Luxury Car Market Size, Share, Trends and Report by Vehicle Type, Fuel Type, Price Range, and Region, 2026-2034

Luxury Car Market Size and Share:

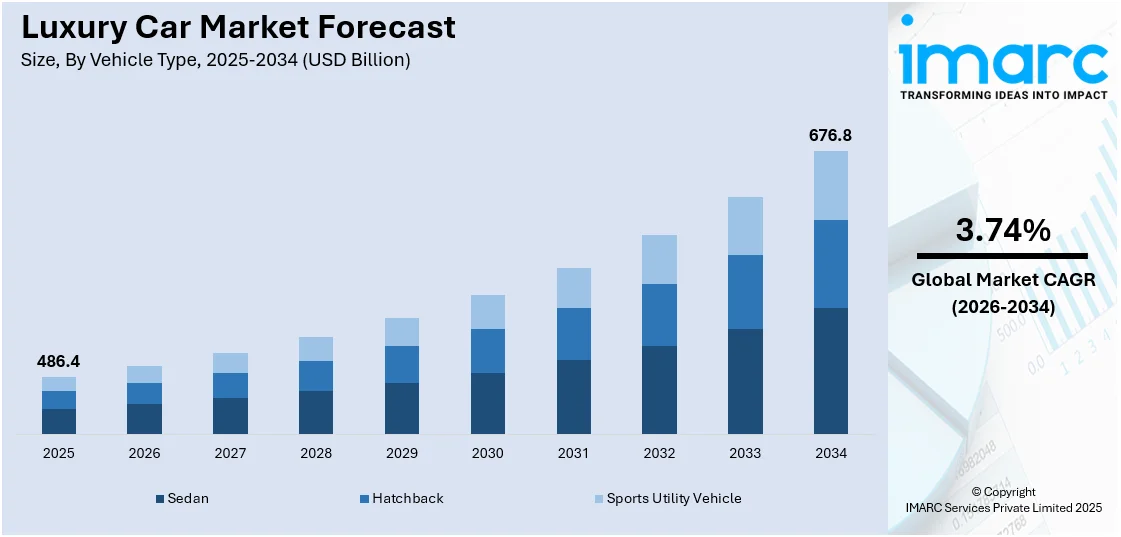

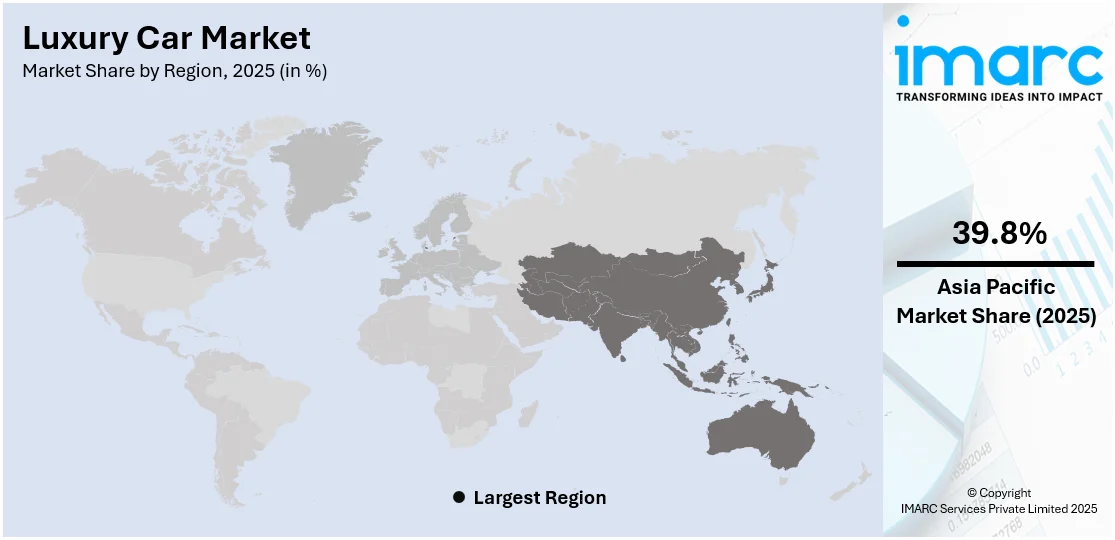

The global luxury car market size was valued at USD 486.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 676.8 Billion by 2034, exhibiting a CAGR of 3.74% during 2026-2034. Asia-Pacific currently dominates the market. The growing demand for opulence and comfort in vehicles, advancements in automotive technology, including safety, connectivity, entertainment, and performance, and rising awareness among the masses about sustainability are among the key factors driving the market growth across the region.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 486.4 Billion |

|

Market Forecast in 2034

|

USD 676.8 Billion |

| Market Growth Rate (2026-2034) | 3.74% |

The luxury car market is mainly driven by the rise in disposable incomes and increased demand for premium vehicles. Moreover, technological advancements have also been a major influence, such as autonomous driving capabilities, advanced infotainment systems, and enhanced safety features that attract tech-savvy buyers. In addition, the growing popularity of personalized and customizable options makes consumers more appealing to buy, as it allows buyers to tailor the vehicle to their preferences. Strategic marketing initiatives- celebrity endorsements and experiential events- further enhance brand appeal and customer loyalty in fostering the growth of luxury automobiles. Brand prestige and exclusivity further fuel market growth as a luxury automobile epitomizes status, and consumers tend to be high income for differentiated and customized products. Besides this, strategic marketing combined with influencer associations promote brand appeal and widen consumer accessibility.

To get more information on this market Request Sample

In the United States, the luxury car market is majorly driven by strong economic growth and high disposable incomes. Advanced technology preference, such as electric vehicles and autonomous driving features, continues to fuel demand for premium models from brands like Tesla, Mercedes-Benz, and BMW. Growing concern for sustainability has further fast-tracked the adoption of luxury EVs. Furthermore, China's luxury car market is propelled by rapid economic development, urbanization, and rising affluence among the middle and upper classes. A fast-growing pool of high-net-worth individuals has created tremendous demand for high-end vehicles. In Europe, the luxury car market is driven by a long-standing tradition of automotive excellence, particularly in countries like Germany and Italy. There is also strong demand for premium brands such as Mercedes-Benz, BMW, Audi, and Ferrari, which reflect consumer appreciation for performance, craftsmanship, and cutting-edge technology.

Luxury Car Market Trends:

Rising Disposable Income

As disposable incomes are rising, individuals are seeking transportation, and a symbol of status and prestige. Luxury cars offer an unparalleled level of craftsmanship, comfort, and performance that appeals to discerning buyers. In line with this, the increasing spending power of consumers is significantly impacting the market growth. For instance, according to BEA, in February 2024, the disposable personal income in the United States increased by 0.2% from the previous month. Also, in Germany, the average household net adjusted disposable income per capita is USD 38 971 a year, higher than the OECD average of USD 30 490. Consequently, the desire for exclusive features, plush interiors, cutting-edge technology, and top-tier safety standards are catalyzing the luxury car market demand.

Increasing Product Offerings

Various key market players are introducing electric and hybrid models with connectivity features, such as IoT capabilities, AI-driven interfaces, and autonomous driving technologies, to elevate the driving experience of the consumers. Moreover, they are making significant investments in developing luxury cars with zero-emission capabilities. For instance, in November 2023, India’s largest luxury auto brand, Mercedes-Benz, launched the GLE LWB SUV and AMG C43 4MATIC sedan. The company launched the face-lifted version of the GLE SUV in India at a starting price of INR 96.40 Lakh (USD 117,135.3) (ex-showroom) across three variants. The SUV made its debut alongside the C43 AMG 4Matic sedan, with a price tag of INR 98 Lakh (USD 117,937.12). Similarly, in August 2023, Audi launched its new electric duo, the Q8 e-tron and e-tron Sportback in India. The Q8 e-tron range is available in two trims with 95kWh and 114kWh battery packs, respectively. In the same year, Lotus unveiled Emeya, the company’s first four-door hyper-GT, in New York City. The increasing introduction of technologically advanced vehicles is anticipated to positively impact the luxury car market outlook.

Environmental Consciousness and Sustainability

Environmental concerns and a growing awareness of sustainability are positively influencing the market. Luxury car manufacturers are responding to the demand for eco-friendly options, leading to the development of electric and hybrid luxury models. Various leading manufacturers are launching hybrid and electric vehicles to cater to environment conscious customers, which is propelling the luxury car market revenue. For instance, Alfa Romeo confirmed the gas-powered Giulia will be revamped in the coming years, dropping its Ferrari-derived V-6 in favor of an electric powertrain for 2025. The base version will make around 350 horsepower, while the Veloce will produce closer to 800 horsepower. Additionally, Hyundai Motor Co. is expected to release hybrid cars under its premium brand Genesis in 2025 to attract drivers hesitant to switch to all-electric vehicles. Similarly, Bentley is targeting a range of at least 373 miles and advanced driver assistance technology. While a series of EVs were set to be launched each year from 2025 to 2030, the plan to go fully EV is now set for roughly 2033.

Luxury Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with luxury car market forecast at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on vehicle type, fuel type, and price range.

Analysis by Vehicle Type:

- Hatchback

- Sports Utility Vehicle

- Sedan

Sedan stands as the largest segment in 2025. Sedans are known for their timeless elegance, superior comfort, and exceptional driving experience. Luxury sedans are often spacious and well-appointed interiors with premium materials, advanced infotainment systems, and cutting-edge safety technologies. They appeal to buyers who prioritize a smooth and refined ride, along with the prestige associated with classic luxury brands. In response to this, different key manufacturers are increasingly investing in the development of sedans integrated with next-generation technologies, which is supporting the luxury car market share. For example, in January 2023, BMW launched its i7 sedan in India. According to the flagship 7-Series, i7 would compete with Mercedes Benz's EQS launched in 2022. Wherein, Mercedes Benz had localized its EQS sedan assembly and in this regard, BMW imported i7 as a fully built-up unit.

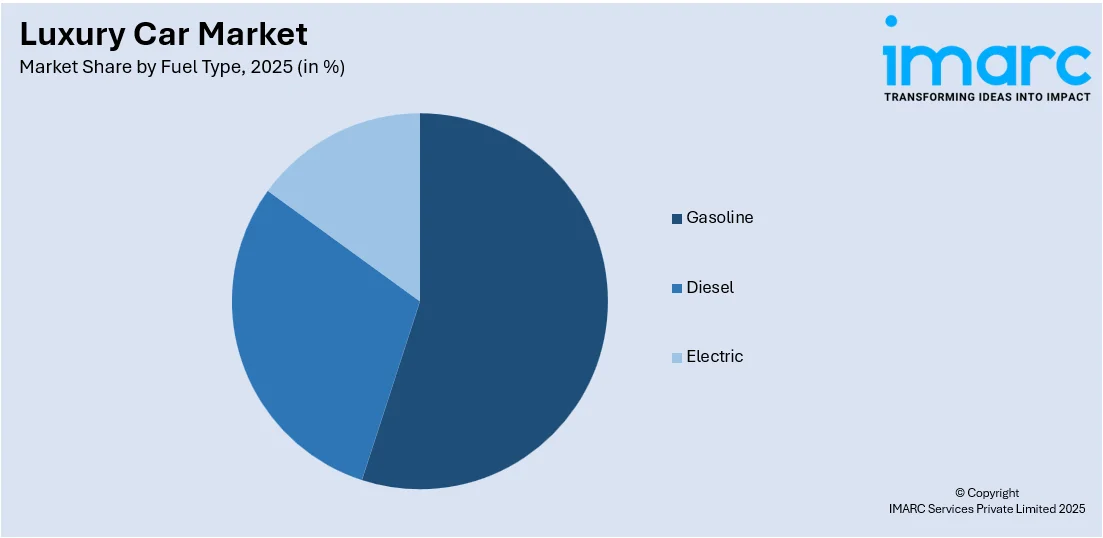

Analysis by Fuel Type:

Access the comprehensive market breakdown Request Sample

- Gasoline

- Diesel

- Electric

Gasoline leads the market share in 2025. Gasoline-powered luxury cars are known for their powerful and refined internal combustion engines, offering a blend of performance and sophistication. Luxury automakers have consistently produced a wide range of gasoline-powered models, ranging from compact sports cars to full-size sedans and SUVs. Moreover, luxury car market statistics indicate that the established consumer base and increasing R&D activities in this segment are creating a positive outlook for the market. For instance, Tata Motors is developing a new petrol powertrain for its premium SUVs, the Harrier and Safari. The new petrol engine, a 1.5-litre GDI engine, is still under development and will be featured in future models of the Harrier and Safari. Moreover, Tata Motors is also working on launching Tata Curvv Petrol soon. Investments in the development of gasoline-based cars will continue to dominate the market.

Analysis by Price Range:

- Entry-Level

- High-End

- Mid-Level

- Ultra

Entry level leads the market share in 2025. Entry-level luxury cars are the most affordable segment of the luxury car market. These vehicles provide a taste of luxury at a lower price than their higher-tier peers. Mid-level luxury cars balance affordability with premium features. These automobiles are suited for the client who demands more in the way of luxury, more high-techness, and higher performance, but also within his budget. Luxury high-performance cars are built to meet the maximum level of indulgence and performance. These vehicles come with elite craftsmanship, sophisticated technology, and high-quality comfort. Ultra-luxury automobiles are at the extreme top of luxury car production. These cars are made with the most meticulous attention to detail, with bespoke materials, handcrafted interiors, and the most advanced technology available.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share. According to the luxury car market report, rapid economic growth in countries, such as China and India, is primarily augmenting the region's growth. Over the past few years, the number of high-net-worth individuals and ultra-high-net-worth individuals has increased significantly in China and India. Due to this, many top luxury car manufacturers are launching their variants in Asia Pacific countries. For example, in August 2023, Audi unveiled its new electric duo in India, Q8 e-tron and e-tron Sportback. The Q8 e-tron is available in two trims with 95kWh and 114kWh battery packs, respectively. Likewise, in November 2023, Nio announced it would be unveiling a significant product on Nio Day in December. It was a CNY 1 Million (USUSD 140 Thousand) luxurious electric sedan that aimed to compete with the Maybach S class in China. The affluence in the region, with investment in developing luxury and high-status vehicles is expected to bolster the luxury car market recent price in the next coming years.

Key Regional Takeaways:

United States Luxury Car Market Analysis

The luxury car market in the United States is driven by high disposable incomes, a strong preference for premium features, and ongoing technological advancements. Innovations such as autonomous driving, advanced infotainment systems, and electric powertrains are preferred by U.S. consumers, compelling manufacturers to invest in cutting-edge solutions. The trend toward electric and hybrid luxury vehicles is gathering steam, driven by government incentives, an increasing number of charging stations, and increasing environmental awareness. Personalization is another key driver as buyers seek vehicles that are more and more tailored to their tastes. This trend, combined with available financing and leasing options, makes the market more attractive. The mature auto ecosystem in the United States, with mature dealership networks and advanced supply chains, enables faster acceptance of premium technologies. Growing urbanization and a thrust toward sustainability have increased the demand for luxury models that are ecologically friendly. The luxury segment is also witnessing a preference for SUVs, which reflects consumers' interest in high-end versatile automobiles.

Asia Pacific Luxury Car Market Analysis

The luxury car market in the Asia-Pacific region is highly growing, spurred by the expansion of the economy, increasing disposable incomes, and rising urbanization. World Bank statistics reveal that East Asia and the Pacific is the most rapidly urbanizing region globally, with an average annual rate of 3%. The fast urbanization leads to a need for high-end vehicles since wealthy individuals in cities prefer more advanced mobility solutions. Of the various region countries, China is the largest market for luxury cars, primarily because of government incentives supporting electric vehicles and a consumers' preference for the newest technology. India and all of Southeast Asia are seeing similar moves where middle-class populations are coming to want to own prestige or luxury cars. Luxury automakers are responding by introducing models tailored to local preferences, such as chauffeur-friendly variants, and investing in electric and hybrid technologies to meet the rising demand for sustainable mobility. Younger consumers in the region, with a penchant for innovation and technology, are driving the adoption of connected and electric luxury cars. Additionally, the region's robust digital infrastructure enables seamless online sales, further enhancing market accessibility.

Europe Luxury Car Market Analysis

The luxury car market in Europe is driven by technological leadership, strict environmental regulations, and high consumer demand for premium vehicles. Major locations for this market are Germany, the UK, and Italy, which have a solid heritage of luxury car production and innovation. UK-based luxury carmaker Jaguar Land Rover announced in 2023 a significant investment plan of USD 18.6 Billion over five years with the support of a Gigafactory planned by its Indian parent company, Tata Group, in Europe. The region leads the world in the development of electric and hybrid vehicles, driven by government incentives and ambitious climate goals, such as the push for carbon neutrality by 2050 in the European Union. Europe's consumers want advanced features that include autonomous driving capabilities, high-end interiors, and sustainable powertrains, which calls for heavy investment in R&D on the part of the car manufacturers. There has been an increase in demand for compact and electric luxury cars as urban consumers are now looking for environmentally friendly premium options. In addition, the trend of SUVs in the luxury market also indicates a shift toward more versatile models that serve the purpose of style as well as functionality. Luxury car manufacturers can enjoy a competitive advantage due to strong infrastructure, such as established dealership networks and an experienced workforce.

Latin America Luxury Car Market Analysis

Latin America luxury car demand is increased due to increased disposable incomes, increased desires for premium by wealthier consumers, but growing urbanization and demand in this market can also be seen by technologically advanced cars. Both countries like Brazil and Mexico account as prime markets. With its total number of urban inhabitants amounting to 189,992,937 in 2023, the World Bank noted a Brazil's urban population was reportedly at. While economic volatility is a challenge, luxury carmakers have found opportunities in customized financing options and SUVs that fit regional preferences for versatile vehicles. The demand for electric and hybrid luxury models is slowly increasing with governments introducing incentives and infrastructure to support sustainable transportation.

Middle East and Africa Luxury Car Market Analysis

The Middle East and Africa luxury car market is influenced by high-net-worth individuals (HNWIs), strong demand for premium SUVs, and a preference for vehicles equipped with advanced technology. The UAE and Saudi Arabia dominate the market, driven by high oil revenues and a culture of luxury. Findings from the Capgemini Research Institute’s ‘World Wealth Report 2024’ revealed that the Middle East experienced year-on-year growth of 2.9% in HNWI wealth and 2.1% in HNWI population in 2023. Electric and hybrid luxury cars are gaining traction, supported by government sustainability initiatives and infrastructure investments. The region’s harsh climate also drives demand for vehicles with superior comfort and durability features. Additionally, increasing tourism and expatriate populations contribute to the luxury segment's growth, as global automakers expand their regional presence.

Competitive Landscape:

Key players in the luxury car market are implementing strategic initiatives to strengthen their market position and enhance competitiveness. A primary focus is on innovation, particularly in electric and hybrid technology, to meet evolving environmental regulations and consumer demand for sustainable luxury. Brands such as Mercedes-Benz and BMW are heavily investing in electric vehicles (EVs) and expanding their EV lineups, aiming to lead in the high-performance electric segment. Another crucial strategy is digital transformation and enhancing customer experience. Companies like Tesla and Audi are integrating advanced digital interfaces, autonomous driving capabilities, and over-the-air software updates to differentiate their offerings. Additionally, brands are leveraging artificial intelligence to provide personalized services and streamline manufacturing processes. Luxury carmakers are also expanding their presence in emerging markets, especially in Asia, by establishing local manufacturing units and tailoring products to regional preferences. Strategic partnerships and acquisitions are further enhancing capabilities; for example, collaborations with technology firms help improve connectivity and driving assistance systems.

The report provides a comprehensive analysis of the competitive landscape in the luxury cars market with detailed profiles of all major companies, including:

- AB Volvo

- Aston Martin Lagonda Global Holding Plc

- BMW AG

- Daimler AG

- Ferrari N.V.

- Nissan Motor Company Ltd.

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

Latest News and Developments:

- September 2024: JSW MG Motor announced plans to introduce four luxury vehicles over the next two years, with the first set to debut in Q1 2025. These models will be marketed under a new premium dealership brand, 'MG Select.' The company aims to establish 12 'MG Select' showrooms within the next six months. Majority-owned by the JSW Group and other Indian stakeholders, the automaker will focus exclusively on "new-age energy vehicles" in the luxury segment.

- September 2024: Tata-owned Jaguar Land Rover began manufacturing the Range Rover Sport in India for the first time. The locally assembled 3.0-litre petrol Dynamic SE variant features a new design, minimalist interiors, and advanced technologies, including a 13-inch Pivi Pro touchscreen, air purification, and adaptive off-road cruise control.

- February 2024: Hyundai Motor Co. is expected to release hybrid cars under its premium brand Genesis next year to attract drivers hesitant to switch to all-electric vehicles. It is said to be launching the first Genesis hybrid variant next year with a 2.5-liter engine, bigger than the 1.6-liter engine installed in Kia's Carnival van hybrid.

- January 2024: Rolls-Royce is likely to go all-electric in India by 2030. The company launched its first electric luxury sedan, the Spectre, in India in January 2024. Spectre's price range starts from Rs 7.5 crore (ex-showroom), making it the priciest electric car in the market.

Luxury Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle |

| Fuel Types Covered | Gasoline, Diesel, Electric |

| Price Ranges Covered | Entry-Level, Mid-Level, High-End, Ultra |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Aston Martin Lagonda Global Holding Plc, BMW AG, Daimler AG, Ferrari N.V., Nissan Motor Company Ltd., Tesla Inc, Toyota Motor Corporation, Volkswagen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury car market from 2020-2034.

- The luxury car market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A luxury car is a premium automobile designed to offer superior comfort, performance, and advanced features compared to standard vehicles. These cars typically emphasize high-quality materials, sophisticated engineering, and cutting-edge technology. Luxury cars often include advanced safety systems, state-of-the-art infotainment, and high-performance engines, providing an exceptional driving experience.

The global luxury car market was valued at USD 486.4 Billion in 2025.

IMARC estimates the global luxury car market to exhibit a CAGR of 3.74% during 2026-2034.

The growing demand for comfort in vehicles, advancements in automotive technology, and rising awareness among the masses about sustainability are among the key factors driving the market growth.

According to the report, sedan represents the largest segment, driven by its elegance, superior comfort, and exceptional driving experience.

Gasoline leads the market by fuel type as they have powerful and refined internal combustion engines.

Entry level leads the market by price range as they provide luxury with a lower price point.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global luxury car market include AB Volvo, Aston Martin, Lagonda Global Holding Plc, BMW AG, Daimler AG, Ferrari N.V., Nissan Motor Company Ltd., Tesla Inc., Toyota Motor Corporation, and Volkswagen AG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)