LTE and 5G Broadcast Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

LTE and 5G Broadcast Market Size and Share Analysis:

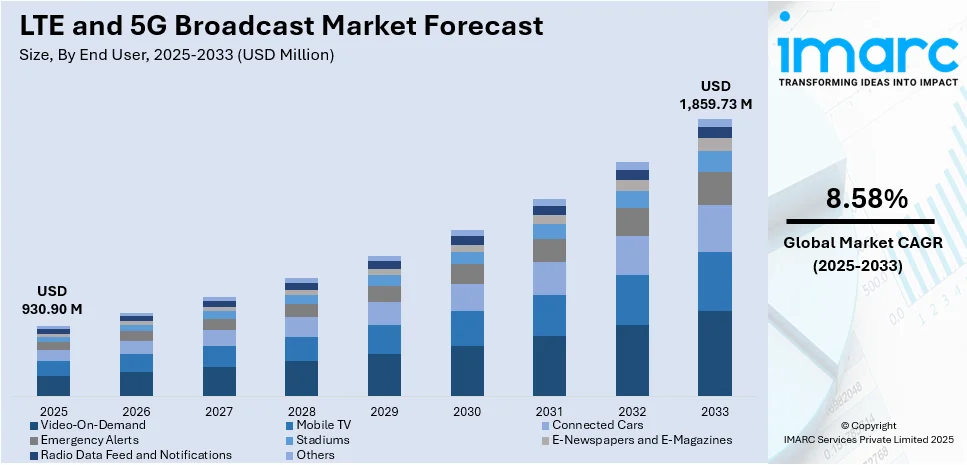

The global LTE and 5G Broadcast market size is anticipated to reach USD 930.90 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,859.73 Million by 2033, exhibiting a CAGR of 8.58% during 2025-2033. North America currently dominates the market, holding a market share of over 36.7% in 2024. The demand for connected cars for gaining insights about traffic congestion and road quality, burgeoning tourism and travel sector as real-time updates are very important for tourists, and initiatives by governing agencies of several countries are supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 930.90 Million |

|

Market Forecast in 2033

|

USD 1,859.73 Million |

| Market Growth Rate 2025-2033 |

8.58%

|

The skyrocketing need for high-quality video content is a key factor propelling the LTE and 5G broadcast market. Additionally, the increasing consumption of videos everyday including live sports, news, on-demand shows, or educational content is favoring the expansion of the market. The global over-the-top (OTT) media market is expected to reach USD 3,741.9 billion by 2033, growing at a rate of 22.9%. As streaming services grow, they require networks that can handle millions of viewers at once without buffering or delays. Traditional unicast networks send data individually to each user, which quickly becomes inefficient during high-traffic events. This gives way to LTE and 5G broadcast technology as they are known to transmit content simultaneously to multiple users and ensure a seamless streaming experience for everyone.

The United States stands out as a key market disruptor with an 83.60% market share in North America. Every year, the number of smartphones usage climbs in the country, and with them, mobile data consumption surges. Between the start of 2023 and 2024, the number of mobile connections in the United States grew by 9.5 million. Presently, phones are not only used for calls or texts but are also used as portable entertainment hubs. They are essential as people engage in binge-watching their favorite series, playing multiplayer games, or attending virtual events, which is creating the need for a stable and high-speed connection. LTE and 5G broadcast are designed to handle such widespread use, delivering consistent performance without overloading the network. Beyond entertainment, industries like education and healthcare rely on mobile connectivity to provide remote services, especially in underserved areas.

LTE and 5G Broadcast Market Trends:

Thriving tourism and travel sector

According to reports, the travel and tourism sector contributed 9.1% to the global GDP in 2023. To enhance the overall tourist experience, LTE and 5G broadcast technologies are highly valuable to deliver high-quality and low-latency content like maps, tourist guides, and AR applications. Remote visitors demand live streaming of events, virtual tours, and educational content of numerous attractions, museums, historical sites, and natural wonders, which can only be possible with the help of LTE and 5G broadcast. The delivery of multilingual audio guides, signage translations, and local cultural information to international tourists is done successfully via these broadcast technologies.

Growing demand for connected cars

Connected cars are highly technologically advanced and can function properly if there are efficient LTE and 5G networks. These cars can deliver information on traffic congestion, software updates, remote diagnostics, and real-time navigation, and so there is a rising LTE and 5G broadcast demand to provide these applications due to their necessary bandwidth and low latency. Continuous communication in connected cars is their major attraction, which is vital for safety-related features, including automatic emergency calling (eCall), collision avoidance systems, and real-time updates on road conditions and hazards. Using LTE and 5G broadcast technologies, automakers can effectively transmit software patches and over-the-air (OTA) firmware updates to connected vehicles. LTE and 5G networks are essential for these services, as they require advanced broadcast technologies. For instance, in 2019, the 5G TODAY project officially introduced its unique field trial for 5G Broadcasting. The project partners, including Bavarian Broadcasting Corporation (Bayerischer Rundfunk, BR), Kathrein, Rohde & Schwarz the Broadcast Technology Institute IRT, along with Telefonica Germany are jointly testing broadcasting options for future 5G technology.

Initiatives by governing agencies

For LTE and 5G broadcast services, governments allot spectrum bands, allowing operators to build and grow their networks. Broadcast technology innovation and infrastructure investment are encouraged by well-defined and administered spectrum policies. Several governments place a high priority on the growth of the digital economy and seek to improve national connectivity. These objectives are supported by LTE and 5G broadcast technologies, which also increase overall economic competitiveness, facilitate new digital services, and improve internet availability. As per the Office for National Statistics, 92 percent of adults in the United Kingdom (UK) were recent internet users in the year 2020, which is an up from 91 percent in 2019. Remote communities can receive digital material and high-speed internet access at a reasonable price with the help of LTE and 5G broadcast technologies. Governing agencies of several countries are organizing several competitions for facilitating research and development (R&D) projects for telecoms, which is strengthening the LTE and 5G broadcast market growth.

LTE and 5G Broadcast Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global LTE and 5G broadcast market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and end user.

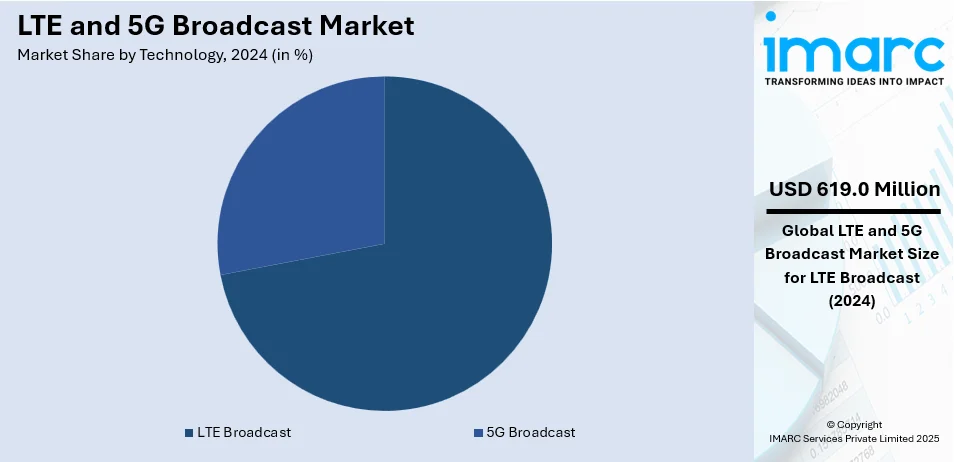

Analysis by Technology:

- LTE Broadcast

- 5G Broadcast

LTE broadcast stand as the largest component in 2024, holding around 72.5% of the market. According to the latest report, LTE broadcast represents the largest segment. Since LTE broadcast has been around for longer than 5G broadcast, it has an advantage over it in terms of adoption and deployment. Particularly in fields like content delivery networks, emergency notifications, and live sports broadcasting, it has proven use cases. Comparing LTE networks to the still developing 5G networks, the former having wider deployment and greater coverage. The extensive LTE infrastructure makes it possible to deploy LTE broadcast services more quickly and widely in various regions. Utilizing the current LTE infrastructure allows network operators to provide broadcast services at a reasonable cost. This lessens the requirement for a sizable increase in funding in comparison to developing new infrastructure especially for 5G. The majority of modern smartphones, tablets, and other networked gadgets are already LTE broadcast technology compatible. Because of its wide device compatibility, end customers may embrace it more easily and don't have to buy new devices.

Analysis by End User:

- Video-On-Demand

- Mobile TV

- Connected Cars

- Emergency Alerts

- Stadiums

- E-Newspapers and E-Magazines

- Radio Data Feed and Notifications

- Others

Video-on-demand accounts for the largest share in the LTE and 5G broadcast market. The emergence of streaming services is leading to a notable rise in the demand for on-demand video content among consumers. VoD consumption has increased as a result of viewers' preference to watch material whenever it's convenient. VoD over LTE and 5G broadcast can maximize network capacity by distributing popular content to numerous users at once via multicast technology. This enhances user experience overall and lessens the strain on the network, particularly during periods of high traffic. Broadcast technologies like LTE and 5G provide high-quality streaming with low latency and buffering, which is positively influencing the LTE and 5G broadcast market insights. Because delivering high-definition (HD) and ultra-high-definition (UHD) information demands a large amount of bandwidth, this is especially crucial.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.7%. According to the report, North America represents the largest regional market worldwide for LTE and 5G broadcast. The telecommunications infrastructure in North America is highly developed and established, particularly in the US and Canada. The area has also been in the forefront of LTE network expansion, which has created a solid foundation for LTE and 5G broadcast services, and it is rapidly expanding its 5G networks. The need for improved broadcast services that LTE and 5G networks may supply is being driven by North American people accustomed to high-speed internet and mobile services. Key players operating in this region are focusing on collaborations to fulfil the demand of clients. For instance, in 2024, Kyndryl, US based company, announced a global strategic alliance with Hewlett Packard Enterprise (HPE) to jointly develop and deliver LTE and 5G private wireless services to customers across the globe.

Key Regional Takeaways:

United States LTE and 5G Broadcast Market Analysis

The United States accounted for 83.60% of the market share in North America. In the United States, the adoption of LTE and 5G Broadcast technologies is rapidly expanding due to a number of specific, ongoing drivers. Telecom providers are constantly upgrading their infrastructure to accommodate higher data throughput, enabling more efficient and widespread delivery of broadcast content over LTE and 5G networks. As consumer demand for seamless, high-quality video streaming is growing, mobile operators are increasing their investments in 5G networks to support this shift, with many major cities already deploying 5G Broadcast services to enhance user experience. According to CTIA, since 5G was launched in 2018, three nationwide networks—and regional provider networks across the U.S.—already reach 330 million Americans. The shift to 5G Broadcast is also being fuelled by the increasing consumption of live events and sports content, which is prompting broadcasters to partner with telecom companies to ensure better delivery of content on mobile devices without overwhelming traditional broadcast networks. Additionally, the rollout of low-latency, high-speed 5G networks is enabling new applications in areas such as augmented reality (AR) and virtual reality (VR), which are further boosting the need for ultra-reliable broadcast services. Moreover, government policies promoting spectrum allocation and investment in next-generation wireless infrastructure are accelerating the transition to 5G, laying a strong foundation for continued growth in LTE and 5G Broadcast services.

Asia Pacific LTE and 5G Broadcast Market Analysis

Telecom companies are building their network infrastructures to satisfy the increasing demand for seamless connectivity and high-speed data, which is speeding up the adoption of LTE and 5G broadcast in the Asia Pacific area. Major cities are seeing the rollout of 5G services by mobile network operators, laying a strong basis for 5G broadcast solutions. The Ministry of Industry and Information Technology claims that over 90% of China's villages and all of the nation's cities and towns are covered by the country's 5G network. Using 5G's increased bandwidth and reduced latency, content producers are working with telecom operators to offer immersive experiences and streaming HD video. By providing spectrum licenses and encouraging the use of 5G through legislative support, governments are enabling this expansion. Consumers are increasingly consuming mobile video content, driving the need for higher-quality and more reliable streaming services. Technology providers are introducing new broadcast solutions that allow for efficient content distribution to a large number of users simultaneously, reducing network congestion and improving user experience. At the same time, manufacturers are launching devices that support 5G and LTE broadcast capabilities, contributing to wider device compatibility. Additionally, mobile network operators are testing and implementing innovative solutions like Dynamic Spectrum Sharing (DSS) to optimize existing infrastructure for 5G deployment, making it more cost-effective and future-proof. This combination of infrastructure development, technological innovation, and changing consumer preferences is propelling the growth of LTE and 5G broadcast in the region.

Europe LTE and 5G Broadcast Market Analysis

The growing need for high-quality, real-time mobile video streaming across several devices is driving the expansion of LTE and 5G broadcast in Europe. In order to satisfy the growing demand for faster, more dependable internet services—especially in urban areas where data consumption is high—mobile network operators are growing their 5G networks. With 68 percent of the population covered, Europe has the most widespread 5G coverage, according to the International Telecommunication Union (ITU). In order to provide improved content delivery capabilities, such as ultra-high-definition video and immersive experiences like augmented reality (AR) and virtual reality (VR), broadcasters are concurrently combining LTE and 5G technologies. Governments and regulatory bodies are supporting the development of these technologies by allocating spectrum for 5G, which is fostering the rollout of next-generation broadcast services. The shift from traditional broadcast to IP-based networks is enabling more flexible, cost-efficient distribution of content, which is driving the adoption of LTE and 5G broadcast solutions. Additionally, consumers’ increasing preference for mobile-first content consumption is pushing broadcasters and operators to enhance their networks to ensure seamless, high-quality viewing experiences on smartphones and tablets. The rise in connected devices, particularly IoT-enabled devices, is further fuelling the demand for broadcast services that can handle diverse data types and ensure efficient, widespread content delivery across regions.

Latin America LTE and 5G Broadcast Market Analysis

As network operators make investments in modernizing infrastructure to satisfy the increasing demand for high-speed data services, the deployment of LTE and 5G broadcast is accelerating in Latin America. To improve coverage and reduce latency, telecommunications companies are extending their LTE networks and putting 5G equipment in place in major cities and urban areas. Through regulatory initiatives and spectrum auctions, governments are aggressively promoting the deployment of cutting-edge wireless technology, hastening the digital transformation of the region. The demand for LTE and 5G services is being driven by the growing number of customized plans that mobile operators are offering that include streaming HD video. Young people in the area are also adopting data-intensive apps like gaming and video content, which is causing mobile data usage to rise. According to the Brazilian Institute of Geography and Statistics, the internet was used in 92.5% of the Brazilian households (72.5 million) in 2023, a rise of 1.0 p.p. over 2022. Additionally, the shift towards mobile-first consumption is prompting businesses to integrate LTE and 5G networks into their operations for enhanced connectivity, ensuring that they remain competitive in the digital ecosystem. As consumers and businesses continuously demand faster, more reliable connectivity, telecommunications providers are prioritizing network upgrades to handle these requirements. The ongoing digitization of industries, such as retail, healthcare, and education, is also fuelling the need for robust LTE and 5G broadcast networks across Latin America.

Middle East and Africa LTE and 5G Broadcast Market Analysis

The Middle East and Africa (MEA) are actively driving the adoption of LTE and 5G Broadcast technologies as they are expanding their broadband infrastructure and increasing mobile data consumption. Mobile network operators are continuously enhancing their capabilities to support higher data throughput, which is essential for meeting the demand for high-quality video streaming and real-time applications. Governments in key countries, such as the UAE, Saudi Arabia, and South Africa, are investing in nationwide 5G rollouts to foster innovation and economic growth. Telecom providers are launching 5G Broadcast services to offer enhanced coverage and capacity for content delivery, especially in densely populated urban areas. According to the International Telecommunication Union (ITU), 5G coverage reaches 12 per cent of the population in the Arab States region. Additionally, the rise in smart cities and IoT applications in MEA is pushing the demand for robust, low-latency networks that LTE and 5G Broadcast can provide. Enterprises are increasingly adopting these technologies for mission-critical operations, such as industrial automation and remote healthcare, which are dependent on real-time data transfer. The demand for immersive content experiences, including AR/VR, is also accelerating the adoption of high-speed, high-capacity networks. Finally, regulatory frameworks are evolving, with governments promoting spectrum allocation and infrastructure development to support the growth of 5G and LTE Broadcast technologies.

Top Leading LTE and 5G Broadcast Companies:

In order to satisfy the growing demand for high-quality video streaming, major competitors in the industry are continually improving their technology. Businesses are concentrating on implementing cutting-edge broadcasting solutions that provide more bandwidth and reduced latency, which are necessary for providing services without interruption. Additionally, telecom operators and content suppliers are increasingly working together, opening up new applications in areas like smart cities and linked automobiles. In an effort to improve service quality and broaden their market reach, these firms are also spending in spectrum acquisition and technological developments as competition intensifies. Overall, the strategic initiatives of these companies position them well to capitalize on the evolving landscape of mobile broadcasting.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- AT&T Inc.

- Athonet srl

- Cisco Systems Inc.

- Enensys Technologies SA

- Huawei Technologies Co. Ltd.

- KT Corporation

- NEC Corporation

- Nokia Corporation

- Reliance Jio Infocomm Limited

- Spinner Group

- Telstra Corporation

Latest News and Developments:

- May 2019: The unique field trial for 5G broadcasting was formally inaugurated by the 5G TODAY initiative. Future 5G broadcasting alternatives are being cooperatively tested by the project partners Bavarian Broadcasting Corporation (Bayerischer Rundfunk, BR), the Broadcast Technology Institute IRT, Kathrein, Rohde & Schwarz, and Telefónica Germany.

- April 2024: The 2024 NAB Show has showcased advancements in 5G broadcast technology, with a focus on its potential to revolutionize live production and distribution. Key highlights include enhanced network efficiency, ultra-low latency, and immersive content delivery, offering broadcasters new opportunities to improve coverage and engage audiences in innovative ways.

- May 2024: For the purpose of distributing TV channels in the city of Halle utilizing 5G Broadcast, the German media body MSA has issued a call for bids for a pilot project. Platform providers can apply for the allocation of the necessary broadcast capacity in the tender, which was issued in the federal state of Saxony-Anhalt's state gazette on April 29, 2024.

- November 2024: Astrum Mobile and Qualcomm Technologies have completed a trial of the world’s first 5G Broadcast service from a geosynchronous satellite to a retail smartphone with software updates to enable 5G Broadcast. The trial utilized an AsiaStar satellite with an Asia Pacific wide service coverage; it was compliant with the 3GPP 5G NTN (Non-Terrestrial Networks) standard as defined in ETSI TS 103 720 featuring a satellite-to-device 5G Broadcast service.

LTE and 5G Broadcast Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LTE Broadcast, 5G Broadcast |

| End Users Covered | Video-On-Demand, Mobile TV, Connected Cars, Emergency Alerts, Stadiums, E-Newspapers and E-Magazines, Radio Data Feed and Notifications, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Inc., Athonet srl, Cisco Systems Inc., Enensys Technologies SA, Huawei Technologies Co. Ltd., KT Corporation, NEC Corporation, Nokia Corporation, Reliance Jio Infocomm Limited, Spinner Group, Telstra Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the LTE and 5G broadcast market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global LTE and 5G broadcast market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LTE and 5G broadcast industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global LTE and 5G Broadcast market size is anticipated to reach USD 930.90 Million in 2025.

IMARC estimates the LTE and 5G broadcast market to exhibit a CAGR of 8.58% during 2025-2033

The market is primarily driven by the increasing demand for high-quality video content and the rapid growth of OTT services, the proliferation of smartphones and mobile internet usage, rapid advancements on the Internet of Things (IoT) technology, and augmenting demand for reduced network congestion, particularly during peak times.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market, with 36.7% of the market share.

Some of the major players in the LTE and 5G broadcast market include AT&T Inc., Athonet srl, Cisco Systems Inc., Enensys Technologies SA, Huawei Technologies Co. Ltd., KT Corporation, NEC Corporation, Nokia Corporation, Reliance Jio Infocomm Limited, Spinner Group, and Telstra Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)