friendly utility vehicles in both business and recreational uses guarantees off-road LSEVs remain a major driver for overall market growth.

Analysis by Voltage:

- 24V

- 36V

- 48V

- 60V

- 72V

The 24V application in low speed electric vehicles is typically utilized for light-duty applications like mobility scooters and small utility carts. These systems have simple power output, which is suitable for short-range, low-demand applications. Their simplicity and reduced cost meet the needs of users who value affordability and simplicity when it comes to maintenance.

36V systems are commonly found on electric bikes, foldable scooters, and personal mobility cars. The 36V level provides a compromise between performance and battery endurance suitable for light inner-city commuting. It has superior speed and range compared to 24V systems, yet reasonable charging loads and moderate energy usage.

48V systems are commonly used in the LSEV industry as they are efficient and versatile. Used in electric rickshaws, delivery vans, and golf cars, they provide increased speed, range, and load capacity. These systems accommodate moderate commercial applications and are widely popular for use both in urban and semi-urban areas.

The 60V voltage segment is for mid-performance LSEVs like utility vehicles and cargo haulers. They provide greater torque and improved hill climbing capability, which is suitable for industrial or semi-commercial applications. Users can get more power without significantly sacrificing battery efficiency, hence making them appropriate for heavy-duty mobility and hard-working urban logistics.

72V systems drive high-performance LSEVs employed in off-road, farming, and bigger utility vehicles. They are famous for their high-power output, which sustains longer travel distances and heavier loads. They are selected where speed, durability, and terrain capacity are essential, particularly in uneven landscapes and commercial activities demanding stable, dependable performance.

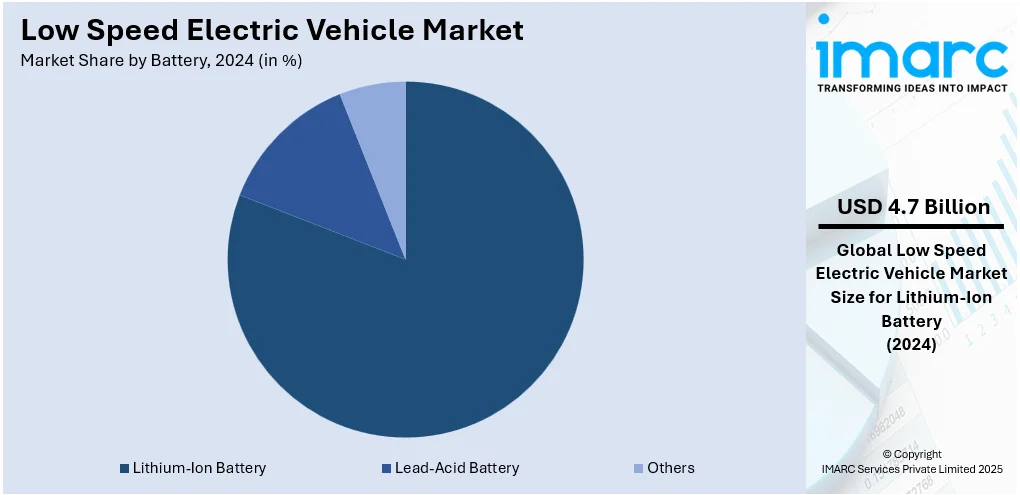

Analysis by Battery:

- Lithium-Ion Battery

- Lead-Acid Battery

- Others

Lithium-ion battery leads the market with around 80.5% of market share in 2024. Lithium-ion batteries are the dominant battery segmentation in the low speed electric vehicle (LSEV) market because of their higher energy density, longer life, and lighter weight compared to conventional lead-acid batteries. They offer greater efficiency and faster charging rates, which improve the overall performance and convenience of LSEVs. Their high output consistency qualifies them for a wide range of LSEV applications, from mobility scooters to utility vehicles for business and recreational use. Lithium-ion technology further enables longer driving ranges and enhanced lifespan, addressing consumer concerns over battery durability and maintenance. In markets emphasizing sustainability, like North America and Europe, lithium-ion batteries fit in well with eco-friendly objectives through minimizing toxic waste and carbon emission. With decreasing battery prices and advancing recycling processes, lithium-ion batteries will increasingly solidify their leadership position in the LSEV industry globally.

Analysis by End User:

- Golf Courses

- Tourist Destinations

- Hotels and Resorts

- Airports

- Residential and Commercial Premises

- Others

Golf courses lead the market share in 2024. Golf courses are a significant part of the end user segment for low speed electric vehicles (LSEVs), which are mostly used for client transportation and grounds maintenance on massive greens. LSEVs provide an almost soundless, emission-free option compared to conventional gas carts that are environmentally friendly and suit the demands of golf courses as far as going green is concerned. They are the perfect size and can move at low speeds to traverse the soft grassy grounds of a golf course without damaging the turf. Apart from the transportation of players, golf clubs employ LSEVs for equipment towing, maintenance, and personnel movement, which makes operations more efficient. In places such as North America, Europe, and Australia, where golf is a very popular sport and recreative activity, the markets for electric golf cart and utility LSEV are on the rise consistently. Since classes of business emphasize green solutions and low-cost maintenance, LSEVs remain a top choice, fueling innovation and usage in this specialty market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 49.8%. North America is one of the dominant regional segments in the low speed electric vehicle (LSEV) market due to stringent environmental policies and growing consumer appetite for eco-friendly transportation solutions. The world's emphasis on decreasing carbon emissions and increasing clean energy alternatives has picked up momentum for LSEV adoption in urban, suburban, and recreational applications. LSEVs are popularly used in the United States and Canada in gated residential areas, golf courses, campuses, and retirement communities, where low-speed mobility solutions are crucial. Leading infrastructure, technological developments, and government policies favoring growth drive the market. Furthermore, increased investments in electric vehicle production and battery technology also improve the efficiency and availability of LSEVs throughout the region. The strong economy and environmental consciousness of consumers in North America drive continued demand, making it the leading market in the world for LSEVs.

Key Regional Takeaways:

United States Low Speed Electric Vehicle Market Analysis

In 2024, the United States accounts for over 80.00% of the low speed electric vehicle market in North America. The United States low speed electric vehicle (LSEV) market is primarily driven by a combination of regulatory support, urban mobility trends, and growing interest in sustainable transportation alternatives. Local governments and municipalities are increasingly adopting LSEVs for applications such as campus transport, gated community mobility, parks, and public works, thanks to their low operational cost, minimal environmental impact, and compliance with neighborhood electric vehicle (NEV) standards. Rising fuel costs and growing environmental awareness have also encouraged consumers to seek alternatives to traditional vehicles for short-distance travel. As a result, numerous universities, industrial parks, and sports venues are investing in LSEVs to reduce emissions from traditional vehicles and streamline on-site transportation. According to the Center for Sustainable Energy, the majority of GHG emissions in the United States are due to transportation, with light-duty vehicles accounting for 57% of total sector’s emissions in 2022. Additionally, LSEVs are gaining popularity in industries such as tourism, last-mile logistics, and agriculture, where compact, quiet, and energy-efficient vehicles are practical. The expansion of retirement communities and planned neighborhoods is further fueling the adoption of LSEVs, with residents using them for local errands. Technological improvements in battery life and charging efficiency are also making these vehicles more appealing, supporting market growth.

Asia Pacific Low Speed Electric Vehicle Market Analysis

The Asia Pacific low speed electric vehicle (LSEV) market is expanding due to rising urbanization, high population density, and the need for affordable, compact transportation in crowded cities. Countries such as China and India are promoting electric mobility to address air pollution and traffic congestion, leading to the widespread adoption of LSEVs for personal, commercial, and municipal use. For instance, in May 2025, Rilox EV formed a collaboration with Hala Mobility to install 400 electric cars (EVs) in India each month. The collaboration will deploy approximately 20,000 electric vehicles across the country, starting with low-speed electric vehicles, providing economical and environmentally friendly transportation options. In addition to this, lower production costs and the availability of low-cost battery technologies are making LSEVs accessible to a broad consumer base. Small businesses and informal transport operators also favor these vehicles for their low maintenance needs and operating costs. Continued investment in EV charging infrastructure and stricter emission norms further support overall market growth.

Europe Low Speed Electric Vehicle Market Analysis

The growth of the Europe low speed electric vehicle (LSEV) market is largely fueled by urban mobility policies, environmental goals, and increasing demand for efficient transportation in low-traffic zones. According to industry reports, under existing policies in the Green Deal regulatory framework, transport may account for 44% of total emissions and still not dip below 1990 levels. Hence, numerous European cities are implementing low-emission zones and restricting access for traditional combustion vehicles, creating space for LSEVs as a viable solution for short-distance commuting, goods movement, and municipal services. Governments, city councils, and private entities are also supporting the adoption of LSEVs through incentives, relaxed licensing requirements, and dedicated infrastructure, such as charging stations. For instance, in June 2025, Tritium, an international provider of DC fast charging solutions for electric vehicles (EVs), announced the launch of the TRI-FLEX platform, a cutting-edge charging architecture designed specifically to meet the EV infrastructure and regulatory requirements of Europe. A high-performance system designed to provide magnitude, versatility, and compliance throughout the European market, Tritium's TRI-FLEX aims to expand Europe’s EV infrastructure with innovative, next-generation solutions. Additionally, advancements in vehicle design, safety features, and battery performance are making newer models more attractive for wider use. In rural areas and small towns, where road speeds are generally lower, LSEVs are emerging as practical alternatives for daily travel. The EU’s focus on carbon neutrality and smarter city planning is also encouraging broader integration of LSEVs into future urban transport systems.

Latin America Low Speed Electric Vehicle Market Analysis

The Latin America low speed electric vehicle (LSEV) market is significantly influenced by the growing interest in sustainable transportation, rising fuel costs, and expanding urban congestion. Cities across the region are exploring electric mobility options to reduce air pollution and improve access in densely populated areas. As per industry reports, air pollution is one of the leading causes of death in Brazil and accounted for approximately 5% of total deaths in the country in 2017, equating to 66,200 individuals. LSEVs are being adopted for local deliveries, security patrols, tourism, and short-distance commuting, particularly in gated communities and historic city centers with speed restrictions. Governments in countries such as Brazil and Chile are also supporting EV initiatives through pilot programs and incentives, encouraging both public and private sector adoption.

Middle East and Africa Low Speed Electric Vehicle Market Analysis

The Middle East and Africa low speed electric vehicle (LSEV) market is experiencing robust growth, driven by increasing investments in smart cities, tourism, and sustainable transportation infrastructure. A report released by the IMARC Group states that the Middle East's smart cities market was valued at USD 62,965.8 million in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 21.89% from 2025 to 2033. To encourage peaceful, low-emission travel, nations like the United Arab Emirates and Saudi Arabia are integrating LSEVs into business districts, leisure areas, and planned communities. LSEVs are also being widely used in resorts, airports, and large public venues for internal transportation, aligning with regional goals to enhance visitor experience and reduce carbon footprints. Other than this, growing urbanization and informal transportation needs in Africa are creating opportunities for LSEVs in short-range commuting and local goods delivery.

Competitive Landscape:

Several major companies in the low speed electric vehicle (LSEV) industry are implementing a number of strategic measures to generate growth and increase presence across different world regions. One such key initiative is ongoing investment in research and development to improve battery technology, vehicle efficiency, and overall performance. Firms are prioritizing light-weight materials, enhanced powertrains, and small formats designed for urban and niche applications such as campuses, gated communities, and golf courses. Manufacturers are also making alliances with technology companies to incorporate smart features such as GPS, digital dashboards, and IoT connectivity, hence catering to current consumer expectations. Moreover, most players are increasing their production capacity and establishing localized assembly facilities to lower costs and simplify distribution. Sustainability is also a focus area, with firms highlighting recyclable materials and embracing environmentally friendly manufacturing processes. To gain market share in developing economies, leading players are launching low-cost models and partnering with local authorities for pilot projects and public transportation solutions. They are also leveraging loosened regulations in some nations to enhance accessibility and consumer adoption. All these efforts are enhancing LSEV manufacturers' global presence and propelling the market toward cleaner and efficient mobility options, according to the low speed electric vehicle market forecast.

The report provides a comprehensive analysis of the competitive landscape in the global low speed electric vehicle market with detailed profiles of all major companies, including:

- Bintelli Electric Vehicles

- AGT Electric Cars

- HDK Electric Vehicle

- Bradshaw Electric Vehicles

- Polaris Inc.

- Hero Electric Vehicles Pvt Ltd

- Terra Motors Corporation

- Speedways Electric

- Textron Inc.

Latest News and Developments:

- May 2025: Yunlong Motors launched its newest range of low-speed electric vehicles that have received certification from the European Economic Community (EEC). These environmentally friendly cars integrate safety, effectiveness, and adherence to strict EU regulations in their design for both passenger and freight transportation.

- May 2025: Mumbai-based Odysse Electric Vehicles unveiled its new low-speed electric scooter, the HyFy. With a price tag of Rs. 42,000, the Odysse HyFy is designed to appeal to urban commuters who are seeking a more affordable and environmentally friendly substitute for traditional petrol-driven scooters.

- April 2025: Greaves Electric Mobility Limited introduced its new e-scooter, the Ampere Reo 80. Priced at Rs. 59,900, the Ampere Reo 80 is a low-speed electric scooter with an 80 km range per charge that aims to increase access to electric mobility solutions.

- January 2025: Yamaha Golf-Car Company entered into a partnership with Pilotcar Otomotiv San. Ve Tic. in order to secure exclusive distribution rights for Pilotcar low-speed electric vehicles in North America. Through this partnership, Pilotcar and Yamaha will be better equipped to meet the evolving demands of LSEV-specific retail customers and dealer partners by collaborating with Yamaha's network of retail dealers, which provide industry-leading profits, components, and support services.

- January 2025: Godawari Electric Motors Pvt. Ltd. launched a new line of vehicles at the Bharat Mobility Global Expo 2025, including the Eblu Feo Z, a low-speed electric scooter designed for short urban commutes. Developed for Indian families, the Eblu Feo Z promises an 80 km range on a single charge, providing comprehensive functionality and reliability.

Low Speed Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Two-wheelers, Three-wheelers, Four-wheelers |

| Vehicle Types Covered | Passenger LSEV, Heavy-duty LSEV, Utility LSEV, Off-road LSEV |

| Voltages Covered | 24V, 36V, 48V, 60V, 72V |

| Batteries Covered | Lithium-Ion Battery, Lead-Acid Battery, Others |

| End Users Covered | Golf Courses, Tourist Destinations, Hotels and Resorts, Airports, Residential and Commercial Premises, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGT Electric Cars, Bintelli Electric Vehicles, Bradshaw Electric Vehicles, HDK Electric Vehicle, Hero Electric Vehicles Pvt Ltd, Polaris Inc., Speedways Electric, Terra Motors Corporation, Textron Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the low speed electric vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global low speed electric vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the low speed electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The low speed electric vehicle market was valued at USD 5.84 Billion in 2024.

The low speed electric vehicle market is projected to exhibit a CAGR of 11.44% during 2025-2033, reaching a value of USD 16.24 Billion by 2033.

The low speed electric vehicle market is driven by rising environmental awareness, government incentives, and the need for cost-effective, short-distance transportation. Urban congestion, advancements in battery technology, and relaxed licensing regulations further support adoption. These vehicles offer eco-friendly alternatives for personal, commercial, and recreational mobility across various global regions.

North America currently dominates the low speed electric vehicle market, driven by growing environmental regulations, demand for sustainable mobility, and expanding applications in residential, commercial, and recreational areas. Government incentives, advanced EV infrastructure, and rising consumer preference for clean, cost-effective transportation solutions further accelerate market growth across the United States and Canada.

Some of the major players in the low speed electric vehicle market include AGT Electric Cars, Bintelli Electric Vehicles, Bradshaw Electric Vehicles, HDK Electric Vehicle, Hero Electric Vehicles Pvt Ltd, Polaris Inc., Speedways Electric, Terra Motors Corporation, Textron Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)